IIT Reform in China: What’s in the Draft Law?

Last year, Individual Income Tax (“IIT”) revenue collected by the Chinese government increased by 19.6 percent from the previous year, outpacing both the per capita income and GDP growth, which stood at 7.3 percent and 6.9 percent, respectively.

In response to this, China’s Ministry of Finance has unveiled a series of Draft Amendments to its IIT Laws, which are intended to boost consumption while combating the effects of rising living costs. These proposed changes are aimed at easing the tax burden for lower-income earners in particular, while taking a tougher stance on both foreigner workers and high-income earners.

The effects of the proposed changes are fourfold: to raise the IIT threshold; to consolidate income categories; to introduce new deductible expenses; and to tighten the IIT’s overall application and enforcement.

Already confirmed by the State Council, the Draft Amendments have now been published for public opinion and will undergo further revision before finally coming into effect on January 1, 2019.

If these proposals are enacted, foreign companies should pay special attention to changes affecting the timing of the tax levy on foreign employees, foreign labor costs, contract profitability, and budgeting requirements, as well as the rippling effects they have on withholding and tax equalizations.

The proposed changes

The Draft Amendments introduced a basket of new changes that affect each level of the IIT system at its calculation, application, and enforcement stages. The key proposed amendments are summarized below.

Calculation basis

The IIT liability of resident taxpayers will now be calculated on an annual basis, rather than monthly, while the IIT liability of non-residents will continue to be calculated on monthly basis or as taxable income arises.

To be noted, employers are still obliged to withhold IIT for their employees on a monthly basis. If IIT-paying individuals have additional tax or tax returns to claim by the year end, they can achieve that through a final settlement process.

Consolidated ‘taxable income’ category

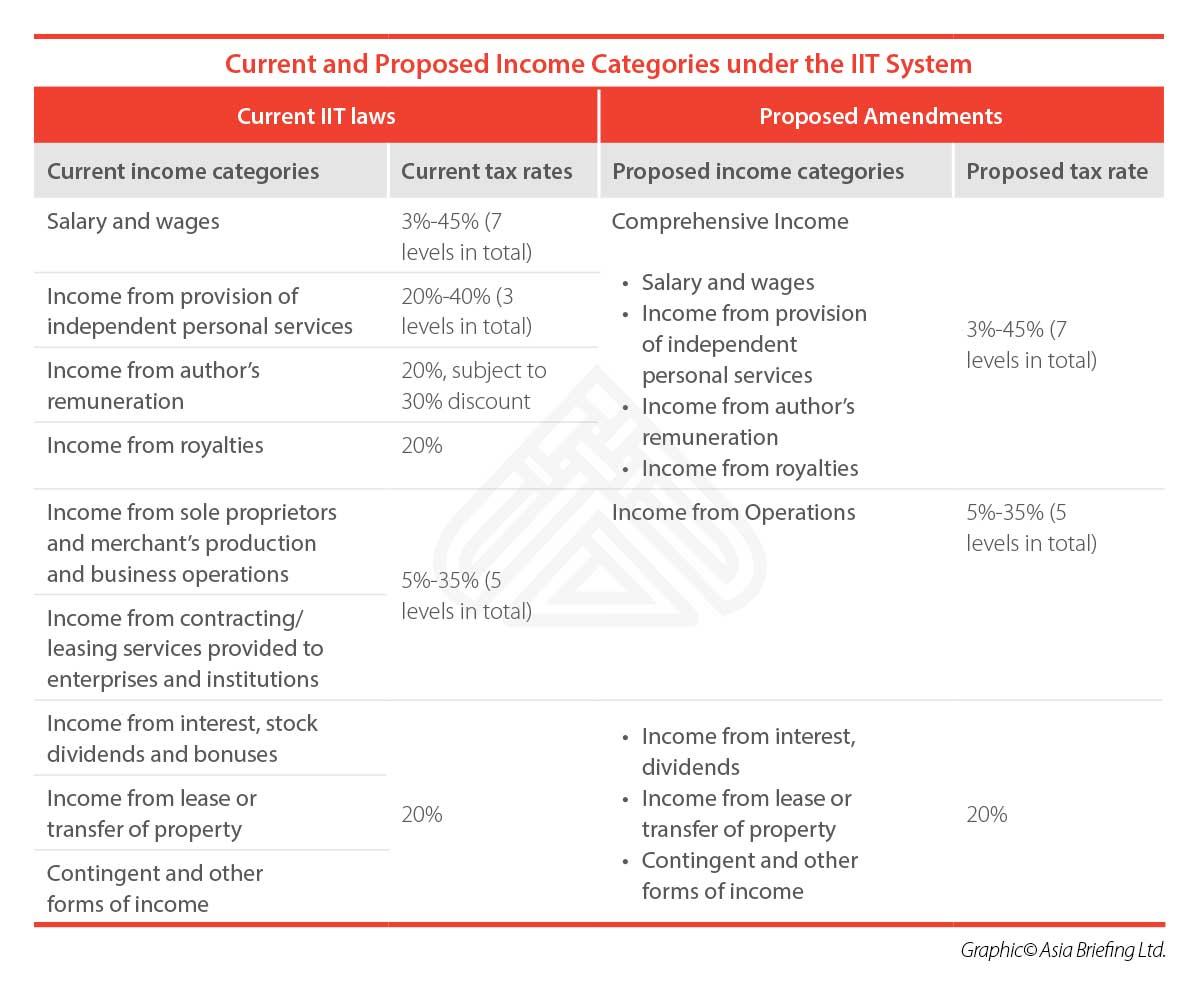

Generally, the Draft Proposal alters the grouping and tax rates applicable the different types of ‘income.’

