Annual Audit and Compliance Requirements for FIEs in China

All foreign-invested enterprises (FIEs) in China are required to carry out annual compliance procedures as mandated by various governmental departments. It is crucial to be aware of the relevant deadlines as failure to carry out these procedures on time may result in extra expenses, penalties, or even revocation of business licenses. Tax compliance is especially important because an FIE can only repatriate profits to foreign investors after the Chinese tax bureaus are satisfied that all applicable taxes have been paid up. While tedious, this process is a good opportunity for companies to conduct an internal financial health check and to optimize tax efficiency, financial structure and processes, as well as internal control mechanisms for fraud prevention.

All foreign-invested enterprises (FIEs) in China are required to carry out annual compliance procedures as mandated by various governmental departments. It is crucial to be aware of the relevant deadlines as failure to carry out these procedures on time may result in extra expenses, penalties, or even revocation of business licenses. Tax compliance is especially important because an FIE can only repatriate profits to foreign investors after the Chinese tax bureaus are satisfied that all applicable taxes have been paid up. While tedious, this process is a good opportunity for companies to conduct an internal financial health check and to optimize tax efficiency, financial structure and processes, as well as internal control mechanisms for fraud prevention.

In this article, we outline the steps for completing the annual compliance requirements in China.

Step 1: Prepare Audit Report

All FIEs (including wholly-foreign owned enterprises (WFOE), joint ventures (JV) and foreign-invested commercial enterprises (FICE)) are required to hire external accounting firms to conduct an annual audit of the company’s financial reports. The audit report must be signed by a China-qualified Certified Public Accountant. The objective of a statutory audit is to ensure that companies meet Chinese financial and accounting standards, including proper use of Chinese GAAP.

The requirements for the audit report vary by region. For instance, in Shanghai, companies must include a taxable income adjustment sheet in the audit report, which is not a necessary supplement in Hangzhou, Beijing, or Shenzhen. Usually, accounting firms start preparing an annual audit report in January, right after the company has closed the previous year’s accounts. The audit procedure takes about two months, and the audit report should be completed before the end of April in order to meet the May 31 tax reconciliation deadline.

Step 2: Prepare Corporate Income Tax (CIT) Reconciliation

In China, CIT is paid on a monthly or quarterly basis in accordance with the figures shown in the accounting books of the company; companies are required to file CIT returns within 15 days from the end of the month or quarter. However, due to discrepancies between the accounting standards and tax laws in China, the actual CIT taxable income is usually different from the total profits shown in the accounting books. Meanwhile, CIT calculation should be in compliance with tax law, not the accounting standards. As such, the State Administration of Taxation (SAT) requires companies to submit an Annual CIT Reconciliation Report within five months from the previous year’s year-end to determine if all tax liabilities have been met, and whether the company needs to pay supplementary tax, or apply for a tax reimbursement. Generally, the Annual CIT Reconciliation Report must include adjustment sheets to bridge the discrepancies between tax laws and accounting standards.

FIEs that conduct frequent transactions with related parties should also prepare an Annual Affiliated Transaction Report on transfer pricing issues as a supplementary document to the Annual CIT Reconciliation Report. For companies declaring losses of more than RMB5 million, an audit report conducted by an external accounting firm is required to be attached to the CIT Reconciliation Report. Local tax bureaus release a guideline on CIT reconciliation every year around March. Taxpayers should carefully study the guideline because the specific requirements can differ by both year and region.

Step 3: Annual Inspection

FIEs in China are required to undergo an annual cooperative inspection jointly conducted by several governmental departments of the State Council. These inspections are designed to ensure that FIEs conducting businesses in China are fulfilling the legal commitments they make to each of the departments. Each year from March to the end of June, the annual inspection is jointly hosted by the following governmental departments:

- Ministry of Commerce (MOFCOM)

- Ministry of Finance (MoF)

- Administration of Industry and Commerce (AIC)

- State Administration of Taxation (SAT)

- State Administration of Foreign Exchange (SAFE)

- Statistical Bureau

Certain parts of the cooperative annual inspection are just a formality, with the first 90 percent of annual compliance work involving annual reporting package preparation, and the last 10 percent involving submission at a one-stop service location where all relevant government departments check and approve the annual reporting package.

Note that the annual inspection required by the SAT is only a review of the tax registration certificate, and is different from the CIT reconciliation. The inspections of AIC and SAFE (see below) are usually more complicated than others and may require additional separate procedures being conducted. Regional variances also exist. WFOEs with branches should pay special attention to ensuring that their branches also undergo annual inspection.

