China-Australia Trade Relations Growing Stronger (Updated)

Australian Trade Minister Don Farrell had a virtual exchange with his Chinese counterpart, Wang Wentao. The meeting represents a new important step toward the stabilization of China-Australia trade relations.

UPDATE (May 19, 2023): According to China’s ambassador to Canberra, Chinese imports of Australian timber have been scheduled to resume from May 18, 2023. Ambassador Xiao Qian announced that the Chinese customs authority has officially informed the Australian Minister of Agriculture about the change. Additionally, discussions are underway regarding a potential visit by Australian Prime Minister Anthony Albanese to Beijing. The timber trade between the two countries, which previously amounted to approximately A$600 million (US$399 million) annually, had been largely halted since late 2020. Thus, this comes as a positive development, in a series of events signaling a warming of relations between the two countries.

On February 6, 2023, Australian Trade Minister Don Farrell had a virtual exchange with China’s Minister of Commerce Wang Wentao. Farrell said that this meeting – the first since 2019 – represented “another important step in stabilizing Australia’s relations with China”. On that occasion, Farrell also announced that he agreed to a face-to-face meeting in Beijing with his Chinese counterpart Wang Wentao. The announcement is the most recent sign that ties between the two countries are warming up.

Despite some tensions emerging in recent years, China and Australia celebrated the 50th anniversary of their bilateral relations in 2022, with both countries’ leaders meeting on the sidelines of the G20 in Bali to discuss how to improve their ties moving forward.

In this article, we discuss the latest developments in the relations between China and Australia, and their impact on trade and investment, in light of the latest exchanges between the two countries’ ministers.

Background: Tensions in China-Australia relations and impact on trade

Notwithstanding the scope of market opportunities for China and Australia, bilateral ties have not always been favorable. Over the past five years, tensions have piled up on a range of issues related to technology, politics, and trade.

In 2018, invoking concerns for national security, Australia became the first member of the Five Eyes intelligence alliance to prohibit Chinese tech giants Huawei and ZTE telecommunications gear from participating in its telecom infrastructure. In addition, Australia openly supported a number of US-led efforts aimed at containing China’s expanding influence in the Indo-Pacific, including the AUKUS alliance, the Indo-Pacific Economic Framework, the Quadrilateral Security Dialogue, and the Partners in the Blue Pacific.

Early in 2020, amid tensions over the nature of COVID-19, bilateral ties took a sudden turn for the worst. China imposed import bans on a variety of Australian exports, including coal, barley, wine, cattle, and seafood. Australia responded by escalating the trade dispute to the World Trade Organization (WTO) and canceling the Belt and Road Initiative (BRI) deal previously agreed to between China and the state of Victoria.

Such occurrences have had a negative impact on trade. Australian exports of wine, barley, lobsters, cattle, and coal were severely impacted, while Chinese companies were subject to increased scrutiny, particularly for transactions involving crucial infrastructure.

As a result of escalating diplomatic tensions, several Chinese companies adjusted their coal purchases from Australia to reduce potential risks. Consequently, China imported 66.37 million tons less Australian coal in 2021 than it did in 2020, a decrease of more than 85 percent year-on-year.

Latest developments

Xi-Albanese meeting at G20

After a protracted diplomatic standstill, Australian Prime Minister Anthony Albanese and Chinese President Xi Jinping finally met on November 15, 2022, at the G20 Summit in Bali, Indonesia. At that time, the two leaders discussed trade relations and agreed that their economies were “complementary.” The two sides also promised to “facilitate the stable growth of Australia-China relations and engage in more cooperation on important issues such as climate change, economy, and trade.”

Earlier in 2022, Albanese had warned that relations with China may remain “difficult,” which would have translated into more tense trade relations between the two countries. However, despite the prolonged tensions and trade restrictions, China still accounts for more than 35 percent of Australian exports and 25 percent of imports. Additionally, the restrictions did not affect the exports of iron ore, wool, or gas, and many of Australia’s biggest firms continued to profit from Chinese imports.

Thus, as expressed in the Bali meeting, it remains a priority of both governments to strengthen trade talks and stabilize diplomatic relations.

Australian Foreign Minister Penny Wong’s visit to China

As a clear sign of Australia’s commitment to restoring its relations with China, Australia Foreign Affairs Minister Penny Wong visited Beijing on December 21, 2022, on the occasion of the 50th anniversary of diplomatic relations between the two countries. Wong was the first Australian minister to visit China in over three years.

