China’s Economic Roundup for July: Growth Slowdown, Export Gains, Business Activity Maintains Momentum

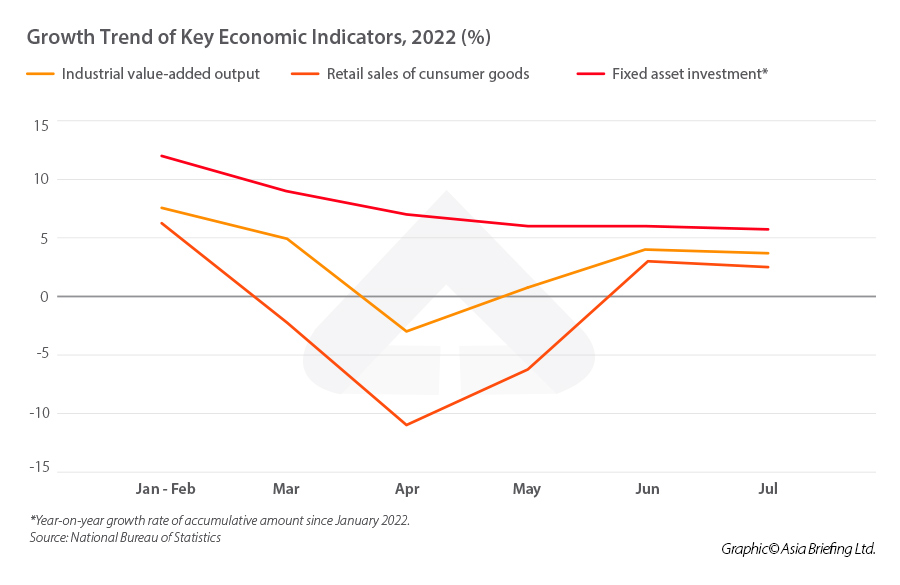

China’s economic indicators for the month of July reveal a slowdown in industrial output, retail sales, and fixed asset investment as the country recovers after months of COVID-19 lockdowns and a worsening global macroeconomic outlook. However, certain industries continue to thrive, and exports recorded the highest figure so far in 2022. In this article, we discuss the key economic and trade indicators for July and how the government will tackle the slowdown going into the fall.

China’s economy is struggling to recover following the strict COVID-19 lockdowns in the spring and summer, which have led to the shutdown of major cities and manufacturing hubs. Several of the main indicators, such as industrial output, retail sales, and fixed asset investment released by the National Bureau of Statistics (NBS) on August 15, show a slowdown in growth.

A combination of continued COVID-19 restrictions, a contracting housing market, a slowing global economy, and high inflation rates in overseas markets are placing downward pressure on the domestic economy. A media Q&A with the spokesperson and head of the NBS also cited the unprecedented heatwave and heavy rains experienced in eastern and southern China as causing further disruption to business and industrial output.

Despite the slowdown, most economic indicators are still positive, and China continues to stave off the beginnings of a recession experienced in many other parts of the world. Certain industries have also defied economic headwinds to see strong growth in July and the preceding months, such as the green energy and technology sectors. Moreover, trade numbers for July continued to show strong growth amid year-high exports.

As we head into the fall, the government has indicated it will roll out further stimulus measures to keep the economy on the uneven road to recovery. At the same time, it will remain committed to the zero-COVID policy and refrain from adopting sweeping stimulus measures.

Below we look at the key economic and trade data for July and discuss how the government plans to steer the country out of the current economic rut.

Economy indicators show stagnating growth

Industrial sector output slows, but green sectors continue to thrive

Value-added output of industrial enterprises over a designated size (those with an annual main business income of RMB 20 million (US$2.9 million) and above) grew 3.8 percent year-on-year, a slight slowdown from the 3.7 percent growth seen in June. This was slower than the 4.3 percent growth rate analysts had predicted.

Two of the three main industries experienced a growth slowdown, while one accelerated:

- Mining grew 8.1 percent year-on-year, slowing from 8.7 percent in June.

