China Joint Ventures as Strategic Investment

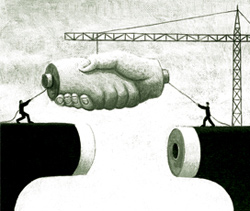

The debate over joint ventures has been going on since China opened up to the West. For some companies, JVs are a cheap way of entering the China market, others see a useful potential in the partner’s production facilities and workforce. While there is a measure of truth in all arguments, the sensible application of due diligence and an understanding of what a Chinese partner brings to a JV are paramount. This series of articles examines these issues to determine how joint ventures in China can be strategic investments.

The debate over joint ventures has been going on since China opened up to the West. For some companies, JVs are a cheap way of entering the China market, others see a useful potential in the partner’s production facilities and workforce. While there is a measure of truth in all arguments, the sensible application of due diligence and an understanding of what a Chinese partner brings to a JV are paramount. This series of articles examines these issues to determine how joint ventures in China can be strategic investments.

China Joint Ventures Part One: Why the Need for a Chinese Partner?

October 27, 2009

As the United States shows signs of emerging from recession, there has been some discussion on the best way to enter the China market but perhaps under reduced financial constraints. A joint venture partner is often considered because it is less expensive than building from scratch. Read the complete article

China Joint Ventures Part Two: Legal Due Diligence

October 28, 2009

Legal due diligence is a complex and contentious issue when it comes to joint ventures in China. Many investors seem to regard it as a waste of time and money; they’ve developed a relationship with an existing supplier, feel the guy can be trusted and see no need for delving deep into the Chinese company’s position. Yet it is as this stage that the foreign party can be most vulnerable. Read the complete article

China Joint Ventures Part Three: Financial Due Diligence

October 30, 2009

Financial due diligence in China can be an awkward issue to resolve, not least because there are no publicly available records systems in China that permit viewing of reported accounts. Instead, field investigations must be carried out to determine the position of the business. Delving into the minutiae of Chinese financial reporting is something of an art ?the average Chinese businessman will not have filed accurate accounts, as China’s tax bureau is woefully inefficient at collecting incomes. Tax avoidance is rife, standards of reporting are far less sophisticated than in the West, and some statements may be designed to extract money from the unwary investor. However, because of this scenario, financial due diligence in China goes beyond a look at the books. It also provides a platform to enable the foreign investor to examine the integral honesty of the business, the management systems in place that administer it, and what needs to be done to bring these up to scratch. Read the complete article

China Joint Ventures Part Four: Understanding the Intangibles

November 4, 2009

The intangible aspects of entering into and running a successful joint venture in China include the business areas where culture, common sense, law and an understanding of finance all cross over and weave together. They are not often included in a checklist of things to do when evaluating a joint venture partner, or considering the management of one. Yet the intangibles are very much part of the sensibility of getting into a JV in the first place. Read the complete article

China Joint Ventures Part Five: Negotiating the Contract

November 18, 2009

Joint ventures by their very nature are intensely idiosyncratic creatures, differing so much depending on circumstances that the area of contractual negotiations is really best dealt with professionally on a case by case basis. They also attract a great deal of opinion; however often this is simply put, and relates to just one experience, good or bad. In dealing with Joint Ventures however our firm over the years has established numerous such entities and the comments below are taken from a median pool of JV experience, dictating what tends to work best. However this may not be applicable to all circumstances. Read the complete article

China Joint Ventures Part Six: Moving Contractual Liabilities Out of China

November 24, 2009

In this concluding part of our series on China joint ventures we discuss alternatives to the legal pitfalls that can befall a joint venture domiciled in China. On the premise that an investor has read our previous articles on the subject and has conducted due diligence on the partner, we now look at moving the liabilities a JV brings with it out of China, and in also being able to reward your potential partner for doing so. In this article we examine the shortfalls in Chinese law that may influence your decision as regards legal domicile, and make suggestions for following this through. Read the complete article