China’s Winter Sports Market: Outlook and Opportunities for Foreign Players

With 50 million people expected to participate by 2025, China’s winter sports market is set to become the biggest in the world. Since winning the 2022 Winter Olympics bid, the Chinese government has purposely intensified its efforts to build dedicated facilities and raise awareness around winter sports, encouraging their rising popularity among younger generations. The market will also generate opportunities for businesses and investors in winter sports-related industries, such as equipment, apparel, catering, and entertainment.

At the 2022 Winter Olympic and Paralympic Games in Beijing, China took the chance to showcase its top-notch sports infrastructure and rouse people’s interest in the events. More than 300 million Chinese engaged in winter sports in 2022 alone, demonstrating the sector’s rising appeal, particularly among the younger generations and the more affluent urban population. In 2021, the market size of Chinese winter sports accounted for just under RMB 60 billion (US$8.84 billion) – an annual increase of more than RMB 15 billion (US$2.21 billion). By 2025, the industry is expected to reach US$ 150 billion.

As winter sports continue to gain popularity in China, the demand for sports clothing, apparel, and equipment is also growing. With this thriving momentum, China is rapidly becoming one of the world’s most competitive markets for winter sports and related sectors. Newcomers can still find the right spot to enter the market, especially when proposing distinctive, avant-garde, original, and moderately priced products and services. This article provides an overview of China’s winter sports market and discusses some of the new trends and opportunities arising within the sector.

China’s winter sports market at a glance

Winter sports (also known as winter activities) are recreational competitive or non-competitive sports practiced on snow or ice. These include sledding, ice skating, and several skiing disciplines. In the past, such activities were often exclusively played in colder climates during winter, but recently have become more common everywhere thanks to alternative tools, such as artificial snow and ice.

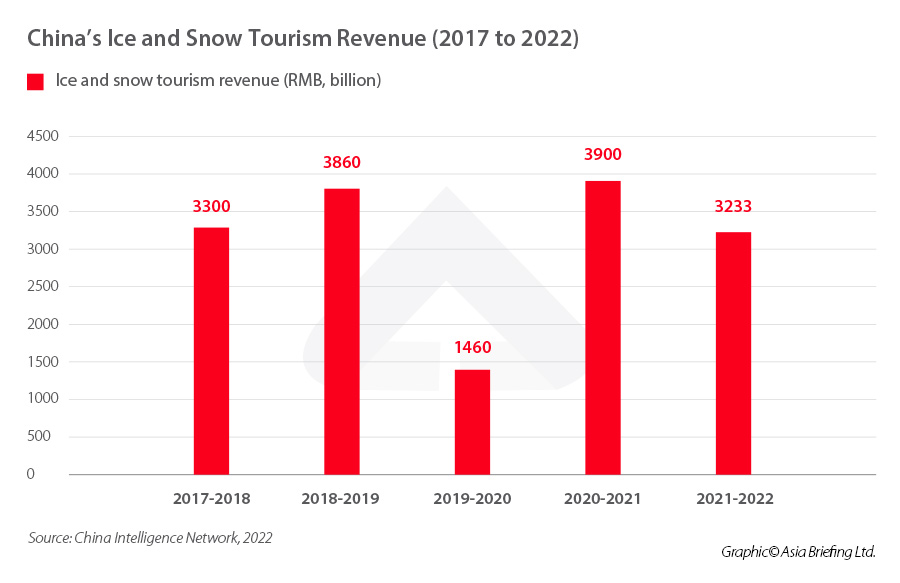

Despite the impact of the COVID-19 pandemic, the number of people participating in China’s seasonal winter sports has grown from 170 million in 2016 to 2017 to 254 million in 2020 to 2021. The increase in popularity boosted by the 2022 Beijing Winter Olympics, the return of tourism, and the overall planning and improvement of national ice and snow facilities were among the main factors for the market expansion. The revenue generated by China’s winter sports-related leisure activities and tourism is estimated to have reached RMB 323.3 billion (US$47.6 billion) in the 2021 to 2022 season.

Skiing

Skiing represents the bulk of China’s winter sports market – the sector was worth RMB 35.1 billion (US$5.1 billion) in 2021 – and is growing at a rapid pace. In 2002 the country counted only 130 ski resorts, while two decades later, there are over 800 of them.

With reference to the 2020 to 2021 ski season, the China Ski Industry White Book recorded 20.76 million skier visits – a year-on-year increase of 98 percent. The majority of these (80 percent) took place on artificial snow, and 83 percent of the participants in the sport were people under the age of 50, 36 percent of whom were between 20 to 30 years old.

These results are revealing about ongoing market trends. In the past two years, the development of indoor ski resorts (especially big and medium-sized indoor ski resorts in southern cities) has had a strong influence on the growth in skier visits. In addition, a number of small-scale outdoor ski resorts stopped operating, significantly decreasing the availability of ski resorts overall.