Most significantly, the 3-45 percent progressive tax rate has been expanded to apply to income beyond the traditional wages and salaries earned through employment.

Under the amendments, income deriving from provision of independent personal service, author’s remuneration, and royalties (collectively known as ‘Comprehensive Income’) will now also be subject to 3-45 percent progressive tax.

In effect, this is likely to increase the tax levied on income belonging to this income category, as the progressive rates (calculated according to the tax brackets) will now be applied to the aggregate of the four types of Comprehensive Income, rather than just ‘wages and salaries.’

Three income types that were traditionally taxed at a flat rate of 20 percent are now taxed at progressive rates according to the tax brackets. Therefore, if the aggregate income of the ‘Comprehensive Income’ exceeds RMB 25,000 (US$3,670) per month, the tax rate will be greater than the 20 percent flat rate previously applied.

See summary of changes in table below.

IIT for foreigners

Expatriates living and working in China will now be subject to the 183-day test—a rule that draws upon recognized international practices. This test deems a foreign individual who resides in China for 183 days or more in a year a ‘resident’ and subjects them to Chinese tax on their worldwide income.

This new 183-day-test will replace the previous five-year-rule under which a foreign individual will be subject to Chinese tax on their worldwide income if they live in China for more than five years.

Previously, IIT liability contained a well-known loophole whereby foreigners could ‘reset the clock’ and thereby avoid income tax liability by leaving the country for an aggregate of 91 days per year or more than 31 days consecutively.

The amendments in effect will make it harder for expatriates to avoid paying tax on their worldwide income tax liability by removing this loophole.

Deductibles

For resident taxpayers, the Draft Amendments propose raising the personal deduction on comprehensive income from RMB 3,500 (US$514) to RMB 5,000 (US$734) per month, raising the annual threshold to RMB 60,000 (US$8,807) per year, to take effect from October 1, 2018.

Additionally, resident taxpayers will be allowed to deduct certain additional items from the comprehensive income. These additional deductible items are categorized as ‘additional itemized deductions for specific expenditures’, which include:

- Education expenses for children;

- Expenses for further self-education;

- Health care costs for serious illness;

- Housing loan interest; and

- Housing rent.

For non-resident taxpayers, the RMB 5,000 (US$734) per month standard deduction will also be applicable to them, to replace the current RMB 4,800 (US$705) per month standard deduction.

However, the IIT draft makes no mention of the deductible allowances applicable to foreigners; the position on this is unclear and further clarification is needed on this aspect.

