China’s ASEAN Tour Yields Promising Results

Countries involved with South China Sea disputes not being isolated

Op-Ed Commentary: Chris Devonshire-Ellis

Oct. 14 – As Chinese Premier Li Keqiang wraps up his tour of Thailand and Vietnam, following hard on the heels of President Xi Jinping’s visits to Indonesia, Malaysia and the APEC forum, the results are shown to remain somewhat enigmatic. China has effectively been engaging in a diplomatic shuffle around four of the largest ASEAN nations, drumming up support and increasing bilateral ties. Yet the tour pointedly missed out the Philippines, who have taken China to the United Nations Maritime Arbitration Court over disputes in the South China Sea.

China has been stung too – by communiques from the ASEAN leadership that have effectively pointed the finger at China being overly assertive in its claims. The response? State visits to Malaysia, Indonesia and Thailand where billions of dollars of trade deals have been signed, and along with some serious pledges of massive infrastructure investments. These have ranged from a Sino-Indonesian joint venture contract to build the Jakarta Metro and upgrade the international airport, to the potential development in Thailand of high speed train services linking the country far more closely to China, and of trade with Malaysia increasing by 60 percent in the next five years.

Yet while Li visited Vietnam, and talks were held over the potential for “jointly developing” disputed areas of the South China Sea, China has felt so unnerved by the pending UN arbitration that it avoided the Philippines altogether. That’s hardly surprising – they uninvited the Philippines president to an ASEAN Expo held in Nanning last month, an almost unimaginable breach of etiquette considering the Philippines is a member of ASEAN and China is not.

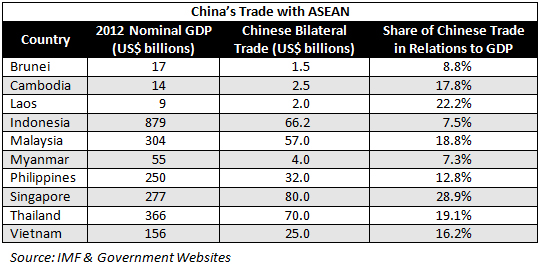

In fact, China has been wary of using trade with ASEAN nations as a weapon to punish errant neighbors. We can compare the extent of Chinese bilateral trade with the ASEAN countries and compare them to each nation’s own economic size to get a rough idea.

Despite the visit of Xi to Indonesia, Chinese bilateral trade with the country as a percentage of the Indonesian GDP remains relatively small at just 7.5 percent, given that Indonesia is close to becoming a trillion dollar economy in its own right. China’s efforts to improve that will not have anything to do with issues concerning the South China Sea. Meanwhile, although the proportion of trade with the Philippines remains relatively low at just 12.8 percent of the Philippines total GDP. Vietnamese trade – another nation wary of China’s South China Sea intentions claims – boasts a 16.2 percentage ratio of their total GDP – relatively healthy and not far behind Malaysia and Thailand, both considered more friendly nations by China.

This means that China’s growing trade with ASEAN is not being politicized – yet. However, both Xi and Li collectively announced significant upgrading of the Chinese relationship with Indonesia, Malaysia and Thailand, promising to develop trade with these nations by as much as 50 percent to 60 percent over next five years. Whether that is a warning to Vietnam and the Philippines, or a sop to the others to keep on China’s side when it comes to South China Sea discussions at ASEAN level, remains to be seen. But it is a narrow tightrope for China to walk if being hopeful of pressurizing its more democratic neighbors in this way, and not all parties in these countries feel enhancing economic ties with China is such a good idea. Grumbling has already emerged from Thailand over comments made concerning Li’s desire to have Thailand award China domestic rail development contracts, and Indonesia remains wary of the political ramifications of thousands of Chinese workers building their own metro system when Indonesian unemployment is high.

Vietnam, meanwhile, still holds a great deal of cards in its dealing with China, and China’s dealings with ASEAN. China has a vested interest in developing improved and high-speed rail links throughout Southeast Asia to the markets of Thailand, Malaysia, Singapore and down to Indonesia. But to do that first, those rail lines need to bisect Vietnam. The Vietnamese will need some major assurances from China and potential settlement of disputed waters for China to realize its primary goal of getting its products deeper and faster into ASEAN as a whole. Yesterday’s meetings between Li and Vietnamese Prime Minister Dung suggested that both countries will work towards solutions and look at joint developments in disputed waters. Yet one feels that China, now pressed into conflict at the United Nations level, may in fact be pragmatic enough to finally reach compromises for the more sustainable issue of developing trade with its neighbors – effectively letting sleeping dogs lie, and allowing some concessions over claims to be made. Otherwise, the Chinese strategy of developing trade by such large amounts in the next five years across ASEAN doesn’t look as feasible as Xi and Li’s words suggest. A more contrite China appears to be emerging.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Manufacturing in Vietnam to Sell to ASEAN and China

Manufacturing in Vietnam to Sell to ASEAN and China

In this issue of Vietnam Briefing Magazine, we introduce our readers to manufacturing in Vietnam as a key part of their business strategy within the ASEAN region and beyond. Specifically, we explain the new ASEAN Free Trade Area, outline what foreign investors can look forward to when creating their manufacturing presence in the country, and introduce the country’s key tax points.

Who in Asia Can Afford a U.S. Default?

APEC for China-Based Businesses – The Key Takeaways

China’s Outbound Investment – It’s Going Into Asia

- Previous Article China Releases Industrial and Commercial Administration Measures for Shanghai Free Trade Zone

- Next Article China Clarifies Recognition of Resident Enterprises Under Hong Kong DTA