Sports Medicine in China: Market Outlook, Regulatory Landscape, and Investment Insights

China’s sports medicine market is experiencing rapid growth, driven by robust policy support, shifting demographics, and rising sports participation. This trend is creating significant opportunities for foreign investors in areas such as medical devices, rehabilitation solutions, and related services.

China’s sports medicine market is experiencing rapid growth, driven by increasing demand for injury treatment, rehabilitation, and recovery services. Shifts in sports participation, demographic trends, and health behaviors are fueling this growth, particularly the increasing incidence of musculoskeletal injuries combined with an aging population. National health and fitness strategies further strengthen this momentum by integrating sports medicine with rehabilitation, preventive care, and chronic disease management goals.

This market presents significant opportunities for foreign investors, especially in advanced medical devices, rehabilitation technologies, and specialized service models. However, market entry requires navigating pricing pressures from centralized procurement, a complex regulatory landscape, and intensifying competition from domestic players. Successful participants will need distinct technological advantages and robust local partnerships. Overall, China’s sports medicine sector is evolving beyond a niche segment to become a key component of the healthcare market, offering sustained potential for innovation-driven and service-oriented growth.

Market overview: Size, growth, segments, and major players

Market size and outlook

China’s sports medicine market is scaling quickly, though sizing depends heavily on the definition. Under a narrow definition focusing strictly on injury repair devices, the market is estimated at US$370.5 million in 2024, growing at a 9.5 percent compound annual growth rate (CAGR).

However, a practical investor’s view often includes the adjacent rehabilitation sector. When this broader ecosystem is considered, the opportunity expands significantly: the rehabilitation equipment market alone is estimated at US$1.03 billion in 2024. This disparity highlights that the bulk of growth lies in the recovery ecosystem rather than operating rooms alone.

Globally, Grand View Research projects the sports medicine market to grow at an 8.6 percent CAGR (2025–2033), while Mordor Intelligence estimates the Asia-Pacific market as the fastest-growing region at about 8.1 percent CAGR (2025–2030). China’s forecast, therefore, sits above these benchmarks, consistent with its expanding fitness participation and healthcare upgrade cycle.

Key market segments

To understand where this capital will flow, investors must look beyond the topline number to the three core business segments. China’s sports medicine market spans both products and services, with demand concentrated across several core segments. Sports injury treatment devices form the clinical foundation of the market, including arthroscopy systems, fixation and repair devices, and soft-tissue and cartilage repair solutions. Tertiary hospitals dominate demand for these products, where surgical capacity and specialist expertise are strongest.

The body support and recovery segment covers braces, supports, compression products, and hot and cold therapy solutions. This segment benefits from rising consumer willingness to pay for recovery, injury prevention, and post-exercise care, particularly among fitness-oriented urban populations.

Rehabilitation equipment and digital rehabilitation solutions represent a rapidly expanding segment. Therapy equipment, connected rehabilitation tools, robotics, and structured home-rehabilitation workflows are extending care beyond acute treatment and hospital settings, broadening the market’s addressable base.

On the services side, clinical sports medicine and rehabilitation services continue to expand. Growth is driven by the strengthening of sports medicine and rehabilitation departments within large public hospitals, alongside the emergence of independent rehabilitation centers in higher-income urban markets.

Competitive landscape

Multinationals remain prominent in high-value segments. Major global players include Arthrex, Stryker, Smith+Nephew, Zimmer Biomet, and others. Domestic orthopedics and rehab-technology capability is rising, with local players strengthening manufacturing, research and development (R&D), and commercialization of implants and recovery solutions.

Procurement dynamics shape competitive outcomes. Recent Value-Based Procurement (VBP)rounds reduced orthopedic implant prices by 55 to 84 percent for certain orthopedic implant categories, according to GlobalData. State media also links national centralized procurement to significant price declines in artificial joints following the first national VBP bid for joints. For suppliers, this environment rewards localized cost structures, robust clinical education, and portfolios that defend value through outcomes, workflow efficiency, and differentiated technology rather than brand alone.

