Profit Repatriation from China

For multinational corporations operating in China, repatriating cash from their subsidiaries has always been an important but challenging issue.

China maintains a strict system of foreign exchange controls, meaning funds flowing into and out of China are tightly regulated. Other laws and regulations – such as the Company Law, relevant tax regulations, as well as China’s transfer pricing rules – impose additional barriers to profit repatriation as well.

In this environment, businesspeople need to understand and incorporate a profit repatriation strategy from the very beginning to ensure access the profits earned.

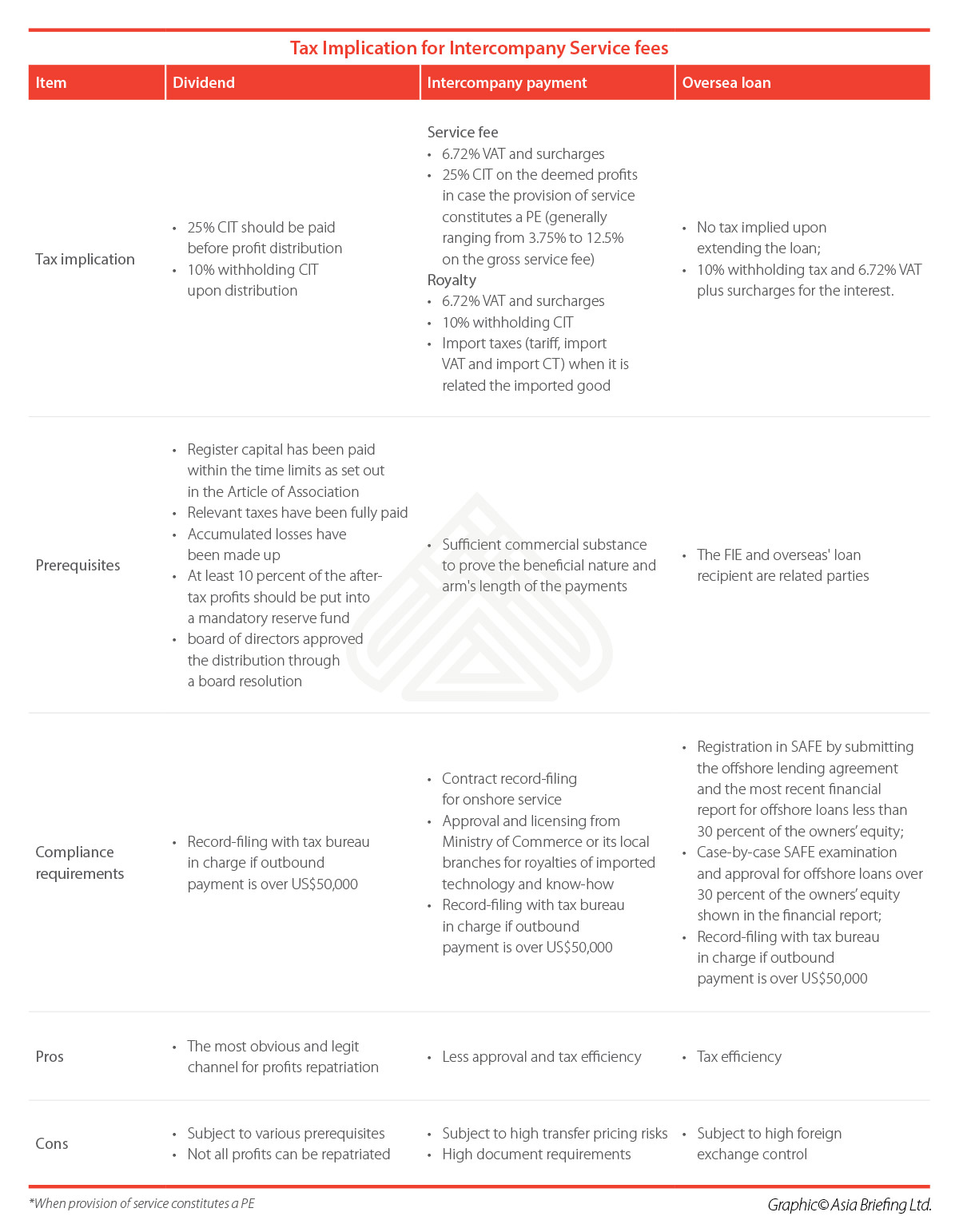

There are several ways to repatriate profits from China. The most obvious method is for the company’s China-based entity to pay dividends directly to its foreign parent company. However, this is subject to certain prerequisites.

