Optimizing Profit by Intercompany Royalty Payments in China

We discuss the benefits and tax implications behind intercompany royalty payments in China as a profit repatriation strategy for multinational companies.

With the progressive introduction of marketization, many multinational corporations have chosen to set up subsidiaries in the Chinese mainland. However, given China’s strict foreign exchange control regime, repatriating cash from the subsidiaries has always been a challenging issue. Businesspeople should understand and develop a profit repatriation strategy to ensure their access to the profit earned.

There are several ways to repatriate cash. The most common way is direct remittance of dividends, yet this method is subject to certain prerequisites and constraints. Intercompany payments, such as charging service fees or royalties, offer an alternative with some advantages. The latter method has no limit on the number of remittances in a year, nor restrictions on cumulative profit, which is simpler and more tax efficient.

This article discusses one type of intercompany payments – royalties (which refer to the payments for the use of, or the right to use intangible assets, such as technical know-how, trademark, design or model, secret formula, or process, etc.) It introduces you to the tax implication, tax benefits under a double tax avoidance agreement (DTA), and what needs to be considered before making royalty payments.

Tax implication

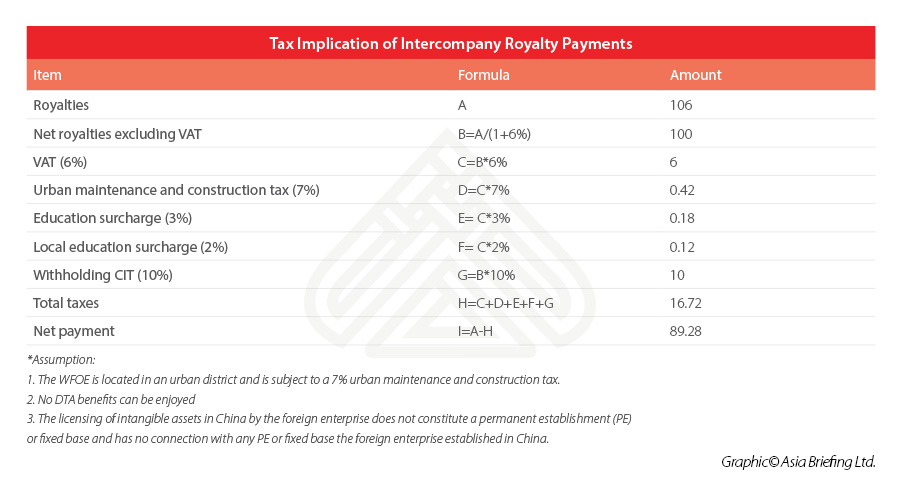

To give you a better understanding on the tax implication of intercompany payments of royalties, we will use a simple case:

A wholly foreign-owned enterprise (WFOE) is a value-added tax (VAT) general taxpayer in China. It pays RMB 106 as royalties to its overseas related company.  If we look at the transaction from a group level, the tax burden caused by intercompany royalties will be less than the total taxes the overseas related company paid. As WFOE is a VAT general taxpayer, the VAT it withheld for the overseas related company could be used to reduce its own VAT payable and the royalties paid could be deducted before its corporate income tax (CIT), if such expense is qualified as a deductible expense. Thus, there is a great chance that royalty payment is more tax efficient than dividend repatriation.

If we look at the transaction from a group level, the tax burden caused by intercompany royalties will be less than the total taxes the overseas related company paid. As WFOE is a VAT general taxpayer, the VAT it withheld for the overseas related company could be used to reduce its own VAT payable and the royalties paid could be deducted before its corporate income tax (CIT), if such expense is qualified as a deductible expense. Thus, there is a great chance that royalty payment is more tax efficient than dividend repatriation.

However, the actual tax burden of the group depends on multiple factors, such as the specific preferential tax rates that the WFOE may enjoy, the preferential tax rate the DTA may offer for the dividend or royalties, etc. Therefore, when multinational companies develop their cash repatriating strategy, comprehensive analysis and comparison are necessary.

Applying DTA benefits for royalties payments

In the DTAs that China has concluded with some countries, the stipulated withholding CIT rate for royalties is lower than the general 10 percent.

Take the DTA between the United Kingdom and China for example, the DTA regulates that payments of any kind received as a consideration for the use of, or the right to use industrial, commercial, or scientific equipment is subject to a 6 percent CIT in China. In such a case, if the nature of the royalties falls in the scope, apparently enjoying the DTA benefits could save some cost for the multinational company.

However, the DTA benefit is not automatically applicable. The WFOE and the applicant (the overseas related company which the royalties are paid to) need to satisfy certain qualifications and go through relevant procedures to obtain the benefits. Among those, “beneficial owner” is one of the basic concepts that is important when applying for DTA treatments on royalties.

Beneficial owner refers to an individual, company, or any other group having the ownership and right of control over the income or the right or property that the income is derived from.

To determine the beneficial owner status of an applicant, a comprehensive analysis should be carried out, taking into account the actual conditions of the specific case. Among others, there are some factors being regarded as “unfavorable” during the beneficial owner assessment stipulated by the Announcement of State Administration of Taxation (SAT) on Issues Relating to Beneficial Owner in Tax Treaties (SAT Announcement [2018] No. 9).

- The applicant is obligated to pay 50 percent or more of the income to a resident of a third country (region) within 12 months from receipt of the income (“Obligated” shall include agreed obligations and de facto payment even though there is no agreed obligation).

- The business activities undertaken by the applicant do not constitute substantive business activities.

- The counterparty country (region) of the tax agreement does not levy tax or exempts tax on the relevant income, or the actual levy rate is very low.

- Aside from contracts for the transfer of copyrights, patents, proprietary technologies, and other usage rights based upon which royalties are derived and paid, there exist contracts between the applicant and a third party pertaining to the transfer of copyrights, patents, proprietary technologies, and other usage rights or ownership.

The payee of the royalties needs to determine whether it qualifies for the DTA benefits and make record-filing to enjoy the preferential tax rates. The tax bureau will conduct post supervision and management on the royalty payment.

Concerns and DSA study

With the advantages partly mentioned above, intercompany royalties, as a tool for avoiding tax and shifting profit, are easily subject to special scrutiny by tax authorities.

When signing an intercompany royalty contract, the company would better take the below-listed particulars into consideration to make sure the royalty payment is compliant with tax regulations:

- Whether such transaction will be beneficial to the WFOE that could bring economic benefits to it.

- Whether the pricing complies with the arm’s length principle that the economic benefit the WFOE gained from the licensing of intangible assets is comparable to the transactions that non-related parties concluded under identical or similar circumstances.

- Whether the payee of royalties performed relevant function and bore corresponding risks in the forming and use of the intangible assets, and the royalties are charged based on the payee’s contributions to the value of the intangible assets.

- Whether the royalties derived from licensing of intangible assets match the economic benefits brought by using the intangible assets to WFOE.

- Whether the value of the licensed intangible assets has changed during the years and the intercompany royalties is adjusted accordingly.

About Us China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com. Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Census 2021: 5 Takeaways for Foreign Investors

- Next Article Wage Growth in China in 2020: How to Read the Latest Data