A Reinvented Hong Kong is Emerging to Become a US$3 Trillion Financial Services Wealth Management Hub

Op/Ed by Chris Devonshire-Ellis

Hong Kong has remained in negative media again this year, with Beijing’s introduction of a new security law at the forefront of much publicity and claims of overly oppressive laws threatening free speech and ‘democracy’. While China has clamped down fairly hard in terms of public dissent, a great deal of nonsense has also spread the word about the demise of Hong Kong and promoted an overall fear of China.

I first visited Hong Kong way back in 1968, when as a child I saw communist disruptions in the streets for the first time. By 1988, I was visiting regularly and by 1992 was living there, as Dezan Shira & Associates opened its first offices. Since then, I have crossed the borders into Hong Kong roughly 600 times in and out. It is a city I know well. Today Dezan Shira & Associates is now living in its fifth office location and currently employs about 30 staff in the city.

I hear what the likes of Nathan Law have to say, now exiled in the UK and am partially appalled by his own manner – which is increasingly all about him as a voice of the people. While I agree that he was treated poorly by the authorities, his new status as a voice for democracy also grates as a type of democracy thumping, self-promoting Kardashian. It is also weird; Hong Kong was never democratic under British rule, and the UK itself is not a full democracy: The House of Lords oversees Democratic voters, and the Queen can, should she choose, veto any planned new legislation. The British Military pledges allegiance to the Monarch, not to a democratically elected Government.

Recent (repeated) articles by the likes of Dan Harris, whose increasingly “Anti-China Law Blog” spout off phrases such as “Hong Kong as an international business and financial center is no more”, “Implement plans for evacuating your Hong Kong personnel” and “Avoid going there unless truly necessary” can all be read in his article “Hong Kong’s Demise and Merry Christmas” through which he seeks to justify his take on the city by stating that his law firm (Harris Bricken) “not being so tied to China” is truly the key to understanding the issues Hong Kong faces.

Well, at least Harris got that part right. He and his blog pontificate mostly from Seattle while Harris has never lived in either Hong Kong or China. It’s a remote, armchair opinion, and is a theme China Law Blog continues with another Harris Bricken lawyer, Fred Rocafort, stating yesterday that “Hong Kong Is Like the Proverbial Boiled Frog“.

Rocafort implies he left his job in Hong Kong to return to the US “because of Hong Kong’s increasing convergence with the Mainland. I wanted no part of that” which makes one wonder if he ever realized Hong Kong was actually returned to China 23 years ago.

That’s OK – should China Law Blog no longer wish to be involved with China then that is their business and with inherent views like that it is hardly surprising to see them attempt to reach out to other, non-Asian markets such as Mexico, actively encourage US companies to leave China, and launch their new Cannabis Law Blog (really!) where they may have more success, and I hope they do. There is little point in using professionals with an active dislike of the country they profess to be servicing, and especially when it comes to foreign investment. We wish China Law Blog good luck with their new non-China ventures, although a little rebranding might be wise.

Democracy meanwhile was never going to be on the cards for Hong Kong, and it was never promised in the “One Country Two Systems” policy either. Calls for this to be expanded by the West have backfired; Beijing isn’t going to be pushed around and it has reacted to criticism by effectively curtailing the 50 years “One Country Two Systems” period into one that has effectively lasted for about 22 years. I think it surprising it lasted that long. After 1997 Hong Kong was always going to be integrated, eventually with China. This is what is happening, and it would be both extraordinary and to Hong Kong’s disadvantage if it were not.

However, while Dezan Shira & Associates continue to maintain a business and employ staff in Hong Kong, including Hong Kong locals, mainland Chinese, and foreign expatriates, we are also unsatisfied with the performance of the local Hong Kong Government. They have messed up the introduction of the security law, failed to address problems within local housing, education, employment, and related issues, and continue to run the place as a quasi-fiefdom.This must stop – vested interests between business interests and local politicians are far too cozy, and our view, which really is from on-the-ground, is that Beijing is unwilling to step in but is compelled to do so due to local political incompetence and corruption. We too are unhappy with the situation Hong Kong finds itself in. But unlike others, we wish to help get it through this difficult phase.