As an alternative, many multinational corporations use intercompany payments, such as service fees or royalties, to remit cash from China. Other Chinese subsidiaries remit undistributed profits by extending a loan to a foreign related company with which it has an equity relationship.

Below, we introduce and analyze the pros and cons of each method to provide investor some initial references for their planning.

Remitting profits as dividends

Remitting profits as dividends is the most direct and common way to distribute profits. However, this is subject to certain prerequisites, which are usually regarded as constraints.

First, a foreign invested enterprise (FIE) can only repatriate profit after its registered capital has been injected within the time limits as set out in the company’s Article of Association.

Second, an FIE generally can only repatriate profit once a year after the annual audit and tax compliance process. This is to ensure a 25 percent Corporate Income Tax (CIT) had been paid up with regard to the profit to be distributed.

Third, no profits can be distributed before the losses accumulated in the previous years have been made up.

The FIE can only distribute dividends out of its accumulated profits, that is to say, the accumulated losses from the previous year must be more than offset by the profits.

According to relevant laws and regulations, the loss incurring in a tax year is deductible from corporate income before tax, and can be carried forward to the subsequent five years to be set off if the current year profit is not enough to make up the losses. After that, the loss still needs to be recovered before profits distribution, but it can only happen after tax clearance.

Fourth, not all profits can be repatriated after tax clearance.

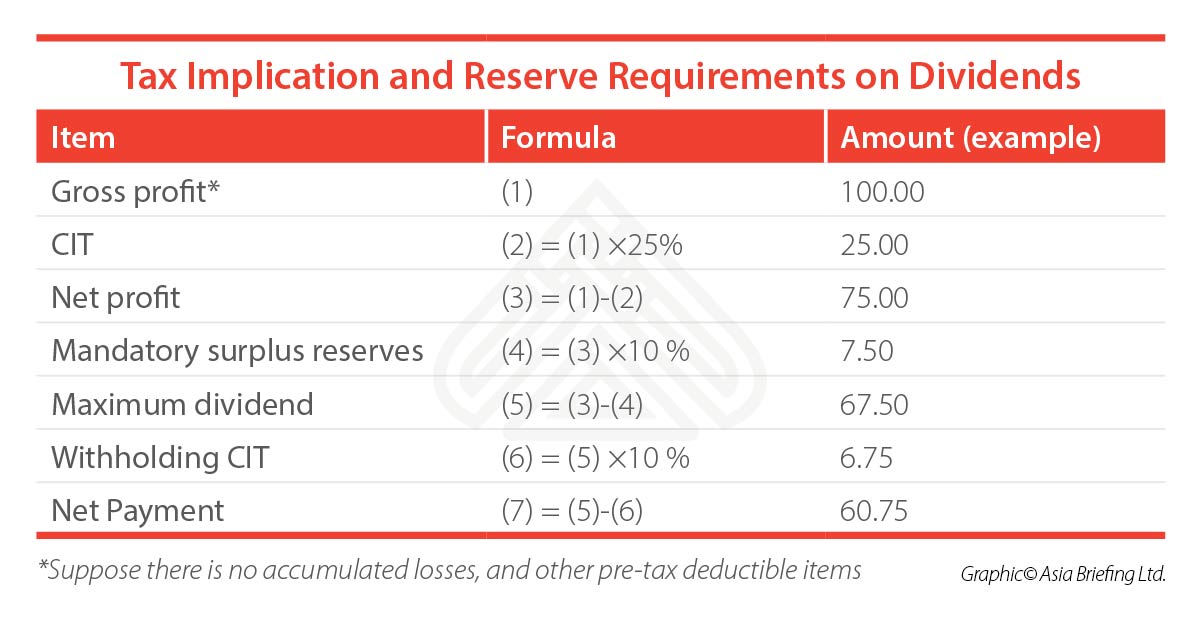

For example, a wholly foreign owned enterprises (WFOE) has to place 10 percent of its annual after-tax profits into a mandatory surplus reserve fund until it reaches 50 percent of the FIE’s registered capital. Besides, the investors usually allocate a portion of after-tax profits to the staff welfare and incentives fund, though these are not mandatorily required.

Finally, the dividend is subject to additional 10 percent withholding CIT when repatriating to foreign investors, with limited exceptions.

