“Eastern Data, Western Computing” – China’s Big Plan to Boost Data Center Computing Power Across Regions

A major new infrastructure and development plan aims to expand the scope of China data centers to improve the country’s data processing, storage, and computing capacity. The plan will see the construction of eight computing hubs and 10 data center clusters in key areas in eastern and western China, and aims to ultimately send data from China’s populous and economically active eastern regions to the resource-rich and sparsely populated western regions. Through this, China hopes to correct the imbalance in supply and demand of computing capacity, create greener and more energy-efficient data centers, and boost the country’s overall computing capacity to aid the country’s digital transformation and technological development.

China recently released a series of policy documents giving the green light to the construction of several new data center clusters in four regions around the country. These new data center clusters form part of a larger plan, called the “Eastern Data, Western Computing” plan (东数西算 dōngshù xīsuàn), first proposed in 2020. The plan aims to build a nationwide data center and computing system that will ultimately see data transferred from China’s populous eastern regions to the more rural and resource-rich western regions.

The plan is a pre-emptive push by the government to shore up its computing power and data storage capacity in anticipation of continued digitization and technological development, as well as an attempt to correct an imbalance between the computing supply and demand in the country.

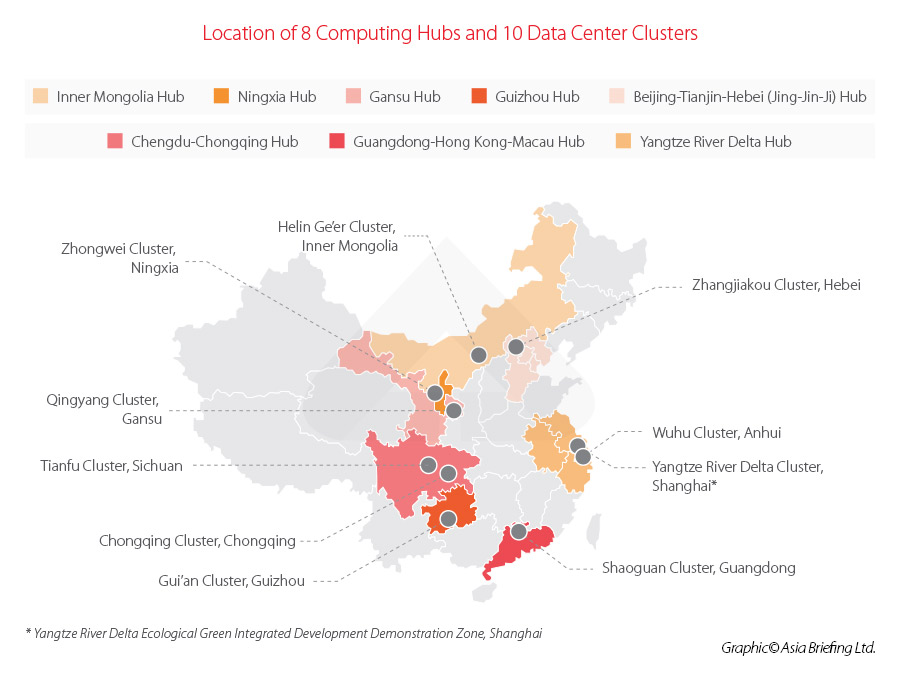

Under the plan, eight new “computing hubs” will be established – three in the east and five in the west – in which 10 new “data center clusters” will be constructed.

The plan will require considerable infrastructure investment and input from private businesses and will present new opportunities and challenges for industries.

In this article, we explain what the plan entails and discuss which businesses and industries are likely to participate and benefit from the construction.

Policy push for developing data centers

The “Eastern Data, Western Computing” plan was first introduced at the end of 2020 when the National Development and Reform Commission (NDRC), the Cyberspace Administration of China (CAC), the Ministry of Industry and Information Technology (MIIT), and the National Energy Administration (NEA) jointly released the Guiding Opinions on Accelerating the Construction of a National Integrated Big Data Center Collaborative Innovation System (the “guiding opinions”). These guiding opinions first proposed the construction of a nationwide integrated data center system.

The plan has now been further propped up with the release of several supporting and actionable policy documents. These include the Implementation plan for the computing power hub of the national integrated big data center collaborative innovation system (the “implementation plan”), released by the NDRC and other ministries in May 2021 (link in Chinese).