Ice skating

Along with skiing, ice skating is one of China’s fastest-growing ice and snow markets – thanks to the government’s focused strategy. In 2003, China only counted 21 indoor ice rinks. This number has increased to 650 thanks to the boost given by the 2022 Winter Olympics. Encouraged by national policies, local governments have largely contributed to the proliferation of winter sports facilities. The Beijing Municipal Government, for example, arranged for there to be newly constructed indoor ice rinks in each district by the end of 2022.

Geographical distribution of ice and snow resources in China

The resources for China’s winter sports activities on ice and snow are mainly distributed in the northeast, northwest, central plains, and some parts of the southwest. Among them, northeast China is considered a pioneer in the development of the winter tourism industry. Specifically, Heilongjiang province is a leader in the industry and is where the core industry formed.

With the rapid development of the global industry related to activities on ice and snow, Chinese brands have been gradually gathering in four major areas of the country, namely, the northeast block, the north China block, the northwest block, and the southwest block. Each of these areas has specific characteristics, as illustrated in the table below.

| Distribution of major tourism destinations for ice and snow-based activities in China | |

| Area | Main Features |

| Northeast block | Composed of the provinces of Heilongjiang, Jilin, Northeastern Liaoning, and Eastern Inner Mongolia, it is a typical resources-oriented tourist destination, and the leading area of tourism related to ice and snow activities in China. The region, led by Heilongjiang and Jilin, will continue to lead the industry of winter sports. |

| North block | Mainly located in Beijing and Hebei province, covering the Central Plains. Its convenient and developed location brings obvious advantages for the development of a strong industry based on ice and snow activities. Beijing and Zhangjiakou, which jointly hosted the 2022 Winter Olympic Games, can enjoy the results of the so-called “Winter Olympics Effects” to further develop the industry. |

| Northwest block | Mainly represented by the Xinjiang Autonomous Region, this block has beautiful natural resources. Although the development has been slower compared to other areas, the government is highly investing in the western region to transform the current facilities into world-class, high-end skiing destinations. |

| Southwest block | Composed mainly of Sichuan province and other smaller locations, the development of winter tourism here started later. It is known for its combination of “snow and sun”: the high altitudes and strong ultraviolet rays contribute to the formation of a unique microclimate that has been attracting more and more seasonal tourists over the years. This region shows great growth potential. |

Government policies to develop China’s winter sports market

China’s commitment to promoting winter sports is demonstrated through its policies and regulations. Preferential tax and financial policies designed to enhance the winter sports sector in China are among the measures that will support market expansion. Beijing has taken several actions to set aside space for winter sports through land use and zoning rules in addition to physically building the infrastructure needed for these activities.

Policies such as the Fourteenth Five-Year Plan for Sports Development and the Action Plan for the Development of Ice and Snow Tourism (2021 – 2023) focus on supporting the development and innovation of China’s winter sports industry and related tourism sector. Meanwhile, the government created a dedicated Winter Sports Development Plan (2016-2025) to reach its target of RMB 1 trillion (US$147.4 billion) industry by 2025, with the long-term goal of increasing the Chinese population’s interest in winter sports of all kinds.

The government has also promoted several educational activities to encourage younger generations to take an interest in winter sports. We collected the main regulations affecting China’s winter sports market in the table below.

| Chinese policies and regulations related to the winter sports industry | |||

| Policy | Responsible departments | Date of publication | Main/related objectives |

| Ice and Snow Tourism Action Plan (2021-2023) [冰雪旅游发展行动计划(2021—2023年)] | The Ministry of Culture and Tourism, the National Development and Reform Commission, and the General Administration of Sport | February 18, 2021 | Supporting ice and snow tourism to achieve a more balanced spatial and industrial structure by 2023. Helping the 2022 Beijing Winter Olympics and reaching the goal of “driving 300 million people to participate in ice and snow sports”. Promoting the harmonious integration of ice and snow tourism development with the natural landscape. |

| Fourteenth Five-Year Plan for Sports Development [“十四五” 体育发展规划] | The General Administration of Sport | October 25, 2021 | Taking the Beijing 2022 Winter Olympics as an opportunity to develop the winter sports industry. |

| Opinions on Vigorously Developing Ice and Snow Sports by Taking the 2022 Beijing Winter Olympics as an Opportunity [关于以2022年北京冬奥会为契机大力发展冰雪运动的意见] | The Central Committee of the Communist Party of China and the State Council | March 31, 2019 | Achieving the development of China’s winter sports industry by 2022, growing the popularity of ice and snow sports, improving their level and competitiveness, and expanding the overall scale of the industry. |

| Plan for the Development of the Ice and Snow Equipment Industry (2019-2022) [冰雪装备器材产业发展行动计划(2019-2022年)] | The Ministry of Industry and Information Technology, the State General Administration of Sport, and other nine departments. | June 5, 2019 | By the end of 2022, exceeding RMB 20 billion (US$2.9 billion) in annual sales as the revenue of China’s ice and snow equipment sector. |

