The Duties and Liabilities of Key Personnel in a Foreign Company in China

Keeping out of trouble and understanding criminal liabilities in China’s business environment

Jul. 24 – In the light of recent scandals and arrests of foreign businessmen in China, we look at the roles, responsibilities and criminal liabilities of key personnel running fully operational companies in China. Foreign executives taking up such roles should be aware of their responsibilities and the potential for criminal prosecution if they, or their company, break the law.

Jul. 24 – In the light of recent scandals and arrests of foreign businessmen in China, we look at the roles, responsibilities and criminal liabilities of key personnel running fully operational companies in China. Foreign executives taking up such roles should be aware of their responsibilities and the potential for criminal prosecution if they, or their company, break the law.

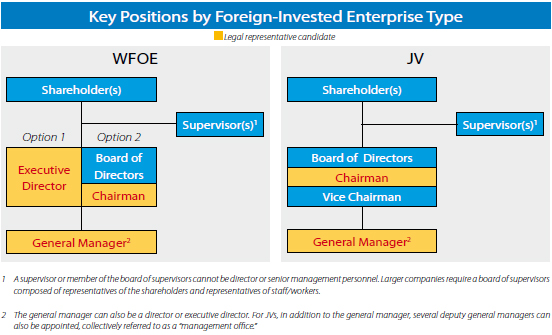

Beyond the common thread of requiring a legal representative (or chief representative in the case of a representative office), the key positions in a foreign-invested enterprise (FIE) in China vary by enterprise structure and size. In a wholly foreign-owned enterprise (WFOE) or joint venture (JV), the legal representative position is held concurrently with another key position. In this article we discuss the key positions in a FIE in China, as well as their respective duties and potential legal liabilities as stipulated by Chinese law.

China’s 2006 Company Law sets forth the primary duties and potential legal liabilities of key positions of limited liability companies in China (including WFOEs and JVs), with additional liabilities stemming from the Civil Code, Criminal Law, Tax Law, etc.

For representative offices, the “RO Regulations” effective March 1, 2011 dictate duties and potential legal liabilities.

Of course, the roles and responsibilities of those in key positions are in no way limited to those defined under Chinese law. In is wise to keep in mind that a foreign-invested company is a subsidiary of a foreign company and therefore falls under both China’s laws and the laws of the country in which its parent company is registered.

For this reason, foreign businesses and individuals operating in China should also be aware of the stipulations of regulations, such as those covering bribery abroad (i.e. the U.S. Foreign Corrupt Practices Act).

Key Positions by FIE Type

For a WFOE, the shareholder(s), those who make capital contributions, are the highest authority of the company. In a WFOE, there can be an executive director or board of directors. The executive director (or board of directors) sets the agenda of the company’s operations according to shareholder decisions.

For a JV, the board of directors is the highest authority. The board of directors should have no fewer than three directors appointed by the parties of the JV, with the ratio between Chinese and foreign-appointed directors determined through consultation between the two parties.

In China, there are two types of joint ventures—cooperative joint ventures (CJV) and equity joint ventures (EJV). For CJVs, the chairman and vice chairman of the board must be appointed by different parties.

Company Law also requires that WFOEs and JVs have at least one supervisor to supervise the execution of company duties by the directors and senior management personnel. To ensure that there are no conflicts of interest, directors and senior management personnel cannot concurrently serve as supervisors.

Where a company has a relatively small number of shareholders and is relatively small in scale, it can have one or two supervisors. For larger companies, a board of supervisors composed of no less than three members is required.

A board of supervisors should consist of representatives of the shareholders, and no less than one-third of the board members should be representatives of the staff and workers of the company. The specific proportion should be stipulated in the company’s articles of association. The board of supervisors should have one chairman, elected by more than half of all the supervisors.

Finally, both WFOEs and JVs need a general manager, who is responsible for company day-to-day operations. The executive director or a member of the board of directors can concurrently serve as the general manager. For JVs, several deputy general managers can also be appointed, collectively this group is referred to as the management office.