In Beijing, Wong met with her Chinese counterpart, China’s Foreign Minister and State Counsellor Wang Yi, to discuss an array of topics, including regional and global challenges, consular matters, climate change, trade and economic issues, and defense.

The first meeting between Trade Ministers since 2019

Australian Trade Minister Don Farrell and China’s Minister of Commerce, Wang Wentao, had a virtual meeting in February 2023, marking a fundamental step in de-escalating the tensions between the two countries, while bringing forward trade talks.

Wang stated that China is ready to reactivate the mechanisms of clear communication between China and Australia on economic and trade matters and to broaden cooperation in burgeoning fields like climate change and the new energy industries. Wang also extended an invitation to Farrell to visit Beijing in the near future.

In addition, analysts believe that these high-profile trade negotiations between the two countries may have opened the door for an official visit of Prime Minister Anthony Albanese to China later this year.

Bilateral trade in 2022

China is Australia’s greatest two-way trading partner in products and services, making up close to one-third of the nation’s international trade, as per the Australian Department of Foreign Affairs and Commerce. Australia, on the other hand, is China’s fifth biggest source of imports and 10th largest export market.

Economic and trade cooperation between the two countries has witnessed continuous growth over the past two years, despite geopolitical tensions.

Data released by the General Administration of Customs (GAC) showed that, in 2022, bilateral trade between the two countries reached US$220.91 billion, down 3.9 percent year-on-year, with Australia’s exports to China amounting to US$142.09 billion, a decrease of 13.1 percent from 2021.

China remains a primary export market for many Australian products, such as coal, iron ore, and wine. However, several of these products lost their market share as domestic businesses looked for substitutes to lessen the risk of interruption amid thawing ties.

As of December 2022, the top exports from Australia to China included iron ore (US$5.48 billion), petroleum gas (US$1.65 billion), other minerals (US$1.08 billion), gold (US$742 million), and wheat (US$214 million).

| Top 5 Products Exported from Australia to China in 2022 | |

| Product category | Amount (billion US$) |

| Iron ore | 5.48 |

| Petroleum gas | 1.65 |

| Other minerals | 1.08 |

| Gold | 0.74 |

| Wheat | 0.24 |

| Source: Observatory of Economic Complexity (OEC), 2023 | |

Australia imports 25 percent of its manufactured products from China. The nature of this merchandise has evolved from the early imports of textiles and clothing to home appliances in the 1990s to engineering items and telecommunications equipment in the present.

Australian products have significant competitive advantages in China, particularly natural resources (coal and gas), wool, and food and agricultural products – beef, wine, barley, and seafood, to mention a few. In addition, its abundant stocks of vital minerals, notably lithium and iron ore, make Australia a strategic trading partner for China. Chinese companies notably own shares in important Australian mines.

As of December 2022, the top exports from China to Australia included refined petroleum (US$496 million), computers (US$403 million), telephones (US$352 million), cars (US$324 million), and other furniture (US$157 million).

| Top 5 Products Exported from China to Australia in 2022 | |

| Product category | Amount (million US$) |

| Refined petroleum | 496 |

| Computers | 403 |

| Telephones | 352 |

| Cars | 324 |

| Other furniture | 157 |

| Source: Observatory of Economic Complexity (OEC), 2023 | |

Bilateral investment

In 2021, China was the eighth largest recipient of Australia’s investment, an increase of 14.5 percent over the previous year, reaching a total of US$5.9 billion, a sharp increase from 2020.

As per the 2022 survey report published by the Australian Chamber of Commerce, 58 percent of the Australian business community and organizations still consider China to be their top or one of their three top priorities for global investment plans over the next three years. The survey respondents showed optimism about future market opportunities and growing profitability in China.

While businesses were faced with challenges posed by the COVID-19 pandemic and related measures, 46 percent of them found coping mechanisms localizing both their sourcing and sales within China, and were able to register a total of 19 percent growth from 2018.

Australian businesses are generally eager to maintain or even increase their investment in China, with the majority of them planning to return or exceed pre-pandemic levels.

