China Bails Out Its Banks

Oct. 12 – Beijing has used the state-owned Huijin Sovereign Wealth Fund to purchase stocks in China’s four largest banks – Agricultural Bank of China, Bank of China, Industrial & Commercial Bank of China, and China Construction Bank – in moves made to support the share prices of each of the banks, as well as the markets overall. Huijin is now in the somewhat odd position of owning a controlling stake in each of China’s biggest banks.

Huijin has stepped in to support share prices as markets in Shanghai and Shenzhen have declined significantly over the year, while the banks themselves have been dealing with bad debt issues following Beijing’s policy of providing easy credit terms to support the economy during the Global Financial Crisis in 2008.

China’s official view is that the banks represent a good investment as “the fundamentals aren’t expected to change anytime soon.”

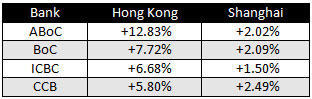

In Shanghai and Hong Kong yesterday, shares in the banks rose as follows:

China’s banks have had to consistently raise their liquidity levels to deal with bad debts issues, and yesterday’s purchase of shares by Huijin seems a strange move. Whether it was engineered to show support for the stock market (and if so, who benefited from this?) or whether it is a longer term move to provide a single focal point for the management of China’s banking remains to be seen.

- Previous Article China’s Pan Asia Gold Exchange: A New Playing Field for Speculators?

- Next Article Shihezi – China’s Cotton and Textiles Hub