How to Calculate and Withhold IIT for Your Employees in China

To help foreign investors and taxpayers understand how China computes individual income tax (IIT), China Briefing offers a guide outlining how to calculate and withhold IIT for both resident and non-resident individuals.

IIT calculation and withholding for resident individuals

When a company pays wages and salaries to a resident individual, the IIT amount must be computed using the cumulative withholding method, with the IIT withheld on a monthly basis.

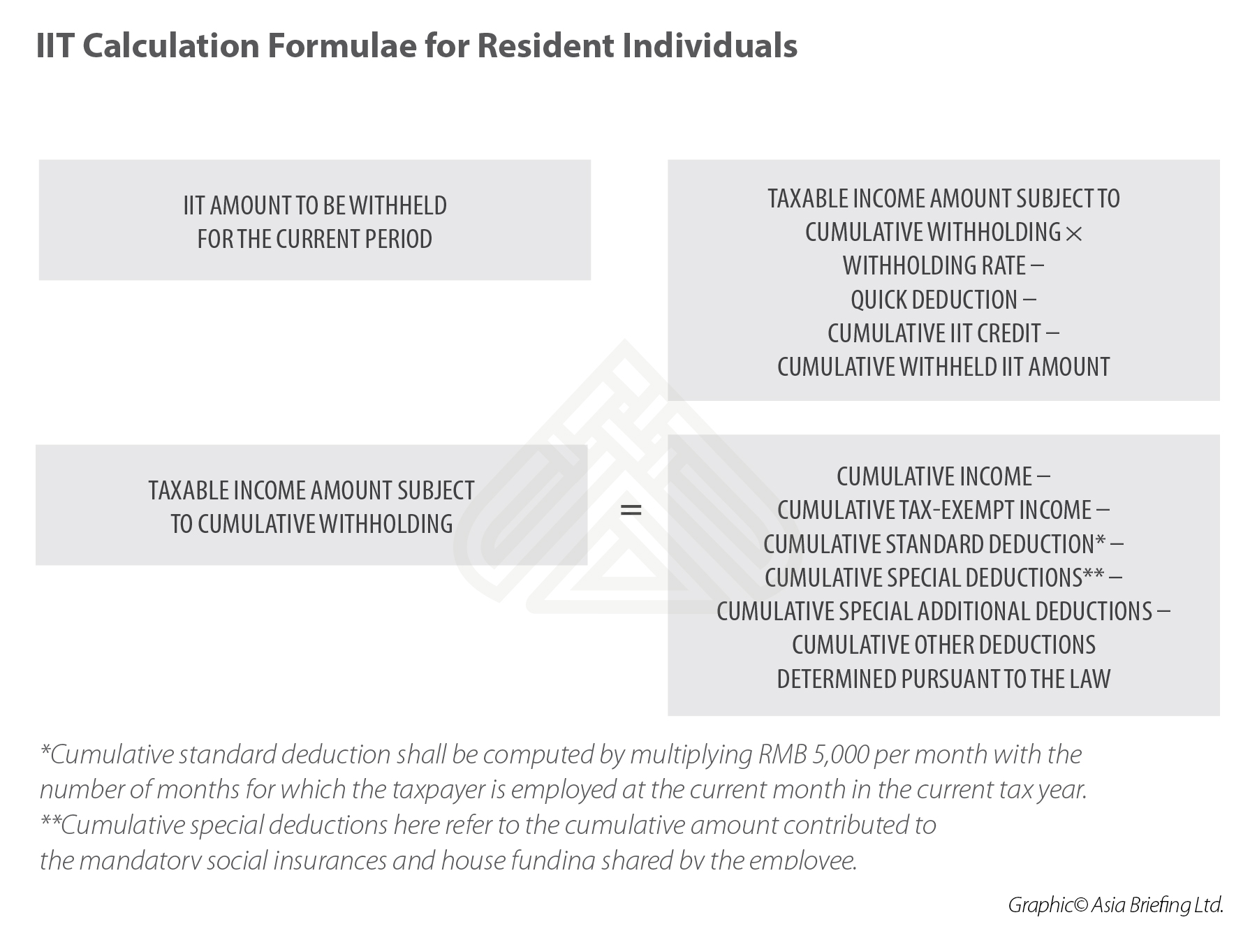

Under the cumulative withholding method, the IIT amount to be withheld for the current period should be the balance of the cumulative IIT withholding amount, with the cumulative tax credit and the cumulative IIT amount that has already been deducted.

