China’s New Measures for Non-Resident Taxpayers Claiming Treaty Benefits

- China’s new measures for non-resident taxpayers claiming treaty benefits will be effective January 1, 2020.

- The new measures adopt the method of “retention of relevant documents for follow-up reviews” instead of “on-site record-filing of relevant documents”, which will streamline the application procedure for taxpayers claiming treaty benefits.

- A higher threshold is placed on non-resident taxpayers so they make an accurate self-assessment during the application process or potentially face increased legal liabilities.

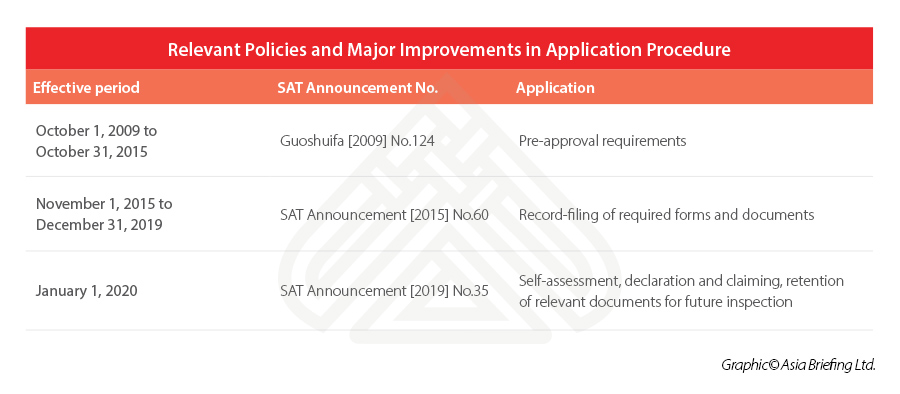

On October 14, China’s State Administration of Tax (SAT) issued the Administrative Measures for Non-Resident Taxpayers to Enjoy Treaty Benefits (SAT Announcement [2019] No.35), aiming to further cut red tape, reduce the tax compliance burden, and make it convenient for non-resident enterprise and individual taxpayers to claim benefits under China’s double tax avoidance agreements (DTAs) and international transport treaties.

The measures will take effect January 1, 2020 and replace existing rules, which were first issued in 2015 (SAT Announcement [2015] No.60) and partly amended in 2018 (SAT Announcement [2018] No.31). In general, the new announcement reflects three major improvements on the existing system:

- Streamlining the application procedure by adopting the method of “retention of relevant documents for future inspection”;

- Simplifying the required submissions; and

- Further clarifying the responsibilities of non-resident taxpayers and withholding agents.

Streamlined application procedure

According to the No.35 Announcement, the application procedure for non-resident taxpayers to claim treaty benefits will be based on a new concept of “self-assessment, declaration and claiming, and retention of relevant documents for future inspection”. This means non-resident taxpayers need to:

- Determine if they meet the conditions for claiming treaty benefits (“self-assessment”);

- Claim treaty benefits at the time of self-declaration of tax filing to the in-charge tax authority and submit an “Information Reporting Form for Non-resident Taxpayers Claiming Treaty Benefits” (“declaration and claiming”); and

- Collect and retain relevant documents as stipulated for follow-up review by the tax authorities (“retention of relevant documents for further inspection”).

In case of withholding tax, the non-resident taxpayer can give the “Information Reporting Form for Non-resident Taxpayers Claiming Treaty Benefits” to the withholding agent.

The latter will review the integrity of the information and submit the reporting form to the in-charge tax authority as an appendix to the withholding tax return.

The steps of “self-assessment” and “retention of relevant documents”, however, should always be done by the non-resident taxpayer.

Simplified documentation submission and retention

The No.35 Announcement substantially simplifies the reporting forms required for taxpayers claiming treaty benefits to submit to the tax bureau.

The previous reporting forms, including both the “Reporting Form on Tax Resident Identity of Non-resident Taxpayer” and the “Reporting Form on Entitlement of Non-resident Taxpayer to Tax Treaty Benefits”, have been compressed into one “Information Reporting Form for Non-resident Taxpayers Claiming Treaty Benefits”.

In addition, by adopting the method of “retention of relevant documents for follow-up reviews” instead of “record-filing of relevant documents at the time of declaration”, the tax bureau will not require the physical submission of relevant documents.

Documents that must be retained (for ten years as stipulated) include:

- Tax resident certificate issued by the tax authority of the other contracting jurisdiction to prove the resident status of the taxpayer for the year or the previous year during which the income is received;

- Certificates of ownership, such as contracts, agreement, board resolutions, payment vouchers, etc. related to the acquisition of relevant income;

- Relevant information proving the identity of the ‘beneficiary owner’ if the taxpayer enjoys the treaty benefits of dividends, interest, and royalties; and

- Other documents that non-resident taxpayers believe can prove their qualification for enjoying the treaty benefits.

These policy changes will greatly reduce the reporting burden of non-resident taxpayers.

In the meantime, however, applicants should note that “although the reporting information is simplified, it’s still necessary for non-resident taxpayers to retain complete information for self-assessment,” according to Hannah Feng, Partner and Head of Dezan Shira & Associates’ Corporate Accounting Services and Tax Team. “Inappropriate self-assessment can lead to higher tax uncertainty. Seeking professional tax advisory becomes even more essential,” she added.

Clarified responsibilities of non-resident taxpayers and withholding agents

The new announcement further clarified the responsibilities of non-resident taxpayers and withholding agents. Non-resident taxpayers who fail to pay or underpay their taxes by making incorrect self-assessment and using treaty benefits that do not apply to them will bear corresponding legal liabilities.

The withholding agent only needs to confirm completeness of the information reporting form provided by the non-resident taxpayer and submit it to the tax authority as an appendix to the tax return.

Hannah Feng added that it meant “the withholding agent may no longer have an obligation to verify the information. This responsibility can be borne only by the overseas payee. Thus, the non-resident taxpayer as an overseas payee should be more careful in filling out the form and preparing the documents in case of more rigorous follow-up inspections.”

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China Releases Draft Implementation Regulations for New Foreign Investment Law

- Next Article Applying for China’s DTA Benefits in Profit Repatriation