The Scope of Contemporaneous Documentation in China

By Dezan Shira & Associates

Author: Shirley Chu

Editor: Qian Zhou

After the OECD/G20 Action Plan for Tax Base Erosion and Profit Transfer Projects (“BEPS Action Plan”) was released in October 2015, tax authorities across the world, including in China, began to revise and improve their local laws and regulations accordingly.

The authorities in China responded in June 2016 with “Announcement on Matters Relating to Improved Administration of Related Party Declarations and Contemporaneous Documentation” (State Administration of Taxation (SAT) Announcement [2016] No.42, “Circular 42”), which is generally in line with the BEPS Action Plan 13.

Circular 42 introduced a three -tiered contemporaneous documentation framework that replaced all previous documentation rules, such as those stipulated in the “Implementation Measures for Special Tax Adjustment (Trial)” (Guo Shui Fa [2009] No. 2, Circular 2) and the “Annual Related Party Transaction Reports” (Guo Shui Fa [2008] No. 114, Circular 114).

According to Circular 42, entities with related party transactions above certain thresholds must prepare the contemporaneous documentation – master file, local file, or special file – in line with corresponding requirements and before stipulated deadlines.

Tax professionals should note that contemporaneous files must be provided to the local tax bureau within 30 days upon request from the authorities, and the reporting period can go back as long as 10 years.

![]() RELATED: Hong Kong’s New Transfer Pricing Regime

RELATED: Hong Kong’s New Transfer Pricing Regime

Preparing documentation

The 2016 fiscal year was the first year for contemporaneous documentation compliance under Circular 42. After June 2017, tax authorities around the country began to review contemporaneous documentation that was submitted, leading to a high level of feedback that helped companies understand what compliance means in practice.

The old Circular 2 vs the new Circular 42

Prior to Circular 42, the prevailing regulation concerning the preparation of transfer pricing documentation was Circular 2. Circular 2 said enterprises should prepare contemporaneous documentation before May 31 following the year of the related party transaction, and submit the documentation to the tax authority within 20 days upon request.

Circular 42, on the other hand, stipulates that enterprise reaching specific thresholds must prepare the master file within 12 months from the fiscal year end of the group’s ultimate holding company, and prepare the local file and special file before June 30 of the year that follows the related party transaction. Further, contemporaneous documentation may need to be provided to tax authorities within 30 days upon request.

Under Circular 2, taxpayers were generally not required to submit transfer pricing documentation for transactions that were not found to be high transfer pricing risks through the previous year’s related party transaction reporting, contemporaneous documents checking, and daily profit level monitoring.

However, under Circular 42, tax authorities in several regions have become very stringent on their interpretation of the transfer pricing documentation rule. Taxpayers that meet the thresholds are commonly required to prepare documentation within the prescribed time limit, but also submit electronic and paper versions of the documentation to the tax bureau.

While not stipulated, this practice has become a common expectation in many regions.

Formatting contemporaneous documentation

Many multinational business headquarters request that their foreign subsidiaries prepare transfer pricing documentation in templated forms that are based on document disclosure requirements in the BEPS Action Plan. However, many local subsidiaries struggle to meet the expectations of their headquarters and the local tax bureau, and this is no different for subsidiaries in China.

In China, many tax professionals struggle when they have followed the BEPS Action Plan disclosure requirements too closely, rather than Circular 42.

Transfer pricing information disclosure requirements are higher under Circular 42 than the BEPS Action Plan. When tax professionals in China-based subsidiaries prepare documentation with a mind focused on a templated BEPS Action Plan-based form, overlooking Circular 42 specifications, they risk the attention and investigation of tax authorities that often look for such discrepancies.

