China Annual (One-Off) Bonus: What is the Income Tax Policy Change?

UPDATE (August 28, 2023): According to a circular jointly released by the Ministry of Finance and the State Taxation Administration, China will extend the preferential tax treatment for the annual one-time bonus until the end of 2027. Under this scheme, IIT on the annual one-time bonus is calculated separately, rather than being combined and taxed together with the comprehensive income.

UPDATE (December 31, 2021): At the weekly State Council executive meeting held on December 29, 2021, Premier Li Keqiang announced that China will continue to implement several preferential individual income tax (IIT) policies. Among others, China will extend the preferential tax treatment for the annual one-time bonus until the end of 2023 – see our latest article here. Under this scheme, IIT on the annual one-time bonus is calculated separately, rather than being combined and taxed together with the comprehensive income.

In a related development, the government has also extended its preferential IIT policy on fringe benefits for expatriates to December 31, 2023 (see Ministry of Finance announcement here). Foreigners working in China will thus continue to be entitled to some tax-free fringe benefits (for example, housing rental, children’s education costs, and language training costs). Previously, this policy was to lapse from January 1, 2022.

Employers and employees in China should keep track of the coming changes to IIT treatment and make adequate preparation to reduce extra tax burden.

The individual income tax (IIT) calculation method for China tax residents’ annual one-time bonus is going to change from January 1, 2022 for some taxpayers. All tax residents who obtain annual one-time bonuses will have to combine their annual bonuses with the yearly comprehensive income for computation and payment of IIT.

For some taxpayers who currently choose to calculate and pay IIT separately on their annual bonuses, the policy change may lead to an increase in their income tax burden, although situations may vary from person to person. Higher-earning workers who derive a large percentage of their income from annual performance bonuses should especially pay attention to the new policy.

This article breaks down the calculation of IIT under the existing (transition period) and upcoming new policy and possible impact on an individual’s tax burden. We also provide suggestions on how taxpayers in China can prepare for the IIT policy change.

Methods of calculating IIT on annual one-time bonus

Method 1

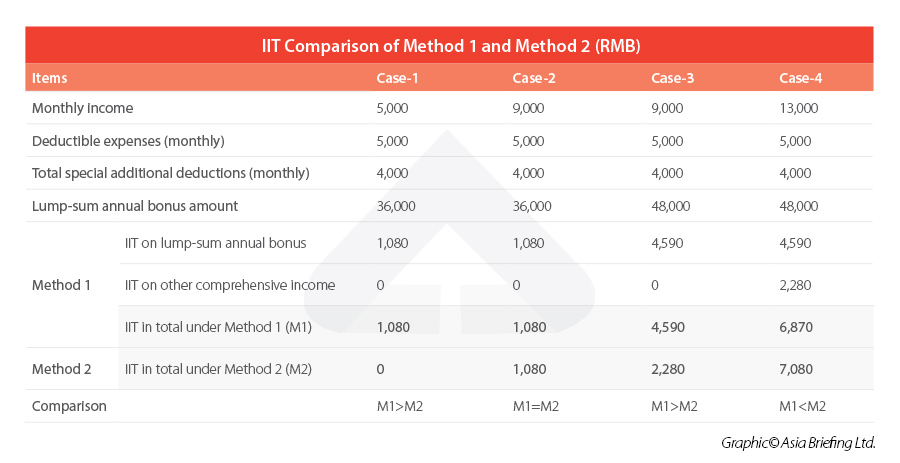

During the transition period from January 1, 2019 to December 31, 2021, tax residents are allowed to choose between the following two methods to compute IIT on the annual one-time bonus, according to the Notice on the Preferential Policy Convergence Program after the Amendment to the IIT Law (Cai Shui [2018] No.164):

- Compute and pay the IIT on the annual one-time bonus separately (not combine the bonus into the comprehensive income); or

- Combine the annual one-time bonus with the comprehensive income of the year

Under Method 1, the IIT on annual bonus is calculated separately based on the following formula:

Tax payable on annual bonus = Taxable annual bonus amount x Applicable tax rate – Quick deduction

By dividing the annual bonus figure by 12 months, one can arrive at the applicable tax rate and quick deduction on the Monthly-Converted Comprehensive Income Tax Rate Table (“monthly tax rates table”) as below.

For example, if an employee will get annual bonus of RMB 36,000 in January 2021, the applicable tax rate under Method 1 would be three percent, because the result of 36,000 divided by 12 is 3,000, matching Level 1 in the table.

Method 2

However, starting from January 1, 2022, tax residents’ annual one-off bonus will have to be combined with their annual comprehensive income for IIT calculation and declaration. The formula is:

Tax payable = [Gross annual comprehensive income (including the annual one-off bonus) – annual individual’s portion of social security contribution – standard deduction – other deductions – annual additional itemized deductions] x Applicable tax rate – Quick deduction

In other words, the annual one-time bonus will be treated as part of the tax resident’s comprehensive income. The applicable tax rate and quick deduction can be adopted from the Annual Comprehensive Income Tax Rate Table (“yearly tax rates table”) after the annual taxable income amount is worked out (by deducting various fees and deductible items from the gross income, which includes the annual bonus).