Later, in July 2021, the plan further was later fleshed out when the MIIT released the Three-year action plan for the development of new data centers (2021 – 2023) (the “action plan”), which outlined key targets for the development of China’s data centers and computing capacity (link in Chinese).

The action plan called for accelerating the construction of four new data center clusters in the Beijing-Tianjin-Hebei (Jing-Jin-Ji) area, the Yangtze River Delta (YRD) area, the Guangdong-Hong Kong-Macau Greater Bay Area (GBA), and the Chengdu-Chongqing Economic Circle. Meanwhile, the action plan requires the regional hubs of Guizhou, Inner Mongolia, Gansu, and Ningxia to improve the service quality and efficiency of computing power to form a base of guaranteeing computing power for non-real-time purposes (such as data storage and backup) for the whole of China.

More recently, in February 2022, the NDRC released four documents approving the construction of the first four regional hubs: the YRD hub, the Chengdu-Chongqing hub, the Jing-Jin-Ji hub, and the GBA hub.

China’s growing demand for computing power

The need for more data centers and high computing capacity will become increasingly pronounced as China’s digital industries continue to develop and as traditional industries continue to digitize. Digitization is one of the government’s key development targets for the coming decade and a core target in the government’s 14th Five Year Plan (FYP) released in early 2021, the country’s main development roadmap for the period from 2021 to 2025.

China already has a relatively strong network of data centers and high computing capacity for consumer application. The penetration rate for mobile internet in China is very high and developed very quickly over the last decade. The current infrastructure has been able to handle the daily mobile computing and data needs of hundreds of millions of mobile internet users, who use an average of 12.62 GB of mobile data per month, according to a report by the China Academy of Information and Communications Technology (CAICT) (link in Chinese).

But today, computing needs go far beyond the individual requirements of consumers. With the advent of novel technologies, such as the Internet of Things (IoT) and Industrial Internet of Things (IIoT), artificial intelligence (AI), big data, intelligent connected vehicles, and cloud computing, among many others – businesses and industries are using increasingly computing-heavy applications, which have much higher network and processing requirements than the average mobile user.

The plan therefore aims to get ahead by ensuring sufficient computing capacity and preventing a potential crunch that could stifle growth. And there is every reason to believe demand in China will continue to grow, as multiple tech industries will require a lot more computing power if they are to meet the growth targets set by the government (such as those for Internet of Vehicles, big data, and the digital economy, to name a few).

To become a world leader in high-tech applications and innovation, China will need to drastically increase its computing capacity, and that means more efficient and high-capacity data centers.

Why transfer data to western China?

The main purpose of the plan is to correct an imbalance in supply and demand for computing power and data processing. There is an extremely high demand for network processing capacity and storage in the populous eastern and southeastern regions of China, where the majority of industry and business is located; as things stand, the western regions do not have as much need for data centers and processing power.

Conversely, China’s remote western regions have ample access to land and resources, in particular, renewable energy from wind, solar, and hydroelectric power. Yet, these areas have a much lower demand for computing power, given the much lower population density and smaller industrial and business presence.

At the moment, the majority of China’s data centers are located in the east, where they are becoming increasingly costly and difficult to maintain. Lack of access to renewable energy also means many of these data centers rely on fossil fuels, contributing further to pollution and climate change.

Through the “Western Data, Eastern Computing” plan, the government is hoping to send the massive amounts of data produced in eastern China to data centers in western China for processing and storage, thereby increasing the demand for computing services in western China and reducing the pressure on data centers in eastern China.

Moreover, this would enable data centers in eastern China to focus on processes that are in high demand by businesses in the region but also have very high network requirements, such as AI and the industrial internet.

Infrastructure requirements

This will require the construction of a considerable amount of infrastructure in the form of data centers, computers, and supporting facilities.

Specifically, the government plans to create eight computing hubs in key areas in western and eastern China, and then build 10 data center clusters within these hubs. These 10 data center clusters will contain several data centers adapted to the purposes of the region, with the larger, more power-hungry data centers concentrated in the data center clusters within the western hubs and low-latency data centers located in the vicinity of large eastern cities.