A director of the board can concurrently hold the post of general manager, deputy general manager, or any other senior management position, which also includes CFO, and any other personnel designated as such in the company’s articles of association.

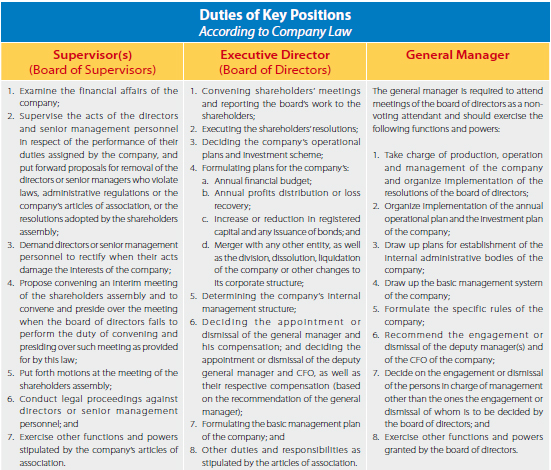

Duties by Role

Below, we describe the qualifications and duties by role for key positions in an FIE:

- Shareholders;

- Supervisors;

- Directors; and

- Senior Management.

Shareholders

The shareholders assembly, which comprises all of its shareholders, exercises the following functions and powers according to Company Law:

- Decide on the operational policy and investment plan of the company;

- Elect or replace directors and supervisors who are not representatives of the staff and workers, and decide on matters concerning the remuneration of the directors and supervisors;

- Examine and approve reports of the board of directors, teports of the board of supervisors or the supervisors, as well as the annual financial budget plan and final accounts plan of the company;

- Examine and approve the company’s plans for profit distribution and for making up losses;

- Adopt resolutions on the increase or reduction of the registered capital of the company, the issue of corporate bonds, and the merger, division, dissolution, liquidation or transformation of the company;

- Amend the articles of association of the company; and

- Other functions and powers provided for in the company’s articles of association.

The meetings of the shareholders assembly are divided into regular meetings (convened on a fixed schedule as specified by the provisions of the company’s articles of association – often simply an “annual general meeting”) and interim meetings (convened when it is proposed by shareholders representing one-tenth or more of the voting rights, by one-third or more of the directors, by the board of supervisors, or by the supervisors of a company without a board of supervisors).

Supervisors

The term of office of a supervisor is three years and a supervisor may, if reelected upon expiration of the term of office, serve consecutive terms. Like the legal representative, the supervisor is not required to reside in, or even visit, China.

A supervisor is entitled to attend meetings of the board of directors as a non-voting participant, and inquire about or put forth proposals on matters on which resolutions have been or are to be adopted by the board of directors.

When the board of supervisors or the supervisor of a company discovers something unusual in the operation of the company, it/he can conduct an investigation into the operating situation; and when necessary, engage an accounting firm or other such services to assist in the work, with the entailing expenses borne by the company.

Where the shareholders assembly requests supervisors, directors or senior managers to be present at its meeting, the latter should attend the meeting as non-voting participants and subject themselves to inquiries by the shareholders.

Directors or senior managers are required to truthfully provide relevant information and data to the board of supervisors or the supervisors, and not hinder the exercise of the functions and powers by the board of supervisors or the supervisors.

Directors

If a company has a relatively small number of shareholders and is relatively small in scale, it can have an executive director instead of a board of directors. The functions and powers of the executive director should be stipulated in the company’s articles of association.

For larger sized companies, a limited liability company in China is required to set up a board of directors comprising of three to thirteen members, which is accountable to the shareholders assembly. A board of directors should have a chairman and could have a vice-chairman, with the measures for the election of the chairman and vice-chairman of the board stipulated in the company’s articles of association.

Senior Management

Senior management includes the general manager, deputy general manager, and CFO of a listed company, along with any other personnel designated as such in the company’s articles of association.