Demand drivers shaping China’s sports medicine market

Rising sports participation

China’s expanding base of regular exercisers forms the most direct demand driver for sports medicine. Official data from the General Administration of Sport of China shows that more than 500 million people now engage in regular physical exercise, supported by rapid growth in mass-participation activities such as running, ball sports, fitness training, and winter sports. The post-Beijing Winter Olympics legacy has further lifted participation in skiing and ice sports, which carry relatively high injury risk and screening needs.

Policy-led expansion of school and youth sports is reshaping demand profiles. Stronger physical education requirements and competitive school sports programs have increased exposure to ligament, joint, and overuse injuries among children and adolescents. This trend is driving earlier diagnosis, preventive screening, and long-term rehabilitation demand, particularly in urban markets with higher household healthcare spending.

Demographics and public health factors

China’s demographic structure reinforces these trends. The country continues to age rapidly, with musculoskeletal disorders, osteoarthritis, and mobility-related conditions rising alongside life expectancy. The National Health Commission consistently identifies disorders of the musculoskeletal system as a major contributor to disability-adjusted life years among older adults. Sports medicine techniques, particularly minimally invasive surgery and structured rehabilitation, are increasingly applied beyond athletes to aging and chronic-disease populations seeking functional recovery rather than purely clinical treatment.

Public health awareness has also strengthened since COVID-19. Preventive health, physical resilience, and post-illness recovery now feature more prominently in consumer decision-making, expanding demand for rehabilitation services and recovery-focused medical products.

Technological adoption and consumer expectations

Technology is reshaping how sports medicine services are delivered. Wearables, motion sensors, and connected rehabilitation devices allow providers to monitor recovery progress outside hospitals and clinics. Tele-rehabilitation and home-based recovery tools help address capacity constraints in public hospitals while meeting patient demand for convenience and continuity of care.

Professional and amateur sports also increasingly rely on data-driven performance analysis. Digital gait analysis, biomechanical assessment, and AI-assisted training feedback systems are gaining traction, broadening the market beyond injury treatment into prevention and performance optimization.

China’s policy and regulatory framework supporting sports medicine

National strategies and sector priorities

China’s Healthy China 2030 strategy anchors the government’s vision for health and wellness as core national priorities. The plan elevates health to a strategic national imperative and aims to expand the health industry, strengthen prevention and rehabilitation services, and improve population health outcomes. It calls for broad development of fitness and leisure sports services, integration of health services, and growth of health-related industries.

The 14th Five-Year Plan (2021–2025) further reinforces this direction by treating both the sports industry and the health services sector as growth engines. National Fitness Campaign documents set quantitative targets, including expanding the proportion of people who regularly exercise, increasing per-capita sports venue area, and improving access to public sports services through “15-minute fitness circles” in urban communities. These targets directly translate into higher injury management, screening, and rehabilitation demand.

