Remitting Royalties from China: Procedures and Requirements

By Angela Ma, Jim Qiao and Eunice Ku, Dezan Shira & Associates

For foreign companies with subsidiaries in China, repatriating cash from their subsidiaries has always been an important and challenging issue.

For foreign companies with subsidiaries in China, repatriating cash from their subsidiaries has always been an important and challenging issue.

There are several ways of repatriating cash from China, the most obvious being for a company’s entity in China to pay dividends directly to its foreign parent company. However, this is subject to certain prerequisites – only profits that have undergone annual audit can be repatriated using this channel, ensuring that the gross profit will be subject to a 25 percent Corporate Income Tax (CIT). Further, a foreign-invested enterprise (FIE) can only distribute dividends out of its accumulated profits, which means that its prior accumulated losses must be more than offset by its profits in other years, including the current year.

An FIE also has to place 10 percent of its annual after-tax profits into a reserve fund until it reaches 50 percent of the FIE’s registered capital. The dividends are subject to a further 10 percent withholding CIT when distributed to foreign investors.

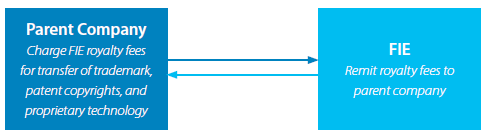

Based on the abovementioned constraints, many multinational corporations have adopted certain implicit policies, such as minimizing their profits in China in a legitimate manner via intercompany payments, i.e., charging their Chinese unit royalty or service fees. Although these transactions will be subject to turnover tax, and, possibly withholding income tax, the fees are deductible from the CIT taxable income and exempt from the 25-percent CIT, resulting in significant cost savings.

In the following sections, we discuss the procedures and requirements for remitting royalties to a foreign parent company from a subsidiary in China.

Royalty Remittances

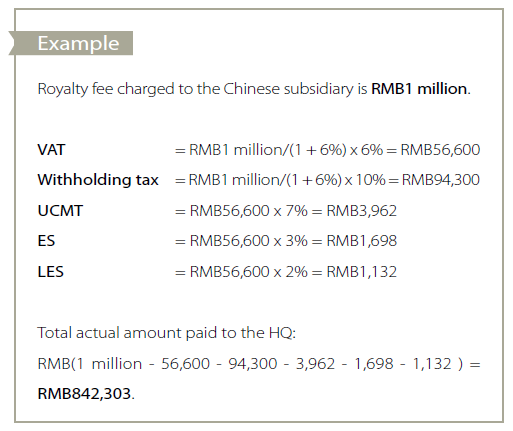

Royalties are fees paid in relation to the use of intellectual property, such as trademarks, patents, copyrights, and proprietary technology. Royalties are deductible for CIT purposes provided they are directly related to the FIE’s business operations and charged at normal market rates. Royalty remittances are subject to a 10 percent withholding CIT and six percent VAT, as well as UCMT, ES and LES.

The Chinese entity acts as a withholding agent to withhold the tax on royalties at the source. The royalty remittance process is similar to remitting service fees, with a few key differences: one of which is that the royalty agreement has to be registered with the trademark bureau.

The statutory CIT withholding tax rate of 10 percent can be reduced to a lower tax rate if a tax treaty is applicable. In order to receive a reduced withholding tax rate under a tax treaty, it is necessary to submit an application to the tax authority, which includes a Statement of Beneficial Owner.

Beneficial Owner Requirement

To enjoy the treaty benefits applied to royalties remitted by the affiliated China company, the non-resident company receiving the royalties must be the beneficial owner. A beneficial owner refers to a person that has ownership and control over the income and rights or properties from which income is derived. The person is generally engaged in substantive business activities (i.e., manufacturing, trade, and management activities), and can be an individual, company, or other organization. Agents and conduit companies do not fall under the scope of “beneficial owners.”

Factors Disfavorable to Being Named a Beneficial Owner

In determining whether the non-resident company is indeed the beneficial owner of the royalties, the tax authorities will apply a “substance over form” principle and conduct analysis based on the actual circumstances of the case. In general, the following factors are disfavorable to an applicant’s determination as beneficial owner:

- The applicant is obligated to pay or distribute all or the majority of its income (e.g., 60 percent and above) to residents of a third country (region) within a stipulated period (e.g., within 12 months from receipt of income);

- Except for holding properties or rights from which income is derived, the applicant has little or no other business activities;

- Where the applicant is a corporation, its assets, scale of operations, and staffing are relatively small (or few) and not commensurate with the amount of income;

- The applicant has little or no control or right of disposal over income or properties or rights from which income is derived, and bears little or no risk;

- The counterparty country (region) of the tax agreement does not levy tax or exempts tax on the relevant income, or the actual levy rate is very low;

- Aside from loan contracts upon which interest is derived and paid, there exist other loan or deposit contracts between the creditor and a third party which are similar in terms of amount, interest rate and date of execution, etc.;

- Aside from contracts for the transfer of copyrights, patents, proprietary technologies and other use-rights based upon which royalties are derived and paid, there exist contracts between the applicant and a third party pertaining to the transfer of copyrights, patents, proprietary technologies and other usage rights or ownership.

This article is an excerpt from the June 2014 edition of China Briefing Magazine, titled “Strategies for Repatriating Profit from China.” In this issue, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

This article is an excerpt from the June 2014 edition of China Briefing Magazine, titled “Strategies for Repatriating Profit from China.” In this issue, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Repatriating Profits and Dividends from China

Getting Cash Money RMB Out of China

Dividend Repatriation: Limits and Tax Considerations in China

- Previous Article Foreign Executives Facing Corruption in China: What to Do

- Next Article Shanghai FTZ Paves the Way for Arbitration Reform in China