To calculate the cumulative IIT withholding amount until the current period:

- First, calculate the taxable income amount subject to cumulative withholding by deducting various items – including the cumulative tax-exempt income, the cumulative deduction expenses, cumulative special deductions, cumulative special additional deductions and cumulative other deductions determined pursuant to the law – from the taxpayer’s cumulative income from wages and salaries for the tax year derived from employment up to the current month; and

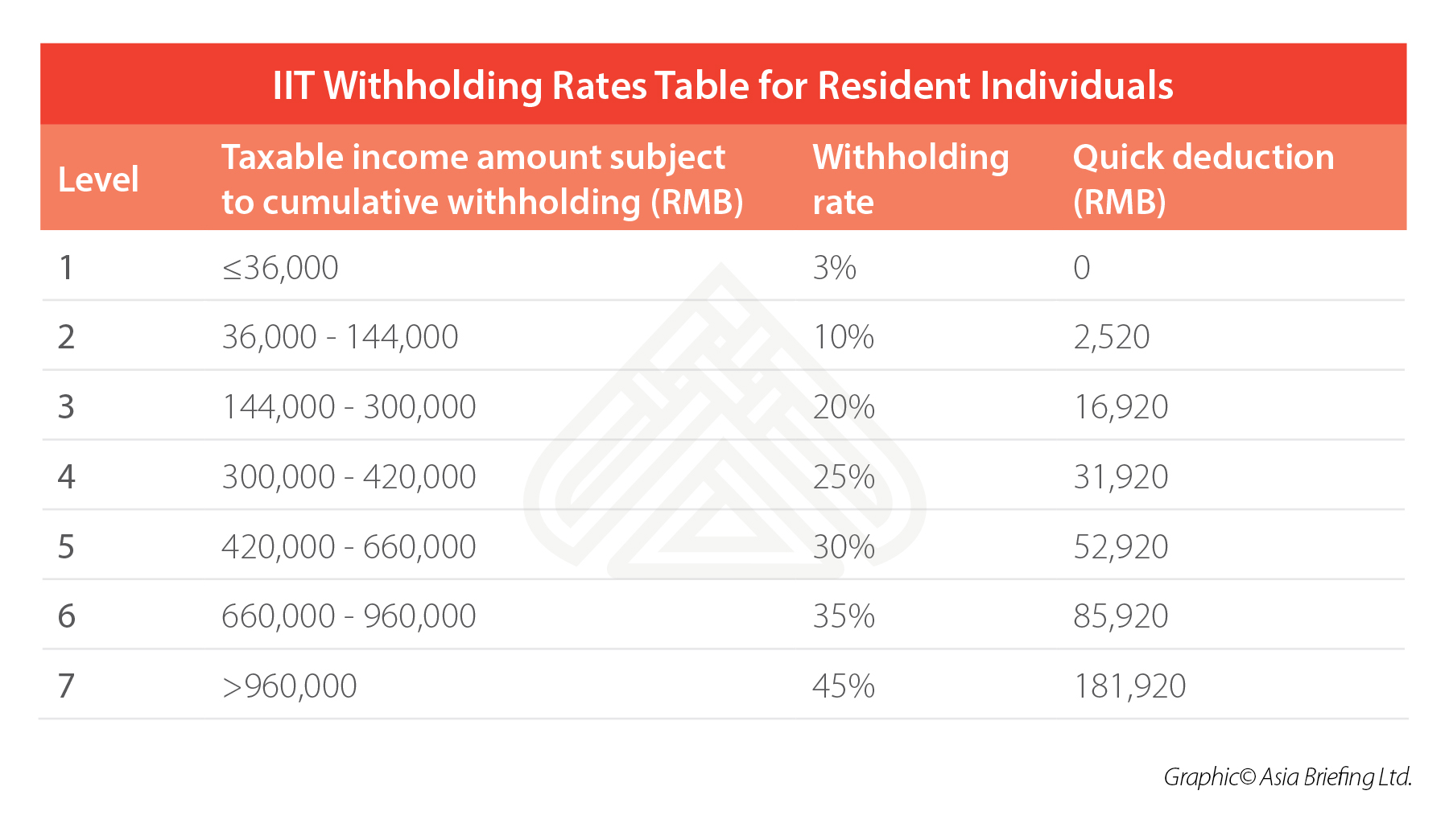

- Second, apply the applicable withholding rates and quick deductions stipulated in the IIT Withholding Rates Table for Resident Individuals.

Where the IIT amount to be withheld is a negative value, a tax refund will not be made in the interim.

Where the balance amount at end of the tax year is still a negative value, the taxpayer will, through completing annual computation and settlement for consolidated income, obtain a tax refund for excess tax paid and make retrospective payment if there is under-paid tax.

This method makes the payroll processing more complicated. However, it could reduce the future processing burden of the annual computation and settlement.

The detailed computation formulae can be found below.

