How China is Adapting to the World Bank’s B-READY Business Environment Benchmark

The World Bank’s B-READY ease of doing business report is slated for the spring of 2024. Although China won’t be included in this new World Bank report until 2025, several cities have released development plans that are in part designed to align with the requirements of B-READY.

China is preparing for the World Bank’s new Business Ready (“B-READY”) ease of doing business report. Officially launched at the beginning of May 2023, B-READY will assess countries’ business and investment environment, based on a variety of metrics.

B-READY replaces the World Bank’s previous Doing Business report, which was discontinued in 2021 due to “data irregularities”. As with the Doing Business report, B-READY will rank countries and global cities on their business friendliness in areas such as public services, the efficiency of administrative procedures, business-related policies, and regulatory environment across a variety.

The first B-READY report is slated for the spring of 2024, although China will only be included from the second edition onward, to be released in 2025.

The B-READY report, and the prior Doing Business report, is important reference material for foreign companies and investors in choosing where to invest and expand their business. Keenly aware of the report’s influence, China will be eager to perform well and burnish its image as an attractive business destination.

Since reopening after the pandemic, China has been striving to re-instill confidence in foreign businesses and attract more foreign investment. To this end, Chinese cities have released a range of policy measures over the course of 2023, aimed at improving the business and investment environment for both foreign and domestic companies, many of which are modeled partly on the World Bank’s new B-READY benchmarks.

How will B-READY assess the business environment?

According to the B-READY Manual and Guide (B-READY M&G), countries will be given a score for each of the following 10 topics that broadly follow a business’s lifecycle:

- Business entry;

- Business location;

- Utility connections;

- Labor;

- Financial services;

- International trade;

- Taxation;

- Dispute resolution;

- Market competition; and

- Business insolvency.

Each of these topics will also be assessed based on three “cross-cutting” themes that are “increasingly important for modern economies”, namely digital technology, environmental sustainability, and gender (based on the World Bank’s Women, Business, and the Law (WBL) index).

Data on these various aspects will be collected through a combination of consultations with experts and company surveys. The report will consider both “de jure information and de facto measures”. This means that regulations, policies, and measures that are officially in place (ascertained through expert interviews) will be taken together with the actual situation on the ground for companies (ascertained through both expert interviews and company surveys).

The official aim of B-READY is to help economies around the world assess their current business landscape and provide “actionable evidence” to promote reforms for private sector development, to ultimately contribute to World Bank’s “twin goals […] of eliminating poverty and boosting shared prosperity.”

How is China adapting to B-READY?

Improving the country’s business and investment environment has been high on the priority list for both the central and local governments this year. The 2023 Government Work Report, released during the Two Sessions in March, talks about “building a market-oriented, legal, and international business environment” and “formulating and implementing regulations on optimizing the business environment, registration and management of market entities [and] promoting the development of individual businesses”.

Since the World Bank released its new guidelines for the B-READY report, several cities have released development plans that are in part designed to align with the requirements of B-READY. These include the business hubs of Shanghai, Shenzhen, and Beijing.

Shanghai

As the largest city in China and one of the country’s most powerful local economies, Shanghai has long been at the forefront of implementing business-friendly policies and enabling wider market access to foreign companies.

Following China’s re-emergence after the COVID-19 pandemic, Shanghai has been active in bolstering its image as an international business hub and is keen to improve the confidence of foreign investors and private businesses. As such, the city’s municipal government has released several policy documents aimed at improving the city’s business and investment landscape. These include measures to attract foreign direct investment, measures to ease cross-border data transfer requirements, and measures to facilitate cross-border funding. These initiatives, while not directly seeking to align with B-READY requirements, seek to significantly improve the experiences of foreign companies in particular, and could improve China’s standing in the B-READY report.

The city has also formulated plans that are partly modeled on the B-READY benchmarks. At the beginning of 2023, the Shanghai Municipal Government released Shanghai’s Action Plan to Strengthen Integrated Innovation and Continuously Optimize the Business Environment Version 6.0 (“Business Environment Action Plan 6.0”). This plan outlines a range of measures to improve the city’s business environment, many of which are aligned with the World Bank benchmarks.

