Using Hong Kong as a Base for China – The Tax Advantages

By Jennifer Lu, Dezan Shira & Associates

HONG KONG, Oct. 5 – Double taxation arises when two or more tax jurisdictions overlap, such that the same item of income or profit is subject to tax in each. In Hong Kong, which has adopted the territoriality basis of taxation, only income or profits sourced in Hong Kong are subject to tax. Income or profits that are derived from a source outside Hong Kong by a local resident are in most cases not taxed by the Hong Kong tax administration.

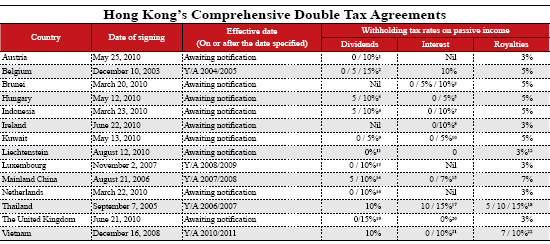

Notwithstanding this, the Hong Kong Special Administrative Region government (HKSARG) recognizes that there are merits in concluding double taxation agreements (DTAs) with the territory’s trading partners. A DTA provides certainty to investors on the taxing rights of the contracting parties, helps investors to better assess their potential tax liabilities on economic activities, and provides an added incentive for overseas companies to do business in Hong Kong; and likewise, for Hong Kong companies to do business overseas. Therefore, it has been the policy of the HKSARG to establish a DTA network that would minimize exposure of Hong Kong residents and residents of the DTA partner to double taxation.

On the other hand, the Inland Revenue (Amendment) Ordinance 2010 passed in January 2010 provided a legal basis for HKSARG to adopt the more liberal 2004 OECD model for exchange of information with its DTA partners. The ordinance amends the existing law by inserting a few new sections, stating more details on how information can be exchanged between Hong Kong and the government of the territory under the DTA. At the same time, all of the five newly signed DTAs with Hungary, Kuwait, Austria, the United Kingdom, and Ireland have included some additional clauses on disclosure of the information to safeguard against possible abuse of the related amendment of the ordinance.

China-Hong Kong DTA

China and Hong Kong reached a double tax agreement on August 21, 2006. This replaced the 1998 agreement and went into force on January 1, 2007 for mainland taxpayers and on April 1, 2007 for Hong Kong taxpayers.

The China-Hong Kong DTA withholding tax rates appear in the chart below.

Although dividends received by foreign investors from a foreign investment enterprise in the mainland are exempt from mainland taxation under the old arrangements, the provision in the new agreement provides some reassurance for Hong Kong investors against any possible withdrawal of this exemption at a later date.

The reduced withholding tax rates are among the lowest rates available in double tax treaties signed by the mainland.

Capital gains tax

Under Article 5 in the 2nd Protocol of the China-Hong Kong DTA from 2008, a full tax exemption is available in the mainland on capital gains obtained by a Hong Kong investor from the disposal of shares in a mainland company, provided that the Hong Kong investor directly or indirectly holds less than 25 percent of the shares within 12 months prior to the share transfer. As there is no tax on the sale of capital assets in Hong Kong under any older arrangements, this could prove beneficial to Hong Kong investors.

Income from employment

There is an important change in the basis period for counting the number of days of presence in the mainland for Hong Kong employees who frequently visit the mainland, from one calendar year to a 12 month period. This has made it harder for tax residents on one side to claim exemption from taxes on the other side.

Under the double tax agreement, a resident of one side is exempt from tax on the other side if they satisfy all the following criteria:

- They are present on the other side for a period or periods not exceeding an aggregate of 183 days in any 12 month period commencing or ending in the taxable period concerned

- The remuneration is paid by, or on behalf of, an employer who is not a resident of the other side

- The remuneration is not borne by a permanent establishment that the employer has on the other side

Exchange of information

Various guidelines have been issued on this topic. While it does allow some information to be exchanged, it is more restrictive and only allows information necessary for carrying out the provisions of the new arrangement or the domestic laws of the mainland and Hong Kong concerning taxes. The two governments are not obliged to supply information which is not obtainable under domestic law or the normal course of administration, and which would disclose any trade, business, industrial, commercial or professional secrets.

Dezan Shira & Associates provide assistance in establishing companies in Hong Kong and has done since 1992. It has several hundred Hong Kong companies under management for clients subsequently invested in China. Please contact their Hong Kong office at hongkong@dezshira.com. The firm also has an additional nine offices in China to assist with mainland incorporation and tax planning. Please download the firm’s brochure here.

Related Reading

Using Hong Kong for China Operations: An overview of Hong Kong Holding and Trading Companies

Using Hong Kong for China Operations: An overview of Hong Kong Holding and Trading Companies

This article was taken from the October issue of China Briefing Magazine. The complete issue detailing incorporation procedures, tax implications, operating costs and annual maintenance requirements is available from the Asia Briefing Bookstore, priced at US$10.

Doing Business in South China (Second Edition)

Doing Business in South China (Second Edition)

Includes chapters on Hong Kong trade with South China, plus mainland incorporation procedures and overviews of Macau and the Provinces of Guangdong, Fujian, Guangxi and Hainan, in addition to concise introductions to the cities of Dongguan, Foshan, Fuzhou, Guangzhou, Haikou, Huizhou, Nanning, Shantou, Shenzhen, Xiamen, Zanjiang, Zhaoqing, Zhongshan and Zhuhai.

Investing in Shenzhen, China’s Main Export Hub

China’s Financial Center, Shanghai or Hong Kong?

- Previous Article China Profit Margins Shrinking as Investors Consider Asia 2.0

- Next Article New FCPA Office in San Francisco – China Being Targeted