Developing Asian Manufacturing Capacity from a China Operational Base

Reaching Out Into Asia is Now Key to Retaining China Profitability

Op-Ed Commentary: Chris Devonshire-Ellis

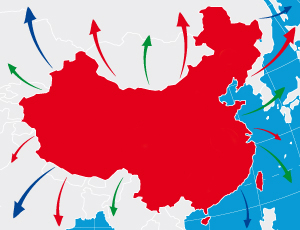

As we noted earlier this week, the ASEAN region generated more foreign direct investment than China did during 2013. Our article on the subject provided the underlying trends behind this, with the basic premise meaning that rising production costs in China and a reduction in China-ASEAN import-exports duties on 90 percent of all products are moving manufacturing capacity away from China and deeper into Asia.

As we noted earlier this week, the ASEAN region generated more foreign direct investment than China did during 2013. Our article on the subject provided the underlying trends behind this, with the basic premise meaning that rising production costs in China and a reduction in China-ASEAN import-exports duties on 90 percent of all products are moving manufacturing capacity away from China and deeper into Asia.

Currently, manufacturers in China are essentially servicing a Chinese middle class consumer base of 250 million. That number, though, will increase to 600 million in the next seven years, and it is that additional 350 million consumers whose purchasing requirements will increasingly be serviced by manufacturing capacity based elsewhere in Asia. The principal recipients of this manufacturing capacity will be Indonesia, Malaysia, Philippines, Thailand and Vietnam, as well as India. Each offer slightly different pros and cons, and choosing between them is a bespoke decision depending very much upon the different requirements of each business. The China manufacturing and operational base is likely to remain in China, it’s just the additional capacity that will be manufactured elsewhere.

That the centre of these operations remains in China makes sense. With a consumer market growing to 600 million, attention to detail and investment in supply chain and point of sale infrastructure in China needs to be well managed. Many of these new consumers are coming from China’s inland and Western regions – posing logistical challenges that extend way beyond the first tier consumer markets of Guangzhou, Shanghai and Beijing. That process can be managed and developed from the existing China operations, some of whom may well change the nature of their business from manufacturing to operational. Yet it is the development of a business to reach beyond China’s borders and actively grow into an Asian operation that is the real challenge. There are a number of issues to face:

Where Should My Trading Hub Be?

China is not a free trade nation, and developing an Asian business requires more than just a China manufacturing base. Many foreign investors have used Hong Kong companies to hold and own their China operations. Using a Hong Kong company to trade internationally makes a lot of sense. It is a free port, taxes are low and it has excellent financial services and logistics infrastructure. Either incorporating a Hong Kong company or “waking up” an existing shelf company is a good idea when looking at consolidating what will become a cross border trading business. Having an operational hub to manage and centralise all that makes a lot of sense.

So too, does Singapore, which has the added advantage of being a member of ASEAN. A trading company based in Singapore can also act as a regional hub when conducting multi-Asian operations, while the ASEAN treaty provides free trade across ASEAN itself. There is little to choose between the two, although if the vast majority of future growth is to be developed in China, then Hong Kong probably makes a more convenient choice. If business is expected to develop more in Asia, then for the same reasons Singapore is probably more appropriate. Both are nearly identical in their low income tax treatment of foreign companies.

RELATED: Establishing Singapore Holding Companies (Complimentary download)

Part of this question is also related to where the investor needs the cash flow. If Permanent Establishments, they often need cash back at HQ. If family owned, this money can be stored offshore. This impacts upon ease of doing business (both Singapore and Hong Kong are very high). Regardless of where the trading hub is located, there are a number of other issues that start to come into play when developing as a multinational company and reaching out beyond China. These vary, mainly because different countries have different tax policies and differing levels of compliance to international standards, as well as differing basic legal security issues. However, these can be checked off when looking to structure an Asian focused MNC as follows:

Free Trade Agreements

There are several important regional Free Trade Agreements that can impact upon the effectiveness of Asian operations and the movement of goods from one country to another. ASEAN is the world’s third largest free trade area, and is also negotiating other Free Trade deals with other countries, such as Japan and Australia. The much touted Trans-Pacific Partnership (TPP) and Regional Comprehensive Economic Partnership (RCEP) agreements, both still being negotiated, will also have a profound impact on global trade. These need to be understood and evaluated as they may determine which countries are more suitable than others for placing your new manufacturing capacity.

Related: Understanding ASEAN’s Free Trade Agreements

Double Tax Treaties

These are important as they can have an important effect on tax minimization. Some countries have many (Singapore), others have none (Cambodia). Understanding what these treaties say and what they mean, and how to take advantage of them, is a key point.

Related: Understanding China’s Double Tax Treaties

Development Zones & Tax Incentives

Many countries throughout Asia also have numerous free trade and development zones. Others also provide tax breaks and incentives. What are these, where are they, and how can they be obtained?