The accompanying table describes the duties of the general manager according to Company Law. Where the articles of association of a company provide otherwise for the functions and powers of the general manager, the provisions of the articles of association will prevail.

The duties and responsibilities of senior management personnel other than the general manager are to be stipulated solely in the articles of association, which has binding force on the company, its shareholders, directors, supervisors and senior management personnel.

Qualification to Accept a Key Position

A person who falls under any of the following categories cannot be appointed as a supervisor, director, general manager or other senior management personnel of a company, according to Article 147 of Company Law:

- Does not have civil capacity or has only limited civil capacity;

- Has been convicted of any criminal offense in the nature of corruption, bribery, conversion, misappropriation or disrupting the economic order of the socialist market and 5 years have not elapsed since any penalty imposed has been completed, or any person who has ever been deprived of his political rights due to any crime and 5 years have not elapsed since the penalty imposed was completed;

- Former director, factory director or manager of a company or enterprise which has been declared bankrupt and liquidated in circumstances where he was personally responsible for the bankruptcy of the company or enterprise, and three years have not elapsed since the bankruptcy and liquidation of the company or enterprise was completed;

- Former legal representative of a company or enterprise which has had its business license revoked and has been ordered to close its business operations due to any violation of law in circumstances where the former legal representative was personally liable for the revocation of the business license and three years have not elapsed since the date of revocation; or

- Has significant unpaid debts.

Any election or appointment of any supervisor, director, general manager or other senior manager made in violation of the provisions of this article shall be invalid. Any existing supervisor, director, general manager or other senior manager the appointment of whom would violate the provisions of this article shall be removed from his post.

Liabilities

The majority of liabilities for the company fall on the shoulders of the legal representative. However, those in other key positions also have liabilities for (and, of course, liabilities to) the company.

These include:

- Liability for criminal offenses

- Liability for liquidation

- Liability to the company

Liability for Criminal Offenses

Where a breach of Company Law amounts to a criminal offense, criminal liabilities can be pursued against a director, management personnel and/or legal representative. Specifically, penalties can be imposed on the company’s officers who were “directly in charge” and/or “directly responsible” for the company at the time the criminal activity occurred.

Criminal Law does not define who qualifies as an “officer directly in charge” or a “directly responsible officer,” so it is unclear whether the shareholder, director, senior management and/or legal representative would be subject to criminal liability.

Criminal offenses under Company Law include bribery, unlawful seizure, and misappropriation of funds.

Any director, supervisor or employee of a company or other kind of enterprise who takes advantage of his position to demand or accept a relatively large bribe is guilty of the crime of commercial bribery. Where the bribe demanded or accepted is in the amount of RMB5,000 to RMB20,000 or above, it will be considered “moderate,” while a bribe of RMB100,000 or more will be considered “major.”

Any director, supervisor or employee of a company or other kind of enterprise who takes advantage of his position to unlawfully seize a relatively large amount of property belonging to the company or other kind of enterprise is guilty of the crime of unlawful seizure.

“Unlawful seizure” means that the violator illegally takes control of property belonging to the company or other kind of enterprise by embezzlement, theft, fraud, or a similar method. Embezzlement of property belonging to a company or other kind of enterprise will be considered “moderate” if the value of such property is from RMB5,000 to RMB20,000 or more, and “major” if the value of such property is RMB100,000 or more.

Any director, supervisor or employee of a company or other kind of enterprise who takes advantage of his position to misappropriate funds belonging to the company or other kind of enterprise for his own personal use or to lend to a third party is, where the amount misappropriated is relatively large and is not returned within three months, guilty of the crime of misappropriation of funds; or where a relatively large amount of such funds are returned within three months but are used to carry on activities for profit or illegal activities, is also guilty of the same crime.

