China Takes Top Spot on Emerging Asia Manufacturing Index 2024

China leads on key metrics, leveraging its support for innovation, trade networks, infrastructure, and a skilled workforce, according to the ‘Emerging Asia Manufacturing Index 2024’—a new report from Dezan Shira & Associates.

In a new Emerging Asia Manufacturing Index 2024 report (“EAMI 2024”) published by Dezan Shira & Associates, China took the top spot among eight emerging countries in the Asia-Pacific region. The other seven economies are India, Indonesia, Malaysia, the Philippines, Thailand, Vietnam, and Bangladesh. Together, these countries lead economic growth and development in the Asia-Pacific region.

About the report

The EAMI 2024 aims to assess the growth risks, measure the potential of these eight economies, and pinpoint specific factors affecting the current manufacturing landscape.

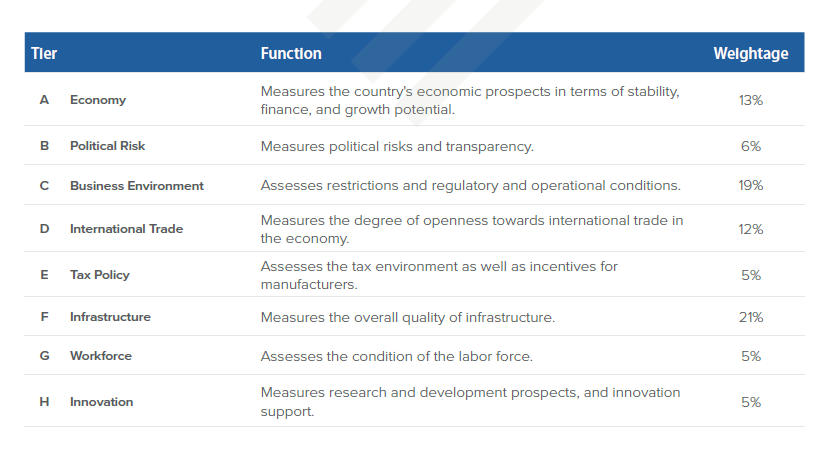

The report’s evaluation hinges on the measurement of 48 distinct parameters organized into eight fundamental core criteria—economy, political risk, business environment, international trade, tax policy, infrastructure, workforce, and innovation.

Why China tops performance indicators

Known as the “World’s Factory”, China has held the title of the world’s largest manufacturer for 14 consecutive years, starting from 2010. Its factories churn out approximately one-third of the global manufacturing output, a testament to its industrial might and capacity.

Despite facing challenges due to global geopolitics and competition from other emerging economies, China’s manufacturing sector continues to thrive. In 2023, the value-added by China’s manufacturing reached an impressive US$5.57 trillion, accounting for 31.7 percent of its GDP.

China’s retention of the status as ‘dominant manufacturing powerhouse’ leverages its push for innovation supported by updated policies and regulatory incentives, expanding trade networks, mature infrastructure, and a skilled workforce. The China+1 strategy essentially involves supply chain restructuring and risk diversification while not wholly divesting from the China market.

Key advantages and challenges

Despite the economic fluctuations and challenges faced by international companies in recent years, China remains resolute on its path to post-pandemic recovery.

While some businesses are exploring re-shoring, near-shoring, or diversification of their global footprint by moving capital elsewhere, those with established operations in China are committed for the medium to long term.

That’s because many recognize the unfolding opportunities and incentives within China, thereby positioning the market as a core base in their broader Asia investment strategies.

|

Top Reasons to Invest in China |

||

| 1. | Incentives for doing business | China has several preferential tax policies—attracting a large number of foreign capital and foreign-invested enterprises. |

| 2. | Location advantage: Economic development zones (EDZs) | Over 2,000 EDZs, each with unique investment incentives and accreditation at different levels of government. |

| 3. | Ease of doing business | Fair and improving business environment for foreign investors with government officials receptive to feedback. |

| 4. | Network of trade, investment, and tax treaties | China has signed off 22 FTAs with 29 countries or regions, 107 BITs, and DTAAs with 114 countries or regions. |

| 5. | Ongoing market reforms | Relaxing market access restrictions and continuously introducing improvements to the business and regulatory environment. |

| 6. | Super city clusters | City clusters support China’s economic growth, promote coordinated development among high performing regions, and enhance international competitiveness. |

| 7. | World’s largest labor market | The labor force in China stood at around 733.5 million people at the beginning of 2022, with the number of employed people at around 402 million. |

| 8. | Prime position in global supply chains | China’s sophisticated manufacturing and logistics infrastructure ensures its importance across global supply chains. |

| 9. | World’s second largest economy | China’s rising purchasing power, expanding middle class, and a population over 1.4 billion, touts it to become the largest retail market in the near future. |

| 10. | Thriving services industry | China’s services sector is the main driver of economic growth and the basis for the next stage in its development. |

Nevertheless, Emerging Asia countries face various challenges, especially in the current phase of increased volatility, uncertainty, complexity, and ambiguity (VUCA). Further, in China’s case, its labor costs are rising, intellectual property concerns persist, and navigating the complex regulatory environment can be daunting for newer investors.

Also, experiences following the pandemic, US-China trade war, and recent global conflict outbreaks demonstrates that dependence on China or any one market will expose businesses to supply chain disruptions. Moreover, climate action and decarbonization targets have pushed environmental and sustainability issues higher on government and shareholder agendas, which can add to operational complexity due to regulatory oversight and ESG reporting obligations, thereby raising costs. Language and cultural barriers, access to a level playing field with domestic enterprises, and quality control issues are other challenges to be considered for China-bound investors.

