China Launches Support Program for Micro and Small-Sized Enterprises

Mar. 12 – China’s State Council released the “Opinions on Further Supporting the Development of Micro and Small-Sized Enterprises (MSEs) (guofa [2012] No.14)” on April 19, 2012, which put forward 29 supporting measures to help MSEs address the operational difficulties brought on by rising costs, a lack of financing options, and heavy tax burdens.

In response, China’s Ministry of Industry and Information Technology (MIIT) recently released the “Implementation Plan on Supporting the Development of MSEs (gongxinbuqiye [2013] No.67)” on March 8, 2013, which launches a special program to support the development of MSEs in the country throughout the year. Major objectives and key tasks for the 2013 supporting program can be found below.

Major Objectives for 2013

-

Promoting supporting measures to assist the development of MSEs

- Completing the recognition procedure for the third batch of 100 national public service demonstration platforms for small and medium-sized enterprises

- Supporting more than 500 guarantee institutions to provide guarantee services to MSEs

- Training 500,000 management persons and 1,000 leading talents to help MSEs improve their management levels

- Establishing a management and consultation database for MSEs

Key Tasks for 2013

1. Promoting the development of the following three types of MSEs:

-

Innovative MSEs: Handled by the Enterprise Division, Science Division, Information Division and Software Division of the MIIT

-

Entrepreneurial MSEs: Handled by the Enterprise Division of the MIIT

-

Labor-intensive MSEs: Handled by the Enterprise Division, Financial Division and Consumer Goods Division of the MIIT

2. Accelerating the development of the service system for MSEs

3. Improving financing services for MSEs

-

Aiding the strategic cooperation between the MIIT and major banks in China in an effort to strengthen the country’s financing support for MSEs

-

Encouraging guarantee institutions to provide relevant service to MSEs, while lowering guarantee fees

4. Implementing various polices to reduce the burdens on MSEs

Micro, Small, and Medium-Sized Enterprises in China

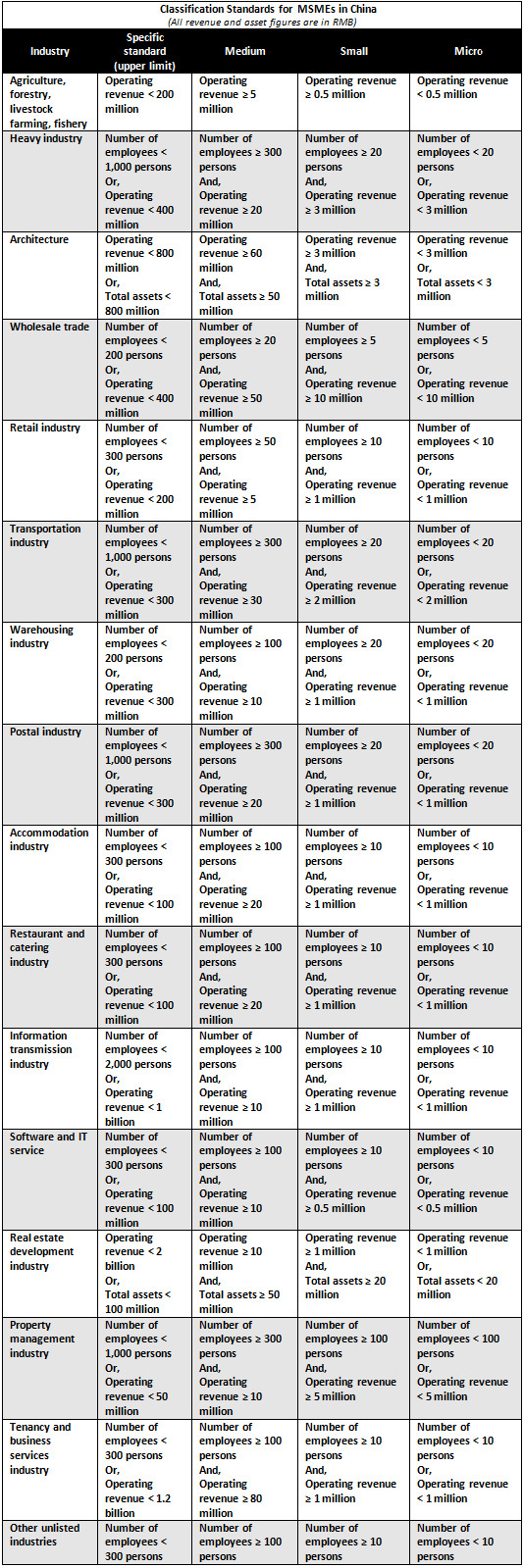

China’s “Regulations on the Standards for Classification of Small and Medium-sized Enterprises (hereinafter referred to as the ‘Regulations’)” were jointly promulgated by the MIIT, the National Bureau of Statistics, the National Development and Reform Commission, and the Ministry of Commerce on June 18, 2011 and came into effect on the same date.

The Regulations clarify what constitutes as a micro, small and micro-sized enterprise according to various industries. The upper limit standard for medium-sized enterprises is the lower limit standard for large-sized enterprises. Individual businesses and industries other than those specified in the Regulations are also categorized by reference to the Regulations.

The specific standards for different industries are as follows:

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Guangzhou Releases Circular to Promote Development of MSMEs

China Releases Scheme to Support Micro and Small-Sized Enterprises

China to Strengthen Support of MSEs

China to Exempt Small Businesses From 22 Fees

- Previous Article China Releases Notice on Thousand Foreign Experts Plan for 2013

- Next Article China Expands RMB Qualified Foreign Institutional Investors Pilot Program