Applying for China’s DTA Benefits in Profit Repatriation

China’s double tax avoidance agreements (DTAs) can be used to avail lower tax rates while making outbound payments. However, DTA benefits are not automatically applicable to everyone.

Foreign invested enterprises and their overseas headquarters must satisfy certain qualifications and go through relevant procedures to obtain the benefits.

Beneficial owner assessment

To apply for DTA benefits, the applicant must be a tax resident of a country that has an effective DTA with China, and the applied benefits must qualify for tax exemption or reduction as stipulated by the DTA. Other details in the DTA must also be satisfied to determine whether the applicant is qualified, and whether the applied benefits are eligible to be enjoyed.

Among these, “beneficial owner” is one of the basic concepts that is important when applying for DTA treatments on dividend, interest, and royalties.

Beneficial owner refers to an individual, company, or any other group having the ownership and right of control over the income or the right or property derived from the income. A beneficial owner should be engaged in actual operating activities; therefore, an agent or a designated payee does not constitute a beneficial owner.

In determining whether a non-resident enterprise is indeed the beneficial owner, the SAT has issued a flurry of related circulars and protocols since the promulgation of the CIT Law in 2008, the most recent of which is the Announcement of State Administration of Taxation (SAT) on Issues Relating to “Beneficial Owner” in Tax Treaties (SAT Announcement [2018] No. 9).

Unfavorable factors for beneficial owner assessment

To determine the “beneficial owner” status of an applicant who needs to enjoy the tax treaty benefits, a comprehensive analysis should be carried out, taking into account actual conditions of the specific case.

Among others, there are some factors being regarded as “unfavorable” during the assessment:

- The applicant is obligated to pay 50 percent or more of the income to a resident of a third country (region) within 12 months from receipt of the income (“Obligated” shall include agreed obligations and de facto payment even though there is no agreed obligation);

- The business activities undertaken by the applicant do not constitute substantive business activities (Substantive business activities include manufacturing, sales and marketing, and management, including investment holding management activities of a substantive nature. Determination of whether a business activity undertaken by the applicant is of a substantive nature should be based on the functions actually performed and the risks borne);

- The counterparty country (region) of the tax agreement does not levy tax or exempts tax on the relevant income, or the actual levy rate is very low;

- Aside from loan contracts on which interest is derived and paid, there exist other loan or deposit contracts between the creditor and a third party that are similar in their terms of amount, interest rate, and date of execution, etc.; and

- Aside from contracts for the transfer of copyrights, patents, proprietary technologies, and other usage rights based upon which royalties are derived and paid, there exist contracts between the applicant and a third party pertaining to the transfer of copyrights, patents, proprietary technologies, and other usage rights or ownership.