IIT calculation and withholding for non-resident individuals

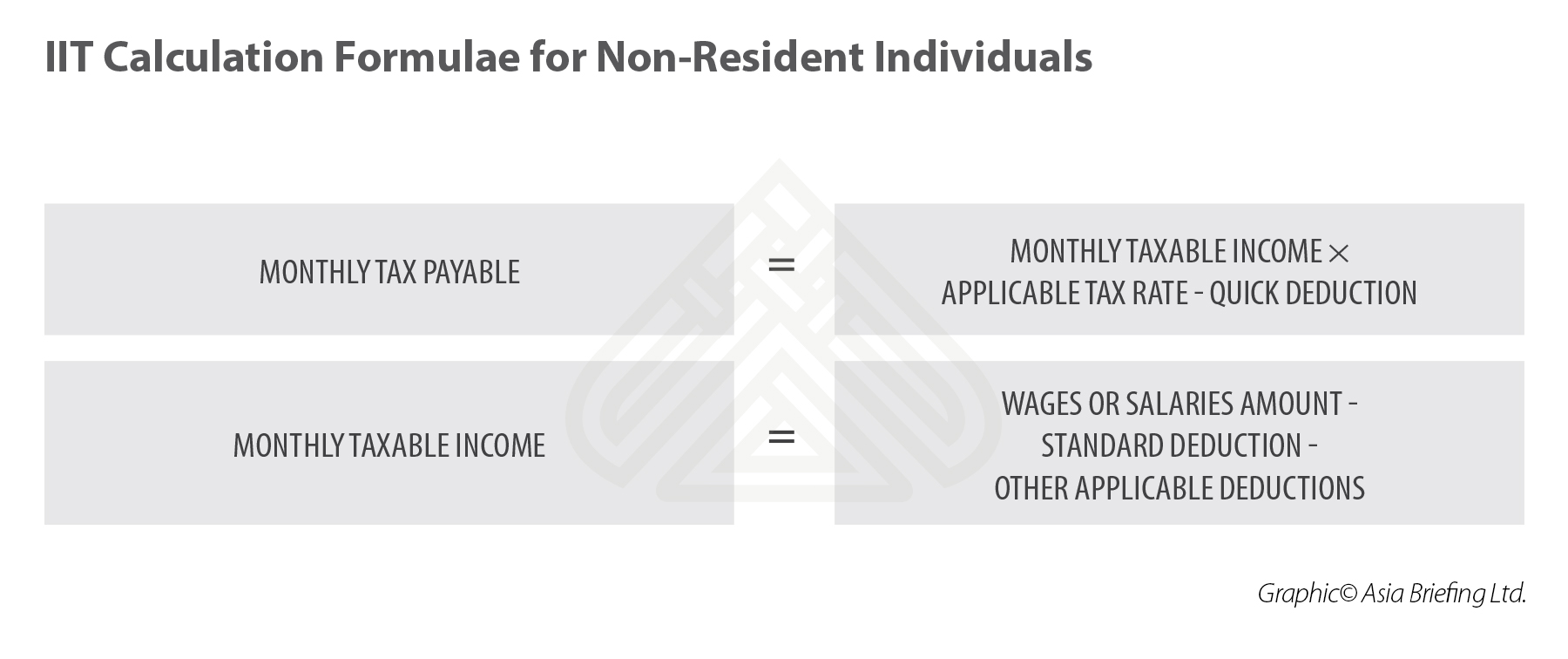

When a company pays wages and salaries to a non-resident individual, it must withhold IIT on a monthly basis, or for each payment, in accordance with the following methods:

- First, calculate the taxable income amount by removing the standard deduction RMB 5,000 and other applicable deductions from the non-resident employee’s monthly income amount; and

