China Clarifies Input VAT Credits for Domestic Transport Services

- Businesses in China can continue to claim input VAT credits for domestic transport expenses incurred by its contracted employees, including dispatched staff.

- General VAT taxpayers will also be allowed to claim VAT input credits for domestic passenger transport services and credit its input tax against its output tax.

- Taxpayers need to provide a hard copy or electronic copy of qualified invoices to claim VAT credit.

Earlier this year, China released a slew of new VAT policies that lowered the rates and increased the availability of VAT credits.

One of the points made by the new policy was that general VAT taxpayers can now claim VAT input credits for domestic passenger transport services and credit its input tax against its output tax.

On September 16, China’s State Administration of Taxation released Announcement No.31 of 2019 which clarifies some of the finer points introduced by the macro changes in April, including expanding on the eligibility of claiming VAT input credits for ‘domestic passenger transportation services.’

This came just one week after China introduced additional VAT credits for some eligible advanced manufacturers.

Collectively these new updates hope to relieve the tax burden for businesses affected by the ongoing slowdown in China’s economy.

Eligibility for claiming input VAT credits

These changes mean that businesses can continue to claim input VAT credits for domestic flights, rail, waterway, and road transportation services.

But, as specified under the announcement, this will be limited to transport expenses incurred by employees who have entered into a labor contract with their employer as well as dispatched staff employed by the company.

Taxpayers must use qualified invoices to claim VAT credit – this includes either a hard copy or an electronic copy of one of the following:

- General VAT invoice for the goods entitled for tax refund;

- Special VAT invoice;

- Travel itinerary; and

- Transport ticket.

The invoices must be issued for the purpose of value-added tax and the invoices shall contain such information as the purchaser’s name and taxpayer identity number.

For taxpayers who fail to obtain a special VAT invoice but can obtain an electronic general VAT invoice, the input VAT credit is the amount indicated on the electronic general invoice.

Timing

The input tax amount of the transport service must have been incurred on or after April 1, 2019 – and supporting documents must accurately reflect this in order for a taxpayer to qualify for the input VAT credit.

For instance, if a taxpayer obtained a Didi fapiao in September but the actual date of travel was back in March, the new VAT credits would not be applicable.

Application for different domestic transportation

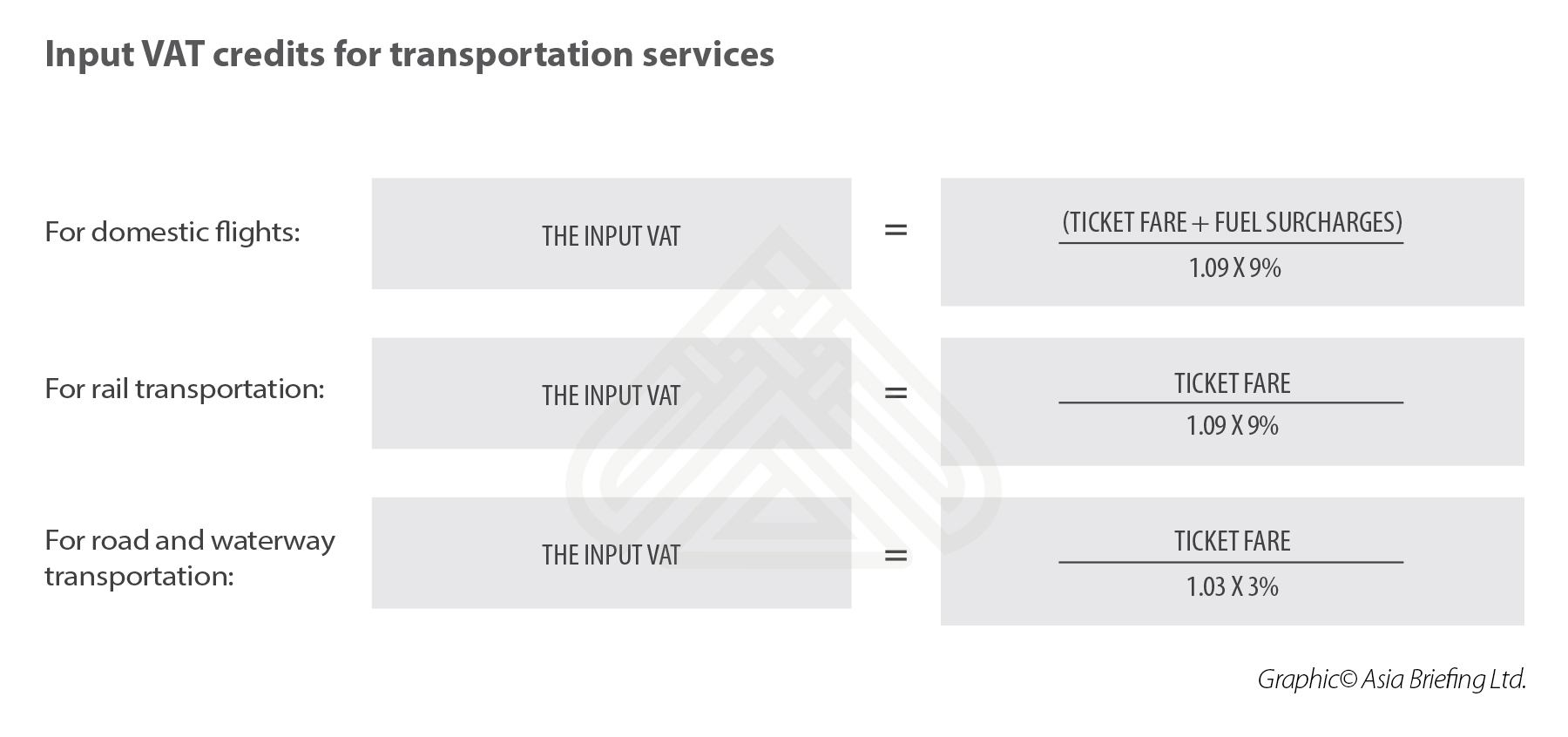

The input VAT credits for transportation services will be calculated differently according to the documentation provided and mode of transportation taken.

For taxpayers who can claim input VAT for domestic flights, rail, road, and waterway transportation services using supporting invoice or ticketing documentation and passenger ID information, the following formulas apply.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Shanghai Releases Implementation Regulation for Foreign Investment Law

- Next Article Tax, Accounting, and Audit in China 2019-20 – New Publication from China Briefing