Shanghai Revises Minimum Wage, Social Insurance Contribution Rates

By Dezan Shira & Associates

Editor: Alexander Chipman Koty

The Shanghai Municipal Bureau of Human Resources & Social Security recently released its annual minimum wage adjustments for 2017, as well as the associated changes to employee benefits.

The adjustments, which came into effect on April 1, affect minimum wages, medical insurance, social insurance, pensions, and other forms of employee compensation.

Minimum wage increase

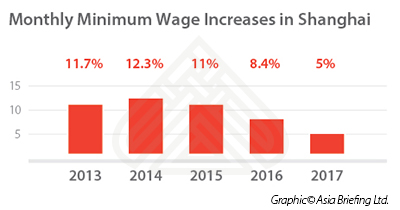

The Shanghai government raised the city’s minimum monthly wage by five percent, from RMB 2,190 (US$318) to RMB 2,300 (US$334), and the minimum hourly wage from RMB 19 (US$2.76) to RMB 20 (US$2.90).

The five percent increase is the lowest since minimum wage hikes in Shanghai were frozen in 2009 as a response to the global financial crisis. The minimum monthly wage increased by 8.4 percent in 2016 and 11 percent in 2015.

While the increase was lower than in previous years, Shanghai still has the highest minimum monthly wage in China. Rapid wage growth is often cited as a key reason for China’s slowing economic growth, as labor costs are outpacing productivity gains.

Many regional governments have consequently put the brakes on minimum wage increases to maintain their competitiveness with other Asian countries. For example, Guangdong province froze minimum wage hikes in 2013 and 2014, and after raising minimum wages by an average of 19 percent in 2015, froze increases in 2016 and 2017.

Social insurance payment limits revised

The maximum medical insurance fund payment limit was revised in accordance with the wage hike, increasing from RMB 420,000 (US$60,987) to RMB 460,000 (US$66,795).

The upper and lower limits of the social insurance contribution base were also increased, with the lower limit raised to RMB 3,902 (US$567) and the upper limit to RMB 19,512 (US$2,833). The limits are based on the average monthly wage of employees in Shanghai: the lower limit is 60 percent of the average wage; the upper is 300 percent.

Shanghai’s social insurance contribution base has grown in tandem with the rapid increase in average salaries over the past five years. In 2013, the lower limit was RMB 2,815 and the upper limit RMB 14,076.

The Shanghai municipal government announced in early April that the average monthly salary in 2016 was RMB 6,504, a 9.5 percent increase year-on-year, while the average annual salary was RMB 78,045. In 2015, the average monthly salary in Shanghai was RMB 5,939, or 71,268 per year.

![]() RELATED: Payroll and Human Resource Services

RELATED: Payroll and Human Resource Services

Social insurance contribution rates revised

The Shanghai government has also released the social insurance contribution rates for 2017. The employer contribution rate for medical insurance has been lowered from 10 percent to 9.5 percent, and the unemployment insurance contribution rate lowered from one to 0.5 percent.

The reductions in contribution rates are part of an effort to reduce the burden on employers. The reduced rates are in effect from January 1, 2017 to April 30, 2018.

All other social insurance rates in Shanghai remain unchanged. The employer contribution rate for pension insurance is 20 percent, maternity insurance one percent, and injury insurance 0.2-1.9 percent.

More HR reforms expected

Shanghai has recently released a slew of other HR reforms, including granting residency to foreign domestic workers, launching an online work permit registration system for foreigners, and giving foreigners in the Shanghai Free Trade Zone easier access to green cards.

The city is aiming to boost its capacity to attract and retain foreign talent, and to deepen reforms in the Shanghai Free Trade Zone. Consequently, businesses in Shanghai should monitor for further reforms that may affect HR and payroll to ensure compliance.

Editor’s note: This article was originally published on April 20, 2017, and has been updated to include the latest regulatory changes.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article Individual Income Tax for Expats in China

- Next Article Debt in China and Its Implications for the Private Sector