China Increases SPV Tax Liabilities from Offshore Holding Companies

Mar. 19 – China recently has announced an increase in applicable taxes from special purpose vehicles (SPVs) used by many multinational corporations in various low-tax jurisdictions holding investment in China.

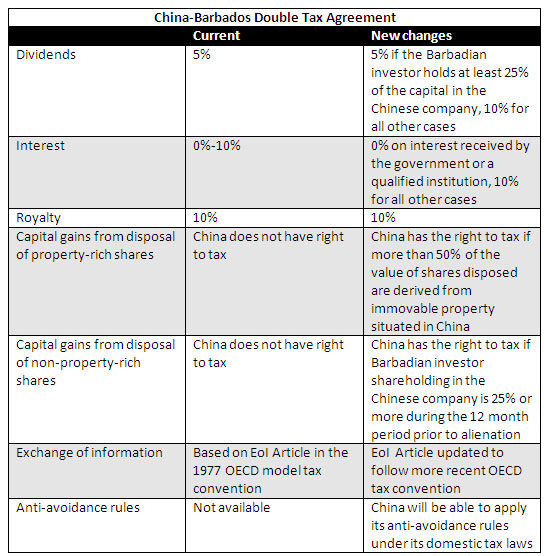

These include Barbados, the Bahamas and the British Virgin Islands along with other jurisdictions. The SAT revised the double tax treaty (DTA) with Barbados and concluded an initial two tax information exchange agreements (TIEAs) with the Bahamas and the BVI.

The changes to the China-Barbados DTA are still pending ratification of the relevant governments and are not yet effective, while the TIEA with the BVI has not yet been published.

China has concluded 95 double tax treaties with other countries and regions. These DTAs are essentially targeted to eliminate double taxation of income, encourage investment, and combat income tax evasion.

This move illustrates the continued push of the SAT to develop international tax networks with its global treaties partners. As China tightens how it assesses its DTAs and TIEAs, multinational corporations with established SPVs in low-tax jurisdictions should take a look at their investment structures to ensure they can adapt to the more stringent tax practices on the mainland. This also extends to the practice of using offshore jurisdictions to hold and resell property assets in Mainland China.

Businesses or individuals requiring an examination of their existing offshore structures as pertinent to the holding of assets and businesses in mainland China may contact Sabrina Zhang, the national tax partner for Dezan Shira & Associates at tax@dezshira.com.

Related Reading

China Capital Gains Tax May be Levied on Indirect Share Disposals Offshore

Expatriates Going Offshore in China Contracts? Think Again

- Previous Article Dalian Little Affected by Financial Crisis

- Next Article Last Call for Tax Exemption of Cultural Enterprises in China