There is a transition occurring and although this is also proving overly traumatic through basic political mismanagement, it is also partially predictable. Any economy that changes direction is going to feel stressed, and Hong Kong is no exception. Yet there is light at the end of the tunnel. Hong Kong is being absorbed into the Greater Bay Area, and this is both redeveloping and repositioning it.

Hong Kong’s low, simple and limited tax, its open capital/forex market, and proximity to the Greater Bay Area and China are obviously clear advantages that will remain beyond the inefficient and laissez-faire attitude of the existing Hong Kong Government running a medium-sized Chinese city without any clear indication about its future. Beyond this current period though, which will pass, there are also positive opportunities – and options.

Hong Kong’s access to a US$3 trillion private wealth market

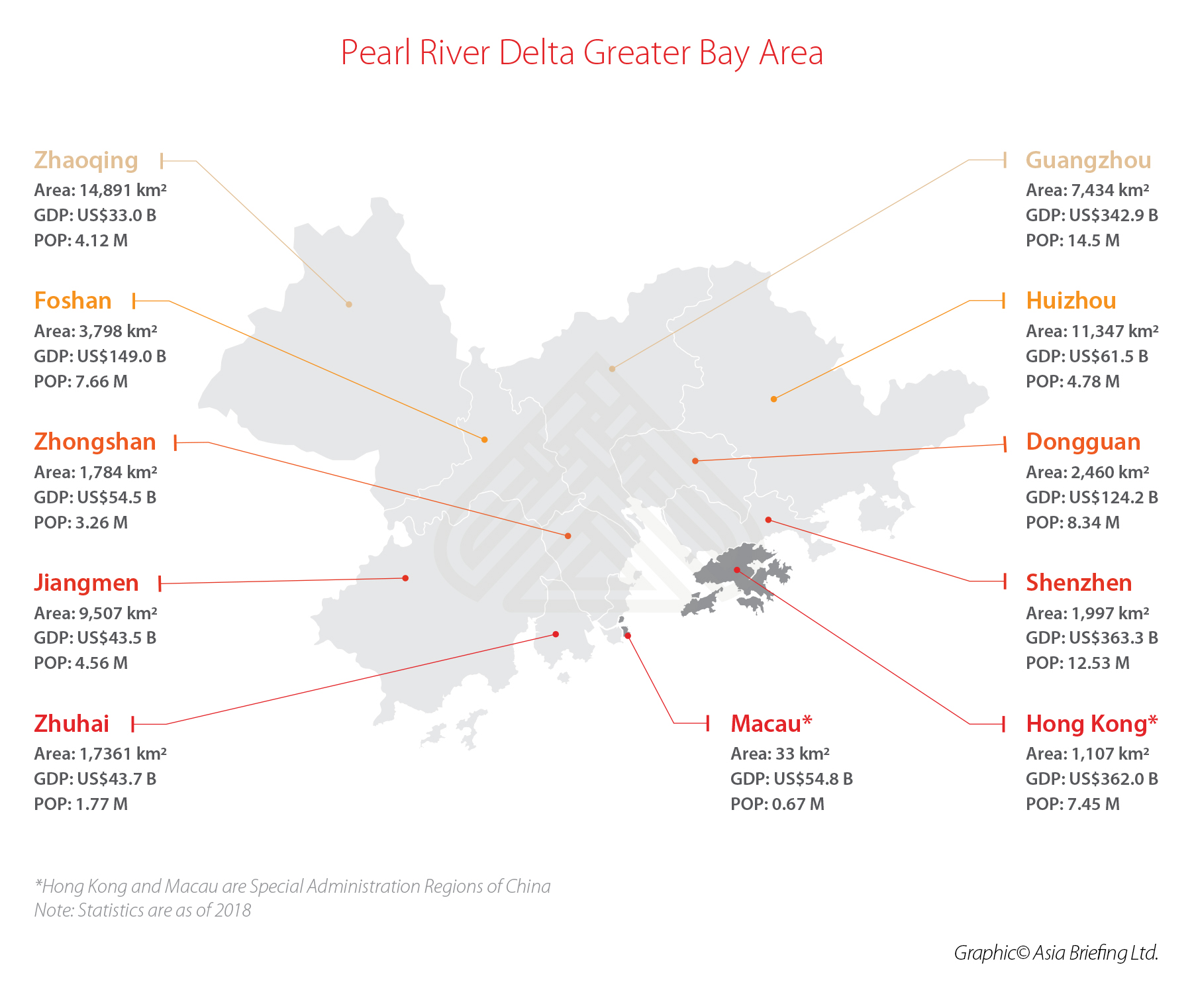

The Greater Bay Area would be the world’s 12th largest economy if taken as a single bloc, comprising of 11 cities with a combined population of 72 million and an economy worth about US$1.7 trillion. This will provide plenty of opportunities for Hong Kong. At the time of Hong Kong’s handover to China in 1997, it accounted for nearly 20 percent of China’s GDP, but due to China’s rise since then, this has shrunk to 3 percent today. Despite that smaller slice of the pie, China’s growth is now creating opportunities for Hong Kong rather than vice versa as in 1997. This is the transition I mention and can be further explained.

Hong Kong is one of Asia’s financial centers, with free capital movement, a low tax regime and strong expertise in financial services (services are 95 percent of Hong Kong’s GDP). These will play an important role when it comes to tapping into the Greater Bay Area’s huge private and corporate savings, and capital markets.A clear advantage for Hong Kong firms and professionals will be in financial services. This sector has been gradually developing over the past few years, starting with the launch of Stock Connect in 2014 to Bond Connect in 2017, allowing offshore money to tap into China’s growing economy and bourses. More recent promulgated regulations this year on Wealth Management Connect provide significant opportunities for both local, Chinese and foreign companies in Hong Kong looking to access the US$3 trillion of privately held financial assets in mainland China (of which over US$1 trillion is in the Greater Bay Area alone). This in turn will provide access to new investment and insurance products, green finance, and other innovative financial services and products.

