Investing in Nansha: New 15 Percent CIT Rate Applied for Companies in Key Industries

Nansha District in the southern city of Guangzhou is a key trade and investment hub and an important transport link to Hong Kong and Macao. The district is enjoying a period of rapid development and economic growth and is seeking to attract more investment in strategic and emerging industries. We discuss the district’s economy, industries, and competitiveness as a major manufacturing and e-commerce base and provide an overview of the preferential policies available to foreign investors.

UPDATE: A reduced 15 percent corporate income tax (CIT) rate has been officially implemented for businesses operating in certain areas in Nansha District, as per a notice released by the Ministry of Finance and State Tax Administration in late October. The reduced CIT rate is available for companies that derive a minimum of 60 percent of their annual business income from one of industries included in Nansha’s 2022 preferential CIT catalogue. See below for more information.

Nansha is a county-level district of the metropolis of Guangzhou in Guangdong province. Located just 38 nautical miles (70 kilometers) from Hong Kong and 41 nautical miles (76 kilometers) from Macao, Nansha holds a strategic position in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) as a vital transport hub linking the mainland with Hong Kong and Macao, and one of Guangdong’s main gateways to sea-based trade.

The district is also home to the Nansha New Area sub-zone of the Guangdong (China) Pilot Free Trade Zone, first established in 2015. Through years of steady development, the area has emerged as a leading hub for manufacturing, while fostering the creation of a broad range of industries that build upon its strength as one of Guangzhou’s key logistics and distribution centers.

The district has thus also become a magnet for foreign investors who seek to capitalize on its favorable position as a springboard to the GBA and the wider Asia-Pacific.

In this article, we provide an overview of Nansha District’s economic and industry development and discuss the benefits of investing in this rapidly growing region.

Economy of Nansha District

Nansha District’s local GDP reached RMB 213.2 billion (US$30 billion) in 2021. This is a fairly small proportion of Guangzhou’s overall economy, accounting for just over 6 percent of the city’s total GDP. However, it was one of the Guangzhou districts with the fastest GDP growth rates in 2021, recording a year-on-year increase of 9.6 percent, second only to Zengcheng District.

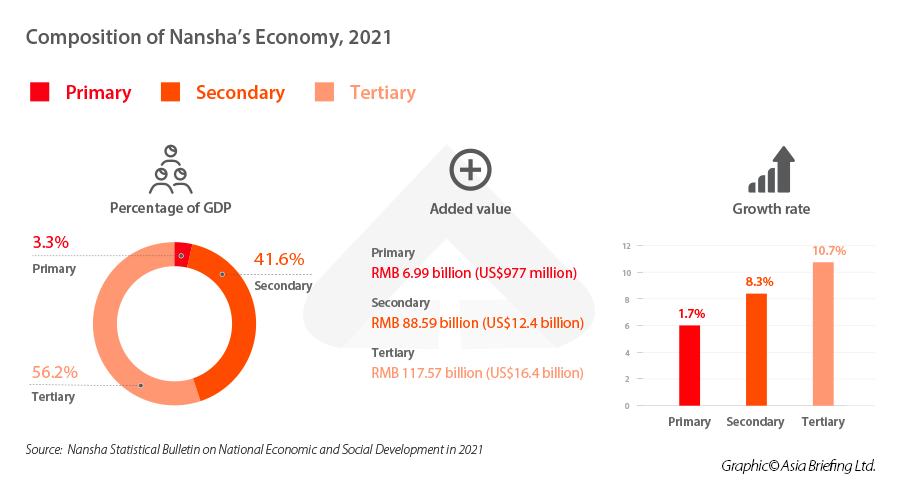

The tertiary sector makes up the lion’s share of the district’s economy, accounting for 55.2 percent of GDP in 2021. The tertiary sector has also grown at the fastest rate in 2021, up 10.7 percent year-on-year from 2020, outpacing both the secondary and primary sectors. The secondary sector is still a major component of the district’s economy, reaching a total added value of RMB 88.59 billion (US$12.4 billion), accounting for 41.6 percent of the district’s total GDP.

Foreign trade and investment in Nansha District

Despite Nansha’s relatively small footprint on Guangzhou’s overall GDP, the district punches above its weight when it comes to foreign investment. The district’s actual use of foreign capital in 2021 reached US$1.5 billion, accounting for 18 percent of the city’s total.