![]() Transfer Pricing Solutions from Dezan Shira & Associates

Transfer Pricing Solutions from Dezan Shira & Associates

Biggest challenges

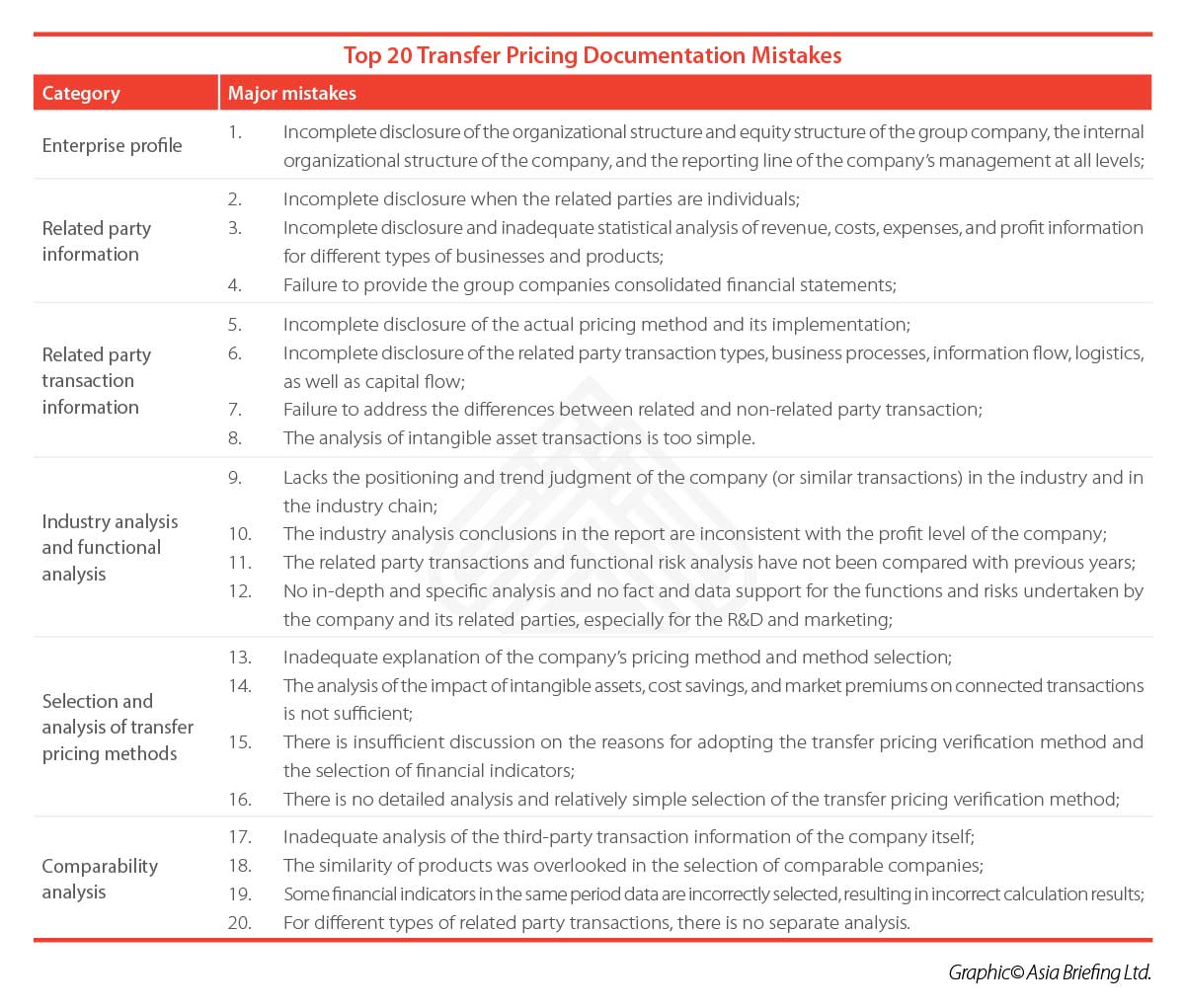

Compared to Circular 2, Circular 42 imposes higher transfer pricing document disclosure requirements on enterprises with related party transactions. Dezan Shira & Associates has found that the following problems typically attract the attention of the authorities:

Make your business compliant

The collection of information needed for preparing contemporaneous documentation may take weeks. This is because the required information is often spread across different departments, and some of the information may even be held by an overseas parent company or other subsidiaries of the same group.

After obtaining this information, tax professionals must provide a detailed and time-consuming analysis for the contemporaneous documentation. Dezan Shira & Associates accordingly recommends that taxpayers start document preparation right after the annual audit report is finalized.

In view of information disclosure discrepancies between Circular 42 and the BEPS Action Plan, Dezan Shira & Associates recommends taxpayers follow the requirements in Circular 42 as to what kind of information should be disclosed and what kind of format should be applied. This helps avoid the contemporaneous document being returned by the tax authorities, which can cause unnecessary credit risks and time costs.

Finally, considering some of the information disclosure requirements under Circular 42 are entirely new, such as analysis of pricing factors and analysis of value chains, Dezan Shira & Associates suggests that taxpayers seek professional assistance. Professional support, analysis, and guidance can substantially reduce the risk of a transfer pricing investigation and tax adjustment.

|

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article Guangdong’s Minimum Wages to Increase July 1

- Next Article China Cuts Tariffs for Five Asian Countries