China-Latin America and the Caribbean: Investment, Trade, and Future Prospects

In recent years, China has enhanced its economic influence in the Latin America and the Caribbean (LAC) region has grown significantly, highlighting the necessity for a thorough analysis of the key drivers, complex trade patterns, and substantial economic impacts. This article explores the nuanced dynamics, potential opportunities, and inherent risks within the flourishing trade relations between these influential regions.

In the past twenty-plus years, particularly since joining the WTO in 2001, China has become a significant economic player in the Latin America and the Caribbean (LAC) region, heavily influencing and changing most countries’ trade relations with the Middle Kingdom. Recently, the Boston University Global Development Policy Center published its annual China – Latin America and the Caribbean Economic Bulletin, showing that China’s and LAC countries’ trade volume once more rose to record levels in 2022 with exports to China valued at US$184 billion and an estimated US$265 billion worth of goods being shipped to the LAC region.

In this article, we would like to examine the trade relations between China and the LAC countries. We aim to explore key drivers, trade patterns, and economic impacts of this significant economic relationship offering a deeper understanding of the dynamics, opportunities, and potential risks that arise from the trade ties between China and LAC.

Overview of trade relations

Trade partnerships & key free trade agreements (FTA)

Ever since China and Chile signed the very first trade partnership in 2005, China has focused its efforts on widening its economic and commercial footprint with LAC countries. Comprehensive strategic partnerships – its highest recognition of diplomatic relations – were signed with at least seven countries. In 2023 alone, China has signed five major deals with LAC countries in the last months, among them an FTA with Ecuador, 15 trade-related agreements with Brazil, and key agreements with Argentina and Nicaragua. These agreements go beyond easing trade and tariff barriers and even include the international use of the Chinese yuan.

The driving forces behind the relationship

Economic motivations for China’s engagement with LAC

In 2008, China published its first strategy paper for LAC, and in 2016, China published an update of its “Policy Paper on Latin America and the Caribbean” underlining its trade and economic strategy for the region. The paper clearly defines China’s ambitions in trade, industrial investment, financial cooperation, and energy as well as infrastructure cooperation as a priority.

Resource-driven trade and energy cooperation

China’s priorities include securing access to raw materials and agricultural goods and opening markets for Chinese goods and services for a region with around 670 million people. And in light of the rising global demand for new energies, there has been an increasing focus on key resources like lithium to secure Chinese companies’ position as the world’s largest manufacturer of e-batteries. We have highlighted some of the key points of the strategy paper:

(1) Trade:

- Promote the trade of specialty products, goods with competitive advantages or high added-value, and technology-intensive products; and

- Strengthen trade in services and e-commerce cooperation between China and LAC countries.

(2) Industrial investment and capacity cooperation:

- China will encourage its enterprises to expand and optimize investment in LAC countries; and

- Sign more agreements on investment protection, avoidance of double taxation, and tax evasion

(3) Financial cooperation:

- China will support its financial institutions to strengthen business;

- Expand cross-border local currency settlement and discuss RMB clearing arrangements; and

- Bilateral financial cooperation and giving full play to China-Latin America Cooperation Fund, concessional loans, and special loans for Chinese-Latin American infrastructure.

(4) Energy and resources cooperation:

- Expand and deepen cooperation in the fields of energy and resources; and

- Cooperation in downstream and supporting industries such as smelting, processing, logistics trade, and equipment manufacturing.

(5) Infrastructure cooperation:

- Strengthen cooperation on construction and engineering, equipment manufacturing and operation management in the fields of transportation, information and communication technology, energy, and power;

- Support and encourage competent enterprises and financial institutions to actively participate in the planning and construction of logistics, power, and information passages.

(6) Manufacturing cooperation:

- China will support its strong enterprises to participate in major resources and energy development projects and infrastructure construction projects;

- Using these projects as the basis, to build production lines and maintenance service bases in the region;

- China will encourage its enterprises to carry out cooperation in such fields as automobiles, and new energy equipment.

Infrastructure investments and connectivity projects

Following the above guidelines of the strategy paper, trade, and investment activities are now mirroring the previous year’s efforts by Chinese companies. As published by the Council on Foreign Relations, Chinese state-owned enterprises (SOE) and large private corporations have heavily invested mainly in energy, infrastructure, and so-called new infrastructure which includes smart cities, AI, and 5G Technology. Furthermore, refineries and processing plants in countries with vast energy sources such as copper or coal have been built, with Power China alone, an SOE, having more than 15 ongoing projects in LAC.

