The Legal Fundamentals of China M&As

By Eunice Ku, Rachel Xuan and Susan Kang

Oct. 6 – In 2003, the Chinese government first laid down in a single piece of M&A legislation the relevant principles, procedures and requirements allowing foreign investors to acquire Chinese limited companies. The most recent version, the “Rules on Acquisition and Merger of Domestic Enterprises by Foreign Investors (M&A Rules),” was promulgated in 2006 and revised in 2009.

These regulations provide investors with a basic framework and guidance on carrying out M&A activities in China, while giving the government ample discretion to examine and approve M&A activities that would potentially impact national and economic security.

Due to the recentness of China’s exposure to M&As, M&A culture in China is still in its infancy and the Chinese government is careful in weighing the benefits against the risks of acquisition of enterprises in China by foreign enterprises, especially in key sectors.

Acquisition of equity and assets requires the approval from the local Ministry of Commerce (MOFCOM) branch and registration with the local Administrative Bureau of Industry of Commerce.

In addition to anti-monopoly provisions, China reserves the right to review foreign acquisitions of Chinese companies and assets from a national economic and security perspective.

MOFCOM approval at the central level is required in the following M&A situations:

- The Foreign-Invested Enterprise (FIE) formed after the M&A is under a category or industry sector designated for MOFCOM examination and approval

- A company, enterprise or natural person in China acts through a company it legitimately established or controls outside of China, to merge with or acquire a domestic company with which the company, enterprise or natural person is affiliated

- M&A of a domestic enterprise by foreign investors whereby:

- Foreign investors obtain a controlling stake in key industries, or

- Safety factors exist that are likely to impact the economic security of the State, or

- Foreign investors obtain the actual right of control over a domestic enterprise that owns well-known trademark or China’s time-honored brands

Below, we examine the provisions with which foreign investors who wish to carry out M&As in China have to comply.

The M&A Rules apply only to the merger and acquisition of domestic firms, and foreign investors seeking to acquire firms in China that already enjoy FIE status must adhere to a different set of regulations.

Matters concerning the reporting and approval of all changes in the equity structure of an FIE are governed by the Several Provisions on Changes in Equity Interest of Investors in Foreign-Invested Enterprises (“FIE Equity Interest Change Provisions”), published by the Ministry of Foreign Trade and Economic Cooperation in 1997. Matters not addressed by these provisions are handled “with reference” to the M&A Rules.

Applicability

The M&A Rules apply when a foreign investor:

Equity acquisitions:

- Purchases equity interests of a shareholder of a domestic non-foreign invested enterprises (i.e., domestic enterprises)

- Subscribes to the capital increase of a domestic enterprise

Asset acquisitions:

- Establishes a foreign-invested enterprise, through which it purchases and operates the assets of a domestic enterprise

- Purchases assets of a domestic enterprise, and uses such assets to establish a foreign-invested enterprise to operate the assets

Stipulations

According to the M&A Rules, M&A of domestic enterprises by foreign investors must comply with the Foreign Investment Industrial Guidance Catalog (“Catalog”). This means that mergers or acquisitions may not result in foreign investors:

- Creating a WFOE in the acquired enterprise in industries where no WFOE is allowed under the Catalog

- Becoming a controlling party or relatively controlling party in an acquired enterprise in industries which require the Chinese party to be controlling or relatively controlling

- Acquiring any enterprise engaged in industries where operation by foreign investors is prohibited or restricted

Acquisition procedure

The M&A Rules stipulate time limits for foreign investors to pay in full the considerations for equity or asset transfer, or the capital increase to which they subscribed; the ratio between the registered capital and total investment; and the application procedures and documents required.

Application Documents

An equity acquisition will require the following documentation:

- The unanimous shareholders resolution of the target domestic company (LLC or JSLC) on the contemplated equity acquisition

- Application for the converting establishment of the FIE

- Contract and articles of association of the FIE to be formed after acquisition

- The agreement on the foreign investor’s acquisition of equities of shareholders of the domestic company or on its subscription of the capital increase of the target domestic companies

- Audit report on the financial statement of the previous fiscal year of the target domestic company

- The notarized and certified documents for the foreign investor’s identity, registration and credit standing

- The descriptions about the enterprises invested in by the target domestic enterprise

- Duplicates of the business licenses of the target domestic enterprise and its invested enterprises

- The proposal of employees arrangement in the target domestic enterprise

- Documents relevant to the agreements on liabilities of the domestic company, appraisal report issued by an appraisal institution and disclosure and explanations for the associated transaction, if applicable

- Other documents related to the following may be required: business scope and scale, etc.

