An Introduction to Doing Business in Hong Kong 2024

An Introduction to Doing Business in Hong Kong 2024, the latest publication from China Briefing and Dezan Shira & Associates, is out now and available for download through the Asia Briefing Publication Store.

The People’s Republic of China regained sovereignty over Hong Kong from Britain in 1997, from which point it has been a Special Administrative Region (SAR) of the country. However, the way in which the city is governed is still fundamentally different from the Chinese mainland – a fact that is reflected in its slogan of “One Country, Two Systems”. Hong Kong is largely autonomous from China, and foreign companies will quickly discover that the rules of doing business in the mainland simply do not apply in Hong Kong, and vice versa.

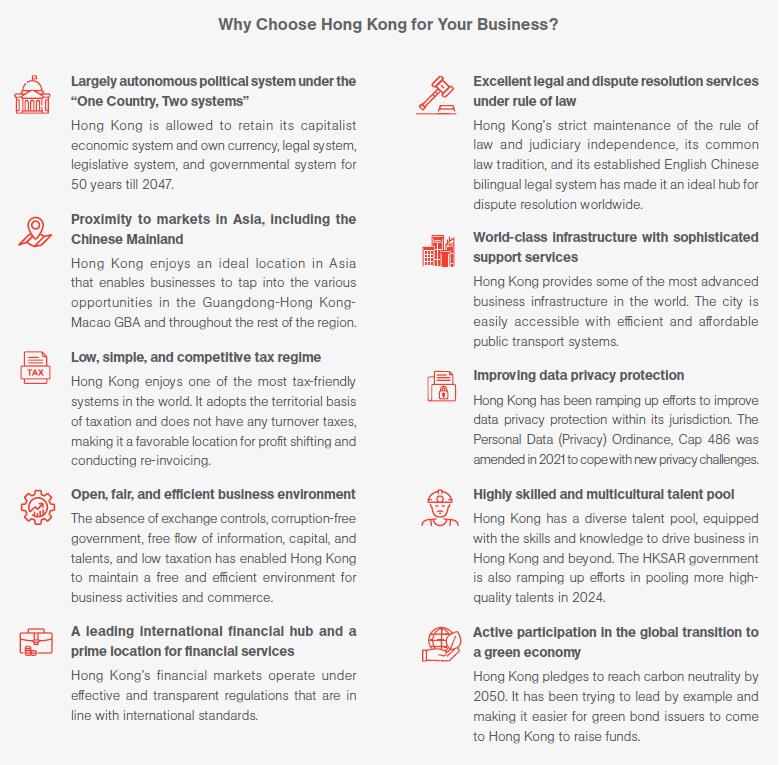

For this reason, Hong Kong has long served as a dominant “gateway” to the Chinese mainland. Its geographical proximity to the Chinese mainland, low taxes, business-friendly environment, free flow of capital, rule of law, independent judiciary, and robust intellectual property protection have made it an ideal place for foreign investment. Despite the hardships of the post-pandemic period, Hong Kong remains strong as ever and will continue to function as a free global financial hub, strengthened by the development of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

This publication, designed to introduce the fundamentals of doing business in Hong Kong, was created in April 2024 using the most up-to-date information available at the time. It was compiled by Dezan Shira & Associates, a specialist foreign direct investment practice that provides corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence, and financial review services to multinationals investing in emerging Asian markets.

Contents of this guide

An Introduction to Doing Business in Hong Kong 2024 covers the following:

- Why Hong Kong

- Establishing and Running a Business

- Tax, Audit, and Accounting

- Human Resources and Payroll

- Cybersecurity and data protection

Within these chapters, we discuss a range of different topics that affect doing business in Hong Kong, including investment models, key taxes applicable to foreign companies, employment contracts, and compliance requirements regarding cybersecurity and data protection.

What‘s new in this guide

The below changes are noticeable for your attention:

- Incorporation and business registration: We incorporate updates to the business registration process, including changes in the business registration fee for the 2024-25 period.

- Intellectual property protection: We have revised the patent registration section to include the application process for standard patent (O) in Hong Kong. Additionally, we’ve updated the procedures for applying standard patent (R) and short-term patent.

- Tax reductions proposed in the Budget Plan 2024-25: We have updated relevant chapters to reflect the tax measures introduced in Hong Kong’s 2024-25 Budget. These measures include reductions in profits tax, salaries tax, and tax under personal assessment for the year of assessment 2023/24.

- New two-tiered standards tax rates of salaries tax: We introduce the new two-tiered tax rate regime for salaries and tax under personal assessment, effective from the 2024 to 2025 assessment year onward.

Updated foreign-sourced income exemption (FSIE) scheme: We include the expanded coverage of foreign-sourced disposal gains introduced in December 2023. - Alignment with BEPS 2.0 Pillar Two rules: We present the latest updates regarding the implementation of the global minimum effective rate in Hong Kong, as outlined in the 2024-25 Budget Plan speech.

- Double taxation treaties: We have updated the table of countries or regions with signed Double Taxation agreements (DTAs) or DTAs under negotiation with Hong Kong.

- Standard of continuous contract: We introduce the proposed amendment to the standard of continuous contract, which will expand the benefits under the Employment Ordinance to more employees.

- Abolition of Mandatory Provident Fund (MPF) offsetting arrangement: We discuss the abolition of the MPF offsetting arrangement that will take effect on May 1, 2025. This is designed to enhance employee protection and ensure fair treatment during employment termination.

- Potential amendments to the data laws: We list some potential amendments to the data protection laws based on proposals in the data office’s annual review reports.

Why Hong Kong?

A highly dynamic city that serves as a gateway to the Chinese Mainland and Asia, Hong Kong is the ideal base for your investment in Asia. Hong Kong’s business-friendly environment, low taxes, rule of law, free economy, independent judiciary, modern infrastructure, I&T capabilities, and robust intellectual property protection allow businesses and individuals to succeed in this most competitive and international city.

About Us

China Briefing is one of five regional Asia Briefing publications, supported by Dezan Shira & Associates. For a complimentary subscription to China Briefing’s content products, please click here.

Dezan Shira & Associates assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Haikou, Zhongshan, Shenzhen, and Hong Kong. We also have offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE) and partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh, and Australia. For assistance in China, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article China Trade Union Funds Explained

- Next Article Shanghai Lingang New Area Releases Whitelists for Data Export, Facilitating Cross-Border Data Flows