- Manufacturing grew 2.7 percent year-on-year compared to 3.4 in June.

- Electricity, heat, gas, and water production and supply grew 9.5 percent year-on-year, an acceleration from just 3.3 percent in June.

Certain industry sectors still saw significant month-on-month grow despite the overall slowdown, in particular green energy and smart products, such as new energy vehicles and solar energy batteries:

- New energy vehicles were up 112.7 percent year-on-year compared to 111.2 percent in June.

- Solar energy batteries grew 33.9 percent year-on-year, up from 31.8 percent in June.

Meanwhile, growth of the value-added output of the high-end manufacturing industry also outpaced the overall industrial sector, reaching 5.9 percent, which was nonetheless a significant slowdown from the 9.6 percent growth seen in June.

The manufacturing purchasing manager’s index (PMI), which gives an indication of manufacturing activity in China, showed a contraction in July at 49 percent, down 1.2 percentage points from June.

*Year-on-year growth rate of accumulative amount since January 2022.

*Year-on-year growth rate of accumulative amount since January 2022.

Source: National Bureau of Statistics

Retail sales sputter amid weak demand but business activity maintains upward momentum

The Index of Service Production (ISP) for July, which indicates the output change of the service industry, grew by 0.6 percent year-on-year, slowing by 0.7 percentage points from June. However, the ISP for the period between January and July 2022 contracted by 0.3 percent year-on-year, with the drop contracting by 0.1 percentage point from June.

Production indicators of the main services sectors still saw positive growth:

- Information transmission, software, and IT services grew 10.3 percent year-on-year.

- The financial industry grew 4.9 percent year-on-year.

Meanwhile, between January and June 2022, the operating income of service enterprises above a designated size (those with an annual main business income of over RMB 20 million (US$3 million)) grew 4.4 percent from the same period last year. Among these:

- Information transmission, software, and IT services grew 8.3 percent year-on-year.

- Health and social work service grew 7.2 percent year-on-year.

- Scientific research and technical services grew 6.8 percent year-on-year.

China’s Service Business Activity Index for July, which indicates development in the service sector business activities, stood at 52.8 percent. This indicates a continued expansion, though it was lower than the 54.3 percent figure seen in June. The index for industries including railway and air transportation, catering and hospitality, telecommunications, radio and television, and satellite transmission services, ecological protection and public facility management, culture, sports, and entertainment stood at 55 percent, indicating that they are still within the region of expansion.

According to a media Q&A published on the NBS website, the slowdown in the ISP was due in part to drag from the real estate market, which saw a 10.8 percent contraction in its production index, 3.8 percent lower than June. This alone accounted for a 1.7 percentage point drop in the ISP. In addition, some in-person services also saw slowed growth due to the impact of COVID-19 outbreaks and restrictions. The ISP of leasing and business services, for instance, grew just 0.4 percent, a drop of 2.9 percent from the previous month.

Meanwhile, retail sales in July continued to see sluggish growth, reaching 2.7 percent, a slowdown of 0.4 percentage points from June. Among the various types of consumption:

- Retail sales of goods reached RMB 3.2 trillion (US$472 billion), a year-on-year increase of 3.2 percent.

- Catering revenue reached RMB 369.4 billion (US$54.5 billion), a year-on-year decrease of 1.5 percent.

- Retail sales of grain, oil, and food of companies above the designated size (annual main business income of RMB 20 million and above for wholesale companies, RMB 5 million (US$737,539) and above for retail, and RMB 2 million (US$295,015) and above for catering and hospitality) increased by 6.2 percent a year-on-year.

- Retail sales of gold, silver, and jewelry companies above the designated size grew 22.1 percent year-on-year.

- Retail sales of household appliances and audio-visual equipment companies above the designated size grew 7.1 percent.

