China Regulatory Brief: Preliminary Approval System for Business Licenses & Adjusted 2014 Minimum Wage Levels

China Allows Preliminary Approval for Business Licenses in Certain Industries

On August 20, China’s State Administration for Industry and Commerce (SAIC) officially launched a preliminary approval system for business licenses, meaning that eligible enterprises can apply for a business license prior to receiving administrative approval for certain projects. According to the “Catalogue of Certain Industries Eligible for Preliminary Approval of Business Licenses,” eligibility will be extended to 31 items, including coal mining approval, waste electronic equipment disposal permits, and notably, permits for setting up a foreign-invested travel agency. The preliminary approval system is expected to substantially accelerate the set-up procedure for related enterprises.

Hangzhou Adjusts its Minimum Wage Levels for 2014

On August 21, the Hangzhou Government released its monthly and hourly minimum wage levels for 2014, which took effect on August 1, 2014. Accordingly, the monthly minimum wage in Hangzhou has been adjusted to RMB 1650 from RMB 1470 (12.2 percent growth), while the hourly minimum wage has been adjusted to RMB 13.5—both are the highest in Zhejiang province.

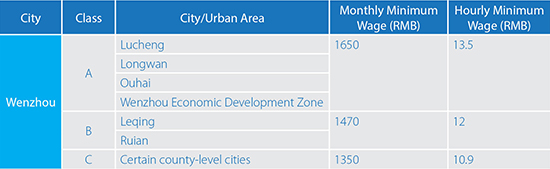

Wenzhou Adjusts its Minimum Wage Levels for 2014

The Wenzhou Government recently released the “Circular on Adjusting Minimum Wages for 2014 (Wen Zheng Fa [2014] No.56),” which took effect on August 1, 2014. According to the Circular, monthly minimum wages in Wenzhou will be divided into three levels. The chart below shows the details of Wenzhou’s new monthly and hourly minimum wage classes:

China Reduces the CIT Rate for the Science and Technology Services Industry

On August 19, the State Council agreed to levy a reduced corporate income tax (CIT) rate of 15 percent on science and technology services companies qualifying as high-tech enterprises, in a bid to bring more private enterprises into the industry. Currently, the majority of science and technology services enterprises in China are under the operation of the Chinese government with comparatively low technical skills.

China Clarifies Scope of Work-Related Injury Insurance

On August 20, the Supreme People’s Court of China released the “Provisions on Several Issues in Work-related Injury Insurance (Fa Shi [2014] No.9),” which will take effect on September 1, 2014. The Provisions stipulates work-related injury insurance liability in five types of special labor arrangements (including labor dispatching) and clarifies four circumstances of work-related injuries incurred during the daily commute to and from work. According to the Provisions, injuries incurred while commuting during the commute caused in the activities of daily life are also included in the scope of work-related injury insurance. For example, injuries incurred when an employee stops off at a grocery store during his/her commute shall be covered by the work-related injury insurance.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Industry Specific Licenses and Certifications in China

Industry Specific Licenses and Certifications in China

In this issue of China Briefing, we provide an overview of the licensing schemes for industrial products; food production, distribution and catering services; and advertising. We also introduce two important types of certification in China: the CCC and the China Energy Label (CEL). This issue will provide you with an understanding of the requirements for selling your products or services in China.

Social Insurance in China

Social Insurance in China

In this issue of China Briefing Magazine, we introduce China’s current social insurance system and provide an update on the status of foreigners’ participation in the system. We also include a comprehensive chart of updated average wages across China, which is used to calculate social insurance contribution floors and ceilings. We hope this will give you a better understanding of the system in China.

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

- Previous Article The Long and Winding Road of IPR Protection in China

- Next Article Trade Fairs in China: Steps to Protect Your IPR