Growth in China’s Own Emerging Markets

China may be experiencing a national slowdown, but growth continues to be strong in the central and western regions

Op-Ed Commentary: Chris Devonshire-Ellis

Sept. 17 – Amid the media attention of a slowdown in China, the reality is that although demand from the West continues to remain sluggish, the state of play on the ground in China is rather different. Lazy analysts like to point to a drop in national GDP growth rates as evidence of some sort of cataclysmic event concerning development in China, yet that is only one, rather blinkered way of assessing the situation. As China’s annual growth has strolled briskly along at 10 percent for much of the past 15 years, a deviation from that is greeted by analytical soothsayers with cries of doom. Yet China’s 10 percent growth was never capable of being sustained, as each successive year of double-digit growth has, naturally, expanded the base to the point where it is now the world’s second-largest economy. As a result, China’s national GDP rates have slipped to somewhere between 7-8 percent.

However, while residents of first and second-tier cities such as Shanghai, Beijing and Shenzhen can be seen holding Louis Vuitton bags and iPhones, a significantly larger, yet less individually affluent market has begun to rise within the country. It is within this terrain that China’s breakneck growth is now being demonstrated.

It’s still a bit too early for them to be showing off designer handbags and Apple gimmickry, yet a solid, and highly sustainable growth wave is happening across China’s fourth, fifth, and sixth-tier cities in the central and western regions.

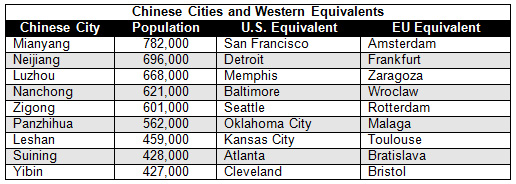

Here are some examples, in terms of rough population equivalents:

My bet is that while many readers will be familiar with most of the American and European cities, hardly any will be familiar with their Chinese counterparts. There’s one other aspect to this I should point out: all of the Chinese cities mentioned are in just one province – Sichuan.

When one factors in Shanxi, Henan, Hubei, Hunan, Anhui, and Jiangxi in Central China, and Gansu, Guizhou, Ningxia, Qinghai, Shaanxi, Yunnan and Xinjiang in West China, the sheer size of China’s own emerging markets becomes vastly apparent. There are some 500 cities across the region with populations similar to those listed above.

What’s happening in these lower-tier Chinese cities is that the local populations are now themselves becoming more affluent. Crucially, this is a phenomenon driven by State policy as Beijing wishes to reduce the national East-West income gap and raise the standards of wealth across the country. It has been doing this by embarking on an aggressive policy of increasing minimum wages on a national basis, and especially so in the hinterland areas. That is having the effect of increasing disposable income levels, and these consumers are now upgrading purchases from previously purely Chinese brands towards increasing levels of Western products.

This includes fast-food chains such as McDonald’s, KFC and Starbucks; massive multi-brand retailers such as Wal-Mart and Carrefour; and others who are also making inroads into these further flung destinations. The Louis Vuitton bag may still be the preserve of China’s super wealthy in Shanghai, but in cities such as Mianyang, youths are trading up their cheap Chinese sports shoes for Nikes, and looking to acquire Levis instead of the local jeans. With these consumer patterns being duplicated across the rest of China’s inland provinces, the result is little less than a revolutionary upgradation of inland consumer power.

The other markets in China that are worth keeping an eye on are those located along China’s borders. I wrote about Urumqi as a springboard for Central Asia recently, yet developments elsewhere in Asia dictate that other border areas will also begin to experience significant growth, not least because of the ASEAN bloc full free trade agreement that abolishes tariffs between member nations in 2015.

ASEAN includes countries such as Vietnam and Myanmar rubbing up alongside China’s southwest border, and adds to that countries such as Cambodia, Laos, Malaysia, and Thailand, while to the south of China (and Guangdong Province in particular), ASEAN nations such Indonesia and the Philippines provide easy access. Why is this important? Because China has its own free trade agreement with ASEAN and those 0 percent export tariffs among ASEAN nations are largely duplicated within China’s own agreements with the bloc. That means cities such as Jinghong and Luxi in Yunnan are also poised to become trade hubs. Jinghong, with a population of 520,000 is the equivalent in size to Tuscon, Arizona and Sheffield in the United Kingdom, and borders Vietnam, while Luxi borders Myanmar, and with a population of 350,000 is similar in size to Tampa, Florida, or Bilbao.

China may be experiencing a “slowdown” to single-digit GDP growth when measured on a national basis. But the real story is the continuing fast track development in wealth, disposable income, and increasing consumerism in China’s own emerging markets and the fourth, fifth and sixth-tier cities that help make this up this gigantic consumer sector. The challenge for the foreign investor is now to reach out and go after them.

Chris Devonshire-Ellis is the founding partner and principal of Dezan Shira & Associates and is based from the firm’s U.S. liaison office in Charlotte, North Carolina. Prior to relocating to North America, he spent 20 years with the practice in China and India. Dezan Shira & Associates has 12 offices across China and can advise on investments across the country. Chris is available for discussions concerning investments into China in any city within the United States. He may be reached at chris@dezshira.com, or visit www.dezshira.com.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

China’s Neighbors (Second Edition)

China’s Neighbors (Second Edition)

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Business Guide to China’s Second and Third Tier Cities

Business Guide to China’s Second and Third Tier Cities

The guide book is the definitive guide to China’s second and third-tier cities. It provides a thorough and in-depth analysis, regional intelligence and overviews of fifty of China’s emerging cities, featuring economic data, infrastructure and investment climate reviews, and a directory to development zones, business associations, media and major hotels in all locations.

Joint Ventures Back in Vogue for Accessing China’s Central Regions

China’s Second Tier Cities – The Third and Fourth are Catching Up

ASEAN and China to Become Top Trade Partners by 2015

- Previous Article China Issues Guidance to Promote Enterprise Technological Transformation

- Next Article Official Data Issued on China’s Balance of International Payments