China Releases Draft 2022 Encouraged Catalogue, Signals New Opportunities

We highlight new opportunities in China’s draft “2022 Catalogue of Encouraged Industries for Foreign Investment”, which contains 1,435 items. These align with China’s plans to attract foreign investments into high-tech manufacturing, production-oriented service industries, as well as regional advanced industries in the central, western, and northeastern regions. Opportunities also exist in industries linked to green, healthcare, elder care, sports, and vocational education sectors besides rural revitalization.

On May 10, 2022, the National Development and Reform Commission (NDRC) and the Ministry of Commerce (MOFCOM) released the Catalogue of Encouraged Industries for Foreign Investment (Edition 2022) (Exposure Draft) (hereafter the “2022 FI Encouraged Catalogue (Exposure Draft)”) to gather public opinions until June 10, 2022.

Once enacted, the 2022 FI Encouraged Catalogue will replace its 2020 version.

Similar to the previous version, the 2022 FI Encouraged Catalogue (Exposure Draft) includes two sub-catalogues – one covers the entire country (“national catalogue”) and one covers the central, western, and northeastern regions (“regional catalogue”). Together, the 2022 FI encouraged catalogue (Exposure Draft) identifies industries where foreign direct investment (FDI) will be welcome and treated with favorable policies in China.

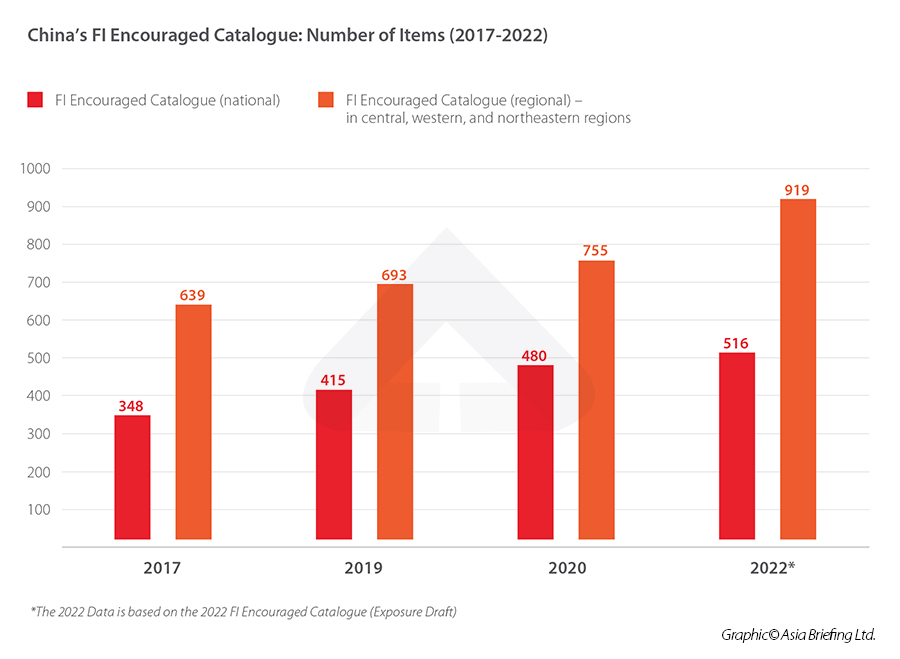

The newly released 2022 FI Encouraged Catalogue (Exposure Draft) contains a total of 1,435 items, increased by 16 percent from 1,235 items in the previous version. The lengthening of the catalogue signifies that more investment fields will favor foreign investors.

To break this down: the 2022 FI Encouraged Catalogue (Exposure Draft) has added 238 items, modified 114 items (mainly expanding the area covered by the original entry), and removed 38 items. In the national catalogue, 50 new items have been added, 62 items modified, and 14 items removed while 188 new items added, 52 items modified, and 24 items have been removed in the regional catalogue.

Considering the additions to the regional catalogue accounts for 79 percent of all new entries, the 2022 FI Encouraged Catalogue (Exposure Draft) aims to attract greater foreign investment into China’s less developed central, western, and northeastern regions.

Key changes in the 2022 FI Encouraged Catalogue (Exposure Draft)

According to the official interpretation, the revision of the 2022 FI Encouraged Catalogue (Exposure Draft) is intended to continuously lure foreign investment in three main areas:

- Manufacturing sectors

- Production-oriented service industries

- Reginal advanced industries in China’s central, western, and northeastern regions

Nationwide, the catalogue has added or expanded items on manufacturing of components and parts and equipment. In the service industries, foreign companies are encouraged to invest in production-oriented services, with items, such as professional design, technical services, and development, newly added to the national catalogue.

The regional catalogue has added or expanded relevant items catering to the specific advantages of China’s central, western, and northeastern regions, such as labor force availability, distinctive resources, and need for investment.

Taking a closer look, the revision to the encouraged catalogue is also in line with China’s priorities on further improving the country’s healthcare system, sports industry, elder care, rural revitalization, vocational education, and the transition to a green, low-carbon, and circular economy.

We briefly highlight some of the investment opportunities in the promoted industries below. Businesses should seek professional support to understand the full extent of the opportunities available and potential access to incentives that may streamline costs and offer market benefits.

Healthcare

The 2022 FI Encouraged Catalogue (Exposure Draft) adds multiple new items for the healthcare sector. Some areas where foreign investment is encouraged are:

- Production and research and development of therapeutic medical and health textiles, artificial skin, absorbable sutures, hernia repair materials, new dialysis membrane materials, catheters for interventional therapy, and high-end functional biomedical dressings.

- Development and production of drugs for rare diseases and special drugs for children.

- Consumables related to pharmaceutical manufacturing industry: separation and purification media, solid phase synthesis media, chiral resolution media, consumables for drug impurities control and detection, etc.