In the period between January and July 2022, total retail sales of consumer goods reached RMB 24.6 trillion (US$3.6 trillion), a decrease of 0.2 percent from the same period in 2021. Of this, online sales of material goods accounted for 25.6 percent of total retail sales and 86.2 percent of all online sales, growing 5.7 percent from the same period in 2021 to reach RMB 6.3 trillion (US$929.3 billion).

Fixed asset investment growth slows to a crawl as housing crisis bites

Growth of fixed asset investments (FAI) in July slowed to just 0.16 percent month-on-month, and slowed from 6.1 percent in the first half of 2022 to 5.7 percent in the period from January to July 2022. Meanwhile, infrastructure investment grew 7.4 percent year-on-year on the back of increased government spending through the issuance of special purpose bonds (SPBs), manufacturing investment grew 9.9 percent year-on-year, and real estate development decreased by 6.4 percent year-on-year.

Real estate development investment and sales saw the largest contraction, with commercial housing sales dropping 28.8 percent year-on-year (compared to a decrease of 28.9 percent from January to June 2022). China’s housing market has been in a deep crisis since several developers began defaulting on loans in the latter half of 2021 and a mortgage boycott continues to spook potential home buyers.

Investment across most other sectors continued to grow, with FAI slowing slightly from June in the three main industry sectors:

- FAI in primary industries grew 2.4 percent year-on-year, slowing from 4 percent in June.

- FAI in secondary industries grew 10.4 percent year-on-year, slowing from 10.9 percent in June.

- FAI in tertiary industries grew 3.7 percent year-on-year, slowing from 4 percent in June.

Meanwhile, FAI in high-tech sectors in July remained strong:

- High-tech manufacturing increased 22.9 percent year-on-year, slowing slightly from 23.8 percent in June.

- High-tech services increased 14.3 percent year-on-year, accelerating from 12.6 percent in June.

Among the high-tech manufacturing sectors:

- Investment in electronics and communications equipment manufacturing grew 27.5 percent year-on-year compared to 28.8 percent in June.

- Investment in medical instruments and apparatus manufacturing grew 26.6 percent year-on-year compared to 28 percent in June.

Foreign trade exceeds forecasts as exports hit annual high

China’s trade data has continued to exceed forecasts in 2022. Total import and exports of goods in July reached RMB 3.8 trillion (US$559.8 billion), a year-on-year increase of 16.6 percent, outpacing the June figure by 2.3 percentage points to reach the highest rate so far in 2022. Exports continued to see strong growth, reaching RMB 2.24 trillion (US$330 billion) in July. This acceleration exceeded the forecast 15 percent growth rate, up 18 percent year-on-year in dollar terms and slightly faster than the 17.9 percent growth seen in June.

The growth of imports remained slow, reflecting weak domestic demand, increasing 7.4 percent year-on-year to reach RMB 1.56 trillion (US$229.8 billion), or 2.3 percent in dollar terms.

Imports and exports between private companies accounted for 50 percent of the total in the period between January and July, increasing 2.1 percent year-on-year.

China’s largest trade partner in 2022 remains the ASEAN region, which accounted for 15 percent of all imports and exports in the period between January and July. China’s trade surplus with this region has also expanded by 76.4 percent during this period, reaching RMB 562.6 billion (US$83 billion). It also imported the largest amount from ASEAN, reaching RMB 1.48 trillion (US$218 billion), a year-on-year growth rate of 19.7 percent.