“Safe harbor rule” in beneficial owner determination

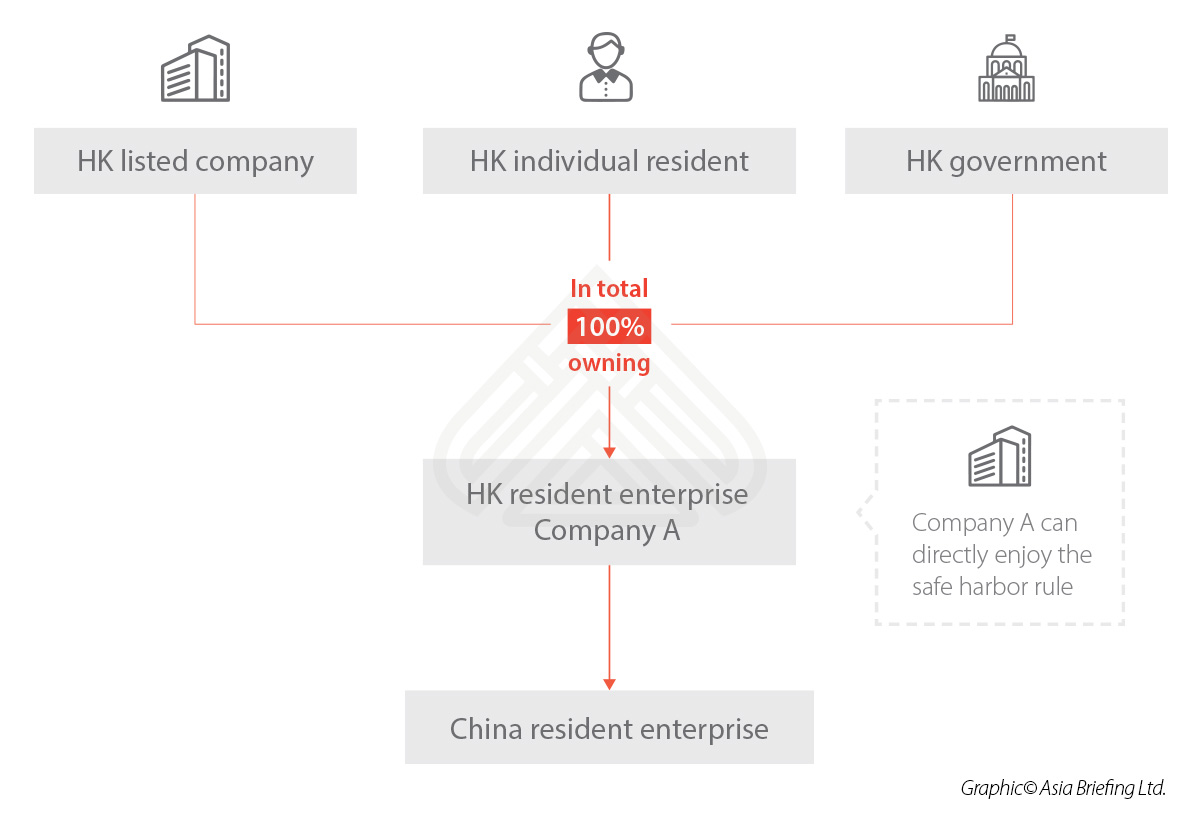

To reduce the burden of the applicants who want to enjoy DTA benefits, China tax bureaus created the “safe harbor rule”, where the applicant can be determined as a beneficial owner without going through the comprehensive analysis based on the unfavorable factors, upon satisfying certain conditions.

Under the current laws and regulations, the below applicants are subject to the safe harbor rule for their dividends, regardless of the assessment outcome based on the unfavorable factors:

- The applicant is a company that is a tax resident of a state that has a valid DTA with China (hereinafter, the DTA counterparty) and is listed in that jurisdiction;

- The applicant is the government of DTA counterparty;

- The applicant is an individual who is a resident of the DTA counterparty; and

- The applicant is a subsidiary that is 100 percent directly or indirectly owned by one or more persons covered by the safe harbor rule (In the case the subsidiary is indirectly owned by the persons covered by the safe harbor rule, the multi-tier holders should be either Chinese residents or residents of the DTA counterparty).

Additional opportunities for applying beneficial owner status

For applicants deriving dividends from China who neither pass the beneficial owner unfavorable factor assessment, nor are qualified to enjoy the safe harbor rule, there are other opportunities to qualify as beneficial owner.

This applies when the person who directly or indirectly holds 100 percent of the applicant’s shares directly or indirectly satisfies the criteria for “beneficial owner”, and the below two circumstances are satisfied:

- Circumstance I: Where the above-mentioned shareholder is a resident of the same country (region) for which the applicant is a resident, there is no special requirement for the intermediate shareholders (if any); and

- Circumstance II: Where the above-mentioned shareholder is not a resident of the country (region) for which the applicant is a resident, then the above-mentioned shareholder and any intermediate shareholders should be qualified to enjoy the same or better DTA treatment compared to that is entitled to the resident of the country (region) for which the applicant is a resident.

Applying for DTA benefits in China

Under the current law and regulations, non-resident taxpayers may determine whether they are qualified for the tax benefits by themselves and enjoy the preferential tax rates under the tax bureau’s afterwards supervision and management.

The non-resident taxpayers may either choose to claim the benefits on their own or finish the application procedures with a tax withholding agent.

As of September 2018, China has signed DTA with 108 countries or regions, among which 102 treaties have been in effect.

(This article was first published in November 2014. It has since been updated on October 29, 2018 and November 13, 2019.)

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China’s New Measures for Non-Resident Taxpayers Claiming Treaty Benefits

- Next Article Intellectual Property in China: Laws and Registration Procedures