Letters from America: China Growth and Development for U.S. Companies in 2012

The majority of U.S. corporations in China report growth of 10 percent and above, while keeping an eye on their China-destined manufacturing capacity

This is Part IX of our ongoing Letters from America to Asia Series, featuring opinions and observations on America’s trade relations with China and emerging Asia from Chris Devonshire-Ellis.

Nov. 26 – The majority of American companies in China continue to report strong growth and profitability in the country, according to the 2012 China Business Environment Survey recently released by the U.S.-China Business Council (USCBC). Comments from the USCBC Chairman John Frisbie stated that “Two-thirds of companies surveyed said revenue from their businesses in China grew by 10 percent or more in the past year” and went on to find that 75 percent of respondents said profit margins from their China operations were the same as or better than their company’s global margins.

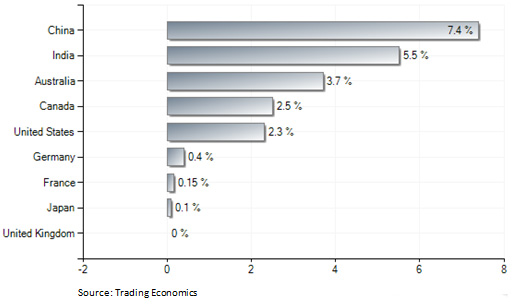

Domestic growth in the United States this past year has been about 2.3 percent, according to Trading Economics, with Mexico and Canada, two of America’s largest markets, reporting respective rates of 3.3 percent and 2.5 percent. Brazil, another export market highlighted by American companies, has grown at less than 1 percent this past year.

Although Frisbie’s comments were tempered with some warnings concerning China’s business environment, namely rising costs, domestic competition, and continuing regulatory and market access barriers, these should not prove overly problematic for American companies with a China plus strategy. Domestic competition exists in all overseas markets, while the rising cost factor has its benefits as well as its downside. The latter – which China is engaging as a matter of State policy in terms of mandatory wage increases, is putting off additional manufacturing capacity from being developed in China. This situation has been in a state of flux for the past two or three years, however with the advent of the 2015 RCEP Free Trade Agreement, China’s customs duty and import-export relations with the rest of Asia will change significantly, allowing more American companies to relocate to lower wage nations such as Vietnam and continue to sell to China without customs or duty penalties.

The focus on American corporates in the China sphere is therefore shifting from being purely about manufacturing, to now include product delivery, sales and the collection/distribution of income. The shifting of manufacturing capacity to countries across Asia is driving higher GDP growth rates in many Southeast Asian nations as well. Vietnam itself is on course for growth of 4.8 percent this year, with our own firm servicing many previously China-based players now choosing to operate their Asian base from Hanoi or Ho Chi Minh City. Bangladesh has also benefited from the rising price of China – it has inherited a healthy portion of China’s textiles industry and, conveniently sandwiched between China and India, grew at 6.3 percent this year. The trend is similar across Southeast Asia:

What is happening in China then is a twofold change – although higher costs are driving away some manufacturing facilities, the operational facilities – essentially servicing the sale of goods to China – are increasing. This goes hand-in-hand with the rise in Chinese consumerism I wrote about in the article “Selling to Asia’s New Middle Class” and has also been picked up by CNN commentator Shaun Rein here.

I have also argued that the phenomena of American brands such as Starbucks, KFC and McDonald’s, with their thousands of branches across hundreds of cities in China is creating welcoming environment for other American and Western consumables manufacturers to sell to the newly wealthy of China’s middle class. So although costs may be increasing, the upside is the Chinese can now afford to buy – and some 600 million of them by 2020 expect that to occur.

But none of this highlights the other great Asia market for American companies. India, with it’s own middle class population about the same size as China’s, is also inheriting a lot of manufacturing – the average wage of a worker in India is about one-third of the equivalent in China today. That double whammy – inexpensive labor, and a huge consumer market – is pushing India’s own growth rates up, to 5.5 percent in 2012, with higher rates expected to follow on from 2013.

What this tells us is that American companies now have more than one opportunity and more than one choice when it comes to looking at China and the rest of Asia. The USCBC report listed the top 10 challenges American corporate now face in China, and these include human resources management and administrative licensing hurdles as items one and two. Cost increases in China were identified as the top restraint on profitability growth, which again points to factory operational procedures beginning to make China subsidiaries evolve, estimate the costs of manufacturing in China, replacing that with a lower cost nation, and then using the new double tax and free trade agreements that are coming into effect in the next two years to refocus on China delivery and sale.

The top 10 China challenges cited by USCBC member companies:

- Human resources: Talent recruitment and retention

- Administrative licensing

- Competition with Chinese enterprises (state-owned or private)

- Cost increases

- Intellectual property rights enforcement

- Uneven local enforcement and implementation of laws and policies

- Investment restrictions

- Competition with foreign companies in China

- Competition with foreign or Chinese companies not subject to U.S. Foreign Corrupt Practices Act

- Standards and conformity assessment

The USCBC also reported that 94 percent of companies stated that they are doing business in China primarily to access the domestic Chinese market, not to develop an export platform. In short, American companies have begun to realize that China is now part of Asia, and that the servicing of China’s huge domestic consumer market, especially from the manufacturing perspective, can now be shared around.

If any report highlighted the changes and evolutions China is going through, it is this one, and American companies should be pondering the implications of where China now fits into their Asian, and global business development strategy. China is developing as a consumer market with massive growth. However, the financial and profitability trick is to know where to base that manufacturing production.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates. The firm provides foreign direct investment legal, tax and comparative advice between China, India, Vietnam and Emerging Asia and maintains 17 offices throughout the region. The practice also maintains a liaison office in Charlotte, North Carolina, and is a U.S. Department of Commerce preferred service supplier to American businesses in Asia. To contact the firm, please email asia@dezshira.com or visit the practice website at www.dezshira.com.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

The Complete ‘Letters from America to Asia’ Series

A complete list of articles from our ongoing ‘Letters from America to Asia Series’ featuring opinions and observations on America’s trade relations with China and emerging Asia.

- Previous Article China Accelerates Approval of Investment Quotas for QFIIs and RQFIIs

- Next Article China’s Actual Use of Foreign Capital