Foreign-Earned Income Exclusion for U.S. Citizens in China

Eligibility and limitations for foreign-earned income exclusion, foreign housing exclusion and deductions available for U.S. citizens and lawful residents abroad

By Zdravka Zlateva

Apr. 22 – U.S. citizens or residents (including green card holders) living or traveling outside of the United States are generally required to file income tax returns. A common misconception about foreign earned income is that income earned outside of the United States is non-taxable and non-reportable on a U.S. tax return (1040 Form). In fact, in order to fully or partially exempt income earned outside of the United States, certain requirements as described below must be satisfied.

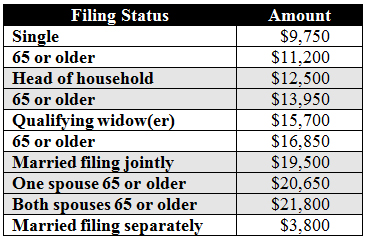

Main factors to determine the filing requirements for a particular tax year are the amount of gross income, filing status and age. Filing a U.S. tax return for 2012 is required if a person’s gross income from worldwide sources is above the relevant tax filing status listed below:

The foreign earned income exclusion, the foreign housing exclusion and the foreign housing deduction are based on foreign earned income – which is defined as income received for services performed in a foreign country during a period when the tax home is in a foreign country and if either the bona fide residence test or the physical presence test is met.

Classification of Types and Source of Income

Source of Earned Income

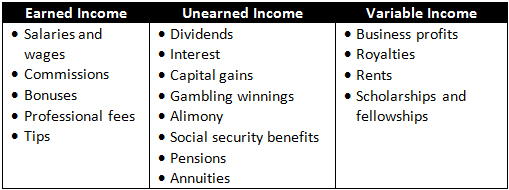

The “earned income source” is that place where such income is received. “Foreign earned income” is income received for performing personal services in a foreign country regardless of where and how this income is paid. “Variable income” is income that may be treated either as earned income or unearned income, or partly both.

Earned and Unearned Income (Variable Income)

Some types of income are not easily identified as either earned or unearned income – specifically, income from sole proprietorships, partnerships, royalties, rent and scholarships.

Example: A U.S. citizen who is a bona fide resident of China and is working as an engineer at a salary of US$68,250 per year. In addition, the employer paid out a US$7,000 cost-of-living allowance and a US$4,000 education allowance. The employment contract did not indicate that the U.S. citizen is to use these allowances only while outside of the United States. Furthermore, a dividend income is released on shares owned by the U.S. citizen for the amount of US$1,250.00, which the U.S. citizen sold for a net capital gain profit of US$90,000.00. If the work employment duties are performed only in China, the earned income is US$79,250 and unearned income is US$91,250.00.

Foreign Currency

If any part of the income received is in a foreign currency, its equivalent in U.S. dollars must be reported on the U.S. tax return. The relevant exchange rate at the date when the income is received, paid or accrued must be used to transfer the foreign currency into U.S. dollars. Exchange rates may be obtained from banks and U.S. Embassies.

Foreign Earned Income Exclusion

Foreign earned income may be excluded from an individual’s taxable income up to the maximum amount of US$91,400 for 2009, US$91,500 for 2010, US$92,900 for 2011 or US$95,100 for 2012 (subject to the length of stay limitation during the relevant tax year).

Limit on excludable amounts

The maximum amount of foreign income exclusion available is up to US$95,100 of foreign earned income in 2012.

The excludable amount is the smaller of:

- US$95,100; or

- The foreign earned income exclusion for the tax year minus the foreign housing exclusion.

If spouses work abroad and each meets either the bona fide residence test or the physical presence test (described below), then each may choose their foreign earned income exclusion. Both do not need to meet the same test. Together, both spouses can exclude as much as US$190,200.

Part-year exclusion

The adjustment of the foreign income exclusion is based on the number of qualifying days, which is the number of days in the year within the period for which the following are both true:

- The tax home is based in a foreign country; and

- Either the bona fide residence test or the physical presence test is met.

For this purpose, the qualifying days are all days within a period of 12 consecutive months once the tests are met. To figure out the maximum exclusion amount, the maximum excludable amount for the year is multiplied by the number of qualifying days in the year, which is then divided by the total number of days in the tax year.

Example: A U.S. citizen works abroad for 400 days in 2012 and 2013. The total days qualified for the foreign earned income exclusion under the bona fide residence test is 75 days in 2012, and the total earned income was US$110,000.00 for 2012. The maximum income that can be excluded in this case is 75/366 of US$95,100, or US$19,488.

Foreign Housing Exclusion and Deduction

Housing expenses

Housing expenses include reasonable expenses paid or incurred for housing in a foreign country for the taxpayer and (if they live with him/her) the taxpayer’s spouse and dependents. Housing expenses can be claimed only for the part of the year that qualifies for foreign earned income exclusions.

Some examples of housing expenses include rent, repairs, utilities (other than telephone charges), the rental of furniture and accessories, and real and personal property insurance.

Housing expenses do not include expenses that are lavish or extravagant under the circumstances, deductible interest and taxes, the cost of buying property (including principal payments on a mortgage), television subscriptions, depreciation or amortization of property or improvements and purchased furniture or accessories.

Foreign housing exclusion is due on payments with employer-provided amounts. If the total amount of earnings are employer-provided amounts (i.e., not self-employed provided), the entire housing amount is considered “paid” for with those employer-provided amounts and is treated as foreign housing exclusion. This means that the entire housing amount can be excluded (up to the specified limits).