Analyzing trade patterns and trends in China and Latin America

Overview of trade volumes and values in recent years

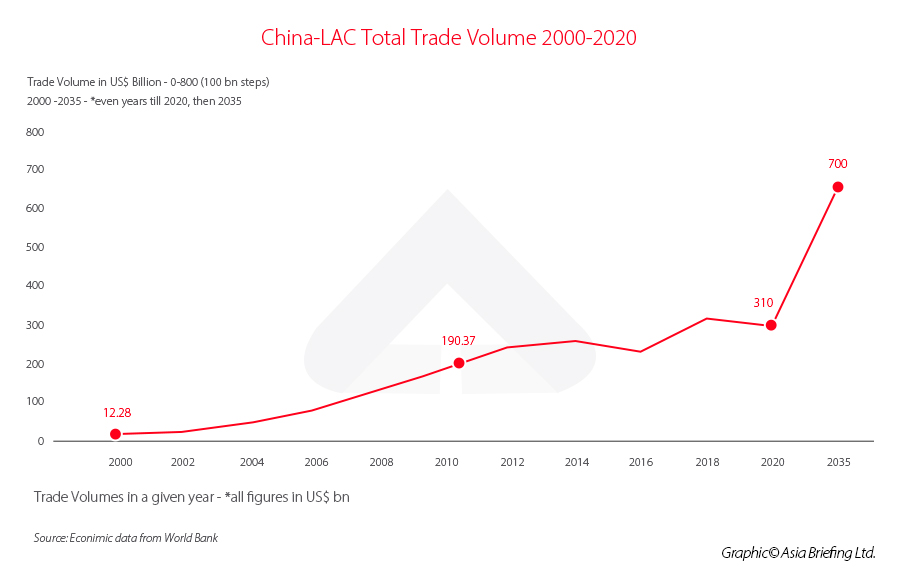

According to the World Economic Forum (WEF), trade between China and the LAC region grew 26-fold between 2000 and 2020 from US$12 billion to US$315 billion In comparison, the total trade of the US and LAC stood at US$758 billion in 2020, while the EU’s and LAC’s trade volume was US$197.4 billion The trade development between China and LAC countries is in line with global trends, especially in the Global South, to further focus and align economic activities towards and with China. Though it is unlikely that the trade relations between China and the LAC region will continue to grow at the speed of recent years, estimations by the WEF still foresee potential growth doubling to US$700 billion by 2035.

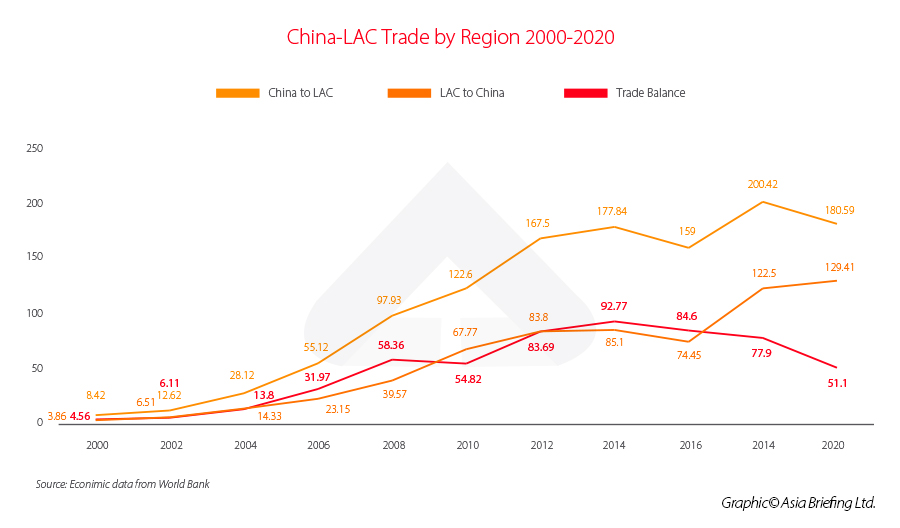

As shown above, on the Chinese side, trade volume grew from US$8.5 billion in 2000 to US$180 billion in 2020, growing 20-fold in the period, while the LAC region’s trade figures grew from US$3.86 billion to US$129 billion, growing 33-fold.