Under Company Law, the officer directly in charge (who may be the legal representative) is also liable where:

- The company issues false or deceptive financial and accounting reports to the public, in which case the officer directly in charge, along with other directly responsible personnel, may be subject to fines ranging from RMB30,000 to RMB300,000; or

- A company in liquidation conceals property, records false information or distributes property prior to payment of debts, in which case the officer directly in charge, along with other directly responsible personnel, may be subject to fines ranging from RMB10,000 to RMB100,000.

When a case is serious enough to involve criminal liability, the legal representative and/or the person directly responsible will generally be questioned and investigated by the public security bureau.

Liability for Liquidation (Piercing the Corporate Veil)

Under usual circumstances, a corporation is treated as a separate legal person and directors and shareholders are not liable for the debts of the corporation.

However, Chinese law stipulates a few circumstances under which courts can pierce the corporate veil, i.e. where the courts hold the investors in a limited liability company liable beyond their subscribed registered capital for the debts of the company, in order to protect creditors of the company against fraud and unfair practices.

One of these situations is where any delay in the performance of the shareholders’ liquidation obligations results in the loss of significant properties, account books, material documents or other things of the company and in an impossibility of the relevant liquidation work, in which case directors or controlling shareholder (the shareholder holding more than half of the company shares) should be severally and jointly responsible for the debts of the company.

Liability to the Company

Another type of supervisor, director and senior management liability about which Company Law is especially specific is liability to the company.

The Company Law provides that supervisors, directors and senior management of a company should assume the duties of loyalty and diligence to the company. They cannot take advantage of their functions and powers to accept bribes or collect other illicit earnings, and should not take illegal possession of the property of the company.

Where those in key positions violate laws, administrative regulations or the company’s articles of association in performance of their duties for the company, and thus cause losses to the company, they will be liable for compensation.

According to the 2007 Enterprise Bankruptcy Law, where personnel breach their duties of loyalty and diligence and this results in the bankruptcy of the company, they should bear civil liability according to the law.

In addition, they will be forbidden from serving as a director, supervisor or senior management personnel of any enterprise within three years from the date of the completion of the bankruptcy procedure.

The Company Law also prohibits a director or senior management personnel from the following conduct, for which he/she will be liable to compensate the company for any resulting damage to its interests:

- Lending the company’s funds to others or pledging the company’s property to secure third party debt without the approval of the shareholder(s) or the board of directors;

- Concluding contracts or conducting business with the company without the approval of the shareholder(s) or the board of directors;

- Usurping the company’s business opportunities or engaging in the same type of business as the company for his own benefit or for the benefit of another by using his authority in the company without the approval of the shareholder(s) or the board of directors;

- Accepting commissions from third parties for their transactions with the company;

- Disclosing confidential information of the company without authorization; or

- Breaching his fiduciary duty to the company.

If a director or senior management personnel violates any of the above prohibitions, all wrongful earnings must be returned to the company.

In addition, any shareholder of the company is entitled to initiate, or request the company’s supervisor or board of supervisors (as the case may be) to initiate, legal proceedings against him. The shareholder may also lodge a complaint under his own name, if:

- The supervisor (or board of supervisors) refuses to take action or fails to sue more than 30 days after the complaint was lodged; or

- The circumstances are so urgent that irreversible damage will result if proper action is not taken immediately.

In practice, there are few cases of shareholders or supervisors pursuing civil or criminal liabilities against a director or management personnel.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Internal Control and Audit

Internal Control and Audit

This issue of China Briefing Magazine is devoted to understanding effective internal control systems in the Chinese context and the role of audits in detecting and preventing fraud.

The China Manager’s Handbook

The China Manager’s Handbook

Stories of expats having their name added to the Administration of Industry and Commerce “blacklist,” or being “trapped in China” for company legal proceedings, encourage a careful consideration of key positions in an FIE. This issue of China Briefing Magazine aims to shed a little light on this topic.

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

- Previous Article Internal Control and Anti-Corruption Regulations in China

- Next Article Why Corruption is Inevitable in China’s Pharmaceutical Industry