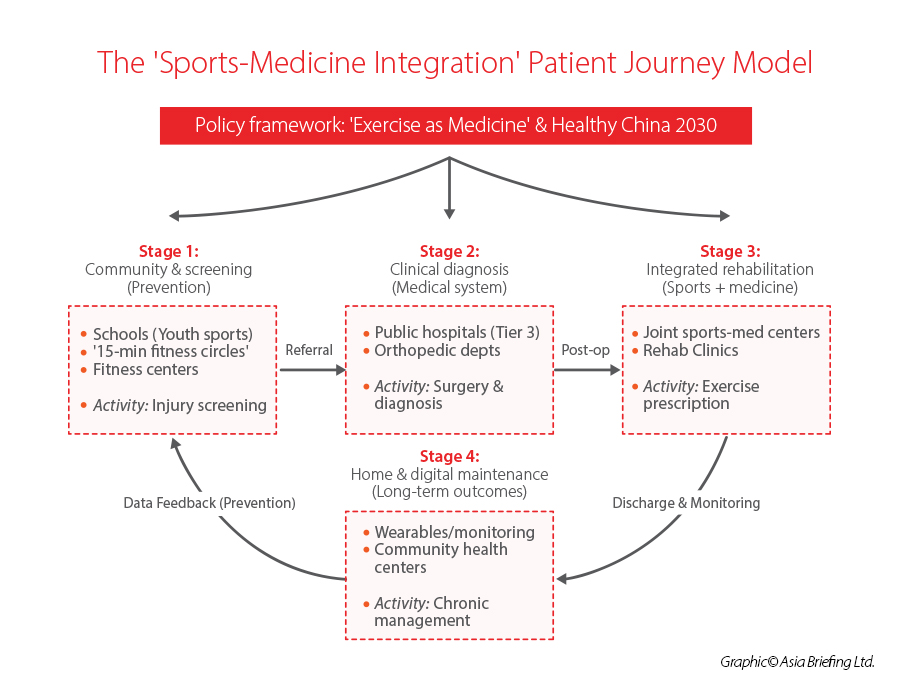

“Sports–medicine integration” initiatives

China is moving beyond high-level strategy toward the operational integration of sports and healthcare. National policy now positions “exercise as medicine,” encouraging hospitals and community centers to collaborate on injury prevention and rehabilitation. Pilot programs in cities like Shanghai and Suzhou have already introduced joint centers that combine clinical diagnosis with structured recovery.

These pilots signal a shift in how policymakers view sports medicine, not as a specialty limited to elite athletes, but as a scalable public-health tool embedded in primary care and chronic disease management.

Medical device regulation and pricing pressures

Sports medicine products fall under the National Medical Products Administration (NMPA)’s standard regulatory framework, requiring classification-based registration and clinical evaluation. Regulatory strategy must also account for procurement dynamics; while not all sports medicine devices are currently subject to national VBP, the regulatory trend clearly favors cost-containment and standardized pricing over brand premium.

Opening to foreign investment

Policy signals toward healthcare opening continue to strengthen. China has expanded pilot programs allowing wholly foreign-owned hospitals in selected free trade zones and major cities, creating entry points for foreign-led specialty clinics, including sports medicine and rehabilitation centers. However, success requires careful compliance planning around hospital licensing, data governance, digital health regulation, and cross-border data management. In this environment, foreign investors gain the strongest foothold through localized partnerships aligned with public policy priorities rather than standalone market entry.

Opportunities for foreign investors

High-demand product categories

Foreign suppliers continue to hold an advantage in technologically advanced sports medicine solutions, particularly where clinical outcomes, precision, and workflow efficiency matter most. Minimally invasive surgical (MIS) systems, including arthroscopy towers, high-definition and 3D visualization platforms, and bioresorbable or motion-preserving implants, remain in strong demand at large tertiary hospitals and high-end private facilities. These products align with China’s push toward faster recovery, shorter hospital stays, and improved post-surgical outcomes, priorities highlighted by the National Health Commission in clinical capacity upgrades.

Beyond surgery, high-tech rehabilitation equipment represents one of the fastest-expanding opportunity sets. Robotic-assisted rehabilitation, balance and gait training systems, and AI-enabled recovery platforms address structural gaps in therapist availability and standardization of care. Industry research from Grand View Research and China-based health equipment associations shows rehabilitation demand growing faster than acute-care capacity, particularly for post-operative and chronic musculoskeletal patients. This dynamic favors suppliers who can demonstrate measurable functional outcomes and cost efficiency.

At the consumer and semi-clinical level, smart braces, wearables, and remote monitoring devices are gaining traction. These products sit at the intersection of sports medicine, digital health, and consumer wellness, benefiting from rising health awareness and policy support for home-based and community rehabilitation.