Overall, while China remains attractive for its market size, skilled workforce, and infrastructure, careful assessment of the various pros and cons is crucial for informed decision-making and business success.

Key findings of the EAMI 2024

Among the eight areas, China ranks high in terms of innovation, infrastructure, international trade, and political risks. However, it still faces challenges related to the economy, workforce, tax policy, and the business environment.

Infrastructure (1st)

The infrastructure criteria measure the overall quality of the infrastructure. It accounts for various infrastructure parameters, such as Energy Cost, which measures the electricity prices offered in each country to support manufacturing operations, while Infrastructure Investment addresses the total percentage of GDP invested in infrastructure by the government. It also includes an analysis of Water Availability and International Freight Costs.

China ranks first in this parameter due to its excellence in energy availability, infrastructure investment, quality of infrastructure, and Internet speed. However, there is room for improvement in terms of water availability and cost, as well as gas/fuel expenses.

China dominates the infrastructure tier, boasting the region’s largest ports, airports, leading highway network, and fastest high-speed railway. China’s strategic infrastructure investments provide reliability and efficiency for manufacturers (if there is no lockdown).

— Bruno Hernandez, Senior Associate, International Business Advisory Dezan Shira & Associates

Innovation (1st)

The Innovation criteria measure the specific innovation performance of each country. This parameter encompasses two main parameters: R&D expenditure and Innovation/Technology Access.

China comes out on top for innovation. China’s research and development (R&D) expenditure witnessed an impressive increase of over 35 times between 1991 and 2018. This remarkable growth has made China an innovation powerhouse, drawing significant FDI from international investors.

None of the other seven countries in this ranking can surpass China in terms of its current innovation rate, given China’s status as an innovative powerhouse, distinguished by substantial investments in research and development across multiple industries.

— Ines Liu, Senior Manager, International Business Advisory Dezan Shira & Associates

International trade (2nd)

The International Trade Tier provides insight into the degree of openness for international trade in each economy. This section provides a comprehensive look into the overall trade flow of each country, the restrictiveness of trade barriers, and an estimate of domestic suppliers for key industries in each country.

China ranks second in this parameter, following Vietnam. It excels in trade balance, custom facilities, free trade integration, and domestic suppliers. However, its ranking is slightly impacted by its trade openness level.

Additionally, when compared to Vietnam, China benefits from membership in seven out of nine “significant” FTAs but lacks free trade agreements with the UK and EU, which means it has not achieved the same level of free trade as Vietnam.

Surpassing China in terms of domestic suppliers seems improbable for any country in this index, given the heavy reliance of numerous industries on China for specific parts and resources, posing challenges in finding alternatives.

— Pritesh Samuel, Head of Business Intelligence at Dezan Shira & Associates

Political risk (3rd)

The Political Risk criteria provide a comprehensive assessment of the country’s government and regulatory stability.

China ranks third in this parameter, following Malaysia and Vietnam. The country has maintained a high level of political stability through a complex and multifaceted policy system. However, its ranking is slightly affected by a highly restrictive regulatory framework and censorship schemes.

Economy (4th)

The economy criteria encompass parameters such as economic growth and inflation, evaluating the general economic situation with a focus on stability, resilience, and growth potential.

Among the eight countries, China ranks second in terms of economic resilience, following Bangladesh. China’s swift response to the COVID-19 pandemic significantly reduced the death toll and helped stabilize the economy. In the post-COVID era, concerted efforts were made to facilitate economic recovery. In 2023, the country’s GDP grew by 5.2 percent, meeting the targets set for the year.

However, China’s economic ranking was negatively impacted by debt issues and manufacturing growth potential, resulting in a fourth-place position under this parameter.

Tax policy (4th)

The Tax Policy criteria measure the tax incentives in each economy for the manufacturing sector. Key parameters include Corporate Tax Rates and Tax Incentives for Manufacturers.

China ranks fourth in this parameter, following Thailand, Vietnam, and Malaysia.

Workforce (7th)

The Workforce criteria measure the current condition of the labor force. Noteworthy parameters include the combination of Population Size, Population Growth, Median Age, Minimum Wage, and Average Wage. These factors can play a pivotal role in identifying markets with cost-effective labor.

China ranks seventh in this parameter, followed by Thailand. Despite having one of the largest populations in the world, which provides diverse opportunities for a sizable workforce, China is currently experiencing minimal population growth. Additionally, the emergence of an aging population, reflected in a median age of 39, poses challenges, especially for manufacturers, as this higher median age may not align with the optimal workforce cohort.

Moreover, increasing labor costs have affected China’s attractiveness to manufacturing investors, but its high labor productivity partly mitigates this concern.

Business environment (8th)

The Business Environment tier provides insights into the specific restrictions, regulatory framework, and operational conditions within an economy.

China ranks eighth in this parameter. Despite its high rankings for the general business environment, intellectual property protection, and ease of hiring foreign staff, China’s final position is adversely impacted by factors such as the minimum average manufacturing capital, the average time required for company setup, and restrictions on industries for foreign direct investment (FDI).

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Understanding the Relaunched China Certified Emission Reduction (CCER) Program: Potential Opportunities for Foreign Companies

- Next Article Tax Incentives for Manufacturing Companies in China in 2024