China’s Gaming Industry: Trends and Regulatory Outlook 2024

China’s gaming industry remains a global powerhouse, boasting significant growth in mobile gaming revenue and expanding international presence. Despite regulatory challenges, the sector shows resilience, with a focus on e-sports, VR integration, and globalization efforts, all against a backdrop of evolving regulatory dynamics aimed at promoting responsible gaming practices.

China maintains its stronghold in the global gaming industry, positioning itself as the leading market worldwide. It commands the largest share of global mobile games revenue – a significant one-third of the total revenue in the sector. Additionally, Chinese game developers are expanding their presence internationally, accounting for 47 percent of the global mobile gaming revenue.

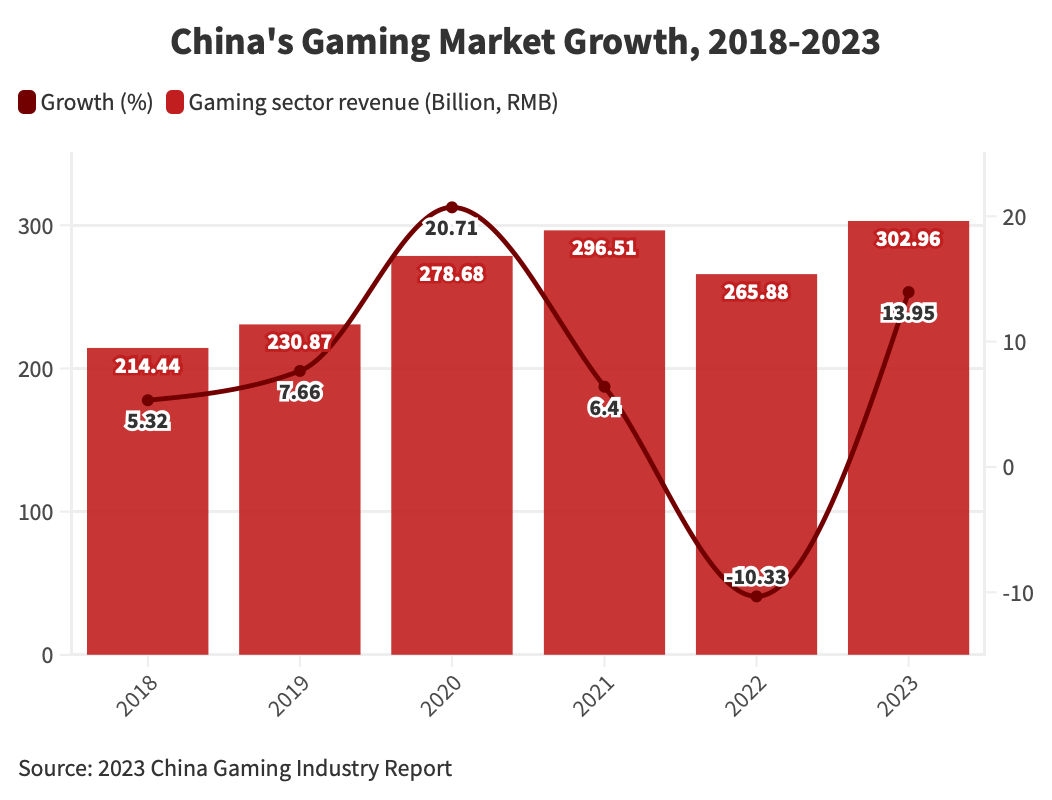

The China Audio-Video and Digital Publishing Association revealed that in 2023 the actual sales revenue of China’s domestic gaming market exceeded RMB 300 billion for the first time, reaching RMB 302.96 billion (US$41.68 billion) — a 13.95 percent year-on-year increase.

This scenario is particularly significant when looking at the country’s record number of gamers, totaling 668 million in 2023. To put that in perspective, this is almost double the number of the entire population of North America. The popularity and widespread nature of the gaming culture in China underpin the market’s scale and potential.

This resurgence follows the Chinese government’s regulatory realignment of the gaming industry, which introduced several uncertainties to market dynamics over the past two years.

Understanding market dynamics and regulatory shifts, along with its upcoming trends, is crucial for navigating the industry’s potential. In this article, we delve into the Chinese gaming sector, providing insights into its outlook in 2024.