| Guiding Opinions of the General Office of the State Council on Expediting the Development of the Sports Competition and Performance Industry [国务院办公厅关于加快发展体育竞赛表演产业的指导意见] | The State Council | December 21, 2018 | Creating more events related to the winter sports industry. Strengthening cooperation with international organizations to introduce high-profile winter sports events and competitions. |

| Mass Winter Sports Promotion and Popularization Plan (2016-2020) [群众冬季运动推广普及计划(2016-2020年)] | The State General Administration of Sports and 23 other departments | November 17, 2016 | Promoting and popularizing winter sports. Creating more venues and facilities for winter sports. |

| Ice and Snow Sports Development Plan (2016-2025) [冰雪运动发展规划(2016—2025年)] | The General Administration of Sport, the National Development and Reform Commission, and two other departments | November 25, 2016 | Aiming for the total scale of the winter sports industry to reach RMB 600 billion (US$88.4 billion) by 2020 and RMB 1 trillion (US$147 billion) by 2025. Attracting over 50 million people to join winter sports. |

| National Ice and Snow facilities construction [全国冰雪场地设施建设规划(2016-2022年)] | The National Development and Reform Commission, and other departments | November 3, 2016 | Improving the supply of winter sports facilities across the country, creating a network of venues dedicated to winter sports. |

| Guiding Opinions of the General Office of The State Council on Accelerating the Development of the Fitness and Leisure Industry [国务院办公厅关于加快发展健身休闲产业的指导意见] | The State Council | October 28, 2016 | Promoting the construction of facilities for ice and snow sports and comprehensively improving their popularity. |

| Several Opinions of the State Council on Accelerating the Development of the Sports Industry and Promoting Sports Consumption [国务院关于加快发展体育产业促进体育消费的若干意见] | The State Council | October 2, 2014 | Developing plans related to the winter sports industry. Using ice and winter sports to promote the popularity of fitness and leisure projects. |

Winter sports-related industries

From a market perspective, China’s winter sports market can be generally classified into three sectors: design and equipment, operation and services, and final consumption. Participants in the industry include:

- Comprehensive service and product providers, offering design, construction, and operation services and products such as equipment for ice and snow activities.

- Service and product consumers can be broadly divided into fixed consumers who participate in seasonal activities more than three times a week (70 percent), winter sports enthusiasts who often participate in such activities (20 percent) less than three times, and professional athletes (10 percent).

Trends and opportunities in China’s winter sports market and related industries

Since China’s winter sports market has enormous potential, foreign investors may take advantage of the government’s purposeful efforts to encourage the sector and access its related industries, from winter sports equipment to dedicated resorts.

Ice and snow tourism is booming

Winter tourism has become a new mode of entertainment and fitness for Chinese consumers. Business opportunities in the field vary from winter sports events and experiences to luxury resorts. Due to the impact of COVID-19, in the 2019 to 2020 season, China’s ice and snow tourism revenue reached RMB 146 billion (US$21.5 billion), down about RMB 240 billion (US$35.3 billion) from the previous year. However, the sector was able to rebound to reach RMB 323.3 billion (US$47.6 billion) during the 2021 to 2022 season.

A growing taste for winter apparel and equipment

The 2022 Winter Olympics effect has positively impacted the Chinese market for winter clothing. According to estimates from Statista, the market generated US$725 million in revenue last year. While international brands have mostly avoided it (due to the past preference for Chinese consumers to travel abroad for winter sports), Chinese companies such as Snowfavor, Copozz, and Free Ski Zone have recently increased their activities to fulfill the growing local demand, particularly online, in addition to Decathlon which has been in China for a long time.

Similar to the winter apparel market, China’s winter sports equipment sector is expected to grow, reaching a projected US$0.87 billion in 2023, with a CAGR of 4.94 percent from 2023 to 2027. Benefiting from the overall growth of the ice and snow industry, the ski equipment market continues to expand. In the 2022 to 2023 season, the scale of China’s ski equipment market will exceed RMB 15 billion (US$2.2 billion).

Key takeaways and prospects

China’s winter sports market has expanded dramatically in only a few decades, helped by government incentives, educational initiatives, the excitement surrounding the 2022 Beijing Winter Olympics, and the rising spending power of the Chinese middle class. Nevertheless, the sector is still relatively new and is characterized by a small number of resorts (relative to the population size), a predominance of beginner consumers, and comparatively high prices. In addition, there is a lack of experienced teachers in the winter sports sector who can coach beginners and help them become experienced winter sportspeople or even advanced athletes.

While the COVID-19 pandemic has negatively impacted China’s winter sports market, the constant government assistance and the active introduction of corresponding support measures have put the sector on the right path to recovery and growth. For international companies and investors ready to contribute to the growth of this developing industry, China’s ice and snow market offers great prospects, whether it is in the catering and entertainment sector, or strictly related to sports and training.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Prospects for European Companies in China in 2023

- Next Article Travel and Consumption Recover Over the 2023 Chinese New Year Period