Repatriating Profits and Dividends from China

Oct. 11 – When setting up a business entity in China, one of the most important considerations in overall business planning is the mechanism to facilitate the effective repatriation and maximization of profits. Below we discuss the relevant tax liabilities, the timing of repatriation, and the requirements for remittance under China’s foreign exchange control system.

Oct. 11 – When setting up a business entity in China, one of the most important considerations in overall business planning is the mechanism to facilitate the effective repatriation and maximization of profits. Below we discuss the relevant tax liabilities, the timing of repatriation, and the requirements for remittance under China’s foreign exchange control system.

Tax liabilities

China levies withholding tax on profits or dividends repatriated to non-resident taxpayers, with the amount varying from 0 percent to 20 percent depending on the stipulations of the relevant double tax treaty. Dividends connected to profits made prior to January 1, 2008 are exempt from this withholding tax.

Application for enjoying treaty benefit should be made separately to the competent tax authority by submitting the following documents:

- Application Form for Approving Tax Treaty Treatment for Non-Resident Enterprise;

- Identity Information Form for Non-Resident Enterprise Enjoying Tax Treaty Treatment;

- Filing Record Form for Non-Resident Enterprise Enjoying Tax Treaty Treatment;

- Relevant proof to justify the obtaining of dividends such as contract, agreement, or board resolution;

- Letter of authorization issued by the headquarter of the applicant;

- Statement of beneficial owner; and

- Other documents required by the tax authorities.

Not all profits can be repatriated or reinvested after tax clearance. A portion of the profit (at least 10 percent for WFOEs) must be placed in a company’s reserve fund account. This is treated as part of owner’s equity on the balance sheet. This account is capped when the amount of reserves reaches 50 percent of the registered capital of the company. The investor can also choose to allocate some of the remainder to a staff bonus or welfare fund or an expansion fund, although these are not mandatory for WFOEs. Further, no profits can be distributed before losses from previous years have been made up. The remaining balance is available for redistribution.

Timing of repatriation

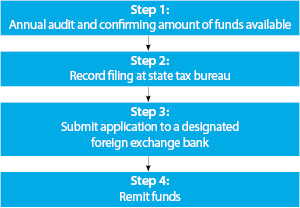

Profit repatriation can only be conducted once a year after the annual audit has been completed. The purpose of the audit is such that the State Administration of Taxation (SAT) can make sure all corporate income tax (CIT) has been paid up with regard to the profits being distributed. This is why all foreign-invested enterprises (FIEs) are required to go through the annual audit for tax compliance conducted by the local tax authority, which is usually completed around June or July every year.

Remittance requirements

All foreign exchange transactions in and out of China are subject to strict control by the State Administration of Foreign Exchange (SAFE), a bureau under the People’s Bank of China that is in charge of drafting rules and regulations governing foreign exchange market activities, supervising and inspecting foreign exchange transactions, managing the State foreign exchange reserves, and setting RMB convertibility/exchange rate policy.

Previously, when remitting more than US$30,000 in funds abroad, banks required the provision of a tax clearance certificate to prove that the correct amount of taxes has been paid before the funds can be remitted abroad. However, this requirement was cancelled under the “Announcement on Issues Concerning Tax Filings for Outbound Payments under Services Trade (Announcement [2013] No. 40)” issued by SAFE in conjunction with the SAT in July 2013.

Instead, individuals and institutions in China making outbound payments the value of which is the equivalent of more than US$50,000 are now required to conduct record filing with the in-charge local offices of the State Tax Bureau (STB). Foreign investors reinvesting in China with income legally obtained from their direct investment in China in an amount that is the equivalent of more than US$50,000 also need to complete a filing.

Under this records filing system, instead of having to apply for a tax payment certificate before they can make payments overseas, companies will only need to fill out a filing form and provide valid contracts or other relevant transaction documents (Chinese translation required) to the STB. The STB will affix a seal to the filing form, and companies will be able to remit funds outbound by submitting to banks the filing form and relevant transaction documents. Under the “Guidelines for the Administration of Foreign Exchange under Service Trade” and its detailed implementation regulations (Huifa [2013] No. 30) issued in conjunction with Announcement 40 by SAFE, such documents include:

- Annual financial audit report issued by a certified public accounting firm;

- Board resolution on profit distribution; and

- Applicant’s most recent capital verification report.

Verification of the documents and tax assessment will be conducted within 15 days after the STB receives these documents and therefore the company might be facing more risks of being challenged in the future if the tax authorities deem that the tax withholding has not been done properly.

Beijing STB explains that Announcement 40 does not change the tax obligation, including withholding tax obligation, but only simplifies the outbound payment procedure. Companies or individuals who are found to not have fulfilled their tax obligations or filing and registration requirements could face fines ranging from 50 percent to 500 percent of the unpaid tax payable.

In principle, banks are not required to inspect and verify the transaction documents for profit repatriation where the value of such funds is the equivalent of US$50,000 or less. Exceptions apply when the nature of the funds are unclear, in which case banks will request the submission of transaction documents.

Both Announcement 40 and the Guidelines came into force on September 1, 2013.

After receiving the bank’s approval, the money can then be converted into foreign currency at the daily conversion rate against the RMB issued by the People’s Bank of China and transferred directly to the foreign country from the FIE’s bank account.

Timeframe

Depending upon the specific case, this process was used to be completed in a minimum of six weeks, but may take longer if DTA benefits need to be claimed. With the implementation of the new policies, it is expected to be less time consuming.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

An Introduction to Tax Treaties Throughout Asia

An Introduction to Tax Treaties Throughout Asia

In this issue of Asia Briefing Magazine, we take a look at the various types of trade and tax treaties that exist between Asian nations. These include bilateral investment treaties, double tax treaties and free trade agreements – all of which directly affect businesses operating in Asia.

Understanding Permanent Establishments in China

Understanding Permanent Establishments in China

This issue of China Briefing Magazine casts some light on permanent establishment status in China by discussing the circumstances triggering a PE in China, focusing on Service PEs. We also discuss the tax implications for a non-resident enterprise where its activities in China constitute a Service PE in the country, and address the taxation of representative offices.

Double Taxation Avoidance Agreements

Double Taxation Avoidance Agreements

In this issue of China Briefing Magazine, we look at the evolution of the legal framework of double taxation agreements in China, including the foundations of anti-avoidance, obligations in reporting offshore transactions, how to qualify as a beneficial owner and how to claim treaty benefits. We also outline the interpretations given in Circular 75 of the China-Singapore DTA, which was the first time that the Chinese tax authorities really opened up about DTA interpretations.

![]() ASEAN Briefing

ASEAN Briefing

Our new ASEAN Briefing site contains details of double tax agreements, free trade agreements, and bilateral investment treaties between ASEAN, its members, and other countries around the world. ASEAN Briefing is a library source for researching tax and trade treaties, and is an essential guide for cross border tax planning. The site also includes news and treaty updates on ASEAN, China, India, the United States and Europe.

- Previous Article China’s New Measures to Combat Air Pollution Toughest to Date

- Next Article Shanghai FTZ Launches Cross-Border E-Commerce Platform