China Extends the Preferential Tax Treatment for Annual One-Time Bonus to the End of 2027

We answer FAQs on China’s preferential tax treatment for the annual one-time bonus, which is now extended until the end of 2027.

According to a circular jointly released by the Ministry of Finance (MOF) and the State Taxation Administration (STA), China will extend the preferential tax treatment for the annual one-time bonus until the end of 2027.

Under this scheme, individual income tax (IIT) on annual one-time bonuses is calculated separately, rather than combined and taxed with the comprehensive income.

The move is intended to alleviate the IIT burden on China’s middle-income groups and boost consumer confidence at a time when the economy is under downward pressure.

What is the current income tax policy?

During the period till December 31, 2027, resident taxpayers in China will be allowed to choose between the following two methods to compute their IIT on the annual one-time bonus:

- Method 1: Annual one-time bonus being taxed separately.

- Method 2: Annual one-time bonus being taxed as part of the annual comprehensive income.

(Method 1, which was due to expire at the end of 2021, has now been extended twice, first to end of 2023, and now to the end of 2027, while Method 2 will continue to be in effect.)

For detailed calculation methods, you may jump to the section: “Methods of calculating IIT on annual one-time bonus”.

Which income groups will benefit from the extended tax policy (Method 1 of IIT calculation)?

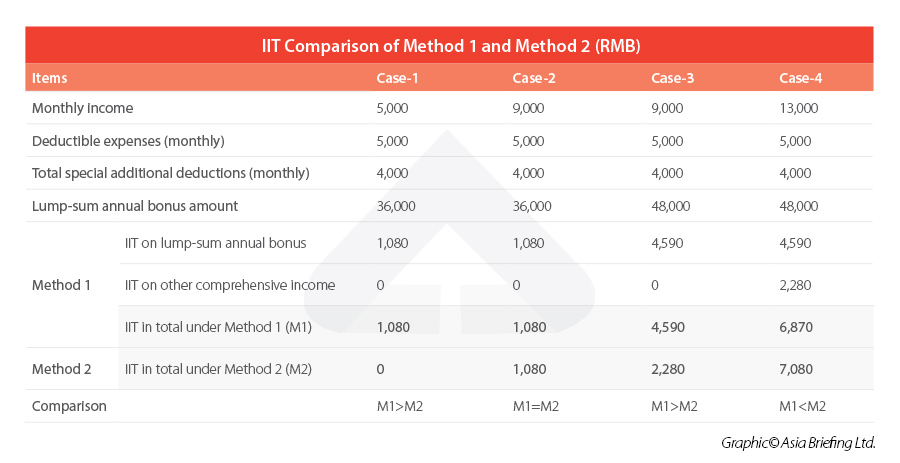

As shown in the table below, an individual’s IIT burden under Method 1 could be higher, lower, or even equal to IIT burden under Method 2 – in different cases.

For some tax residents with low basic salary, it would be more beneficial for them to combine their annual bonuses with basic salary to calculate the total IIT (under Method 2) because all kinds of deductions could be fully utilized.

However, for most middle-income wage earners, Method 1 is deemed more friendly.

Based on estimates, groups with (1) an annual one-time bonus no less than RMB36,000, (2) annual income (annual bonus + annual salary – social security payments and various deductible expenses) no less than RMB 96,000, and (3) annual salary higher than annual one-time bonus – will benefit from Method 1.

How to navigate China’s income tax policy environment?

Since China’s IIT reform kicked off in 2018, the tax authority has been rolling out transitional policies, which expose employers and employees to a constantly changing tax policy environment.

To avoid extra tax burdens, employers and employees are strongly advised to pay close attention to and stay fully informed on the latest changes in China’s income tax policies.

With a large professional team of HR and payroll experts located throughout China, Dezan Shira & Associates has been providing professional human resources, payroll, and tax advisory services as well as China individual income tax briefing for our clients.

Supporting our integrated payroll service is our proprietary cloud-based portal in China – asiaadmin™ – which provides timely policy updates in the system to ensure the accuracy of your tax calculation. The state-of-the-art HR and payroll system will help you stay on top of China’s income tax policy developments.

For more information and assistance, you are welcome to contact us at China@dezshira.com.

Annex: Methods of calculating IIT on annual one-time bonus

Method 1

Under Method 1, the IIT on the annual bonus is calculated separately, based on the following formula:

Tax payable on annual bonus = Taxable annual bonus amount x Applicable tax rate – Quick deduction

By dividing the annual bonus figure by 12 months, one can arrive at the applicable tax rate and quick deduction on the Monthly-Converted Comprehensive Income Tax Rate Table (“monthly tax rates table”) as below.

For example, if an employee will get an annual bonus of RMB 36,000 in January 2021, the applicable tax rate under Method 1 would be three percent, because the result of 36,000 divided by 12 is 3,000, matching Level 1 in the table.

Method 2

Under Method 2, the IIT on the annual bonus is calculated as part of the comprehensive income of the year, based on the following formula:

Tax payable = [Gross annual comprehensive income (including the annual one-off bonus) – annual individual’s portion of social security contribution – standard deduction – other deductions – annual additional itemized deductions] x Applicable tax rate – Quick deduction

The applicable tax rate and quick deduction can be adopted from the Annual Comprehensive Income Tax Rate Table (“yearly tax rates table”) after the annual taxable income amount is worked out (by deducting various fees and deductible items from the gross income, which includes the annual bonus).

(This article was first published on December 30, 2021, and was last updated on August 28, 2023.)

(This article was first published on December 30, 2021, and was last updated on August 28, 2023.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Annual (One-Off) Bonus: What is the Income Tax Policy Change?

- Next Article China Extends the GBA IIT Subsidy to the End of 2027