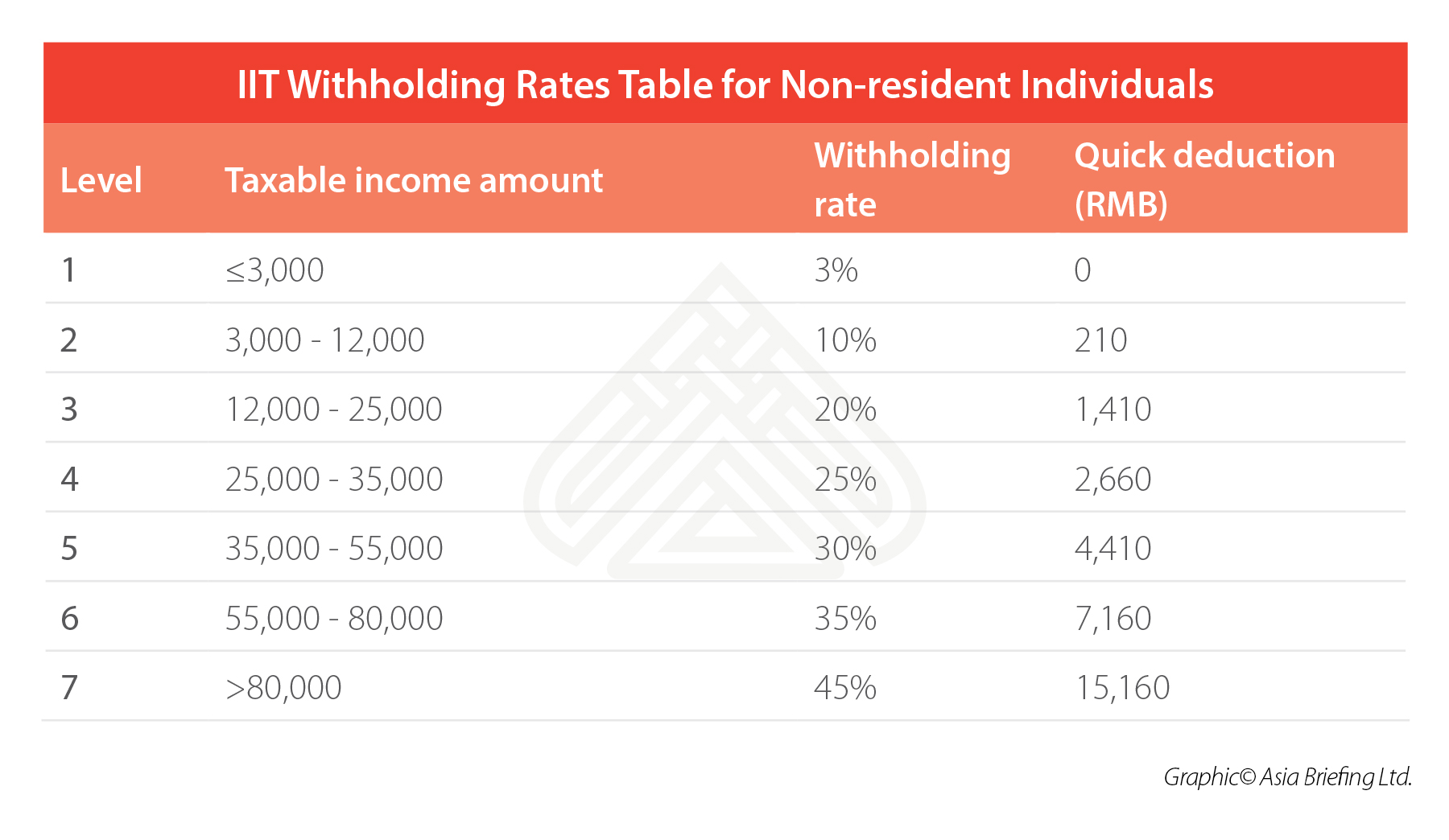

- Second, apply the applicable tax rates and quick deductions stipulated in the IIT Withholding Rates Table for Non-resident Individuals.

The detailed computation formulae can be found below.

The withholding method for a nonresident individual within a tax year is unchanged, but when a non-resident individual satisfies the criteria for resident individual, they must notify the employer of the change, and complete computation and settlement formalities at end of the year.

Special attention for special additional deductions

Employees have the option to claim special additional deductions directly through their tax filing or employer.

Where an employee provides the relevant information to the employer, and requests the employer to handle special additional deductions, the employer is obliged to make deduction for the employee on a monthly basis at the time of withholding tax.

Further, the employer cannot refuse.

The employer should compute the tax amount and make the withholding declaration based on the information provided by the employee.

If the employer discovers a discrepancy in the information provided by the employee, the employer can request the employee to make amendment, and report to the tax bureau in charge if the employee refuses to make an amendment.

The employer is not allowed to arbitrarily change information provided by its employee. In other words, the employer has no obligation to ensure the authenticity and accuracy of relevant information provided by the employee for the purpose of special additional deductions. Individuals are responsible for their deduction information.

Employer should retain the ‘Information Sheet for Special Additional Deductions for Individual Income Tax’ provided by the employee, in case of inspection by the tax bureau. It also protects the employer if the employee provides inaccurate or false information.

Moreover, employers should keep information provided for special deductions confidential – employees may wish to keep information regarding children, marriage, and real estate private.

Other obligations

The employer should deal with relevant matters regarding the tax treaty benefits for their employees if the employee intends to claim entitlement under a tax treaty, informs the employer in advance, and submits corresponding information and documents.

For payment of wages and salaries, the employer should be able to provide the income information and the withheld IIT amount information to its employees within two months from end of the year. Where the employee requests for the aforesaid information at any time during the year, the employer is obliged to provide.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China and Italy Sign New Double Taxation Agreement

- Next Article Residencia fiscal en China: aclaración sobre la regla de los seis años