Case study

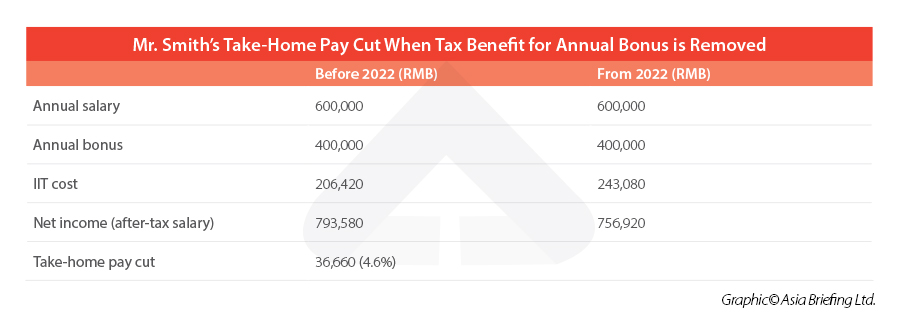

Mr. Smith is a marketing director at a Chinese company. He has been receiving his annual performance bonus for many years from his employer.

In 2021, the IIT on Mr. Smith’s year-end bonus (that is, his one-off annual bonus) is calculated separately (under Method 1). Assuming that Mr. Smith is not subject to any other tax deductions, if he earns gross salary – including annual basic salary of RMB 600,000 and annual one-time bonus of RMB 400,000 – he will need to pay IIT of RMB 206,420 this year and his net income would be RMB 793,580.

The formula is: Tax payable = tax payable on salaries + tax payable on annual bonus = (600,000 – 60,000) x 30% – 52,920 + 400,000 x 25% – 2,660 = RMB 206,420

In 2022, when combining his year-end lump-sum bonus with his comprehensive income (under Method 2), he is supposed to pay IIT of RMB 243,080, and his net income would be RMB 756,920.

The formula is: Tax payable = (1,000,000 – 60,000) x 45% – 18,1920 = RMB 243,080

As a result, Mr. Smith’s annual take-home salary from the year 2022 will be RMB 36,660 less than that of the previous year. It can be imagined that he will be upset to see the take-home pay to be cut by 4.6 percent.

“However, please note that for some other tax residents with low basic salary, it would be more beneficial for them to combine their annual bonuses with basic salary to calculate the total IIT (under Method 2) because all kinds of deductions could be fully utilized. As such, it is different from case to case,” says Katrina Huang, Assistant Manager Human Resources Administration and Payroll Services at Dezan Shira & Associates’ Shenzhen office.

Preparing for the IIT policy transition

In practice, “whether an employee’s tax burden will go up also depends on the ‘tax bearing method’, which is usually specified on their labor contracts,” Huang comments.

If IIT is paid and borne by the employer, the individual’s annual take-home salary will not change when the new policy takes effect. However, in reality, most employees’ IIT is paid and borne by themselves, which will possibly subject them to more tax burden next year. Therefore, Huang’s advice is that these employees re-examine whether their take-home annual salary would be cut; if so – they should examine whether it’s possible to discuss and adjust the relevant terms of their labor contracts.

“For employers,” she adds, “in order to attract more talents or retain excellent employees, it is advised that they may increase gross salary package or offer fixed net salary package to their employees.”

For some taxpayers who enjoy a more favorable payment in terms of IIT under Method 1 and haven’t used Method 1 to calculate their annual bonuses in the year 2021, they can also consider and talk with their employers to claim their year-end bonus earlier before the IIT benefit expires.

In addition, in some cases, even an RMB 1 wage difference can result in a significant difference in IIT because the applicable tax rate may fall under the higher brackets on the tax rate table. If employers and HR managers want their employees to enjoy the highest net income, they should pay close attention to the numbers around the threshold for each progressive tax bracket.

To ensure staff stability, it is also highly advisable that employers assess and implement relevant changes to their payroll policies. As early communication and planning can improve transparency and avoid any disputes, and some employment contracts require a six-month notice, or longer for any amendments, it is best for employers to communicate with employees as early as possible.

With a large professional team of tax, HR, and legal experts located throughout China, Dezan Shira & Associates has been providing professional human resources, payroll, tax, legal advisory services, and China individual income tax briefing for our clients. For more information and assistance on salary structure adjustment, labor contract modification, and staff re-allocation, you are welcome to consult our experts and email us at China@dezshira.com.

(The article was first published on November 11, 2021. Updates were inserted on December 31, 2021 and August 28, 2023.)

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Closing Your China Bank Accounts During Company Deregistration: New Instructions and Tips

- Next Article China Extends the Preferential Tax Treatment for Annual One-Time Bonus to the End of 2027