Minimum Wage in China: Minimal Increases in 2017

By Alexander Chipman Koty

In China, regional governments are authorized to set their own minimum wages according to local conditions. If adjustments to minimum wages are made, they usually occur in the first half of the year. However, the cities of Shanghai and Shenzhen and the provinces of Shandong, Fujian, and Shaanxi are the only jurisdictions that have done so in 2017.

In China, regional governments are authorized to set their own minimum wages according to local conditions. If adjustments to minimum wages are made, they usually occur in the first half of the year. However, the cities of Shanghai and Shenzhen and the provinces of Shandong, Fujian, and Shaanxi are the only jurisdictions that have done so in 2017.

Authorities in Shanghai, Shenzhen, Shandong, Fujian, and Shaanxi all increased their minimum wage levels. Although other regions still have ample opportunity to adjust their wages in 2017, the reluctance of a majority of provinces to increase wages in the first half of the year reflects the nationwide concern to keep wage growth in check in order to maintain competitiveness, particularly as China’s economy slows.

Employers in the affected regions must take into account the revised wage standards, as well as social insurance and other forms of employee compensation that may be tied to wages in a given location. Investors in labor-intensive industries should also review the latest minimum wage adjustments to understand payroll trends that could affect their business.

Shanghai

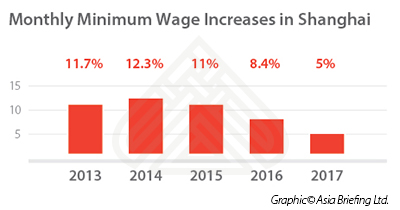

The Shanghai municipal government raised minimum wages earlier this year, effective as of April 1, 2017. The monthly minimum wage was elevated by five percent, from RMB 2,190 to RMB 2,300, while the hourly minimum wage increased from RMB 19 to RMB 20.

Although Shanghai has increased its minimum wage each year since wage hikes were frozen in 2009, the five percent increase is lower than in previous years. Nevertheless, Shanghai still has the highest monthly and hourly minimum wages in China.

Shenzhen

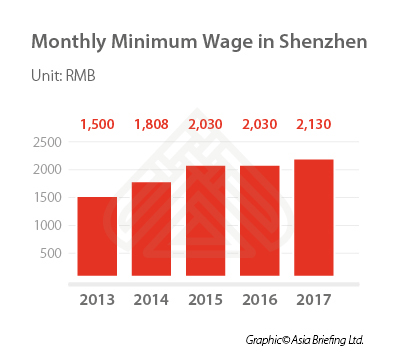

Shenzhen has increased its minimum wage for the first time since 2015. The monthly minimum wage has increased from RMB 2,030 to RMB 2,130, and the hourly minimum wage from RMB 18.5 to RMB 19.5. The changes came into effect on April 1, 2017.

With the increase, Shenzhen continues to have the second highest minimum wage in China, trailing only Shanghai, which also recently increased its minimum wage.

There is no minimum wage increase for the rest of Guangdong province, as provincial authorities put a freeze on minimum wage hikes for 2016 and 2017.

Shenzhen autonomously sets its own wages, separate from Guangdong Province.

Shandong province

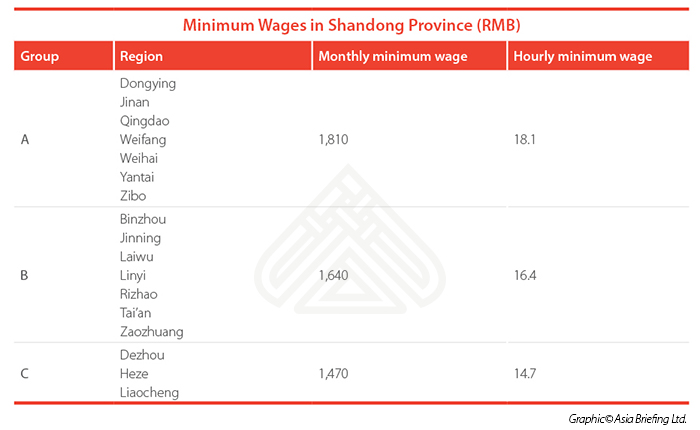

Shandong provincial authorities announced on May 26 that the province will increase minimum wages, effective June 1, 2017. Shandong also increased its minimum wage last year.

Minimum wage standards in Shandong are divided into three groups, depending on the region’s stage of development. Group A monthly minimum wages have been increased by RMB 100 to RMB 1,810; Group B by RMB 90 to RMB 1,640; and Group C by RMB 80 to RMB 1,470. Hourly minimum wages have increased to RMB 18.1, RMB 16.4, and RMB 14.7, increases of RMB 1, RMB 0.9, and RMB 0.8, respectively.