The EU was the second largest trading partner with a total of RMB 3.23 trillion (US$475.9 billion), accounting for 13.7 percent of all imports and exports so far in 2022. Exports grew 19.7 percent year-on-year, while imports fell by 7.6 percent, likely due to the impact of the Russia-Ukraine conflict. The trade surplus with the EU thus also saw significant expansion, growing 71.7 percent year-on-year to reach RMB 1.05 trillion (US$154.7 billion).

| China’s Top Trade Partners (January to July 2022) | ||||

| Country/region | Imports | Exports | Total | Year-on-year change |

| ASEAN | RMB 1.48 trillion (US$218 billion) | RMB 2.05 trillion (US$302 billion) | RMB 3.53 trillion (US$520 billion) | 13.2 percent |

| EU | RMB 1.09 trillion (US$160.6) | RMB 2.14 trillion (US$315 billion) | RMB 3.23 trillion (US$475.9 billion) | 8.9 percent |

| US | RMB 677.82 billion (US$99.9 billion) | RMB 2.25 trillion (US$331.5 billion) | RMB 2.93 trillion (US$431.7 billion) | 11.8 percent |

| South Korea | RMB 774.05 billion (US$114 billion) | RMB 618.04 billion (US$91 billion) | RMB 1.39 trillion (US$204.8 billion) | 8.9 percent |

| Source: China General Administration of Customs. | ||||

The US is China’s largest export country and third largest trade partner. Exports grew 15.1 percent year-on-year to reach RMB 2.25 trillion (US$331.5 billion), while imports grew just 2.3 percent year-on-year. The trade surplus expanded by 21.7 percent to reach RMB 1.57 trillion (US$231.3 billion).

South Korea is China’s fourth largest trade partner, accounting for 5.9 percent of total imports and exports. Exports to South Korea grew 17.9 percent, while imports grew just 2.6 percent. China’s trade surplus with South Korea shrank by 32.2 percent, standing at RMB 156 billion (US$23 billion) as of July 2022.

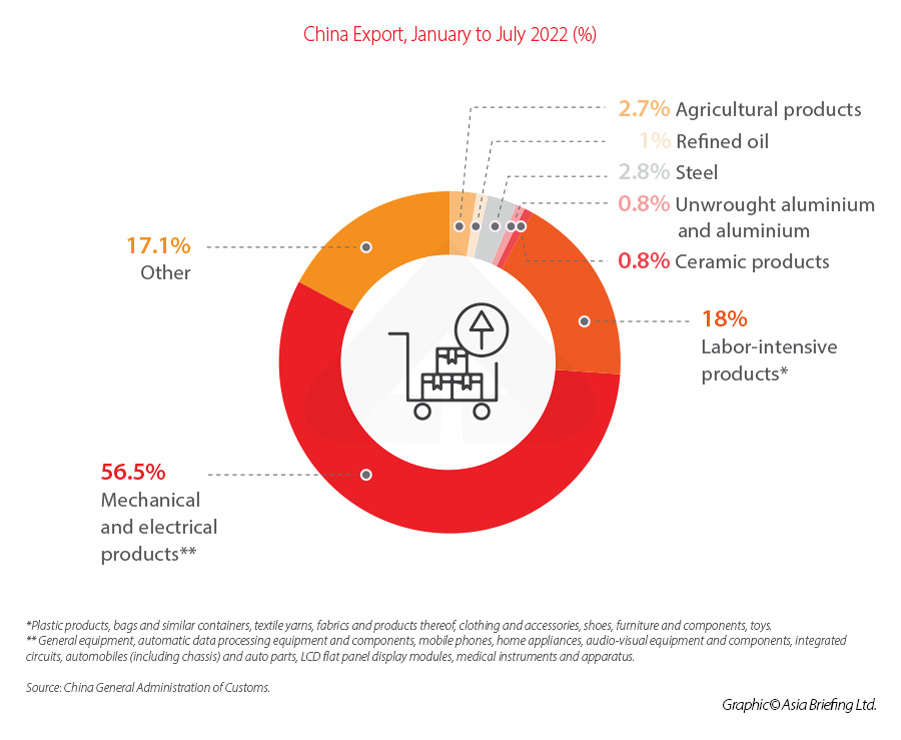

Mechanical and electrical products accounted for 56.6 percent of all exports in the period from January to July 2022, increasing 10.1 percent from the same period in 2021. Among them, exports of automatic data processing equipment and components increased by 4.4 percent year-on-year to reach RMB 918.2 billion (US$135.4 billion), while exports of mobile phones increased 2 percent (RMB 494.63 billion (US$73 billion) in total exports), and exports of automobiles grew 54.4 percent (RMB 175.74 billion (US$25.9 billion) in total exports).

