Shenzhen’s Qianhai Cooperation Zone Expands Preferential IIT and CIT Policies

The Shenzhen Municipal Tax Bureau, Shenzhen Municipal Finance Bureau, and State Tax Administration have issued two notices broadening tax incentives for individuals and companies in the Qianhai Cooperation Zone.

The Shenzhen Municipal Tax Bureau, Shenzhen Municipal Finance Bureau, and State Tax Administration have released two notices expanding a preferential individual income tax (IIT) and corporate income tax (CIT) policy for companies and individuals working in the Qianhai Shenzhen-Hong Kong Modern Service Industry Economic Cooperation Zone (“Qianhai Cooperation Zone”).

Under the expanded policies, Hong Kong residents working in the Qianhai Cooperation Zone, a development zone located in Shenzhen, will be exempted from paying the portion of IIT exceeding their salary tax burden in Hong Kong. In addition, a 15 percent CIT rate, reduced from the standard 25 percent rate, has been expanded to more areas of the zone.

IIT exemption policy for Hong Kong residents

The notice states that Hong Kong residents working in the Qianhai Cooperation Zone can be exempted from paying the portion of their IIT burden that is in excess of what they would pay in salary tax in Hong Kong.

Hong Kong applies a progressive salary tax rate ranging from 2 to 17 percent. Meanwhile, China’s IIT rate ranges from 3 to 45 percent. This means many Hong Kong residents would enjoy a lower IIT rate if they remained in Hong Kong, potentially disincentivizing the flow of talent to the Qianhai Cooperation Zone. This policy therefore ensures Hong Kong residents will not have to pay more IIT if they choose to work in the Qianhai Cooperation Zone rather than Hong Kong.

High-end and in-demand foreign talent in the Qianhai Cooperation Zone are already able to enjoy a preferential IIT policy that allows them to reclaim the portion of IIT paid in excess of 15 percent in the form of subsidies.

The income covered includes comprehensive income derived from Qianhai (including wages, salaries, labor remuneration, royalties, and franchise fees), operating income, and talent subsidy income certified by the local government.

The Hong Kong residents eligible for this policy can enjoy this preferential policy when settling their annual IIT in Qianhai.

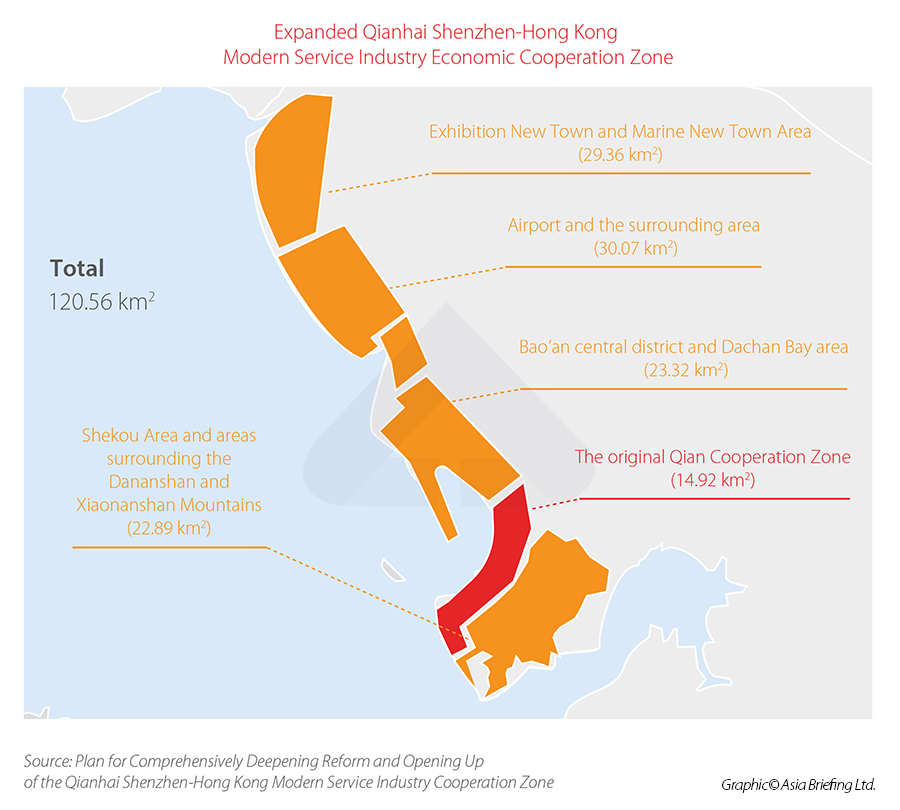

The policy applies to the entire Qianhai Cooperation Zone as designated in the “Development Plan”. This refers to a 120.56 square kilometers area covering the Shekou and Xiaonanshan areas, the adjacent Convention and Exhibition City and Ocean New City areas, the airport and surrounding areas, the Bao’an central area and Dachan Bay area, and the initial 14.92 square kilometer area.

The policy will be effective from January 1, 2023, to December 31, 2027.

15 percent CIT policy expanded to the whole zone

The second notice states that the 15 percent preferential CIT policy available to eligible companies will be expanded to cover the entire Qianhai Cooperation Zone.

This policy, which was first introduced in 2021, initially applied to the area of the Qianhai Cooperation Zone specified in the 2010 Development Plan, covering an area of 14.92 square kilometers. In 2021, the State Council approved a plan to gradually expand the zone to a total of 120.56 square kilometers by 2035. The expansion of the 15 percent CIT policy therefore means it will be available to companies located in the newly expanded areas.

The expanded CIT policy will be applied from January 1, 2023, to December 31, 2025.

In order to be eligible for the preferential CIT policy, companies must be engaged in certain encouraged industries and have “substantial operations” within the zone. Under this criterion, more than 60 percent of a company’s total income raised in the Qianhai Cooperation Zone must be derived from one of the industrial projects specified in the “Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone Enterprise Income Tax Preferential Catalog (2021 Edition)”.

Companies whose head offices are located in the Qianhai Cooperation Zone can enjoy the 15 percent tax rate on the eligible income garnered by the head offices and branches located in the cooperation zone. For companies with institutions outside the zone, the 15 percent CIT rate will only apply to the income from branches located in the zone that meets itself that meet the relevant requirements.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Asia Transfer Pricing Brief: Q1 2024

- Next Article China’s New Measures to Support Foreign Investment in Sci-tech Firms