Location of China’s planned computing hubs and data center clusters

The main eastern regions are the Beijing-Tianjin-Hebei (Jing-Jin-Ji) Economic Circle, the Yangtze River Delta (YRD) region, which covers Shanghai, Jiangsu Province, Zhejiang Province, and Anhui Province, and the Hong-Kong-Guangdong-Macau Greater Bay Area (GBA) in the southeast.

The western regions are Inner Mongolia, Ningxia, Gansu Province, the Chengdu-Chongqing area of Sichuan Province and Chongqing Municipality, and Guizhou Province.

According to an explainer published on the NDRC website (link in Chinese), data from the Jing-Jin-Ji area will be sent to the Gansu and Inner Mongolia hubs, data from the YRD region will be sent to the Gansu and Chengdu-Chongqing hubs, and data from the GBA will be sent to the Guizhou hub.

The Chengdu-Chongqing hub will also reroute data to the Gansu and Guizhou hubs, presumably because this region, although not as developed as its eastern counterparts, is growing rapidly and will soon have significant computing needs for its own homegrown businesses.

Computing requirements

The data centers will be situated to best support the computing needs of businesses and industries in different areas. This means there will still be a need for data centers in closer vicinity to the large eastern cities. The data centers in these areas will be dedicated to real-time applications with higher network demands and will also have slightly different technical requirements than the data centers in the west, such as lower latency to accommodate faster processing for the high-tech needs.

According to the implementation plan, the larger data centers will be located in the western regions that have better access to renewable energy. Cities and surrounding areas leave room for the development of medium-scale edge data centers, which can serve businesses and applications that have extremely low latency requirements, ensuring efficient use of urban resources.

The eastern computing hubs will therefore mainly handle “hot data” requirements; that is, procedures that have high network requirements and data that needs to be retrieved frequently and quickly. This includes applications such as industrial internet, finance and securities, early disaster warning, remote healthcare services, video and calls, and AI.

Meanwhile, the data centers in the western regions will handle “cold data”, procedures that have low network requirements and data that needs to be accessed less frequently and less urgently. These applications include data processing, offline analysis, and storage and backup.

Moreover, previous policy documents released by the government, including the action plan and the implementation plan, provide requirements for latency speeds:

- For data center clusters, end-to-end one-way network latency of under 20 milliseconds.

- For individual data centers, end-to-end one-way network latency of under 10 milliseconds.

Construction of data center clusters within the first four regional hubs

The goal is to build high-density, high-energy-efficiency, and low-carbon data center clusters within these hubs and improve the quality of data supply and fully leverage each region’s hub market, technology, talent, and capital advantages.

In the YRD hub, the government has announced the construction of two data center clusters:

- Yangtze River Delta Ecological Green Integrated Development Demonstration Zone data center cluster, of which initial areas will be built in the cities of Shanghai, Suzhou (Jiangsu Province), and Jiaxing (Zhejiang Province).

- Wuhu data center cluster, of which the initial areas will be built in two districts of Wuhu city and Wuwei city (Anhui Province).

For the Chengdu-Chongqing region, the following data center clusters will be built:

- The Tianfu data center cluster, of which initial areas will be built in two districts of Chengdu and Jianyang city, Sichuan Province.

- The Chongqing data center cluster, of which the initial areas will be built in three different areas of Chongqing Municipality.

For the Jing-Jin-Ji region, the initial areas of the data center cluster will be built in three districts of Zhangjiakou, Hebei Province, and for the GBA hub, the data center cluster will be built in the high-tech area of Shaoguan City, Guangdong Province.

The documents provide energy and operational targets for the data centers:

- Average availability rate (the degree to which the data center is operational and accessible when required) of no less than 65 percent.

- Power usage effectiveness (PUE) (the ratio of the energy used by the entire data center compared with the energy used by the IT equipment) index of less than 1.25.

- Significant improvement in the rate of renewable energy used (no specific target provided).

Opportunities and challenges

The Eastern Data, Western Computing plan is a huge infrastructure project, which will provide significant opportunities for businesses operating in the space, while providing local governments with a high-quality project to invest in. It could also help boost the economy of the regions in which the data center clusters are located, as it ropes in a number of auxiliary industries and businesses.

