Hong Kong’s New Two-tiered Profits Tax

Hong Kong has introduced a two-tiered profits tax regime, which will reduce the overall tax burden on enterprises, especially for small and medium enterprises, and boost Hong Kong’s status as a preferred investment jurisdiction in Asia. Here, we look at the details of the new tax system.

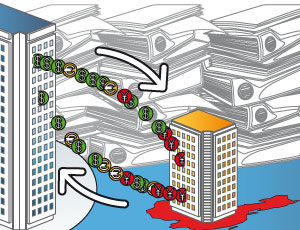

Hong Kong BEPS Bill: New Transfer Pricing Regime to Regulate Documentation

Hong Kong has brought forward a new BEPS bill that introduces a transfer pricing regulatory regime and mandatory transfer pricing documentation requirement as well as a variety of other anti-BEPS changes. The bill, which is more comprehensive than expected, marks a significant step up in Hong Kong’s transfer pricing enforcement regime.

China’s Environmental Protection Tax

On January 1, 2018, the Chinese government implemented a new environmental tax policy, effectively ending the pollutant discharge fee that had been in effect for the past 40 years. In this article, we look at the new Environmental Protection Tax, and its impacts on businesses in China.

Shenzhen Businesses: Register Tax Personnel by February 28

Businesses in Shenzhen have until December 31 to register real name authentication of key tax-related personnel. In this article, we provide a step-by-step guide on how businesses can register their tax personnel with the local authorities.

Corporate Income Tax in China

Corporate income tax (CIT) is one of the main taxes for businesses in China. In this article, we explain the legal basis for CIT, who it applies to, its rates, and how to calculate it.

Managing China’s Financial System – New Issue of China Briefing Magazine

The latest issue of China Briefing Magazine, Managing China’s Financial System, is out now and available for download from the Asia Briefing Publication Store.

How China Taxes International Sport Events and Foreign Athletes

More and more high-level sporting events are being held in China. These events, however, are subject to unique tax treatment. This article explores the tax requirements of foreign sporting events companies and the taxation of foreign athletes in China.

Calculating Value-Added Tax in China

Value-Added Tax (VAT) reform in China has been fluid and on-going, but taxpayers note that the methods used to calculate VAT has remained comparatively steady. In this article, we explain the basics for calculating VAT in China for you and your business.