Meanwhile, foreign-invested enterprises (FIEs) accounted for 63.9 percent of the total output value of industrial enterprises above the designated size (those with an annual main business revenue of over RMB 20 million (US$2.8 million) in Nansha in 2021. The total output value of these companies reached RMB 217.4 billion (US$30.5 billion), growing 17.8 percent year-on-year.

In 2021, 283 new FIEs were established in the district, a year-on-year increase of 15.5 percent. In addition, 26 investment projects by Forbes 500 companies were launched in the district, reaching a total of 223 in the district, as well as 13 projects with an output of over RMB 10 billion (US$1.4 billion).

Nansha is an important trade hub in Guangzhou and the wider GBA. The Port of Nansha, which is part of the Guangzhou Port Group, is the fastest-growing port in South China, and its capacity has been increasing every year since its opening in 2004. It is also the only deep-water port on the western banks of the Pearl River estuary. In 2021 it handled around 24.47 million TEUs, 31.9 percent of which was to North America.

Nansha’s total value of foreign trade reached RMB 260 billion (US$36.3 billion) in 2021, growing 14.7 percent year-on-year, its ninth consecutive year of growth. 2022 is set to be another year of strong growth, with the value of import and export goods declared in Nansha reaching RMB 387.9 billion (US$54.2 billion), up 48.4 percent from the same period in 2021.

Major industries in Nansha District

Nansha District is home to a sizeable manufacturing industry and is a major producer of automobiles. Due to its location on the west bank of the Pearl River estuary, its economy is also heavily reliant on trade and related industries, such as e-commerce, logistics, and modern services.

Automobile manufacturing

Auto manufacturing is the single largest manufacturing sector in Nansha, accounting for 45.5 percent of all industrial sectors in 2021. The district’s vehicle production capacity exceeded 800,000 units annually in 2021. That year, the total output value of the auto manufacturing industry reached RMB 154.9 billion (US$21.7 billion), a year-on-year increase of 16.5 percent.

The single largest industrial company by both output value and sales amount among all industrial companies in 2021 was GAC Toyota, a joint venture between Toyota and the Chinese GAC Group. The company, which is headquartered in Guangzhou and has its main production base in Nansha District, produced 823,300 vehicles in 2021, despite the impact of the global chip shortage.

E-commerce

Nansha District, and the Nansha terminal of the Port of Guangzhou, is a major port for cross-border e-commerce. (CBEC). In 2021, CBEC reached RMB 36 billion (US$5 billion), growing 70 percent from 2020. In the first eight months of 2022, the import and export of CBEC in Nansha reached RMB 23.99 billion (US$3.4 billion), a year-on-year increase of about 15.6 percent.

One of the district’s main areas for the development of CBEC is the Guangzhou Nansha Comprehensive Bonded Zone, which recorded 130 million import and export CBEC commodities in the first six months of 2022.

There are over 600 registered CBEC businesses in Nansha. Several major Chinese e-commerce platforms have established distribution centers in Nansha, such as Tmall, Kaola.com, and Vipshop. Several foreign brands have also established operations for CBEC in the district, including Mead Johnson China, Danone, and Swisse.

Modern services

The added value of modern services in Nansha district reached RMB 87.1 billion (US$12.2 billion) in 2021, accounting for 40.9 percent of the district’s total GDP and 74.1 percent of the value add of the tertiary sector.

The annual operating income of modern service companies above designated size (those with an annual main business income of over RMB 20 million (US$2.8 million) reached RMB 124.8 billion (US$17.4 billion) in 2021, a year-on-year growth rate of 36.7 percent. Among these, the operating income of Internet, software, and information technology services grew 40.6 percent year-on-year, leasing and business services grew 11.9 percent year-on-year, scientific R&D and technology services grew 16.1 percent year-on-year, and culture, sports, and entertainment grew 13.7 percent year-on-year.

Development of Nansha District

On June 14, 2022, the State Council released a new plan for the development of Nansha District, titled the Overall plan for deepening the comprehensive cooperation between Guangdong, Hong Kong and Macao facing the world in Nansha, Guangzhou (the “Nansha Plan”), which outlines key policies and measures for developing the district and deepening cooperation with Hong Kong and Macao.