Service and operating models

Service-based entry models are becoming increasingly relevant. Partnerships with private hospitals, international clinics, and premium healthcare groups allow foreign players to establish specialty sports medicine and rehabilitation centers without bearing full regulatory and operational risk. Such centers often combine diagnostics, surgery, and structured rehabilitation, offering differentiated patient experiences.

Another emerging model integrates sports medicine services into fitness chains, professional training institutions, and elite sports academies. These partnerships focus on injury prevention, screening, and performance optimization, expanding demand beyond treatment into lifecycle sports health management.

In parallel, corporate wellness and occupational rehabilitation are gaining attention as employers seek to reduce injury-related absenteeism and healthcare costs. This business-to-business (B2B) channel remains underdeveloped but aligns with broader Healthy China objectives.

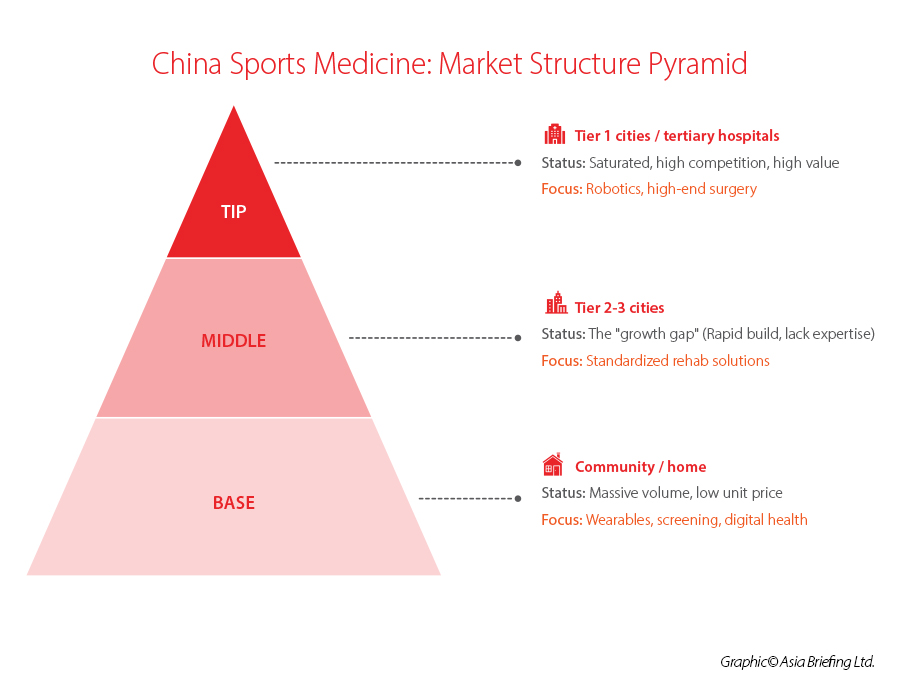

Regional and demographic “white spaces”

Geographically, demand remains concentrated in Tier 1 cities, but Tier 2–4 cities show widening gaps in sports injury diagnosis and rehabilitation capacity. Government investment in public sports infrastructure continues to stimulate participation without equivalent growth in medical support services, creating room for scalable, standardized solutions.

Demographically, elderly mobility and fall-prevention programs remain underpenetrated segments. Programs focused on fall prevention, mobility maintenance, and functional rehabilitation adapt sports medicine techniques for elderly users, aligning commercial opportunity with national priorities on active aging. For foreign investors, these white spaces favor strategies that combine technology leadership with localized service delivery and policy alignment.

Key challenges and market-entry considerations

Pricing and reimbursement constraints

Pricing pressure remains the immediate hurdle. The core challenge is managing long-term margin compression as centralized procurement expands beyond current categories, accelerating the commoditization of standardized products.

On the demand side, limited reimbursement constrains mass adoption. Public medical insurance prioritizes essential treatment over prevention or performance optimization. Consequently, many rehabilitation and screening services rely heavily on out-of-pocket payments, restricting rapid volume growth primarily to high-income urban markets.

