Average Wages in China – Determining Minimum and Maximum Social Insurance Contributions

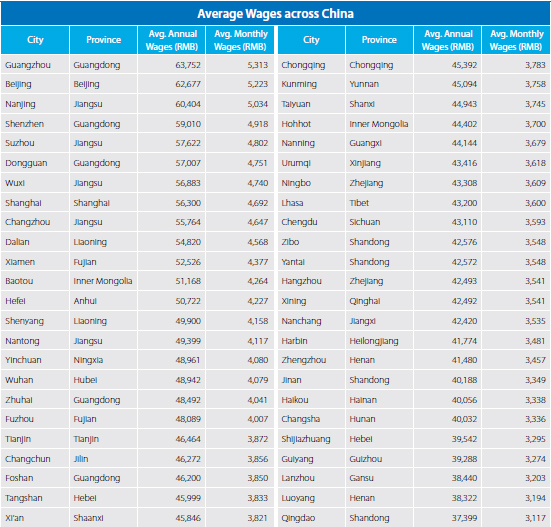

Average wages for 48 cities across China – from Guangzhou to Qingdao, Beijing to Luoyang

Nov. 19 – When determining social insurance contributions, there is a base figure for calculating the minimum and maximum contribution amounts for individuals whose salaries fall below or above certain thresholds. This base figure is derived from the average monthly wage of staff of the relevant city/province in the previous year, which is released around May to August each year.

As an example, in 2012, Beijing’s annual average salary was RMB62,677, with a monthly average salary of RMB5,223. In 2013, the cap for the social insurance base is three times the monthly average salary of 2012, i.e., RMB15,669. This gives a maximum contribution amount of RMB7,333 for the employer and RMB3,481.5 for the employee. For pension and unemployment insurances, the base figure for calculating the contributions is 40 percent of the 2012 monthly average salary (i.e., RMB2,089).

For medical, work-related injury and maternity insurances, the base figure for calculating contributions is 60 percent of the 2012 monthly average salary (i.e., RMB3,134). With these figures and the contribution rates, we are able to determine that, for an individual who has a Beijing urban hukou, the minimum contribution of the employer and employee per month is RMB783.5 and RMB237, respectively.

Some cities that release their own average wages nonetheless adopt the data at the provincial level in calculating social insurance payments. Also, for some cities such as Dongguan, the city’s average wages of the previous year are used to determine the pension ceiling, but provincial average wages are used to calculate the unemployment ceiling. In some other cities, two different average wage figures are released, with one applying to the five insurances, and the other applying to the housing fund. In the chart below, we focus on figures that apply to the five insurances.

Portions of this article came from the November 2013 issue of China Briefing Magazine, titled “Social Insurance in China.” In this issue of China Briefing Magazine, we introduce China’s current social insurance system and provide an update on the status of foreigners’ participation in the system. We also include a comprehensive chart of updated average wages across China, which is used to calculate social insurance contribution floors and ceilings.

Portions of this article came from the November 2013 issue of China Briefing Magazine, titled “Social Insurance in China.” In this issue of China Briefing Magazine, we introduce China’s current social insurance system and provide an update on the status of foreigners’ participation in the system. We also include a comprehensive chart of updated average wages across China, which is used to calculate social insurance contribution floors and ceilings.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Human Resources and Payroll in China (Third Edition)

Human Resources and Payroll in China (Third Edition)

A firm understanding of China’s laws and regulations related to human resources and payroll management is essential for foreign investors who want to establish or are already running foreign-invested entities in China. This guide aims to satisfy that information demand, while also serving as a valuable tool for local managers and HR professionals who may need to explain complex points of China’s labor policies in English.

Work Visa and Permit Procedures Across Asia

Work Visa and Permit Procedures Across Asia

In this edition of Asia Briefing Magazine, we outline the specific documents required for foreign nationals working in China, India, Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, as well as highlight the relevant application processes in each of these countries.

Update: Shenzhen Residence Permit Interviews with Public Security Bureau

Designing a Labor Contract in China

Permitted Allowances for Foreign Employees in China

China Releases Final Draft of New Visa and Residence Permit Regulations for Foreigners

China Strengthens Enforcement of 24-Hour Registration Rule for Foreigners

Properly Handling Mass Layoffs in China

Understanding China’s ‘Fapiao’ Invoice System

- Previous Article China Regional Focus: Urumqi, Xinjiang

- Next Article China to End ‘One-Child Policy’ & Introduce ‘Two-Child Policy’