The measures include 88 tasks aimed at deepening benchmarking reforms in key areas and enhancing the competitiveness of the business environment in line with the World Bank’s new evaluation system. These include measures related to increasing market access and market exit, simplifying the system for start-up establishment, business name registration and disputes, obtaining business premises, and other matters related to business incorporation

The Business Environment Action Plan 6.0 specifically outlines measures to align with the World Bank’s assessment requirements, including:

- Improve the city’s water supply system to meet supply reliability and quality requirements; and

- Establishing a unified digital platform for public employment services, improving labor dispute resolution mechanisms, and strengthening the protection of the rights and interests of flexible employment personnel to meet requirements related to labor and employment.

In May 2023, the Shanghai High Court released the Special Action Plan to Promote the Construction of a Legalized Business Environment Version 6.0 (“the High Court’s Action Plan”). This plan focuses specifically on improving conditions for businesses in two of the 10 B-READY’s fields of assessment: dispute resolution and business insolvency.

The High Court’s Action Plan lays out 17 measures across three areas relating to improving systems for dispute resolution and business insolvency, outlined below.

- Benchmarking reform in key fields: Benchmarking against B-READY’s new concepts and requirements, the Action Plan 6.0 seeks to improve fairness, efficiency, and convenience of judicial trials in Shanghai courts.

- Reengineering keys steps and processes: The Action Plan 6.0 will focus on blockages in the system that prevent the improvement of trial quality and efficiency, and strengthen the systematic integration of relevant policies and mechanisms.

- Improving the key supporting facilities: The Action Plan 6.0 will promote the disclosure of judicial quality and efficiency, guarantee and promote fair and honest administration of justice, leverage the ability of digital reform to empower and improve effectiveness and strengthen the publicity of the rule of law in the business environment.

In addition, the High Court’s Action Plan outlines 11 specific tasks for the reform of bankruptcy trials, specifically targeting the improvement of business insolvency procedures in the city.

The tasks cover four main areas:

- Improving the quality and efficiency of bankruptcy trials, by, among other things, aiming to conclude general bankruptcy cases within 12 months and simple bankruptcy cases within 6 months;

- Promoting the modernization of bankruptcy trials by means such as establishing special bankruptcy procedures specifically suited to small and micro enterprises, among other measures;

- Improving the public service system for bankruptcy, which will include the launch of the Shanghai Court’s online system for bankruptcy cases.

- Promoting the systematic integration of bankruptcy policy mechanisms, which includes the release of a policy document in March 2023 proposing 35 specific measures, which include promoting the exploration of cross-border bankruptcy practice and exploring the priority of creditor’s rights in bankruptcy environments.

Shenzhen

In July 2023, the Shenzhen Municipal Government released a document titled Key Points on Shenzhen’s Work to Optimize the Business Environment in 2023, which outlined 10 key areas of development and improvement that align exactly with the 10 B-READY topics:

- Optimizing the market access environment (business entry);

- Guaranteeing provision of business premises for companies (business location);

- Optimizing the installation of municipal public infrastructure (utility connections);

- Improving the quality of public employment services (labor);

- Improving the efficiency of financial services (financial services);

- Reducing cross-border trade costs (international trade);

- Optimizing tax services (taxation);

- Improving the commercial dispute resolution mechanism (dispute resolution);

- Promoting fair market competition (market competition); and

- Improving the quality and efficiency of handling bankruptcy (business insolvency).

The document contains 100 points in total under these fields, providing more granular implementation tasks for achieving the stated goals.

For instance, under the taxation field, the document proposes a variety of measures to improve the overall system, including improved availability of online services for non-resident taxpayers:

- Launching a so-called “Bay Area Pass” (in reference to the Guangdong-Hong Kong-Macao Greater Bay Area) cross-border payment service for social security contributions, in which contributors can pay social security fees in Shenzhen in Hong Kong dollars through their mobile phones;

- Establishing an overseas version of the electronic tax bureau website and offering a bilingual tax interface for non-residents to handle tax declaration for non-resident companies;

- Advancing the pilot implementation of digital electronic invoices (known as e-fapiaos), providing free 24/7 online services for taxpayers, including the issuance, delivery, and verification of e-fapiaos; and

- Improving mechanisms for resolving commercial disputes.