- Dental implant system for implant repair in patients with bone loss.

- Closed negative pressure drainage and protect wound materials, bacterial cellulose film, and polyurethane foam dressing and other polymer material dressing manufacturing.

- Minimally invasive surgery medical equipment development and production: 3D imaging, electron microscopic system, surgical robot, mechanical arm and other mechanical arm, and hearing aid and cochlear implant.

- Rehabilitation institute for autistic children.

Sports sector

Inspired by the success of the Beijing Winter Olympic Games, the 2022 FI Encouraged Catalogue (Exposure Draft) encourages foreign investment into China’s snow and ice industry, with “research and development and production of snow and ice heavy equipment and light equipment for ski resort, passenger ropeway, snow machine, snow press, and other special equipment” being added to the encouraged catalogue.

The 2022 FI Encouraged Catalogue (Exposure Draft) also added “construction, operation, and management of fitness facilities such as outdoor sports camps” and “development, popularization, and promotion of intelligent sports products and services” as encouraged items for foreign investment.

Elder care sector

To facilitate the development of the elder care sector, the 2022 FI Encouraged Catalogue (Exposure Draft) encourages foreign investment in “research, development and manufacturing of smart healthcare products for the elderly”, which include geriatric products and auxiliary products manufacturing, geriatric medical equipment and rehabilitation AIDS manufacturing, elderly intelligent and wearable equipment manufacturing.

Moreover, foreign investment is also encouraged for elder care related services, including services for renovation and barrier-free transformation of home, livable environment, and public facilities for the elderly, training services designed for elder care, and education and human resources services provided to the elderly.

Rural revitalization

The 2022 FI Encouraged Catalogue (Exposure Draft) adds multiple items that are designed to improve the agriculture, living environment, logistic, commerce, and industrial structure of the rural area. Among others, the below items are introduced in the encouraged catalogue:

- Efficient water-saving irrigation, farmland soil improvement and ecological management, comprehensive utilization of farmland reserve resources – such as saline-alkali land, and green farmland construction, technology development, and application.

- Rural environmental remediation, rural sewage and garbage treatment, water ecological environment treatment, and restoration related engineering construction, technology development, and application.

- Construction of cold chain logistics facilities for storage and preservation of agricultural products.

- Smart agriculture (integrated application of software technology and equipment, digital transformation of agricultural production, operation, and management).

- Rural e-commerce and new type of rural services, including agricultural productive services adapted to large-scale, standardized, and mechanized agricultural production, as well as rural life services.

- Rural tourism, leisure sightseeing, agricultural experience, outdoor expansion, ecological health, and labor education and practice base construction.

Vocational education

To echo China’s plan to strengthen the country’s vocational education system, in addition to the Vocational Education Law that came into force recently on May 1, 2022, the 2022 FI Encouraged Catalogue (Exposure Draft) adds “non-academic art vocational training institutions”.

To be noted, this does not include “non-disciplinary culture and art out-of-school training institutions”, which are still subject to stringent supervision amid China’s effort to reduce burden for students and parents.

China’s transition to a green, low-carbon and circular economy

On top of the nearly 100 items that are relevant to China’s green transition in the 2020 FI Encouraged Catalogue, the 2022 FI Encouraged Catalogue (Exposure Draft) introduces more, such as:

- Development and production of new technology and products for wood structure and wood building materials.

- Industrial water-saving technology, technology development, and application and related equipment manufacturing.

- Low-carbon upgrade of petrochemical chemical raw materials.

- Clean production technology development and service, traditional energy clean operation, engineering construction and technical service, and clean production evaluation, certification, and audit.

- Advanced system integration technologies and services of low carbon, environmental protection, green, energy saving, and water saving.

- Development and application of environmentally friendly technologies.

What are the favorable policies to facilitate FDI in encouraged industries?

So far, the following favorable treatment is in place for foreign-invested enterprises (FIEs) engaged in doing business in the listed industries published in the encouraged catalogue:

- Tariff exemptions on imported equipment – for encouraged foreign-invested projects, the import of self-use equipment within the total amount of investment can be exempted from customs duties.

- Access to preferential land prices and looser regulation of land use – land can be preferentially supplied for encouraged foreign-funded projects with intensive land use. The land transfer reserve price can be determined at 70 percent of the national minimum price for the transfer of industrial land, which yet shall be no less than that of the local land.

- Lowered corporate income tax (CIT) – for FIEs in encouraged industries in the central, western, and northeastern regions that meet the requirements, the CIT rate can be reduced to 15 percent.

How to read China’s recent efforts on improving foreign investor access

China’s strict curbs implemented to prevent and control the COVID-19 pandemic, especially lockdowns and restrictions on movements has seriously hampered the national economic growth in 2022, together with an uncertain international environment caused by the Russian-Ukraine conflict, geopolitical confrontation among the superpowers, shrinking overseas demand, and continued supply chain bottlenecks.

Given that FIEs account for about a quarter of China’s industrial output, a fifth of its tax revenue, and about 40 percent of its total imports and exports – stabilizing foreign investment and optimizing the distribution of foreign capital is a top priority for the government and policymakers.

The shortening of the FI negative lists as well as the lengthening of the FI encouraged catalogue marks further opening-up and friendliness of Chinese markets to foreign investors, as promised by the country’s government.

On the other hand, analysts hold that the further relaxation of foreign investment access alone is not enough to boost FDI. Officials will need to substantially loosen COVID-related restrictions and implement more concrete stimulus measures, among others, to restore business confidence in China.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article New Specifications for Cross-Border Processing of Personal Information for MNCs

- Next Article China Annual IIT Reconciliation – Your Tax Refund FAQs Answered