Apart from wealth management, there are plenty of opportunities for life insurance, funds, securities, asset management, and so on. Insurance Connect will also follow on the successes of the other “connect” services mentioned, while B2B and B2C financial sector products, green finance, family offices, block-chain, and fintech are all creating new incentives to be in Hong Kong and the region.

Greater Bay Area tax regimes are also being adjusted. Currently, the Individual Income Tax (IIT) system of mainland China adopts a seven-level progressive rate, ranging from three percent to 45 percent, which is higher than Hong Kong’s salary tax and personal assessment. Hong Kong has a five-level progressive rate, ranging from two percent to 17 percent, or a standard rate of 15 percent.

To lower the IIT rate and offset the difference with Hong Kong, nine mainland Greater Bay Area cities have introduced IIT subsidies from 2019 to 2024. During this period, the portion of the IIT that exceeds 15 percent of the taxable income paid of the qualified overseas talent will be refunded as fiscal subsidies. Small- and medium-sized enterprises’ (SME) looking at Hong Kong may wish instead to consider the Greater Bay Area options, where taxes are similar but operating costs such as rent and general cost of living far lower.

RMB trading & global China support services

Hong Kong is still the world’s largest RMB clearing center (75 percent of the total) and will continue to maintain its role as an RMB business hub, in turn, fitting in with China’s desire to position the RMB as an international currency. The RMB is already the second-most transacted currency through SWIFT, overtaking the euro in use back in 2013. That trend will continue and runs parallel to Beijing’s desire to internationalize the RMB.

There are significant back-office and customer relationship center requirements throughout the Greater Bay Area which Hong Kong will both fund, and support, while Hong Kong’s universities and academics are already expanding their activities into China.

That said, there are challenges.

Why Hong Kong? What are my options?

For foreign investors, the first question is why do you need to be in Hong Kong?

Where and what is your business? Where do you perhaps have better opportunities?

The answer is: it depends. It depends upon the type of business you are involved with, and where best to position that. The positive aspect is that investors have options, with Hong Kong being one of them. Rather than crude statements such as “Hong Kong is dead, stick a fork in it“ investors interested in China and Asia now have options.

In this regards, China has been opening up and improving its business environment, elements of which I described in a fairly comprehensive article A New China for 2021 where I discuss the positive impact of China’s new Foreign Investment Law, Negative List, outbound investment trends and Belt and Road projects all bring to the table for foreign investors in the New Year.