The Nansha Plan sets out a broad range of development targets, including:

- Building a scientific and technological innovation industry cooperation base

- Creating a youth entrepreneurship and employment cooperation platform

- Promoting the consolidation of international high-end talent

- Cultivating and developing high-tech industries

- Strengthening international economic cooperation

To help meet these targets, Nansha District will be provided with an annual increase of RMB 10 billion (US$1.4 billion) in its local debt limit in the time period from 2022 to 2024, which will be included in the balance of the local government’s debt. Raising the debt limit for the local government will allow it to issue more special-purpose bonds, one of the main tools local governments use to fund projects within their jurisdiction.

Key development zones in Nansha District

Nansha New Area portion of the Guangdong (China) Pilot Free Trade Zone

The Nansha New Area portion of the Guangdong (China) Pilot Free Trade Zone (FTZ) (“Nansha New Area”) is one of the three main areas of the Guangdong Pilot FTZ, along with the Hengqin Cooperation Zone in Zhuhai, and the Qianhai Cooperation Zone in Shenzhen. The Nansha New Area covers a total of 60 square kilometers and is divided into seven sub-areas that are separated into the port area, central area, and Qingsheng area (Qingsheng being a village in Nansha).

Launched in 2015, the area is designed to promote free trade between Guangdong, Hong Kong, and Macao, and is also home to range of established industries, such as shipping and logistics, international trade, high-end manufacturing (including automobile manufacturing, shipbuilding, and equipment manufacturing), and technology innovation (including 3D printing, fintech, and intelligent manufacturing).

Guangzhou Nansha Comprehensive Bonded Zone

The 4.99 square kilometer Guangzhou Nansha Comprehensive Bonded Zone (“Nansha Bonded Zone”) is the district’s main hub for distribution, foreign trade, and CBEC. As such, the zone has a considerable bonded warehousing and services industry and is home to some of China’s three largest bonded drug distribution centers.

In the first six months of 2022, the total value of the zone’s imports and exports exceeded RMB 50 billion (US$7 billion), while the total value of imports and exports of the Nansha International Distribution Center reached almost RMB 20 billion (US$2.8 billion).

Preferential policies in Nansha District

Preferential CIT policies

In late October 2022, the Ministry of Finance (MOF) and State Tax Administration (STA) released the Notice on Preferential Corporate Income Tax Policies in Nansha, Guangzhou (the “Notice”), which provides details on the implementation of a reduced 15 percent corporate income tax (CIT) rate for companies operating in encouraged industries located in certain areas of Nansha District. The standard CIT rate in China is 25 percent.

The Notice was released to implement the reduced 15 percent CIT rate introduced in the Nansha Plan in three “initial launch areas”.

As stated in both the Nansha Plan and in the Notice, the initial launch areas are the Nansha Bay area of the Guangdong Pilot FTZ, the Qingsheng Hub Cluster, and the Nansha Hub Cluster, which together cover a total of 23 square kilometers.

A reduced 15 percent CIT rate has already been implemented in a number of other development zones in China, including the Lingang New Area in Shanghai and the Hengqin and Qianhai portions of the Guangdong Pilot FTZ. Generally, each of these areas will compile its own list of encouraged industries that are eligible for the reduced CIT rate, as well as specific required scope and parameters for being considered as a participant in that industry.

To be eligible for the reduced CIT rate, a company’s main business must be in one of the industries listed in the Nansha Guangzhou Preferential Corporate Income Tax Catalogue (2022 Edition) (the “Catalogue”), and derive a minimum of 60 percent of their main business income from this industry. The total income must be calculated in accordance with Article 6 of the Corporate Income Tax Law of the People’s Republic of China.

Companies must also have a “substantial operation” in one of the three initial launch areas in Nansha to be eligible. A “substantial operation” means that the actually managed entity of the company is located in one of the initial launch areas of Nansha District and that the company implements substantial and comprehensive management and control over production and operations, staffing, accounting, and assets.

For enterprises whose head office is located in the initial launch areas of Nansha, the 15 percent CIT rate is only applicable to the income garnered by the head office and branch offices established in the initial launch areas in Nansha that meet the above requirements. For companies with head offices located outside of Nansha, the 15 percent CIT rate is only applicable to the income derived from branch offices established in the initial launch areas in Nansha that meet the above requirements.

