Post VAT Reform: Defining Small Scale and General Taxpayer Status in China

Prior to the full implementation of the VAT reform in May, the SAT released an announcement clarifying the scope of small scale and general taxpayers. In this article, we look at how to determine if your entity qualifies for general taxpayer status.

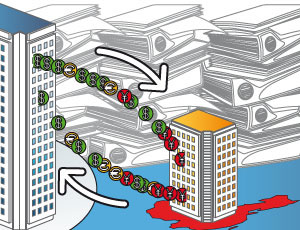

China Introduces Wide-Sweeping New Transfer Pricing Rules

On June 29, China’s State Administration of Taxation issued new transfer pricing rules for the country. Set to fundamentally change how China regulates transfer pricing, the new law forms part of China’s movement towards implementing stricter supervision on intercompany/related-party transactions.

Inflicting Loss on Investors through Cooked Books: Assessing Accounting Fraud in China

Although accounting fraud is a global issue, China’s investment climate presents higher risk. In this article, we look at accounting misconduct in China and the recent amendments made by the IASB to help investors better understand an entity’s business state.

China Dismantles Controls of Yuan Conversion on Capital Account, Impacting Foreign Institutions

After one year of China’s RMB conversion pilot program in its four Free Trade Zones, the government is ambitiously introducing the policy nationwide to all non-financial institutions, both domestic and foreign, to help internationalize the RMB, secure its evaluation, and stabilize foreign exchange rates.

China’s VAT Reform and its Implications for RO Tax Structure

The recent finalization of VAT reform was China’s biggest tax overhaul within the last 20 years. Changes include the tax rate on business activities conducted by ROs in China, which has been reduced from five percent to three percent.

China’s Resource Tax Reform Presents New Opportunities and Restrictions in the Mining Sector

China’s national resource tax reform will comprehensively come into effect on July 1, meaning that the resource tax will be levied based on each resource’s price instead of its quantity. In this article, we discuss the upcoming nationwide resource tax reform and its impact on foreign mining companies in China.

Transfer Pricing in China 2016 – New Publication from China Briefing

Transfer Pricing in China 2016, out now and available for download in the Asia Briefing Bookstore, explains how transfer pricing functions in China. It examines the various transfer pricing methods that are available to foreign companies, highlights key compliance issues, and details transfer pricing problems that arise from intercompany services, royalties and financing.

Understanding How China’s VAT Reform Has Affected the Real Estate and Construction Sectors

Effective as of May 1, China completed the last step in its extensive business tax to VAT reform. Previously, the real estate and construction industries were subject to three and five percent business tax (BT) respectively, but both are now subject to 11 percent VAT.