Annual Compliance Requirements for Foreign NGOs in China

Listen to article summary

Annual compliance for foreign NGOs in China is a critical process that ensures legal status and operational continuity. This article explains the timeline, financial reporting obligations, and compliance risks NGOs face. It also provides strategic tips to help organizations stay ahead and avoid penalties.

Foreign non-governmental organizations (NGOs) operating in China face a unique regulatory environment that demands strict adherence to annual compliance obligations. These requirements are not merely procedural – they are critical for maintaining legal status and operational continuity. Failure to comply can result in severe consequences, including fines, suspension of activities, or even deregistration. Given the complexity and tight timelines, NGOs must adopt a proactive compliance strategy to mitigate risks and safeguard their presence in China.

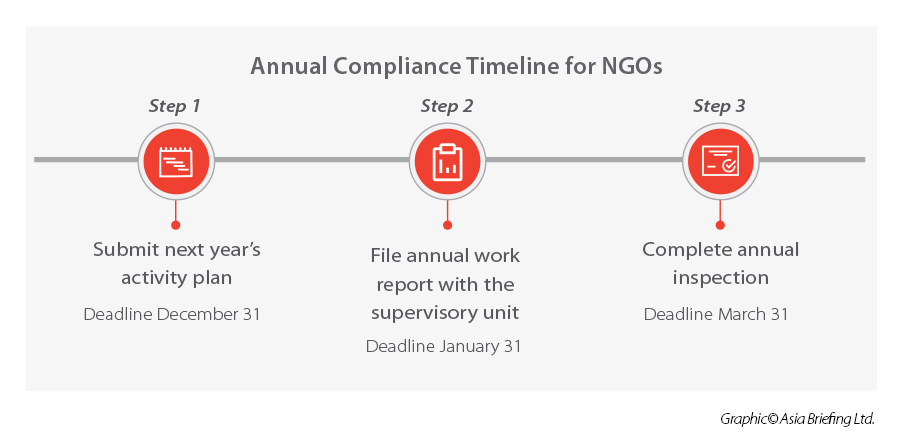

Annual compliance timeline for NGOs

Annual compliance for foreign NGOs operating in China differs significantly from that of ROs or WFOEs. These requirements are primarily governed by the Law on the Administration of Activities of Overseas NGOs in the Chinese Mainland, particularly Articles 19 and 31, and involve multiple submissions within strict deadlines.

Step 1: Submit next year’s activity plan

Deadline: December 31

NGOs must submit their activity plan for the upcoming year to their professional supervisory unit by December 31. This plan should detail project implementation and funding arrangements. Once approved, the supervisory unit files the plan with the registration authority within 10 days. If adjustments become necessary during the year, NGOs must promptly report these changes for record filing.

Step 2: File annual work report

Deadline: January 31

By January 31, NGOs are required to submit their annual work report to the supervisory unit through the designated online system. This report typically includes:

- Basic organizational information

- Changes in registration details

- Personnel information

- Public welfare activities conducted during the year

The supervisory unit reviews and provides its opinion before the next step.

Step 3: Complete annual inspection

Deadline: March 31

By March 31, NGOs must submit the reviewed annual work report to the registration authority (usually the Public Security Bureau) for annual inspection. The report must include audited financial statements, details of activities carried out, and any changes in personnel or organizational structure. Additionally, NGOs are required to publish their annual work report on the registration authority’s official website to ensure transparency.

Financial reporting obligations

In addition to submitting the annual work report, foreign NGOs in China must prepare a comprehensive financial accounting report that aligns with their approved activity plan and supports the disclosures made in the annual inspection. This report serves as a critical component of compliance, ensuring transparency and consistency between financial data and operational activities.

The annual financial report should include, at least, the following elements:

- Financial summary tables: Key statistical data summarizing income, expenses, and fund allocation.

- Balance sheet: A snapshot of assets, liabilities, and net assets at year-end.

- Statement of business activities: Similar to an income statement, detailing revenue sources and expense categories, including project-specific spending.

- Statement of cash flows: A summary of cash inflows and outflows during the reporting period.

- Fixed asset inventory: A detailed schedule of tangible assets, including acquisitions, disposals, and depreciation.

- Public welfare project details: A breakdown of each project’s financial performance, presented in the same order as the annual activity plan for consistency.

- Notes to the financial statements: Explanatory notes providing context for figures and accounting policies.

- Financial situation statement: A narrative overview of the NGO’s financial position and plans for the next accounting period.

Maintaining support documentation

When compiling the financial report, NGOs must maintain supporting evidence for all disclosures, including:

- Approved annual activity plan and any amendments;

- Payroll records and labor contracts;

- Staff registration forms;

- Bank statements, reconciliation schedules, and cash journals;

- Contracts for major expenditures; and

- Accounting vouchers and payment receipts.

These documents must be properly archived and made available to third-party auditors during the annual audit and to regulatory authorities during inspections or random checks.

Compliance risks and penalties

Non-compliance with these obligations can lead to:

- Administrative penalties: Fines or warnings from the Public Security Bureau

- Operational restrictions: Suspension of activities or freezing of bank accounts

- Reputational damage: Public disclosure of non-compliance

- Deregistration: Permanent loss of legal status in China

Strategic tips for NGOs

To successfully navigate China’s stringent compliance requirements, foreign NGOs should adopt a proactive and structured approach. Start early by preparing the activity plan and financial reports well ahead of the official deadlines. Early preparation allows time for internal reviews, supervisory unit feedback, and adjustments without the pressure of last-minute submissions.

In addition, NGOs are advised to leverage technology to streamline compliance processes. Digital tools for document management, workflow tracking, and secure data storage can significantly reduce administrative burdens and minimize the risk of errors. Implementing these systems ensures that all records are organized and easily accessible for audits or inspections.

It is also critical to engage auditors proactively. Scheduling audits early, ideally before the peak compliance season, helps avoid bottlenecks and ensures that financial statements are thoroughly reviewed and ready for submission. Early engagement with auditors can also uncover potential discrepancies before they become compliance issues.

Another essential practice is to maintain transparency across all reporting activities. Ensure that financial and operational data align with the approved activity plan and that any amendments are promptly documented and filed. Transparency not only satisfies regulatory requirements but also builds trust with supervisory units and stakeholders.

Last but not least, train staff regularly on compliance obligations and reporting procedures. A well-informed team can prevent costly mistakes and respond quickly to regulatory changes. Training should cover the use of compliance tools, documentation standards, and the importance of timely submissions.

Conclusion: Building a compliance culture

Annual compliance for foreign NGOs in China is more than a regulatory checkbox—it is a strategic imperative. By implementing robust internal controls, maintaining accurate records, and fostering a culture of compliance, NGOs can meet legal obligations and strengthen trust with stakeholders and authorities. In a highly regulated environment, proactive compliance is the key to sustainable operations and long-term success.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Annual Filing of Stamp Tax on Business Account Books before January 15: FAQs

- Next Article Frequently Asked Questions in VAT Management in China