Intensifying domestic competition

Domestic competition is rising rapidly. Chinese orthopedic and rehabilitation equipment manufacturers have strengthened their technological capabilities, manufacturing quality, and clinical presence. Supported by industrial policy and local hospital relationships, domestic players now compete directly with multinational firms in mid-range and, increasingly, high-end segments.

This shift raises the bar for foreign entrants. Success now requires deeper localization, including product design adapted to Chinese patient profiles, localized clinical evidence, continuous physician training, and long-term engagement with key opinion leaders. Global brand recognition alone no longer guarantees pricing power or hospital access.

Regulatory and operational complexity

China’s regulatory environment adds further complexity. Sports medicine devices must navigate NMPA registration, often involving extended timelines and evolving clinical data requirements. Hospital entry remains multilayered, shaped by tendering rules, internal hospital committees, and regional implementation differences.

Digital and connected rehabilitation platforms face additional scrutiny under China’s data security and cybersecurity framework, particularly when involving cloud-based analytics or cross-border data flows. Compliance planning must begin early in the market-entry strategy.

Finally, local distributors and service partners determine execution success. Strong after-sales support, clinical education capabilities, and ecosystem partnerships increasingly determine commercial outcomes. Investors who underestimate these operational requirements risk delayed scaling and eroded competitiveness.

Forward-looking market outlook

Long-term growth trajectory

China’s sports medicine market is poised for sustained expansion through 2035, supported by structural demand rather than short-term cycles. Service capacity and standardized delivery models remain insufficient relative to rehabilitation needs. Orthopedic departments in large public hospitals will continue to upgrade surgical and rehabilitation capabilities, while dedicated sports medicine and rehabilitation centers are expected to expand beyond Tier 1 cities. In parallel, capital inflows into private healthcare are likely to strengthen nationwide service capacity, particularly in rehabilitation and post-acute care, areas that remain undersupplied relative to demand.

Policy-led momentum and evolving care models

Policy implementation will remain a central growth catalyst. Continued policy execution is expected to reinforce preventive and community-based care models. Sports medicine integration pilots are likely to scale gradually, embedding exercise prescription, injury prevention, and rehabilitation into primary care and chronic disease management. Over time, policymakers may expand reimbursement coverage for rehabilitation and selected digital recovery tools, especially where evidence shows cost containment and improved outcomes. Community-level sports health centers are also expected to improve early intervention and referral efficiency.

Innovation and emerging growth drivers

Technological progress will reshape market structure. Advancements in arthroscopy systems, sports biomaterials, and AI-enabled rehabilitation platforms will raise clinical efficiency and expand treatment indications. Consumer adoption of data-driven training, injury prevention, and recovery solutions will blur the boundary between medical care and wellness. These trends create new collaboration opportunities for global MedTech, software, and digital-health companies with strong integration capabilities.

Strategic signposts for foreign investors

Key indicators to monitor include updates to centralized procurement rules for high-value consumables, further liberalization of medical services in free trade zones, adjustments to rehabilitation reimbursement policies, and the nationwide rollout of standardized community sports-medicine programs. Together, these signals will define the pace and quality of market expansion through 2035.

Ready to Enter Asia’s Healthcare Market?

Navigate ownership limits, licensing pathways, and entity structuring with confidence. Our experts provide:

- Jurisdictional comparisons for diagnostics, clinics, and labs

- Healthcare-specific entity setup and licensing guidance

- SPV or operating company structuring by delivery model

- Tax-efficient HQ or R&D center establishment

- Advisory on nonprofit, CSR-linked, or PPP-based models

Contact us to design the right structure for your healthcare investment in Asia at China@dezshira.com.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Dezan Shira & Associates Releases Asia Manufacturing Index 2026 Amid Intensifying Competition

- Next Article Why China is Still the Top 1 Manufacturing Destination in Asia