If a double tax avoidance agreement (DTA) is available, and the parent company qualifies as the beneficial owner, a preferential withholding CIT rate of five percent or even lower may apply.

And if non-resident enterprises decided to re-invest the dividends derived from FIEs into projects encouraged by the country, the withholding CIT on this part of the dividends can enjoy deferral treatments by fulfilling certain conditions.

Below, we take the WFOE as an example to demonstrate the tax implication and reserve requirements of repatriating profits by dividends.

Withholding tax deferral for foreign investment

On September 29, 2018, the Ministry of Finance (MOF), State Administration of Taxation (SAT), National Development and Reform Committee (NDRC), and Ministry of Commerce (MOFCOM) jointly released The Notice on Widening the Scope of Application Regarding the Provisional Deferral Treatment for Withholding Tax on Distributed Profits used for Direct Re-investment by Foreign Investors (Caishui [2018] No.102, or Circular 102), as one of the measures to further promote foreign investment.

According to Circular 102, qualified non-resident enterprises can defer income tax as long as they reinvest equity investment incomes such as dividends and bonuses derived from resident enterprises directly into projects and sectors not prohibited by the country. Previously, only those re-invested into projects and sectors encouraged by the country are eligible for the deferral treatment.

Projects and sectors not prohibited by the country refer to those not listed as prohibited sectors as specified in the Special Administrative Measures (Negative List) for Foreign Investment.

Dividends and bonuses received by foreign investors on or after January 1, 2018 are eligible for the withholding tax deferral treatment and a refund for the tax already paid could be applied. Eligible foreign investors can also apply for the treatment retrospectively within three years from the date the tax payment was made and claim a refund.

Paying intercompany fees to foreign investors

When confronted with the constraints of remitting dividends, many multinational corporations attempt to repatriate profit from China via intercompany payments.

Often, they attempt to achieve this by charging for supporting services (such as human resources, information technology, or financing) or intangible assets (such as trademark, patent, or know-how) provided to Chinese affiliates.

In comparison with remitting dividends directly, profit repatriation through intercompany payments has some advantages for some investors. Because there are less prerequisites, intercompany payments are often easy way to

repatriate profits.

For example, the FIE can make intercompany payments without going through the annual audit and tax compliance process. Further, the company can make intercompany payments when needed, rather than once per year for dividend remittance.

Remitting money through intercompany payments are more tax efficient as well. Although the intercompany transactions are subject to turnover taxes, surcharges, and possible withholding CIT, these intercompany payments

can be deducted from the CIT taxable income by fulfilling certain requirements.

Despite these many advantages, profit repatriation through intercompany payments bears more risk for tax investigation. Chinese tax authorities put special scrutiny on intercompany service fees, and royalties paid by Chinese enterprises to the overseas related parties, because they regard the practice as a tool for avoiding tax and shifting profits.

This is particularly the case when the payment is lack of business substance, when the payment is large, or when the recipient is located in low profit jurisdictions; the tax authorities are very likely to conduct special anti-avoidance investigations on such transactions.

Separately, the tax efficiency of this method could be further impacted when the provision of service in China by the foreign enterprises is deemed to constitute a permanent establishment (PE). In such case, the service fees will be subject to CIT at 25 percent on the deemed profit rate of 15 to 50 percent, unless a CIT exemption applies under a DTA.

