Tax Implications for Businesses Under China’s New Company Law

Under China’s New Company Law, companies and stakeholders face new tax implications. Ahead of its implementation, thorough understanding, staying informed, and consulting legal and tax experts are essential for proactive risk management.

Against the backdrop of the New Company Law, companies, shareholders, and creditors will face new tax implications. Before committing capital to a new company, deciding the contribution form, deciding to buy or sell the equity in a company, or planning to reduce capital for making up losses, companies and individual investors are advised to carefully consider the corresponding tax implications and adopt a cautious yet proactive approach for tax planning and financial strategy development.

Five-year subscribed capital payment term and relevant tax implications

Article 47 of the New Company Law stipulates that shareholders of a Limited Liability Company (LLC) must fully pay their subscribed capital within five years from the company’s establishment. This five-year contribution term applies not only to new companies but also to existing companies established before the New Company Law takes effect on July 1, 2024. For the latter, it is necessary to adjust their contribution term to align with the new five-year requirement during the transition period.

Pre-tax deduction of interest expense

According to Article 38 of the Implementation Regulations for the Corporate Income Tax Law (CIT Regulation), the following interest expenditure incurred by an enterprise in production and business activities shall be deductible:

- Interest expenditure for borrowings made by a non-financial enterprise from a financial enterprise;

- Interest expenditure for approved bonds issued by an enterprise; and

- Interest expenditure for borrowings made by a non-financial enterprise from a non-financial enterprise which does not exceed the amount computed according to the interest rate for same type of loans of a financial enterprise during the same period.

By these provisions, the interest expenses related to a company’s external loans are eligible for pre-tax deduction. However, the Reply of the State Taxation Administration on Pre-tax Deduction of Interest Expenses Incurred on Unpaid Investments by Enterprise Investors (Guo Shui Han [2009] No. 312) imposes certain limitations on this tax treatment.

As per Guo Shui Han [2009] No. 312, if an investor fails to pay the payable capital amount within the specified period, the interest incurred from external borrowings—equivalent to the interest payable on the difference between the actual paid-up capital and the capital amount due within the stipulated period—shall not be considered a reasonable expenditure for the enterprise. Thus, this interest burden shall be borne by the investors and cannot be deducted when calculating the taxable income of the enterprise.

The term “specified period” generally refers to the capital contribution timeframe specified in the articles of association. Under the existing Company Law, there is no specific time limit for capital contributions, leading many enterprises to set lengthy contribution terms. In such cases, triggering the pre-tax deduction restriction on loan interest becomes less likely.

However, with the introduction of the 5-year contribution term requirement in the New Company Law, it has become easier to activate the loan interest deduction restrictions.

Therefore, we recommend that LLCs with a substantial amount of outstanding unpaid capital exercise vigilance when obtaining external loans. It is advisable to proactively engage with competent tax authorities to clarify the applicable tax treatment, accurately calculate the pre-tax deduction for interest expenses, and fulfill enterprise income tax obligations.

Additionally, Article 49 of the New Company Law states that shareholders who fail to timely pay their capital contribution in full must not only settle the full amount owed to the company but also assume liability for any resulting losses incurred by the company. If the corresponding interest cannot be deducted before tax due to the shareholder’s unpaid contribution, the company is entitled to request the shareholder to bear this tax loss. Potential tax on capital reduction.

Under the context of the New Company Law, many companies may opt to reduce their registered capital to lower the required paid-in capital.

Reducing capital may trigger income tax liabilities. Taking the company shareholders as an example, according to the State Taxation Administration Announcement [2011] No. 34, the assets obtained by an investing enterprise through capital reduction can be divided into three categories:

- Investment cost recovery: This corresponds to the portion of assets acquired by the investing enterprise from the invested enterprise, equivalent to the initial capital

- Dividend income: Equivalent to the proportion of undistributed profits and accumulated surplus reserves of the invested enterprise, calculated based on the reduction in paid-in capital.

- Income from investment asset transfer: The remaining

Among the three categories, only the portion related to income from investment asset transfer is subject to CIT payment.

Under the New Company Law, when companies decrease their registered capital to lower paid- in capital, shareholders may not receive income from investment asset transfers due to the capital

reduction, thus avoiding CIT payment. However, if a company has significant net assets and retained earnings, shareholders reducing capital without receiving investment income may face scrutiny from the tax bureau.