Fujian province

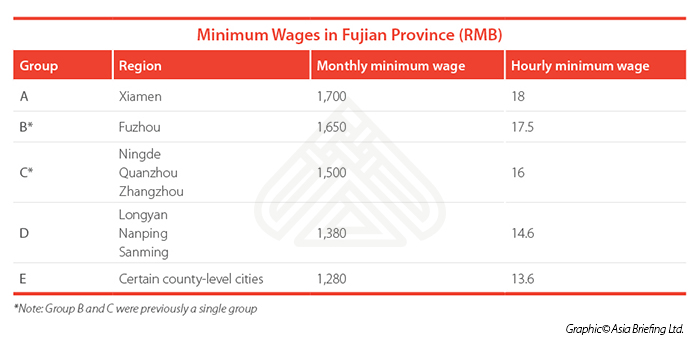

The Fujian provincial government recently announced minimum wage changes, also the province’s first since 2015. Besides increasing wages, the update divides what was previously Group B into two separate groups, thereby increasing the number of wage groups from four to five. Fuzhou is now alone in Group B, while Ningde, Quanzhou, and Zhangzhou occupy Group C.

Dividing Group B – which previously had a monthly minimum wage of RMB 1,350 – into two separate groups helps Fujian keep wages in line with local conditions. With the new scheme, the wealthier provincial capital Fuzhou enjoys a higher minimum wage of RMB 1,650, while the slightly less developed cities in Group C have a lower minimum wage of RMB 1,500.

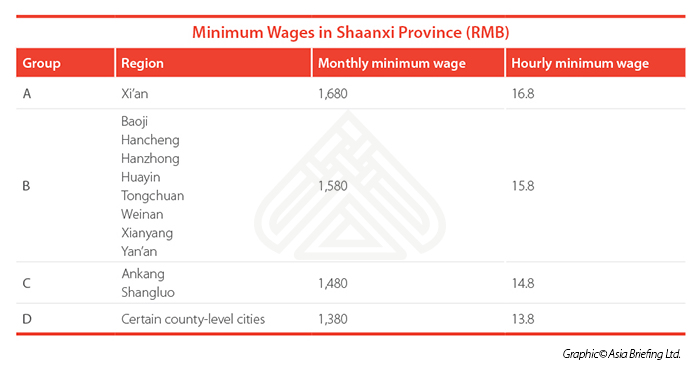

Shaanxi province

Shaanxi province has also adjusted its minimum wage for the first time since 2015. The monthly minimum wage in Group A has increased from RMB 1,480 to RMB 1,680; Group B from RMB 1,370 to RMB 1,580; Group C from RMB 1,260 to RMB 1,480; and Group D from RMB 1,190 to RMB 1,480. Hourly minimum wages increased from RMB 14.8 to RMB 16.8; RMB 13.7 to 15.8; RMB 12.6 to RMB 14.8; and RMB 11.9 to RMB 13.8, respectively.

The changes came into effect on May 1, 2017.

Slowing wage increases

So far, only five regions – Shenzhen, Shandong, Fujian, Shaanxi, and Shanghai – have increased their minimum wages in 2017. At a similar point in 2016, nine regions had already adjusted their minimum wages, while 27 had already done so in 2015. Of the regions increasing wages, only Shanghai and Shandong also increased wages the previous year.

In 2016, China’s Ministry of Human Resources and Social Security (MOHRSS) gave provinces more independence and flexibility in determining minimum wages. Previously, provinces had to adjust their minimum wages at least once every two years.

Factors such as economic growth, average wages, the cost of living, and housing prices affect the calculation of minimum wages. As wages in China have sharply risen over the past several years and growth has slowed, it appears as though many provinces are freezing wage increases to maintain their competitiveness – both within the country as well as vis-à-vis locations in ASEAN and India.

Despite these efforts, fewer and fewer workers in China are being paid at the minimum levels. With an aging labor pool and a growing demand for skilled workers, wages in China are steadily increasing. In 2016, the average monthly salary in 34 leading Chinese cities was RMB 7,606.

Although provinces are trying to put the brakes on rapid wage growth, China’s demographic and macro-economic changes suggest that average wages will continue to increase at a steady rate.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article China’s Great Firewall: Business Implications

- Next Article China’s New VAT Fapiao Requirements to Affect Taxpayers, Service Providers