Related: Understanding Development Zones in Asia

Common Law ‘Source’ Principle for Tax

Some countries provide a localized system for tax calculations and liability. Others, such as China and the United States, operate a worldwide system. What is the likely full extent of your tax liabilities? Understanding how the national tax regime works and the extent of its coverage is a key question.

Determining Corporate and Individual ‘Residence’ in Location for Tax Purposes

How is the status of “Permanent Establishment” legally defined? This can impact upon whether or not single employees on the ground can trigger a corporate tax liability.

Related: Triggering Permanent Establishment Status in China

Local Tax Policies

What are these? What corporate tax rates apply? With a multitude of different taxes that come into play in each country when operating a business, an examination needs to be made as to which are the most attractive. Vietnam, for example, will reduce its corporate income tax rate to 20 percent from 2016. That is 5 percent lower than China. Additionally, taxes can vary within a country. Unlike China, India doesn’t have a unified tax system in place – instead, these vary somewhat from state to state (rather like the U.S.). These variables need to be understood.

Related: The ASEAN Tax Comparator

Local Tax Policies on Individuals

What are the rates of individual income tax? What are the mandatory welfare payments that need to be made to staff? In China, it can be as high as 50 percent. In Indonesia, as low as 4.8 percent. This has a huge impact on labor costs.

Other Operational Taxes

What are the applicable taxes on items such as stamp duty, VAT, and capital gains tax? What about applicable import-export tariffs? All these need to be understood.

Related: Import & Export Duties in China

Transfer Pricing

It is also important to look at TP, especially when manufacturing elsewhere in Asia and selling to your China entity for further distribution. What is permissible under local regulations in terms of fixing the cost of goods and services between related parties needs to be fully examined and understood and a distinct TP policy built right across your business.

Intellectual Property Protection

Some countries in Asia are signatories to the global standards of IP protocols such as the Madrid and Nice conventions. Others are not, meaning different registration procedures apply. Others countries have strict IP protection laws that are rigorously applied, others are more lax. You need to know the local landscape – and ensure it is registered – before committing your IP.

Related: Intellectual Property Rights Strategies In Southeast Asia

Centralizing Staff Payments in Different Countries

It can be awkward to manage staff payments in other countries from China, let alone anywhere else. Payroll processing therefore is key when looking to build a smooth running operation, both in various local tax and welfare compliance, and for ease of ensuring staff are paid promptly. This needs to be built and developed.

Related: Payroll Processing Across Asia

As increasing numbers of foreign investors are now starting to reach out further afield into Asia, the nature of, and very structure of, the body corporate changes. It is not, for example, a particularly good idea to set up a subsidiary of your China WFOE as a legal entity in Vietnam or Indonesia, although it can be done. It is simply uneconomic in terms of the tax structuring, and almost unworkable in terms of financial planning and operations. China business structures are limited to conducting business in China. When reaching out overseas, a larger picture starts to develop of a structure that includes the China operations, but places them in the correct operational context.

Pan-Asia trade and manufacturing is the new trend – structuring such operations when faced with numerous different countries, each with their own unique approach to tax and administrative affairs, can be a daunting prospect. Having taken our own practice out of China and into India and ASEAN several years ago, our firm is now able to provide the intelligence and on-the-ground knowledge that is required with multiple offices and strategic partners throughout the region. Businesses now requiring multiple presences across Asia is becoming an increasing trend.

Structuring a business across different countries may appear difficult. Yet with the increasing disparity in costs between China-based manufacturing and Asia, it is a task that increasingly needs to be dealt with. It can, with the right amount of Asian expertise and geographical reach, be conducted to further enhance your China-based business profitability and competitiveness.

Chris Devonshire-Ellis is the Founding Partner of Dezan Shira & Associates – a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam, in addition to alliances in Indonesia, Malaysia, Philippines and Thailand, as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email asia@dezshira.com, visit www.dezshira.com, or download our brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

Work Visa and Permit Procedures Across Asia

Work Visa and Permit Procedures Across Asia

In this edition of Asia Briefing Magazine, we outline the specific documents required for foreign nationals working in China, India, Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, as well as highlight the relevant application processes in each of these countries.

Trading with India

Trading with India

In this issue of India Briefing, we focus on the dynamics driving India as a global trading hub. Within the magazine, you will find tips for buying and selling in India from overseas, as well as how to set up a trading company in the country.

Manufacturing in Vietnam to Sell to ASEAN and China

Manufacturing in Vietnam to Sell to ASEAN and China

In this issue of Vietnam Briefing Magazine, we introduce our readers to manufacturing in Vietnam as a key part of their business strategy within the ASEAN region and beyond. Specifically, we explain the new ASEAN Free Trade Area, outline what foreign investors can look forward to when creating their manufacturing presence in the country, and introduce the country’s key tax points.

- Previous Article Why ASEAN Overtook China’s Foreign Investment Last Year

- Next Article China Releases First Official Plan for Urbanization Campaign