Market overview

The gaming sector in China is expected to witness substantial growth, with projections indicating an increase from US$66.13 billion in 2024 to US$95.51 billion in 2029, reflecting a compound annual growth rate (CAGR) of 7.63 percent.

At present, 46 percent of the Chinese population actively engages in video games, with approximately 300 million of them being women. The average age of gamers in China is 35, with an average revenue per user (ARPU) standing at US$64.

Mobile gaming reigns supreme among Chinese gamers, commanding 66 percent of their total expenditure on games. Chinese game studios dominate the global mobile gaming market, capturing 47 percent of the revenue share worldwide. Within the top 100 global mobile game publishers, 38 hail from China.

In the domestic market alone, the mobile gaming segment maintains its stronghold in the market, commanding a significant share of 74.88 percent of actual sales revenue in 2023. It is worth mentioning that Tencent and NetEase collectively represent over half of the total share for domestic computer and mobile games revenue. However, it’s notable that their combined market share witnessed a decline compared to the previous year, suggesting emerging competitors are gaining traction in the industry.

In terms of driving factors, the country’s booming gaming industry owes much of its growth to the surging popularity of e-sports, a competitive facet of gaming where players engage in competitions broadcasted online.

Chinese businesses are also capitalizing on global digitalization opportunities by integrating digital transformation across their product cycles to boost production efficiency. For instance, Tencent Games unveiled seven projects in June, including collaborations on game technology, such as the digital recreation of iconic landmarks and innovative robot learning projects.

The proliferation of mini-games embedded within mobile apps like WeChat, which offer social engagement and easy accessibility, has also largely contributed to China’s gaming industry growth.

The modernization of cable networks, particularly with the adoption of high-speed technology like DOCSIS 3, has enabled cable operators to provide robust cloud gaming services. Moreover, the widespread availability of cloud infrastructure has revolutionized the gaming landscape by offering scalable and cost-effective computing resources. As a result, gaming services stand out as one of the fastest-growing sectors for cloud computing in China.

Trends in China’s gaming industry

E-sports maintain momentum, fueled by mobile gaming

China maintains its status as the epicenter of the world’s e-sports industry. Over the past decade, the country has emerged as a dominant force in e-sports, game development, publishing, and tournament organization. Today, it is home to world champions across various games and hosts some of the largest e-sports companies worldwide, and this trend is bound to continue.

China leads globally in both the number of active e-sports players and revenue generated from e-sports titles. The rapid growth of mobile e-sports has been a significant catalyst in the market expansion. Popular PC titles like League of Legends and mobile games such as Honor of Kings and the China-specific PUBG Mobile variant, Peacekeeper Elite, enjoy immense popularity in the country.

In terms of domestic players, Tencent, the world’s largest gaming company headquartered in China, owns Riot Games and holds significant stakes in numerous other e-sports title publishers, playing a pivotal role in China’s e-sports development. Additionally, Chinese tournament organizer VSPO holds a prominent position in the Asian e-sports industry, operating the King Pro League and Honor of King’s franchised league.

Similarly, NetEase Games reported stellar financial results in Q3 2023, reflecting an 11.6 percent year-on-year revenue increase. The success was driven specifically by the company’s strong performances in mobile games and value-added services, including flagship titles such as Justice Online Mobile and Dunk City Dynasty.

Foreign companies have also made inroads into the Chinese e-sports landscape. Prominent organizations such as G2 E-sports and T1, both of which ranked highly in Mailman’s 2023 China Digital Performance Index, alongside tournament organizers and even the Premier League football club Wolves (Wolverhampton Wanderers F.C.), have all forged partnerships with Chinese leagues and brands.

Virtual reality convergence

Virtual reality (VR) technologies have rapidly gained popularity in China, revolutionizing various industries and captivating consumers with immersive experiences, and the gaming world is no exception.

Recently, Meta Platforms, previously known as Facebook, made headlines in the Chinese market by unveiling a partnership with Tencent Holdings. This collaboration aims to introduce an affordable VR headset, marking Meta’s strategic re-entry into China’s dynamic technological landscape. By teaming up with Tencent, Meta not only seeks to compete with ByteDance’s Pico VR but also to leverage Tencent’s extensive distribution network to penetrate the Chinese market effectively.