The export of labor-intensive products also increased significantly during this period, growing 15.2 percent year-on-year and accounting for 18 percent of all exports. Among them, clothing and accessories grew 13.5 percent to reach RMB 647.54 billion (US$95.5 billion), textiles grew 11.9 percent to reach RMB 581.45 billion (US$85.8 billion), and plastic products increased 16.3 percent to reach RMB 402.1 billion (US$59.3 billion) in exports.

How does the government plan to get the country out of the economic rut?

In late July, China’s Politburo quietly walked back on its 2022 GDP growth target of “around 5.5 percent” in a meeting on the economy, indicating it does not foresee reaching this figure by the end of 2022. Instead, it advocated for a “focus on stabilizing employment and prices, keeping the economy operating within a reasonable range”. It also stated that “provinces with the conditions [to do so] should strive to achieve the expected economic and social development goals”.

China has consistently adhered to a “prudent” monetary policy that favors the use of targeted monetary tools, such as relending and policy loans to support specific industries and groups and broader loan rate cuts to inject liquidity through the banking system over more heavy-handed stimulus. The goal of this policy is to prevent flooding the market with liquidity and over-stimulating the economy. The July Politburo meeting appears to stick to this monetary playbook, stating that “monetary policy should keep liquidity reasonably adequate”.

On August 15, the same day the July economic indicators were released by the NBS, the People’s Bank of China (PBOC) cut the medium-term lending facility (MLF) rate for the second time in 2022, reducing it by 10 base points to 2.75 percent. The rate was cut for RMB 400 billion (US$59 billion) worth of one-year MLF loans.

Infrastructure investment has traditionally been a core driver of China’s economic growth, and it appears the government will continue to rely on it to prop up the economy in the coming months. The July Politburo meeting proposed “increasing credit support for enterprises and making good use of new credit from policy banks and investment funds for infrastructure construction”.

Monetary policy should maintain reasonable and sufficient liquidity, increase credit support for enterprises, and make good use of new credit from policy banks and investment funds for infrastructure construction. It also called on local governments to speed up infrastructure investment by “making good use of local government special-purpose bonds (SPBs) and supporting local governments to make full use of the SPB limit”.

The issuance of SPBs is one of the main ways local governments finance infrastructure projects in their localities. The above statement indicates that the central government may enable local governments to issue more SPBs beyond the annual incremental limit (set at RMB 3.65 trillion (US$538.4 billion) for 2022), provided it remains within the total accumulated limit (set at RMB 21.8 trillion (US$3.2 trillion) for 2022), in order to fund more infrastructure projects. The current total accumulated balance stood at RMB 20.3 trillion (US$3 trillion) at the end of June, according to the Ministry of Finance.

The government has previously urged local governments to issue most of the SPBs by the end of June and spend them by the end of August. By the end of June, local governments had issued RMB 3.4 trillion (US$501.5 billion) in SPBs.

China has also implemented several measures to stabilize the property market, easing restrictions on bank loans for property developers and lifting lending restrictions for affordable renting housing projects, among other measures.

The government is unlikely to waiver on its zero-COVID, or “dynamic clearing” policy, any time soon. The July Politburo meeting doubled down on the policy, stating that “it is necessary to efficiently coordinate epidemic prevention and control with economic and social development” and “when an outbreak occurs, we must immediately and strictly prevent and control”.

The focus on infrastructure investment and targeted monetary tools are unlikely to completely turn around the economy by the end of the year, but it may stave off the worst effects of the impending global recession and keep China on the trajectory of slow but positive growth.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article 10 Things Businesses Need to Know When Setting Up a Company in China and the UK: Episode 3

- Next Article Investing in Jiaxing: Industry, Economics, and Policy