SASAC Releases 2009 China State Owned Enterprise Performances

Aug. 24 – The State Council’s State-owned Assets Supervision and Administration Committee (SASAC) released the 2009 performances of 108 of the 129 SOEs under state level supervision yesterday.

Missing are China’s banks and financial institutions, which are among the most profitable, but are either under the supervision of the China Banking Regulatory Commission or the China Insurance Regulatory Commission. The SASAC has already indicated it wishes to reduce the numbers of SOEs it administers from 129 to 100, to be achieved through mergers.

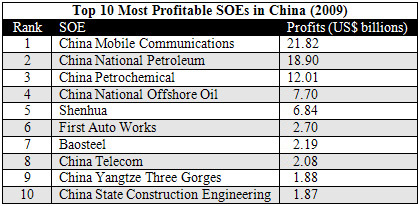

The top 10 performing SOEs were as follows:

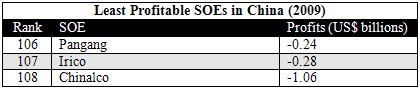

The worst performing SOEs were:

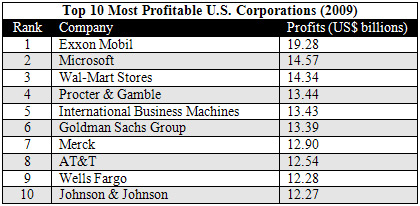

Chinalco’s poor performance has been down due to the depressed market in aluminum, but the company is being restructured and is diversifying away from aluminum products. It has recently acquired several rare earth, copper and iron ore mining assets in a bid to diversify. The performances of China’s top SOEs contrast with the top 10 most profitable companies in the United States listed below (2009 figures to compare).

- Previous Article Guangxi: China’s Direct Link to Southeast Asia

- Next Article Shaanxi: China’s National Science and Engineering Development Hub