There are alternatives to Hong Kong. Why be based there and not in any of the other ten cities of the Greater Bay Area? In financial terms, the Greater China stock exchanges of nearby Shenzhen and Shanghai conducted about 40 percent of all global IPO’s in 2020, while Hong Kong’s share of IPOs declined US$6 billion below its 2018 peak. That said, it should not be forgotten that last year Hong Kong handled two of the world’s top five IPOs in Alibaba (US$12.9 billion) and Budweiser (US$5.7 billion). Hong Kong will recover ground as its situation normalizes, but it does have serious competition.Dezan Shira & Associates have already long responded to the new challenges and opportunities of the Greater Bay Area region – we have offices in five of the top ten Greater Bay Area cities: Hong Kong itself, Guangzhou, Shenzhen, Dongguan, and Zhongshan. We recognize the need to be integrated into what is happening and to provide regional services throughout the Greater Bay Area – including Hong Kong. They are complementary, with Hong Kong’s future role being as a financial services hub.

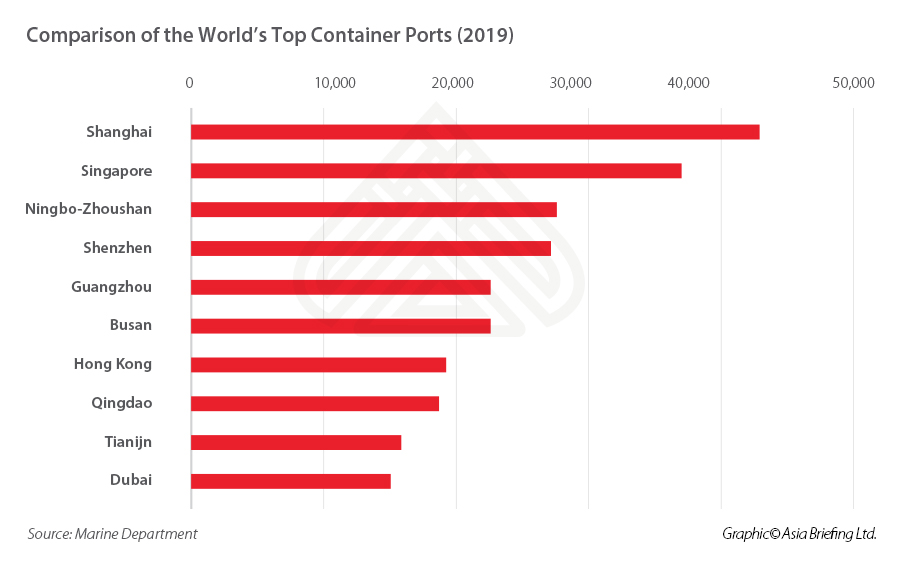

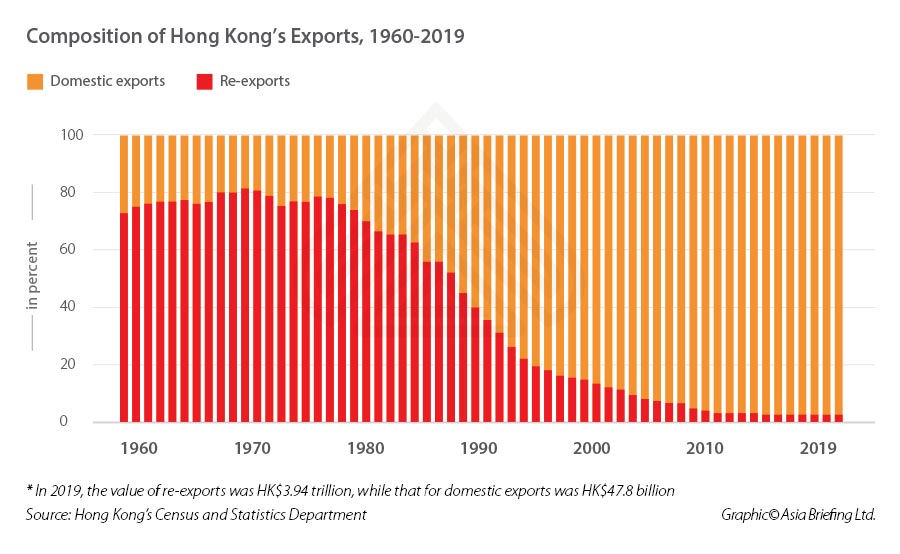

That growing competition that many suggest signals a ‘demise’ also extends to Hong Kong’s position as a China export Port of choice. In freight terms, it will soon be overtaken by Qingdao and Tianjin in global rankings, while integration with the Greater Bay Area will mean leveraging other cities (and ports) strengths in terms of infrastructure and logistics. Hong Kong’s traditional advantage in transshipment will cease to be a specific advantage.