The key essence of the trade relations: Major goods and services exchanged between China and LAC countries

Despite significant growth on both sides of the trade relations, there are some key differences in the commodities traded and how they impact local industries and trade relations. One aspect emerges instantly when looking at the type of goods traded between China and LAC. It is an exchange of raw materials for finished goods and services. In a paper published last year by the EU Institute for Securities Studies, it is emphasized that the trade relation is highly concentrated, both in goods and geography. 70 percent of the goods shipped from LAC to China are composed of five main products, including soybeans, crude oil, and copper, with 90 percent of these goods coming from four countries: Brazil, Chile, Peru, and Venezuela. On the other side, we see a different picture with mainly manufactured, technology-intensive products being exported from China to LAC.

The value-adding thus takes place in China, which has put the LAC region in dependency on Chinese goods and has also further led to the deindustrialization of the region, especially in Argentina and Brazil, undercutting local industries with cheaper goods from China.

Furthermore, the above-mentioned exploitation of natural resources in mining, energy, and agriculture in the LAC region, has raised environmental concerns, for example, water pollution and deforestation. To ensure a resilient partnership, both sides, but particularly the LAC region should explore sustainable solutions for raw material exploitation and also seek to diversify the types of goods and services traded, reducing reliance on specific sectors and products.

Investment and finance

Financial cooperation, currency swaps, and regional development banks

China has not only secured the above-mentioned FTAs, but has also engaged in strategic cooperation: According to an article published in The Economist in June this year, China has already signed up 21 LAC countries for the Belt & Road Initiative (BRI), a global infrastructure development strategy that encompasses major projects to secure trade with key partners further strengthening its position in trade and commerce.

Additionally, China signed currency-swap deals with Argentina and Brazil. Currently, Argentina holds around 1/3 of its central-bank reserves in Chinese yuan, and in Brazil, the Chinese yuan passed the Euro as the second-most important currency. There has even been discussion of China entering into a complete FTA with Mercosur, Latin America’s regional economic organization. We will further monitor this development and its impact on the trade relations.

Lending from China to LAC has often been facilitated by Chinese state-owned and multilateral banks, such as the Shanghai-based New Development Bank established by Brazil, Russia, India, China and South Africa (BRICS) or the two main policy banks – China Development Bank and China Export-Import Bank, providing loans worth US$141 billion since 2005, lending more than the World Bank or the Inter-American Development Bank.

China’s direct investment in the LAC region

In terms of foreign direct investment (FDI), the LAC region as a recipient of Chinese FDI, has not been such a major target as one may expect, from the year 2000 to 2020, US$160 billion was invested, mostly in M&A and less in greenfield investments. According to a study by RED ALC-CHINA, an academic think tank, Chinese FDI only accounted for 5.74 percent of the total FDI received by LAC countries between 2000 and 2020. In comparison, the EU’s and the United States combined FDI accounted for 70-80 percent of FDI in the LAC region.

Regional case study

China-Chile trade relations: A success story?

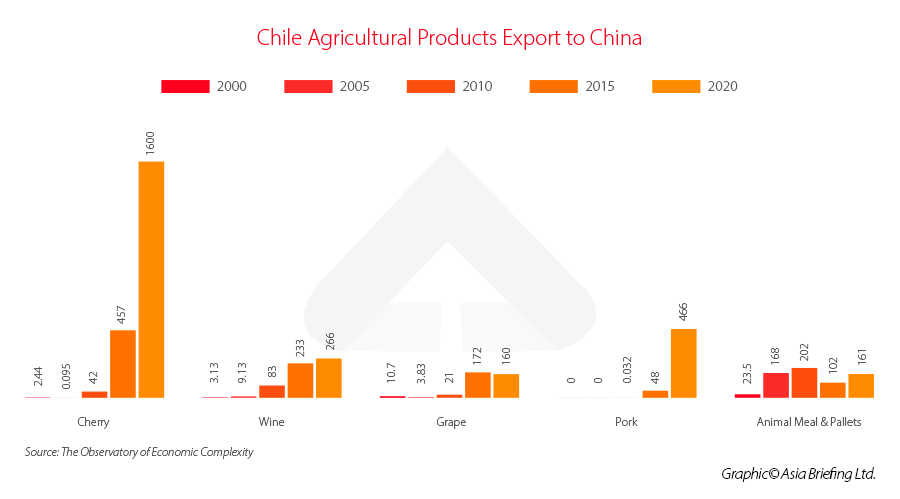

In the following passage, we would like to take a glance at China’s and Chile’s relationship – Latin America’s longest-standing diplomatic and trade relationship. China established diplomatic relations with the Andes state in 1970 and signed Latin America’s first FTA in 2005. Since then, commercial relations have been very fruitful and Chile has become one of the few countries worldwide to have a positive trade balance with China, mostly due to the country’s huge copper reserves. Trade figures from the Observatory of Economic Complexity (OER) show that in 2021 Chile exported goods worth US$36.6 billion to China, while goods valued at US$26.8 billion made its way to Chile. Like most other LAC countries, Chile’s exports are highly concentrated around a few products, mainly copper. In total numbers, copper ore and related products like raw and refined copper made up a total of 77 percent of the countries’ exports to China in 2021. Other important export products are other mining products, agricultural products like cherries (US$1.6 billion), avocados, and wine.