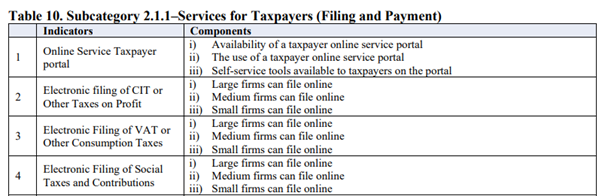

These tasks may help to fulfill some of the criteria under B-READY’s taxation topic, notably the requirements to provide an online service portal for taxpayers.

Sample of indicators for assessment of the Taxation topic (services for taxpayers):

Source: World Bank Business Ready Methodology Handbook (May 2023)

Beijing

As in Shanghai, Beijing has proposed and adopted several measures to improve the business environment in 2023, including ones aimed at foreign investors and private businesses.

Most recently, Beijing issued a plan to boost the city’s service sector, which covers several measures to facilitate business for foreign companies. These include expanding market access in certain service sectors, improving visa procedures for foreign talent, facilitating cross-border data transfer, and expanding cross-border funding options.

In April 2023, the city released the sixth iteration of Beijing’s Implementation Plan for Comprehensively Optimizing the Business Environment and Assisting Enterprises in High-Quality Development. This plan, much like those released in Shanghai and Shenzhen, seeks to improve the city’s business environment.

While it does not explicitly benchmark against the World Bank’s indicators, many of its stated goals nonetheless match the new requirements.

For instance, the plan proposes measures to improve areas related to ensuring fair market competition, facilitating cross-border trade and customs procedures, constructing a “smart taxation” system in which all tax matters can be handled online, reforming the company bankruptcy system, and accelerating and facilitating corporate establishment procedures, among many others.

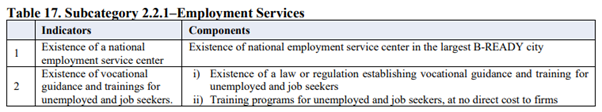

In the field of employment services, the plan outlines several areas of improvement that closely align with B-READY indicators, such as:

- Enhancing vocational skills training and the lifelong vocational skills training system, continuing to provide free vocational skills training for groups such as the unemployed and rural migrant workers, and supporting the development of more than 100 training projects in each district of the city.

Sample of indicators for assessment of the Labor topic (employment services):

Source: World Bank Business Ready Methodology Handbook (May 2023)

Challenges for China under the new system

B-READY’s new benchmarking standards measure a much larger range of indicators than the previous Doing Business standards. As noted by the Shanghai Higher People’s Court in Action Plan 6.0, the indicators for just two of the 10 assessment topics – dispute resolution and business insolvency – have increased from just 40 to 119. This makes the current iteration of the report much more thorough and nuanced, and also more competitive for the countries that feature.

Some of the criteria will be hard for China to meet in the short time frame until the next assessment period.

For companies that will appear in the 2025 report, firm-level surveys will take place from October 2023 to October 2024, while expert consultations will take place between April and October 2024, per the World Bank’s Concept Note. This means that company interviews could take place during a time of reduced confidence in China’s business environment, as evidenced by recent business sentiment surveys. However, there is still time for sentiment to change within the surveying period.

Further, more incremental changes to policies such as increasing market access and easing cross-border data and capital flows, which could improve China’s performance on certain indicators, will be limited to pilot areas at first (such as in the country’s free trade zones), with an uncertain time frame for roll-out to the rest of the country.

In addition, discrepancies between de jure rules on matters such as access to government procurement, copyright protection, and dispute settlement and the de facto situation for companies could impact China’s overall performance in these areas. Although local governments have been instructed to tackle these challenges faced by companies, tangible change may take longer.

The information provided is for general purposes only and may not account for local variations. No liability is assumed for the completeness or accuracy of the information. For personalized advice on specific business queries, consult our experts at Dezan Shira & Associates by emailing China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Monthly Tax Brief: November 2023

- Next Article China’s Economy in 2023 – A Year of Growth and Recovery