Investing in China’s Financial Services Industry

By Roy K. McCall

Up until 2013, China’s inbound investments exceeded outflows. But that’s about to change. In 2014, China is becoming a net outbound investor. This trend signals an increasing opportunity to expand outbound investment choices and services for Chinese investors – already well understood by bulge bracket M&A advisors, law firms and Big 4 accountants. For China’s domestic strategic investors, this trend will continue to improve the country’s understanding of foreign markets and technology. But strategic product company investments are long-term in nature, lacking liquidity. This leads to additional implications for financial markets.

China’s domestic financial investors may complement product-savvy foreign financial service investors. The growing trend in outbound flows signals an opportunity for foreign inbound investors, in customizing more asset management products for Chinese.

This opportunity is reinforced by the imbalance of fund products available in Asia vs. investment products available abroad. For example, Singapore permits investment in over two thousand cross-border funds, and Hong Kong in over twelve hundred. In China, it’s zero. Currently, domestic asset managers, other than those in Hong Kong, cannot invest in foreign funds.

Furthermore, it is illegal for foreign companies to take majority control of domestic asset managers. This is changing, even if gradually. The CSRC (China Securities Regulatory Commission) is expanding foreign ownership limits beyond Hong Kong, for Chinese and the pension system. In the future, there will be more managers offering more foreign asset management products.

RELATED: China Looks to Transform Its Financial Sector

On June 13, 2014, CSRC Chairman Xiao Gang announced reforms for the asset management industry in 11 areas, though with no time table. The next step will be to abolish the 49 percent cap on foreign ownership of Chinese asset management companies.

China’s growing liberalization recognizes the imbalance in choices available to China’s domestic financial investors, and the opportunity for seasoned foreign managers to tailor products that are understandable and suitable for Chinese. Domestic offerings of foreign funds could accelerate as re-distribution fees are eliminated for recycled foreign funds. Original analysis and product selection based in Asia can offer cost-effective alternatives for growing domestic private banking and institutional clients.

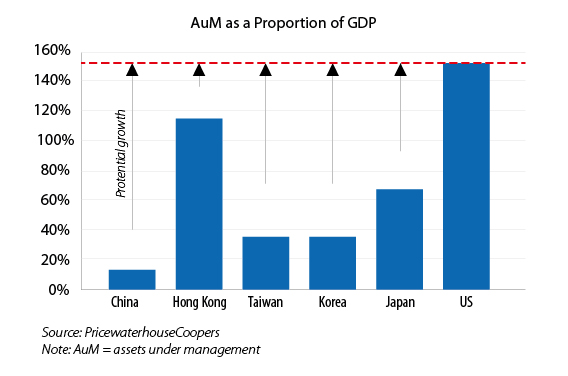

There is a huge imbalance in demand for liquid investments relative to GDP in China, and knowledgeable foreign asset managers – even if just to enforce local analytical discipline – can contribute to China’s growing sophistication in financial services.

The path to liberalization goes through the CSRC, which has set up an outbound funds flow pipeline called QDII (Qualified Domestic Institutional Investors). In principle, a QDII may invest in any overseas capital market with which the CSRC has signed an MoU (memorandum of understanding), now encompassing all major markets. For example, the CSRC recently signed an MoU with European funds management leader Luxemburg. In practice, however, only two QDII ETFs (exchange traded funds) have been approved, and these track the Hang Seng index.

RELATED: CSRC Announces Employee Stock Ownership Plan

If institutional progress in financial services seems slow, then one only need look back to see how far China has come. Now is the time to prepare for the opportunities to be created by future reforms.

Roy K. McCall CFA/CPA was Asia regional audit manager for Salomon Brothers Asia in the 1990’s when he passed the FINRA series 7, 63, 3 & 4 exams. For the past three decades, Roy has served Asian and Middle Eastern financial services clients, in addition to his role improving operating performance for strategic investors.

Related Reading

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

In this issue of China Briefing, we revisit the Shanghai FTZ and its preferential environment for foreign investment. In the first three articles, we highlight the many changes that have been introduced in the Zone’s first year of operations, including the 2014 Revised Negative List, as well as new measures relating to alternative dispute resolution, cash pooling, and logistics. Lastly, we include a case study of a foreign company successfully utilizing the Shanghai FTZ to access the Outbound Tourism Industry.

Strategies for Repatriating Profits from China

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

Industry Specific Licenses and Certifications in China

Industry Specific Licenses and Certifications in China

In this issue of China Briefing, we provide an overview of the licensing schemes for industrial products; food production, distribution and catering services; and advertising. We also introduce two important types of certification in China: the CCC and the China Energy Label (CEL). This issue will provide you with an understanding of the requirements for selling your products or services in China.

- Previous Article Industry Focus: Importing Wine into China

- Next Article The Balanced Flavors of Success in China’s Food & Beverage Industry