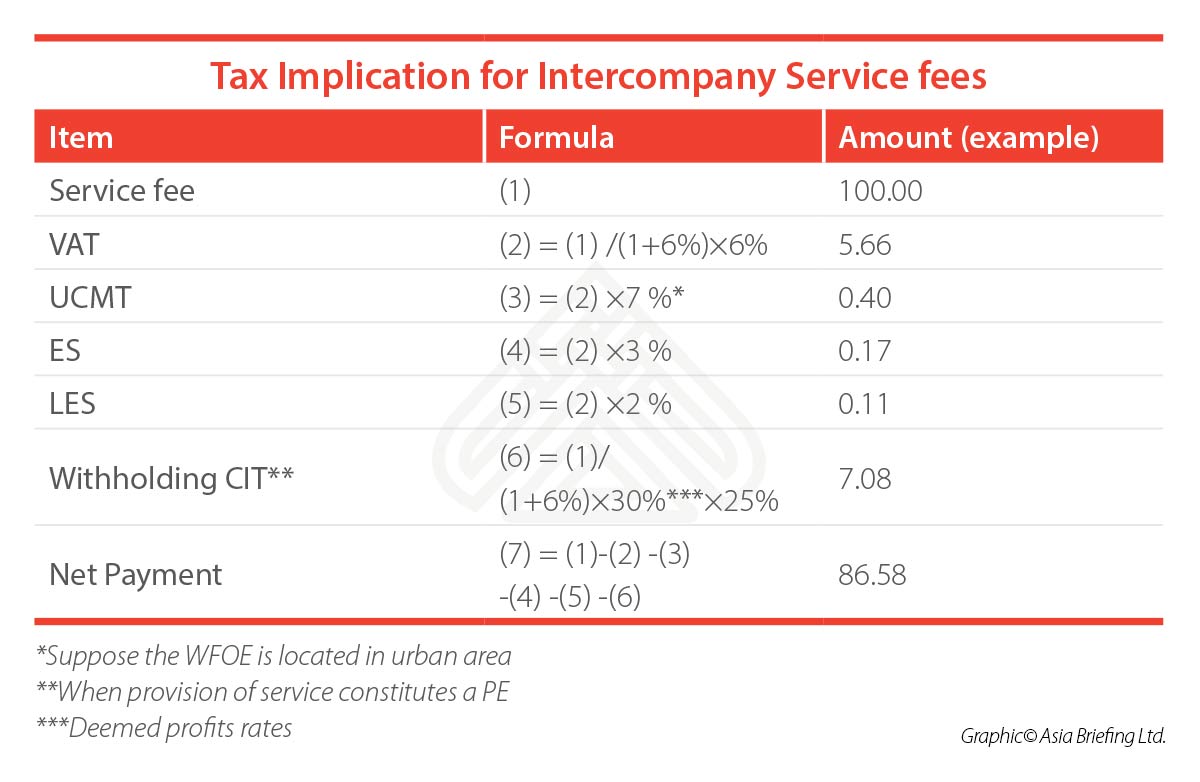

Service fees are subject to VAT, as well as other surcharges, including urban construction and maintenance tax (UCMT), education surcharge (ES), and local education surcharge (LES). Whether it is subject to CIT depends

on whether the provision of service constitutes a PE.

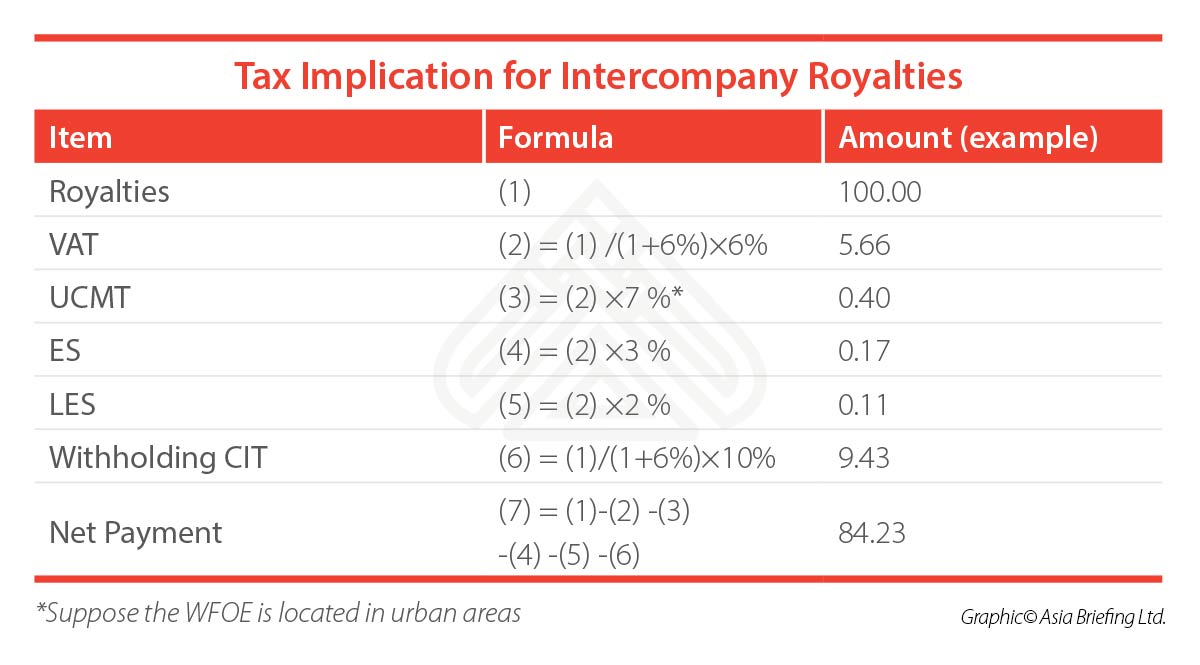

Royalty remittances are subject to a 10 percent withholding CIT and six percent VAT, as well as surcharges (UCMT, ES, and LES). The statutory CIT withholding tax rate of 10 percent can be reduced to a lower rate if a tax treaty is applicable.