The relevant documents required for the annual inspection are:

- Annual inspection report

- Audit report issued by external accounting firm

- Financial statements of the previous year

- Certificate of approval for FIEs

- Business license

- Capital verification report

- Industry-specific license or permit

- Financial registration certificate

- Tax registration certificate

- Other forms or documentation required by relevant government departments

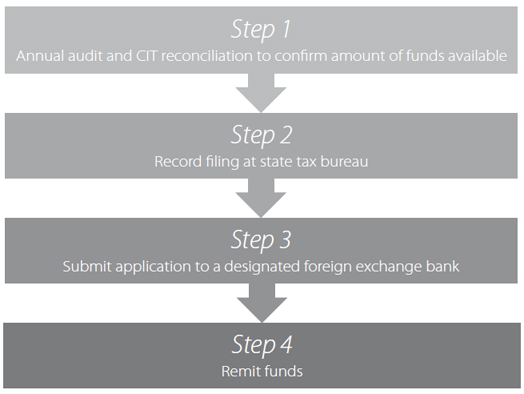

Step 4: Profit Repatriation

Companies distributing profits should complete the reconciliation procedure in advance to leave sufficient time for shareholder companies to prepare for CIT compliance before the May 31 deadline. The submission of additional documents may also be required. In Shanghai, for example, a company should apply for a Letter of Notice for Profit Distribution of Domestic Enterprise issued by the local tax bureau after finalizing its CIT reconciliation. The company receiving the profits will need to attach this letter to its own CIT reconciliation report.

Previously, when remitting more than US$30,000 in funds abroad, banks required the provision of a tax clearance certificate to prove that the correct amount of taxes has been paid before the funds can be remitted abroad. However, this requirement was cancelled under the Announcement on Issues Concerning Tax Filings for Outbound Payments under Services Trade (Announcement 40) issued by SAFE in conjunction with the SAT in July 2013.

Instead, individuals and institutions in China making outbound payments the value of which is the equivalent of more than US$50,000 are now required to conduct record filing with the in-charge local offices of the State Tax Bureau (STB). Foreign investors reinvesting in China with income legally obtained from their direct investment in China in an amount that is the equivalent of more than US$50,000 also need to complete a filing.

Under this records filing system, instead of having to apply for a tax payment certificate before they can make payments overseas, companies will only need to fill out a filing form and provide valid contracts or other relevant transaction documents (Chinese translation required) to the STB. The STB will affix a seal to the filing form, and companies will be able to remit funds outbound by submitting to banks the filing form and relevant transaction documents. Under the Guidelines for the Administration of Foreign Exchange under Service Trade and its detailed implementation regulations (Huifa [2013] No. 30, Guidelines) issued in conjunction with Announcement 40 by SAFE, such documents include:

- Annual financial audit report issued by a CPA firm

- Board resolution on profit distribution

- Applicant’s most recent capital verification report

Verification of the documents and tax assessment will be conducted within 15 days after the STB receives these documents. Beijing STB explains that Announcement 40 does not change the tax withholding obligation, but merely simplifies the outbound payment procedure. Companies or individuals who are found to not have fulfilled their tax obligations or filing and registration requirements could face fines ranging from 50 percent to 500 percent of the unpaid tax.

Where the value of such funds is the equivalent of US$50,000 or less, in principle, banks are not required to inspect and verify the transaction documents for profit repatriation. Exceptions apply when the nature of the funds are unclear, in which case banks will request the submission of transaction documents. Both Announcement 40 and the Guidelines came into force on September 1, 2013.

After receiving the bank’s approval, the money can then be converted into foreign currency at the daily conversion rate against the RMB issued by the People’s Bank of China and transferred directly to the foreign country from the FIE’s bank account.

This article is an excerpt from the January and February 2014 issue of China Briefing Magazine, titled “Annual Audit and Compliance in China.” In this issue of China Briefing, we discuss annual compliance requirements for foreign-invested enterprises, including wholly-foreign owned enterprises, joint ventures and foreign-invested commercial enterprises, as well as the less demanding requirements for representative offices. We also highlight the most recent tax and legal changes that will significantly influence the way companies do business in China in 2014.

This article is an excerpt from the January and February 2014 issue of China Briefing Magazine, titled “Annual Audit and Compliance in China.” In this issue of China Briefing, we discuss annual compliance requirements for foreign-invested enterprises, including wholly-foreign owned enterprises, joint ventures and foreign-invested commercial enterprises, as well as the less demanding requirements for representative offices. We also highlight the most recent tax and legal changes that will significantly influence the way companies do business in China in 2014.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

- Previous Article Understanding China’s Double Tax Agreements

- Next Article Chris Devonshire-Ellis on China’s Economy – Dukascopy Interview