While the specific details of the deal remain under wraps, the exclusive distribution agreement positions Tencent as the key player in bringing Meta’s VR headset to Chinese consumers, with sales anticipated to kick off in late 2024.

Alipay’s gaming ambitions: Mini games and beyond

The intersection of finance and gaming is also increasingly frequent, marking a significant evolution in consumer engagement. As financial technology continues to advance, platforms like Alipay are diversifying their services to include gaming experiences. Financial entities are not only facilitating transactions but also fostering interactive entertainment.

In a strategic move, Alipay has entered the gaming segment with the launch of its mini-game platform. This initiative aims to enhance user engagement and diversify Alipay’s offerings beyond financial services. The platform’s unique features and Alipay’s extensive user base present significant opportunities for developers and gamers alike. Alipay’s foray into the gaming industry aligns with broader trends in the gaming landscape, reflecting the increasing convergence between finance and entertainment sectors.

Globalization of domestic firms

In recent years, globalization has become a prominent trend in China’s gaming industry. As outlined in the China Press and Publication Research Institute’s 2022-2023 Annual Report on the Digital Publishing Industry, Chinese gaming companies made significant efforts in expanding their global footprint. Despite facing challenges such as the global economic downturn, increased regulatory scrutiny, and geopolitical tensions, Chinese gaming products achieved remarkable sales revenue of US$17.34 billion in overseas markets.

Key markets like the United States, Japan, South Korea, and Germany contributed to over 56 percent of the global market share. While Chinese game distributors witnessed growth in Japan, the United Kingdom, and Germany for two consecutive years, the revenue from Chinese-made games in foreign markets saw a 3.7 percent decline from the previous year – marking the first drop since 2018.

Looking ahead, emerging markets such as the Middle East, Africa, Southeast Asia, and Latin America hold significant growth potential for Chinese video games in global gaming markets.

As for domestic industry growth, gaming companies are actively promoting overseas expansion, backed by the emergence of supporting services tailored for global expansion efforts. This indicates that the ecosystem for the globalization of gaming markets is evolving towards greater maturity.

Navigating China’s gaming regulatory landscape in 2024

China’s gaming industry operates within a dynamic regulatory framework, subject to ongoing changes and scrutiny. Amidst evolving regulations, the sector faces multifaceted challenges and opportunities that shape its trajectory in 2024 and beyond.

The regulatory landscape reflects the Chinese government’s efforts to strike a balance between fostering a vibrant gaming ecosystem while also addressing concerns about excessive gaming and its impact on society, particularly among minors. Specifically, initiatives such as imposing playtime restrictions for minors highlight the government’s commitment to promoting responsible gaming habits.

On the other hand, recent proposals to curb excessive spending and regulate in-game rewards have sparked investor concerns, leading to market volatility and apprehensions about future regulatory interventions. While these measures aim to ensure a healthy gaming environment, they also introduce uncertainties for industry stakeholders.

Given these developments, China’s National Press and Publication Administration (NPPA) recently took significant steps to support the gaming sector. In December 2023, the NPPA approved 105 new online games. This decision came amidst concerns within the gaming industry following proposed regulatory measures, which had led to substantial losses for major game developers. Indeed, the NPPA approved a total of 1,075 game licenses in 2023 – more than double the number of approvals in 2022.

Following this, in January 2024, China went further by approving 115 new video game titles, representing the largest batch of approvals in 18 months. This move was seen as a clear indication of the government’s supportive stance towards the gaming sector. These approvals not only provided relief to developers but also signaled a willingness to foster growth and innovation within the sector.

The issuance of new gaming licenses signals a potential shift in China’s regulatory approach, offering opportunities for industry growth and innovation. Looking ahead, the Game Working Committee emphasizes the importance of launching high-quality products and promoting the industry’s sustainable development. Stakeholders are urged to “contribute to building a culturally rich nation.”

As China’s gaming sector navigates these transformations, it is important to remain adaptable and responsive to regulatory changes while fostering innovation and creativity. The industry’s resilience and capacity for innovation position it for continued growth and evolution amidst evolving regulatory dynamics.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates also has offices in Vietnam, Indonesia, Singapore, United States, Australia, Germany, Italy, India, and Dubai (UAE). We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Record Highs in Travel, Consumption Boost Mark 2024 Chinese Spring Festival Holidays

- Next Article China’s New Draft Regulations for After-School Tutoring