China’s position on intercompany payments

Under China’s transfer pricing rules, intercompany payments are only deductible when they comply with the arm’s length principle.

China defines arm’s length intercompany services as beneficial service transactions that are priced according to business practices and fair prices for transactions conducted between non-related parties under identical or similar circumstances.

There are two issues that need to be analyzed here: first, whether the service is beneficial in nature, which is relevant to the authentication of the service provided; second, whether the service is charged under the arm’s length principle (that is, the rationality of the pricing mechanism for the service fee paid).

For intra-group royalties, China’s tax authorities hold the idea that profit derived from transferring or licensing intangible assets should be distributed based on the enterprises’ contributions to the value of the intangibles.

That is to say, certain overseas related parties might be not qualified to receive royalties at all or can only receive royalties to a limited amount.

Under this condition, companies repatriating profits through intercompany payments have to maintain transaction documents as detailed as possible for demonstrating the authentic and beneficial nature of the intra-group transactions, in the case they are challenged by the tax authorities. This substantially increases the compliance burden to the enterprises.

Extending loans to foreign related company

An FIE may also remit undistributed profits by extending a loan.

In comparison with the other two channels introduced above, this channel is not only subject to various prerequisites, but also confronted with stricter scrutiny from the State Administration of Foreign Exchange

(SAFE) and its local branches.

First, an FIE can only extend loan to a foreign company when the overseas company is a related party with which the FIE has an equity relationship.

Second, an FIE can only start to extending overseas loans after it has been established for one year. Both the FIE and overseas loan recipient should have good record in complying with the foreign exchange rules.

Third, overseas lending is limited to 30 percent of the owner’s equity as shown in the latest financial report. Within this limit, the FIE can go through a standard registration in SAFE. For offshore lending that is over the limit, a case-by-case SAFE examination and approval will apply. And the FIE will not be allowed to extend any new loans before the loan ratio falls below the limit.

Fourth, the overseas lending should be in line with general business principles. For example, the rate of loan interests must be higher than zero. Further, the overseas shareholding company is generally expected to repay the money within five years.

Beyond that, the FIE who lends the money should report to local branch of people’s bank or SAFE for record-filing. However, the FIE has no tax implications at the time of extending the loans. It is only required to pay 10 percent withholding tax and 6.72 percent VAT and surcharges on the interest income, and the CIT paid in China may be used later to offset tax liability incurred in the foreign country if there is DTA in place.

Accordingly, extending overseas loans can be used to repatriate cash based on the company group’s own needs.

Study repatriation channels carefully

Among the above-mentioned channels, remitting profits as dividends is the most straightforward way, but it is subject to many prerequisites. Intercompany payment is a comparatively more convenient and tax efficient alternative, but it is subject to a high level of scrutiny from tax authorities.

An FIE can also achieve cash repatriation by extending loans to the oversea entity. However, the overseas entity must be the FIE’s related parties, and the foreign exchange controls for this method is high.

In practice, there exists some other indirect channels, such as remitting cash in the name of outbound direct investment (ODI), remitting cash in the name of qualified domestic limited partner (QDLP), or overseas loan under domestic guarantee.

However, none of these channels can avoid high compliance requirements and corresponding policy risks.

Dezan Shira & Associates advises FIEs to carefully study the cash repatriation channels from the very beginning. Considering no channel is one-size-fits-all, companies should arrange and incorporate the cash repatriation strategy based on its specific characteristics, such as the investment plans, operational goals, financial situation, as well as

shareholder’s preference to different risks.

Through careful planning and implementation, FIEs can collect required documents efficiently, control for potential risks, and a reasonable arrangement for cash flow.

(Editor’s Note: This article was originally published in April 2018 and has been updated to include new developments.)

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article How Foreigners Can Claim Social Insurance Payments When Leaving China

- Next Article Why Should We Care About China’s GDP Growth?