Tax brackets

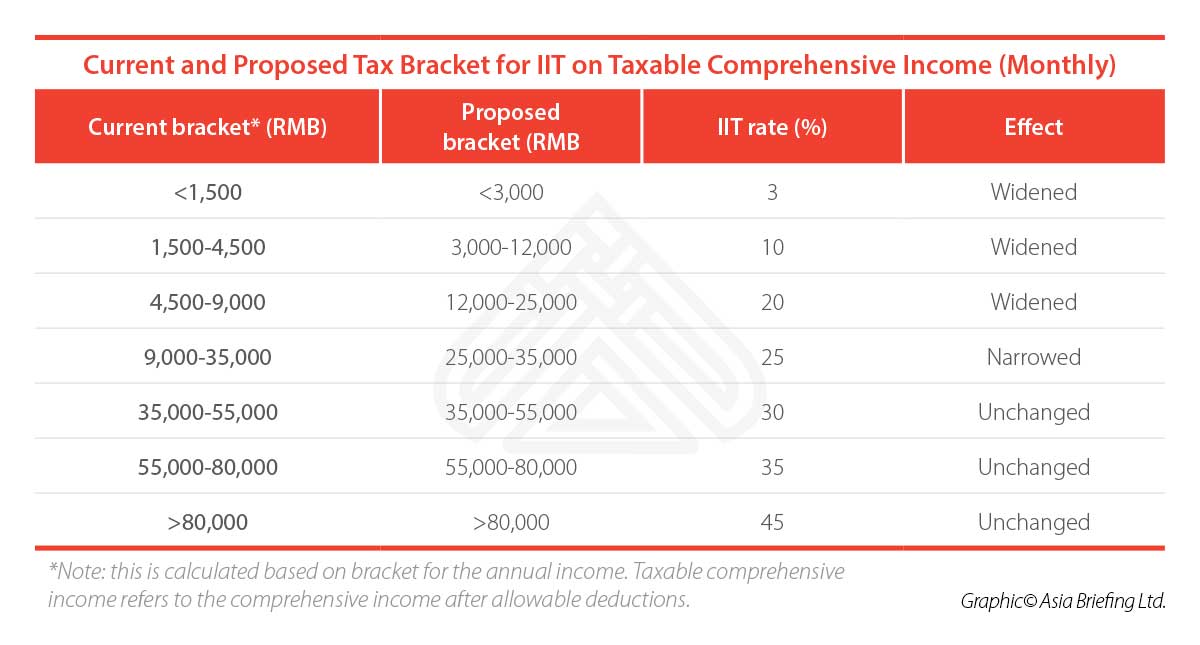

For comprehensive income: The lower tax brackets have also been expanded—meaning the lower tax rates are now applied on a wider range of income levels, while the higher tax brackets remain the same.

Practically, this means that more people can access lower IIT rates.

For example, under the old system, an individual with a taxable income (after deductions) of RMB 10,000 (US$1,468) per month will be subject to 25 percent of tax resulting in RMB 1,495 (US$219) levy every month. Assuming their taxable income remained consistent, in a year they would pay RMB 17,940 (US$2,634) in IIT.

Under the new system, an individual with the same taxable income will be subject to a 10 percent tax rate and will only need to pay RMB 9,480 (US$1,392) (RMB 790 x 12 months) levy every year. Under the new system, the taxpayer would pay little over half the previous tax amount and save RMB 8,460 (US$1,242) per year.

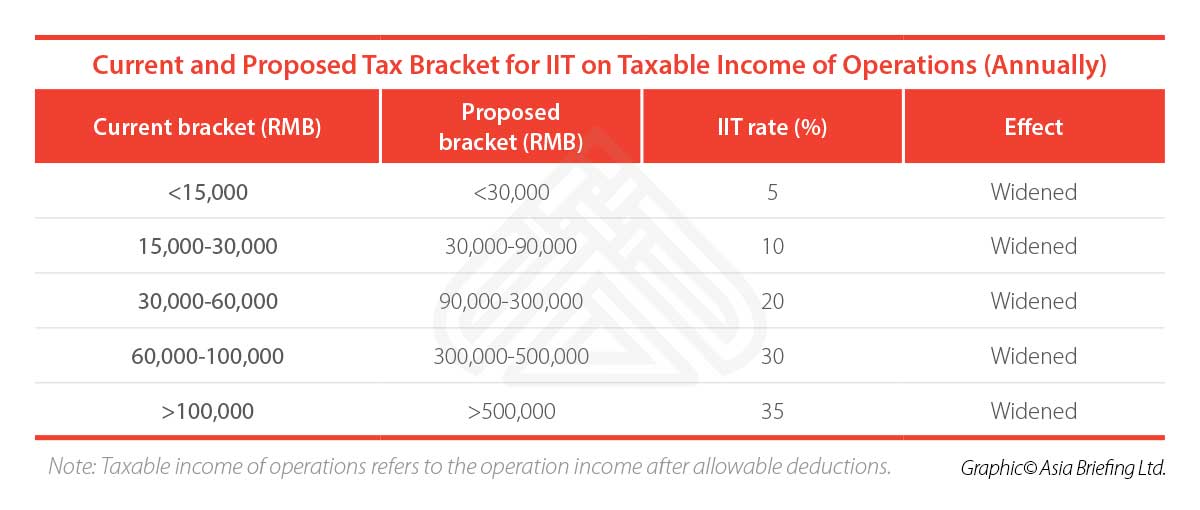

For operation incomes: all brackets have been expanded, shown as follows:

Enforcement

The amendments, if enacted, will give the tax authorities additional powers to enforce tax liabilities on transactions involving non-arm’s length asset transfer, offshore tax avoidance schemes, and commercial arrangements where inappropriate tax benefits are derived.

Although limited details have been provided so far, there are hints towards adopting general anti-avoidance rules similar to the ones currently used to enforce the PRC Corporate Income Tax Laws.

Begin planning for changes

These proposals form part of larger series of tax reforms being implemented by the Chinese Authorities in order to boost consumption amid a slowing economy. Authorities have promised to cut taxes by more than RMB 800 billion (US$117 billion) in 2018, which will have the effect of reducing government revenue by over five percent.

Still in its infant stages of development, many of the details of the Draft Amendments are yet to be released—including details of the residency rules for expatriates and elaboration on the implementation and ongoing administration of many of the rules.

If the draft amendment survives the final rounds of scrutiny, the tax burden will be alleviated for the working class of Chinese citizens. The adoption of an annual levy system and the 183-day residence rule also marks a gradual shift towards more international tax practices.

HR managers with expatriates and foreigners should assess the implications of these changes and plan ahead to manage the consequences of these potential changes.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article How to Manage Statutory Annual Leave in China

- Next Article China Deepens Ties with Africa, UAE Ahead of BRICS Summit