At the same time, the realization of this project will be expensive and will require a significant amount of technological innovation to make the data centers and data transmission efficient and effective. There will undoubtedly also be growing pains as data center expansion may lead to oversupply on the road to reaching a better-balanced industry.

Hardware and equipment requirements

The project will require a significant amount of infrastructure construction and investment, which will provide new opportunities for companies that provide computing hardware and equipment, raw materials, and software services. This includes components, such as servers, switches, power supply equipment, power system supply integrators, materials such as refrigerants, and broadband services.

Examples of foreign companies with a significant presence in China’s data center industry are Intel, AMD, Cisco, and NVIDIA.

Given the focus on renewable energy and power supply, auxiliary industries like wind, solar, and hydroelectric power will also benefit. These industries are already highly developed in China, with domestic players enjoying a market monopoly, meaning that foreign companies are unlikely to be able to make a significant contribution to the industry.

New growth opportunity for telecom companies

This new project will be a major boon for the country’s telecom companies. As China’s mobile internet market has become increasingly saturated, both in terms of competitors and market penetration, and with prior large-scale industrial projects, such as 5G expansion fast reaching their zenith, many telecom companies are looking to find new areas for growth.

Telecom company’s existing capabilities in areas like computing networks, transmission, and cloud computing, as well as critical hardware components and equipment, such as fiber optic cables that will enable the transmission of data thousands of kilometers across the countries, are well-served to support the construction. Several telecom operators have announced they will increase spending budgets to add their support to the government’s initiative.

However, it bears mentioning that this role will almost exclusively be filled by telecom behemoths, such as China Telecom, China Mobile, and China Unicom, while smaller companies are therefore only likely to benefit by providing third-party products and services to the telecom operators.

New technology development and innovation

It bears mentioning that the technology to make this system viable and efficient still needs to mature or be developed. This means there will be a considerable need for technological innovation, and could present opportunities for innovative upstarts, especially as larger, more dominant, and established companies tend to be more risk-averse when it comes to technological investment.

Notably, the action plan also includes calls for increasing research and investment in core technology and encouraging product innovation. According to the action plan, companies are encouraged to increase investment in technology R&D in areas such as data center prefabrication, liquid cooling, and other facility layers, dedicated servers, IT solutions such as storage arrays, and network solutions such as hyper-converged networks.

For software, the action plan highlights the need for innovation in areas, such as new data center infrastructure management (DCIM) software, and cloud-native and cloud-network-edge integration – opening up new opportunities for software and cloud computing companies.

Difficulties for data center operators

Although it may seem counterintuitive, it is not clear that this initiative will be beneficial to data center operators in the short term. There are a few different reasons for this.

First of all, large-scale construction of data centers will serve to undermine the industry’s competitiveness, and a potential oversupply of computing capacity will further reduce unit prices and erode data center’s already thin profit margins.

The technical requirements for the data centers in the policy documents are also very high, which will make it a relatively expensive capital investment for operators, even if they are able to receive some government subsidies.

Finally, the market for industrial and business computing applications is still developing. The goal of the plan is partly to boost digitalization of industry and spurring development of technology and digital industries, which inevitably means that it is banking on potential demand, rather than existing demand. This means the project poses a relatively high risk for data center operators who may have to wait many years to see returns on their significant investments.

Longer-term, however, it is fairly certain there will be a need for more computing power as high-tech industries continue to develop and the government’s push for digitalization makes progress.

A long-term investment in digital transformation

The Eastern Data, Western Computing plan can be viewed as part of a wider national strategy to ensure sufficient resources for economic growth and stability. The government itself has compared the plan to other major cross-regional infrastructure projects, such as the “South-to-North Water Diversion Project”, which diverts water from China’s humid south to the arid north, the “West-East Electricity Transfer Project”, in which power is diverted from the western to the eastern regions, and the “West-East Gas Transfer Project, which also aims to transfer natural gas from the country’s west to the east.

This context helps to explain the scale of the project and the pre-emptive nature of the investment. If implemented successfully as intended, this project will ensure a low-carbon, high-efficiency, and low-cost computing power supply to propel the development of China’s digital and technology industries.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Belt and Road Weekly Investor Intelligence #74

- Next Article China’s New Regulation on Market Entity Registration: What Does the Implementing Rule Say?