Employer-provided amounts

These include any amounts paid to directly or paid or incurred on behalf of the taxpayer by the employer that is considered taxable foreign earned income (without regard to the foreign earned income exclusion) for the year.

Foreign housing deduction is due only on self-employment income.

Self-employed — no employer-provided amounts

If none of the housing amount is considered paid for with the employer-provided amounts (e.g. when all of the income is derived from self-employment), the deductible housing amount is subject to the limits described below.

Limits on housing expenses (housing exclusion and housing deduction)

The amount of qualified housing expenses eligible for the housing exclusion and housing deduction is limited, and the limit is generally 30 percent of the maximum foreign earned income exclusion (computed on a daily basis) multiplied by the number of days in the qualifying period that falls within the tax year.

Example: A qualified individual incurring housing expenses during 2012 can use no more than the standard limit on housing expenses (i.e. US$28,530 per year – 30 percent of US$95,100) to determine the housing amount. The maximum daily housing expenses with a basis US$28,530 would be US$77.95 per day. If the individual has 80 qualified days, then his/her maximum housing amount would be US$6,236.00 for 2012 tax year.

Foreign Earned Income Exclusion/Housing Exclusion (Deduction) Requirements

To claim any of the exclusions described above, all of the following requirements must be met:

- The U.S. taxpayer’s tax home must be in a foreign country;

- U.S. taxpayer must have foreign earned income; and

- The results of either a physical presence test or a bona fide residence test relating to the individual’s presence and activity outside of the Unite States must be met.

Foreign Country

To meet the bona fide residence test or the physical presence test, the U.S. citizen or resident must live in or be present in a foreign country. A foreign country includes any territory under the sovereignty of a government other than that of the United States.

For purposes of the foreign earned income exclusion, the foreign housing exclusion and the foreign housing deduction, the term “foreign country” does not include Antarctica or U.S. possessions such as Puerto Rico, Guam, and the Commonwealth of the Northern Mariana Islands, the U.S. Virgin Islands and Johnston Island.

Tax Home

The term tax home defines the general area of the main place of business, employment or post of duty, regardless of where the family home is maintained.

Physical Presence Test

The physical presence test is met when the taxpayer is physically present in a foreign country or countries for 330 full days during a period of 12 consecutive months. The 330 days do not have to be consecutive. Any U.S. citizen or resident alien can use the physical presence test to qualify for the exclusions and the deduction.

The physical presence test is based only on the length of stay in a foreign country or countries. This test does not depend on the kind of residence established, intentions about returning or the nature and purpose of the stay abroad (i.e., the purpose of stay may be for vacation).

The physical presence test is not met if illness, family problems, a vacation or an employer’s orders requires the length of stay to be shorter than the required amount of time.

Example: A U.S. citizen is planning to work in China from February 1, 2012 to November 1, 2013. The family went back for a vacation in the United States in April 2012 and plans a vacation to the United States in May 2013. During the rest of the period, the U.S. citizen is living in China. The 12-month period is the continuous period that starts in May 2012 and finishes in April 2013. During this period, the client spent more than 330 full days outside of the United States (the client was in China) and will qualify for the foreign earned income exclusion and the foreign housing exclusion and deduction (if applicable).

Bona Fide Residence Test

The bona fide residence test is met by a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year. Requirements for an individual under the bona fide residence test to qualify for the exclusions and the deduction are as follows:

- Must be a U.S. citizen; or

- Must be a U.S. resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect.

The bona fide resident status is not automatically acquired merely by living in a foreign country or countries for one year. The length of stay and the nature of the job are only two of the factors to be considered in determining whether the bona fide residence test is met.

The foreign earned income and housing exclusions apply only if a tax return is filed and the income is reported.

The foreign exclusions or deductions are voluntary and the choice is made by completing and calculating such via Form 2555 (or Form 2555-EZ – foreign earned exclusion only).

Any non-excluded part of the foreign earned income not covered by the exclusion must be taxed using the tax rates that would have applied if no exclusions were claimed.

Useful links from the IRS:

- Publication 54 (2012), Tax Guide for U.S. Citizens and Resident Aliens Abroad

- IRS: 21.8.1.2 (10-01-2007) Foreign Earned Income

- U.S. Citizens and Resident Aliens Abroad

Zdravka Zlateva is a senior manager at Taxback.com – a multinational corporation providing specialist tax return services to private and corporate clients across 100 countries. For more information on Taxback.com’s U.S. tax return services please click here or contact Mark Dolan at mdolan@taxback.com.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Annual Compliance, License Renewals & Audit Procedures

Annual Compliance, License Renewals & Audit Procedures

In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China. We also discuss IIT liability for expatriates in China, IIT rates and calculation methods, permissible tax deductions, and how working for a permanent establishment can change tax liabilities.

Double Taxation Avoidance Agreements

Double Taxation Avoidance Agreements

In this issue, we look at the evolution of the legal framework of double taxation agreements in China, including the foundations of anti-avoidance, obligations in reporting offshore transactions, how to qualify as a beneficial owner and how to claim treaty benefits. We also outline the interpretations given in Circular 75 of the China-Singapore DTA, which was the first time that the Chinese tax authorities really opened up about DTA interpretations.

China Expat Tax Filing and Declarations for 2012 Income

Limiting Tax Exposure for American Expatriates in China

China to Cancel Preferential IIT Policy for Foreigners

Reduce U.S. Federal Income Taxes on Export Profits with IC-DISC

- Previous Article Consolidating Regional Employees onto the Payroll of a Single Office

- Next Article China Clarifies Capital Gains Under DTAs