The Catalogue of industries eligible for the preferential CIT rate covers 140 industry categories across eight broad sectors. These are:

- Key high-tech industries, such as AI and integrated circuits, high-end equipment, environmental conservation technology, and life and health sciences.

- Information technology, such as broadband communication infrastructure construction and services.

- Advanced manufacturing, such as Internet of Things development and multidimensional stereoscopic display and printing technology.

- Biopharmaceuticals, such as biocatalysts, reaction and separation technology development.

- New energy and new materials, such as photovoltaic energy technology and R&D and manufacturing of new materials for aviation and aerospace applications.

- Shipping and logistics, such as shipping information services, supply chain management, and international cruise ship operation and management services.

- Modern services, such as corporate management and the development of digital solutions.

- Finance, such as reinsurance, cross-border investment and financing, and green finance.

The 15 percent CIT rate will be implemented retroactively from January 1, 2022, to December 31, 2026.

Preferential IIT policies

China’s Ministry of Finance (MOF) has recently rolled out preferential individual income tax (IIT) policies for Hong Kong and Macao residents in order to facilitate the movement of talent across the GBA. Under the new policy, Hong Kong and Macao residents working in Nansha are exempt from paying the portion of their IIT burden that exceeds that of Hong Kong and Macao respectively. This income includes the comprehensive income derived from Nansha (including wages and salaries, labor remuneration, author’s remuneration, and royalties), business income, and subsidized income for talents recognized by the local government.

The Hong Kong and Macao residents working in Nansha can receive this preferential policy when handling their annual IIT settlement in Nansha. The above is applicable in the whole of Nansha District and will be implemented from January 1, 2022 to December 31, 2026.

In addition, foreign residents working in Nansha are eligible for the GBA-wide IIT subsidy which grants foreign employers subsidies for the portion of paid IIT in excess of 15 percent of the taxpayer’s taxable income. This subsidy is available once a year until 2023.

Supportive measures for stabilizing foreign trade

On August 25, 2022, Nansha District issued a range of supportive measures to help boost foreign trade. The measures include subsidies for cross-border transport between Guangdong and Hong Kong, export support for independent brands, and business growth awards, among others. Specifically, the subsidies are:

- Up to RMB 300 (US$42) per TEU of barge export goods departing from Nansha Port and destined for Hong Kong (excluding goods transshipped through Hong Kong). Each company can receive a maximum subsidy of RMB 2 million (US$279,544), and the maximum total subsidy available is RMB 20 million (US$2.8 million).

- A subsidy of RMB 1,000 per trip for trucks carrying goods across Guangdong-Hong Kong-Macao cross-border cargo operation points, with a maximum subsidy of RMB 500,000 per company.

- A reward of up to RMB 100,000 (US$139.8) for each additional US$10 million that a company gains in its total value of foreign trade imports and exports in 2022 compared with 2021, with a maximum of RMB 5 million (US$698,860) for each company and RMB 40 million (US$5.6 million) total.

- Processing trade companies that have established their own brands that have an export value of US$10 million in 2022 are eligible for a reward of RMB 20,000 (US$2,795) for every 5 percent year-on-year increase in their export value from 2021. The maximum reward given to each company is RMB 500,000 (US$69,886).

The supportive measures are available until December 31, 2022.

Investing in the Nansha District

The Nansha District of Guangdong is building upon its strengths as an important node in the GBA and key thoroughfare for the import and export of goods to and from the region. The district is particularly strong in its distribution and logistics offerings, which is why it continues to attract foreign e-commerce brands and companies manufacturing their products in the GBA.

But the district also remains home to traditional manufacturing industries and has growing high-end and high-tech manufacturing capabilities. The technological transformation of traditional industries will serve to keep companies in the district and make it an increasingly competitive destination for companies in the GBA.

Moreover, the district’s technology sector is expected to grow substantially as it prepares to implement the preferential 15 percent tax rate for strategic and emerging industries, which will serve to work in tandem with the technological upgrade of existing industrial and service industries.

This article was first published on October 12, 2022, and last updated on November 4, 2022.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Hong Kong’s Education Market – Trends and Opportunities

- Next Article Scholz’s German Business Delegation Looking To Understand China Opportunities