Hong Kong’s relationship with the United States

Hong Kong’s trading with the US is essentially a re-export center, albeit a very powerful one, especially when considering the low or potentially zero corporate tax for offshore transactions. The territory must take into consideration the cost of operations from other countries such as China itself, Singapore, Port Klang in Malaysia, Thailand’s Laem Chabang, Indonesia’s Tanjung Priok among others, and their relationship with the United States and EU. While the US considers Hong Kong-made products ‘Made in China’ and has removed its ‘special status’ then this impacts on Hong Kong’s competitiveness, and perhaps under the new President Joe Biden the issue will be overcome. But in any event, Hong Kong’s growing closeness to the Greater Bay Area overcomes any US trade downturn negativity.

There are other issues to consider when assessing Hong Kong:

- The mutual integration of Hong Kong and the Greater Bay Area must be watertight;

- Questions over permitting the free movement of goods, people, money, and data across the Greater Bay Area have still to be worked out.

- Will the Greater Bay Area move ahead in a coordinated fashion, or will various Greater Bay Area city agendas dictate the pace of development.

- How to harmonize various different systems (legal, tax, accounting, customs, payments, and visas.

- Hong Kong is the most expensive regional city, with the highest cost of living;

- Hong Kong’s salaries over the past several years have been stagnating, GDP has trended down since 2018; rendering it less attractive for high-flyers.

- Hong Kong’s unemployment rate among 15 to 25 year old’s is almost 20 percent – how can youngsters and start-ups embrace opportunities across the border in China?

- How to encourage Hong Kong’s youth to visit, engage, and do business in China when there is anti-China hatred being vehiculated in the community?

- An August 2020 survey by the American Chamber of Commerce in Hong Kong, showed that 39% of respondents said they would consider moving capital, assets, or business operations out of the city at some point in the future. Is this still valid?

- Chinese private and SOE businesses are still investing in Hong Kong, and have doubled in numbers since 2018, yet have not made up for the loss in numbers of those leaving from Japan, the UK, and the United States.

- Yet many still see Hong Kong as an easy hub from where to manage Asian operations – but at a price – costs make Hong Kong SMEs unfriendly and they may be better off locating elsewhere – such as Shenzhen. (Which is exactly what Dezan Shira & Associates did back in 1992).

The repositioning of Hong Kong therefore is a work in progress and many issues remain to be solved. That said, it remains a great place to access mainland China, developing and supporting the financial services industry on the mainland and helping new wealth invest, both at home and abroad. Our Hong Kong office is recruiting additional new staff in 2021. Promoting international funds and raising capital will be a major function of the new Hong Kong.

We also have an office in Singapore and have been actively facilitating clients with more of an Asian rather than purely China focus to relocate there. The relocation of holding companies is nothing new, I recall the offshore company boom years back when people set up businesses instead in the BVI, Cayman Islands, and other similar jurisdictions. Singapore is part complimentary, part competitive to Hong Kong. But to access China, Hong Kong remains the top dog.

Our Hong Kong business will expand and continue to prosper because Hong Kong is being repositioned as a financial service, a quasi-offshore hub for the US$3 trillion held in private hands in China. That is in addition to the IPO’s, banking, and other services the city provides. There are teething problems, but these are identifiable and will be solved over time.

Beijing will get it right. Naysayers will decry the message anyway, but for those of us living and working in the city, changes are coming, and these will, over the coming five years be increasingly positive. At Dezan Shira & Associates, we are investing in that future and will continue to advise investors on the benefits of and alternatives to investing in Hong Kong. That, rather than continual Hong Kong and China-bashing, is the more realistic, and reasonable approach. There are options, and opportunities in Hong Kong, and we advise investors to consider both.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Belt And Road Weekly Investor Intelligence #9

- Next Article EU, China Give Political Approval to Comprehensive Agreement on Investments