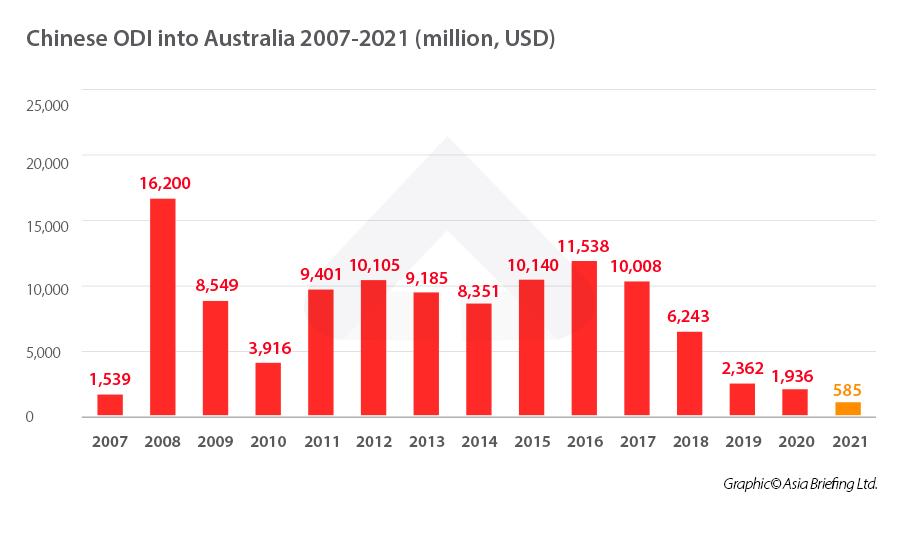

Meanwhile, Chinese investment in Australia decreased by 69.8 percent in the year 2021, from US$1.9 billion to US$0.6 billion. In Australian dollars, the decrease was a 69 percent drop.

With four transactions totaling AUD 545 million in the mining sector, including one for iron ore and three for lithium, mining accounted for 70.1 percent of all Chinese investment inflows. 26.7 percent (AUD 208 million) of the total Chinese investment inflows was in commercial real estate, while 3.2 percent (AUD 25 million) of the total AUD 778.2 million was in renewable energy.

China-Australia trade and investment agreements

China and Australia have multiple trade and investment agreements in place, including the China-Australia FTA (ChAFTA) and a double taxation agreement (DTA), and both of them are members of a range of WTO’s multilateral agreements on trade and investment. In recent years, there are some other developments in this aspect, as introduced below:

Regional Comprehensive Economic Partnership

Effective in January 2022, the Regional Comprehensive Economic Partnership (RCEP) initiative aims to boost trade and investment in the Indo-Pacific region, with the participation of China, Japan, South Korea, Australia/New Zealand, and Southeast Asia (ASEAN countries).

With the help of RCEP, both Chinese and Australian companies gained privileged access to the fast-expanding and vibrant Indo-Pacific area as well as better regulations for trade and investment.

In addition to establishing new regulations for electronic commerce, intellectual property, government contracts, competition, and small and medium-sized businesses, the RCEP has chapters on trade in products, trade in services, investment, and economic and technological cooperation.

Comprehensive and Progressive Agreement for Trans-Pacific Partnership

The Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) is another free trade agreement in the Asia-Pacific area. The GDP of its member nations accounts for 13 percent of the world’s total.

Australia ratified the pact in 2018, while China applied to become an official member in September 2021.

Outlook of China-Australia relations in 2023

Notwithstanding past difficulties, relations between China and Australia are already on the path to recovery. Throughout 2023, the situation may improve further, considering that Chinese companies have a restored enthusiasm for Australia amid the improved outlook for their relations under the new Australian administration.

Reportedly, early in January, Chinese steel producers resumed coal imports from Australia, with the first batch of Australian coal expected to reach China in late February.

Besides restoring trade exchanges, the two countries are expected to push for the improvement of their traditional collaboration in key sectors, including tourism, international education, aquaculture, and fisheries.

While hopes for a complete improvement in bilateral economic and trade relations in 2023 are growing, there are still certain unknowns that might impede development, particularly from the standpoint of Australia’s engagement with the United States.

Meanwhile, Australia may benefit greatly from China’s recent shift to a “living with COVID” approach followed by a progressive opening up of its borders. The biggest upside from Beijing’s openness resides in the services sector since China is the largest consumer of Australia’s tourism and education exports. In 2019, China accounted for 15.3 percent of Australia’s inbound tourism and 26 percent of total international student enrollments. Future official talks could focus on these two key sectors.

This article was originally published on February 6, 2023, and last updated on May 19, 2023.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China to Lift Restrictions on Australian Coal Imports

- Next Article Australia and China Resolve Barley Dispute, Improving Trade Ties