An asset acquisition will require the following documentation:

- The resolution of the property rights holders or governing body of the domestic enterprise on the consent of the sale of the assets

- The application for the establishment of the post-acquisition FIE contract and articles of association of the FIE to be established

- The asset purchase agreement signed by the foreign-funded enterprise to be established and the domestic enterprise, or by the foreign investor and the domestic enterprise

- The articles of association and the business license (duplicate) of the target company

- The creditor notification issued by the target company and the creditor’s statement on the contemplated acquisition

- The notarized and certified documents for the identity, registration and credit standing of the foreign investor

- The proposal to arrange employees in the target domestic enterprise

- The documents relevant to the target company’s liabilities arrangement, appraisal report and disclosures and explanations made by the parties to the acquisition

- Other documents related to the following may be required: permit/license obtained for the contemplated asset acquisition

Many small to medium Chinese companies do not report their true revenue to the China tax office in order to lower the amount of tax they pay. In an equity acquisition, the foreign investor takes on the tax liabilities of the original domestic company. In an asset acquisition, such tax liability remains with the domestic company.

Registered capital

After a foreign investor purchases the equity rights of a domestic company, and the domestic company has been changed to an FIE, the FIE’s registered capital shall be the registered capital of the original domestic enterprise, and the investment contribution by the foreign investor shall be the proportion of the purchased equity in the original registered capital.

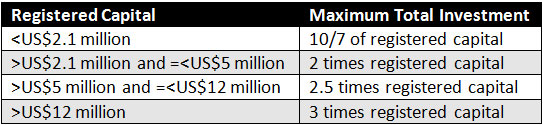

Additionally, when a foreign investor merges with a domestic enterprise by equity merger, Article 19 of the M&A Rules places upper limits on the total investment amount of the foreign-funded enterprise established after the merger. The upper limit on investment is determined by the total amount of registered capital as outlined in the table below.

Article 9 of the M&A Rules provides that, where the ratio of a foreign investors’ capital contribution to the registered capital of an FIE established as a result of M&A is less than 25 percent, the enterprise shall not be entitled to the treatment for FIEs.

Valuation

All M&As between a foreign and domestic enterprise should determine the transaction price on the basis of the result of an evaluation conducted by an asset evaluation institution. The parties may choose the asset evaluation institution themselves, but it must be established within the territory of China in accordance with the law.

Article 14 of the M&A Rules further prohibit the transfer of equity interest or sale of assets at a price “obviously lower” than the evaluation result for the purpose of transferring the capital out of China in a disguised way.

Equity purchase agreement

The foreign investor and domestic enterprise are to conclude an equity purchase agreement, or in the case of foreign investors’ subscription to the capital increase of the target, a capital increase agreement. Article 22 of the M&A Rules provide that the agreement should contain the following:

- The relevant information of the parties in the agreement

- The amount of equity to be purchased or capital to be increased, and the price to be paid

- The term and method of performance of the agreement

- The rights and obligations of each party

- The liabilities for breach of agreement and the means by which disputes will be settled

- The date and place of the conclusion of the agreement

Payment

The foreign investor should pay the full amount stated in the Equity Purchase Agreement within three months of the receipt of the FIE business license. Under special circumstances and subject to the approval of Ministry of Foreign Trade and Cooperation (MOFTEC) or the provincial examination and approval authority, the foreign investor can pay a minimum of 60 percent of the price within six months, with the full balance to be paid within one year of the issuance of the FIE business license.

If the foreign investor conducts the acquisition through subscription to the capital increase of a domestic enterprise, the foreign investor shall pay no less than 20 percent of the amount of registered capital to be increased at the time of application for FIE business license. The time limit for payment of remaining increased registered capital is subject to the provisions of Company Law of the People’s Republic of China, FIE laws and regulations, and regulations on the registration of companies.

Approval and registration

The MOFCOM will announce its acceptance or rejection of the application within 30 days of receipt of the necessary application documents. In the case that the MOFCOM accepts the application, it will present a certificate of approval.

Upon receipt of the approval certificate from the MOFCOM, the foreign enterprise has 30 days to register the acquired domestic enterprise as an FIE with the SAIC or its local sub-branches.

Content for this article was taken from the Sept. 2011 issue of China Briefing magazine titled “Reevaluating China Joint Ventures and M&As.” In it, we take a fresh look at joint ventures and M&As in China – the current market circumstances, the motivations and challenges faced – and provide a few practical insights into key issues such as forming a joint venture contract and finding an M&A partner.

Dezan Shira & Associates is a boutique professional services firm providing foreign direct investment business advisory, tax, accounting, payroll and due diligence services for multinational clients in China. In particular, the firm specializes in all matters relating to mergers and acquisitions in the country. For relevant advice, please email info@dezshira.com, visit www.dezshira.com, or download the firm’s brochure here.

Related Reading

Mergers and Acquisitions in China (Second Edition)

Mergers and Acquisitions in China (Second Edition)

This guide is a practical overview for the international business to understand the rules, regulations and management issues regarding mergers and acquisitions in China. It will help you to understand the implications of what can initially appear be a complicated and contradictory subject as well as points you at the structures you should use and some of the common pitfalls you may encounter.

China Approves Nestlé’s Acquisition of Yinlu

China Formalizes Security Reveiw Rules for Inward M&As

China’s MOFCOM Clarifies Security Reviews for M&A Transactions

China to Start Security Review of Foreign Acquisitions of Domestic Companies

- Previous Article Understanding Development Zones in China

- Next Article Translation vs. Transliteration in Converting Brand Names to Chinese