On the other side, imports from China to Chile are mostly semi-finished or finished products, manufacturing-intensive products. The main categories are broadcasting and telecommunications equipment, electronics, machinery, textiles, automobiles, and trucks. Taking a closer look at the trade pattern of the two countries since 2000, it becomes clear that Chile’s export products have basically remained unchanged with some variations in volume. Copper ore trade in 2021 was worth US$20 billion (55 percent of total export); while in 2000 copper ore worth US$273 m. or 29.3 percent of the total was traded. Pitted fruits, mainly cherry, from Chile, made 4.54 percent of the trade volume in 2021 while standing at only 0.26 percent in 2000. On the other hand, China’s imports to Chile in the 2000s were mostly textiles, footwear, toys, plastics, low value-added, and cheap products. Textiles and footwear made up around one-third of the total trade volume and electronics only about 10 percent. Looking into 2021, we see those textiles and footwear are only making around 10 percent, but broadcasting and telecommunications equipment, and electronics alone standing for around 20 percent doubling since 2000. Furthermore, automobiles, semi-finished metal products, and medical devices have surged as important trade items.

We have taken a closer look at some of Chile’s most traded agricultural products:

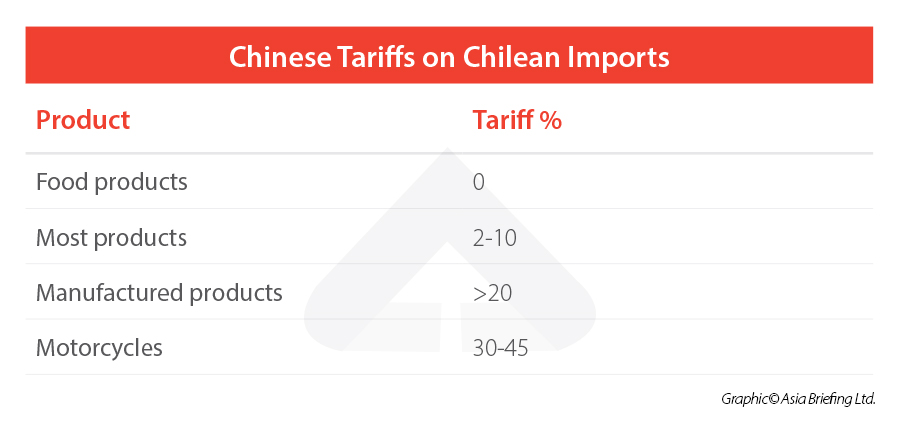

Additional mechanisms were implemented to deepen the bilateral trade relations, in 2015 a double taxation avoidance agreement and the set-up of an RMB clearing center were signed. And in 2019, trade conditions were further improved with the two countries upgrading the FTA and lowering tariffs for around 98 percent of traded commodities. The product portfolio is complementary in some fields with both countries relying on each other’s products and services. For Chilean companies, China’s thirst for raw materials and agricultural products means business opportunities, and this will remain a growth engine for the country.

With China’s middle class continuing to grow and demanding high-quality products, Chile’s related food industry segments will further benefit in the future as China´s food production cannot meet demand, especially not in products such as cherries, avocados, or wine. Furthermore, China also has a growing demand for high-quality meat like beef, which opens further opportunities for Chilean companies. Chilean companies benefit from the FTA, which basically allows them to import food products to China at a zero-tax rate. Other products are imposed with 2-10 percent import tariffs, making imports to China attractive.

Potential for future growth and cooperation

In recent years, the relationship between LAC and China has evolved significantly, showcasing immense potential for future growth and cooperation. This partnership has opened up a wide range of opportunities for both regions, with economic, political, and social implications that can shape the global landscape. As we look to the future, it’s crucial to emphasize the importance of maintaining a balanced partnership between LAC and China. While the potential for growth and cooperation is immense, there are challenges that need to be addressed to ensure the longevity and stability of this relationship.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Chinese Government Restructuring Explained – Changes to State Council Agencies

- Next Article China and Australia Reach Deal over Wine Tariffs Amidst Albanese’s Visit to Beijing