Tax implication of non-monetary contributions

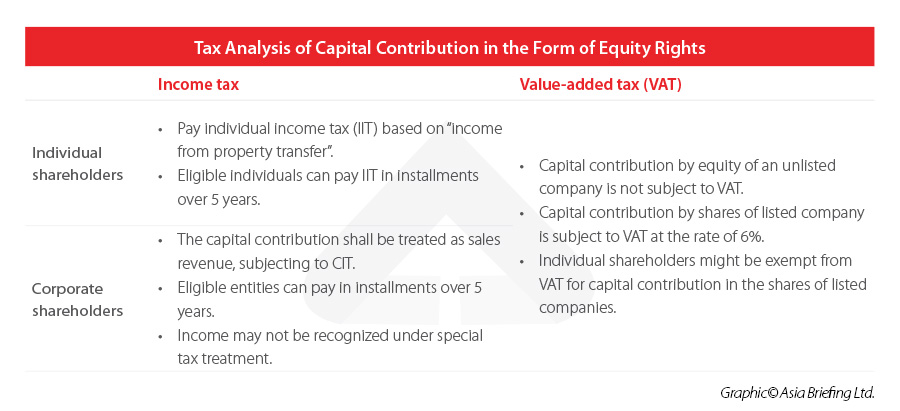

Article 48 of the New Company Law adds that a shareholder may make capital contributions in equity rights and creditor’s rights, in addition to the previous forms. Equity and debt investments both fall under the category of non-monetary contributions, which often involve complex tax implications.

Taking equity investment as an example, the primary tax analysis is summarized in the following table:

Moreover, when transferring assets like equity and creditor’s rights, it may entail debt restructuring between enterprises, leading to complex tax treatment. Additionally, capital contribution in non-monetary assets may qualify for specific preferential tax treatment.

Given these, evaluating the tax burden associated with non-monetary contributions is complicated, with tax implications differing greatly depending on the nature of the non-monetary investment. Therefore, we highly recommend that both companies and individuals thoroughly assess potential tax burdens beforehand when making non-monetary asset contributions. Recognizing these tax implications as crucial elements in investment costs is imperative.

Potential tax implications for equity transfer

Article 88 of the New Company Law adds that the transferor and transferee in equity transfer bear joint liability for the insufficient capital contribution unless the transferee is not aware and ought not to know that the transferor fails to make capital contribution as prescribed or the non-monetary property used as capital contribution is defective.

In this context, the obligation of the transferee to assume the contributions for the transferor should be factored into the consideration for the equity transfer when calculating capital gains, and corresponding IIT or CIT should be paid consequently.

Profit distribution and relevant tax implications

Article 212 of the New Company Law addresses the statutory deadline for profit distribution. It mandates that company boards must distribute profits within six months from the date when shareholders’ meetings pass profit distribution resolutions. The amendment aims to reduce the time gap between resolution and actual profit distribution within companies.

However, does this acceleration imply a faster tax obligation for shareholders’ dividend income?

For resident enterprise shareholders, in many cases, the dividend income they receive from invested resident enterprises can enjoy CIT exemption. Even if dividend income is subject to CIT, Guo Shui Han [2010] No. 79 specifies that income from equity investments in the form of dividends or bonuses should be determined based on the date when the invested enterprise’s shareholders’ meeting makes profit distribution decisions. Therefore, the timing of tax obligations for resident enterprise shareholders regarding dividend income remains unaffected.

Nevertheless, for non-resident enterprise shareholders and individual shareholders, their dividend income tax is generally withheld at the source during payment. This means that the invested enterprise deducts and withholds taxes when distributing dividends. Consequently, early profit distribution may impact the tax-related arrangements for the invested enterprise. Companies with such shareholders should not only promptly carry out profit distribution within the statutory period but also prepare for relevant tax-related work to ensure timely and compliant tax withholding declarations.

Key takeaways

As the effective date of implementation of the New Company Law approaches, relevant entities must consider not only the various changes introduced by the new law but also the potential tax implications when undertaking actions, such as company establishment, capital contribution, equity transfer, profit distribution, and loss compensation. The recent revision of the Company Law encompasses all stages of a company’s life cycle, from registration to dissolution and liquidation.

The tax implications associated with these changes extend well beyond the scope of this article.

We recommend that relevant entities thoroughly study the New Company Law, stay informed about subsequent legal regulations, and assess the comprehensive impact of the new law on their investment and business planning.

When necessary, businesses can also maintain communication with legal and tax specialists to proactively address potential business and tax risks.

For more information, the latest issue of China Briefing Magazine, “Navigating China’s New Company Law: A Guide for Foreign Investors”, is now available as a complimentary download on the Asia Briefing Publication Store.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China Releases New Draft Regulations on Generative AI

- Next Article China Monthly Tax Brief: May 2024