Market Overview: The Entertainment Industry in China

By Dezan Shira & Associates and Brandeis School of International Business

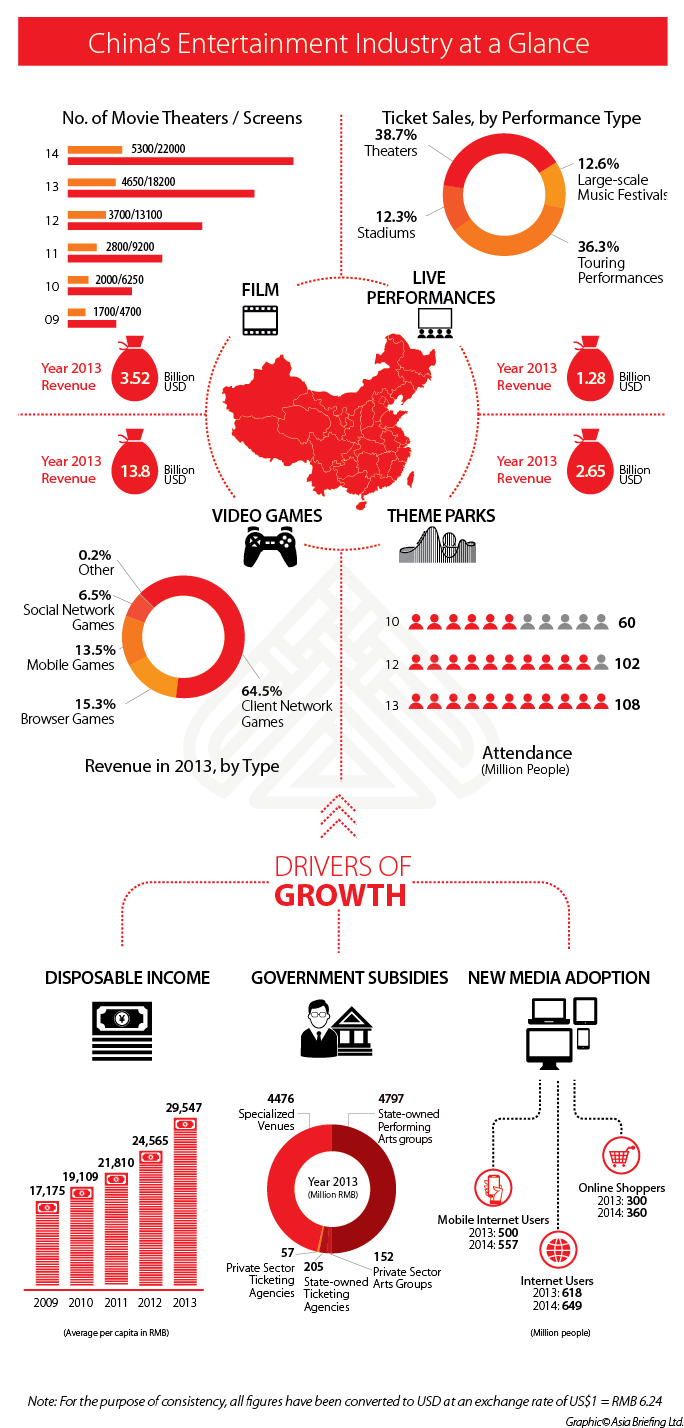

The entertainment industry in China has seen explosive growth in recent years (an expected CAGR of 17 percent between 2010-2015), growing at a much faster pace than the overall economy. As more and more people in China enter the middle class, disposable income has grown by leaps and bounds, from US$760 per person in 2000 to US$3440 by 2011, according to Ernst & Young. As a result, millions of people are finding that they have extra money to spend after accounting for the costs of living. Close to 800 million of those renminbi flowed into the Media & Entertainment sector in 2014, especially into the film, internet and mobile gaming sub-sectors.

When the global economy was thrown into turmoil in 2008-2009, Chinese policymakers intensified their search for ways to diversify China’s economy and shift away from the country’s heavy reliance on exports. This was made clear in the twelfth Five-year Plan (covering the period 2011 to 2015), in which the “cultural industry” was named a key sector for government support.

The Plan set forth the goal to make the cultural industry one of China’s “pillar” industries – often interpreted as a sector that grows at a double-digit rate and contributes at least 5 percent to China’s GDP. In the Plan’s policy documents specific to the cultural sector, two main reasons were identified behind the government’s drive to stimulate the cultural sector:

The first is economic. A vibrant cultural sector is another source of growth – and importantly, jobs – especially amidst investor alarm at what appears to be slowing national economy. To this end, the Plan makes a specific point of improving education and training for talent in the cultural sector.

Through its state-owned banks and other branches of the finance industry, the Chinese government has been making available large amounts of capital to the cultural and entertainment sectors. It is even cautiously allowing foreigners to invest in these sectors, as shown by recent deals such as the founding of a media and entertainment investment fund backed by a Singaporean PE firm and China’s largest private film distributor. Additionally, China Media Capital, a state-backed investment fund recently partnered up with Time Warner.

The second is political. The Chinese government aims to use the cultural sector as a “soft power” tool, through which to increase its own global influence. In this it was undoubtedly inspired by the success of Hollywood movies, Bollywood musicals and South Korean TV dramas had in improving their home countries’ image abroad.

This emphasis on the political use of the cultural and entertainment industries explains some of the sensitivity surrounding foreign participation in China’s domestic cultural scene. For example, China maintains an annual quota on the number of foreign films that are allowed to be imported. Presently, this stands at just 34 titles per year.

While such measures do present obstacles to foreign investment into China’s entertainment industry, opportunities abound for investors willing and able to navigate restrictions in what remains a complex yet immensely lucrative market.

For the time being, foreign entertainment companies are best advised to focus on the more mature markets of China’s coastal regions. While the fastest growth in entertainment spending is occurring in lower-tier cities in more inland parts of the country, the entertainment sector there is still at an early stage – effectively creating two separate markets in China.

Typically, the higher-tier coastal cities are home not only to more developed economies, but also to higher rates of technology adoption and stronger preferences for foreign culture. For the entertainment industry, this translates to a greater tendency, for example, to use mobile payments to buy tickets to the latest Hollywood blockbuster or pop music sensation.

There can be no doubt that growth in the industry is also being driven by the spread of Internet connectivity into every corner of the world’s third largest country by area. The most recent Five-year Plan includes blueprints for a tri-network convergence combining telecommunications, broadcasting services and the Internet on a single platform to deliver user content – estimated by Ernst & Young to inject an added US$250 billion worth of demand when completed. To supply this, spending on Internet access is expected to soar to US$78 billion in 2018.

The entertainment industry certainly represents one of China’s most exciting (and promising) fields for the future of FDI in the country, supported by the ongoing rapprochement between Western and Chinese culture. Put differently, “The show must go on.”

|

|

![]()

Employing Foreign Nationals in China

Employing Foreign Nationals in China

In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad.

China Investment Roadmap: The Medical Device Industry

China Investment Roadmap: The Medical Device Industry

In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

- Previous Article Opportunities Abound for Dental Care in China

- Next Article Human Resources and Payroll in China 2015 – New Publication from China Briefing